North America Data Center Cooling Market Size, Share, and COVID-19 Impact Analysis, By Type (Raised Floors and Non-Raised Floors), By Application (Telecom, IT, Retail, Healthcare, BFSI, Energy, and Others), and North America, Data Center Cooling Market Insights, Industry Trend, Forecasts to 2035

Industry: Machinery & EquipmentNorth America Data Center Cooling Market Insights Forecasts to 2035

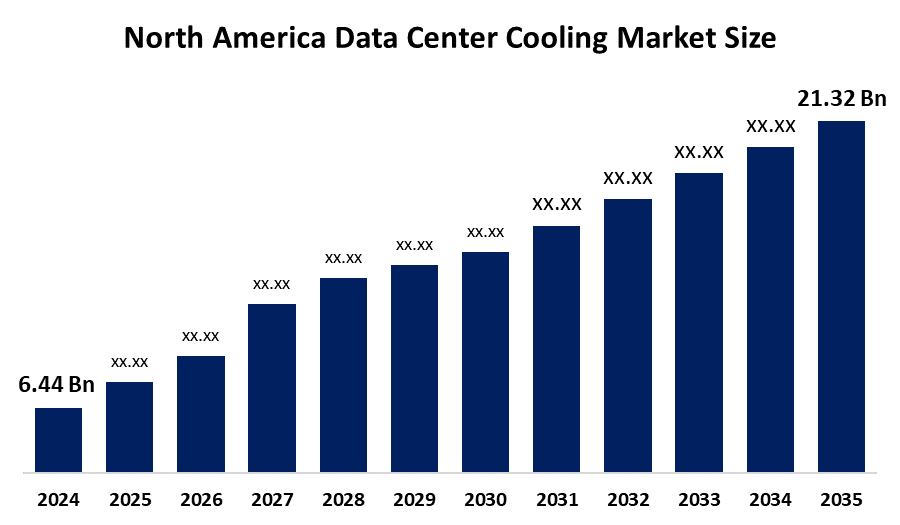

- The North America Data Center Cooling Market Size Was Estimated at USD 6.44 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 11.5% from 2025 to 2035

- The North America Data Center Cooling Market Size is Expected to Reach USD 21.32 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the North America Data Center Cooling Market Size is Anticipated to Reach USD 21.32 Billion by 2035, Growing at a CAGR of 11.5% from 2025 to 2035. Energy-efficient cooling technologies, growing data center construction, the need for sustainable infrastructure, and developments in AI-driven temperature control and thermal management solutions are all factors driving the North America data center cooling market.

Market Overview

The industry segment devoted to the creation, implementation, and upkeep of cooling solutions especially made for data centers in the North America region, which includes the US, Canada, and Mexico, is known as the North America data center cooling market. The North America data center cooling market includes a broad range of systems and technologies, including sophisticated HVAC systems, chilled water systems, air-based and liquid-based cooling, economizers, and more. The dependability, energy efficiency, and performance of servers and networking equipment located in data centers depend on these cooling technologies to maintain ideal operating temperatures. The data center cooling sector is anticipated to see substantial development opportunities due to the increasing demand for energy-efficient North America data center cooling market. The industry is anticipated to have substantial development prospects due to the increasing demand for energy-efficient data centers that are energy-efficient. The quick increase in data generation, which in turn feeds the growing demand for data centers, is another factor driving the promising growth prognosis.

Report Coverage

This research report categorizes the market for North America data center cooling market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the North America data center cooling market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the North America data center cooling market.

North America Data Center Cooling Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 6.44 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 11.5% |

| 2035 Value Projection: | USD 21.32 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 225 |

| Tables, Charts & Figures: | 119 |

| Segments covered: | By Type, By Application |

| Companies covered:: | Madison Air, Stulz GmbH, Asetek A/S, Thermal Care, Vertiv Group Corp., Schneider Electric SE, Rittal GmbH & Co. KG, MODINE MANUFACTURING COMPANY, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The data center cooling market, including utilizing automation and artificial intelligence to track and evaluate patterns, is driving expansion in the North America data center cooling market. The North America data center cooling industry is changing due to the rapid growth of artificial intelligence infrastructure, increasing rack densities above 100 kW, and regulatory pressure to increase power-usage effectiveness. Demand is maintained by colocation providers that provide shared, energy-efficient platforms, but hyperscale owners aggressively embrace immersion and direct-to-chip technologies to control future capacity additions. Most businesses across the world are finding that on-premise data centers are expensive due to the growing volume of data produced by artificial intelligence (AI), big data, analytics, and the Internet of Things (IoT).

Restraining Factors

High upfront investment prices, difficult installation procedures, worries about energy usage, and difficulties retrofitting older data centers with cutting-edge cooling technologies are some of the issues restricting the growth of the North America data center cooling market.

Market Segmentation

The North America data center cooling market share is classified into type and application.

- The non-raised floors segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The North America data center cooling market is segmented by type into raised floors and non-raised floors. Among these, the non-raised floors segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The growing need for effective, space-saving cooling systems and changing data center designs are the main drivers of the non-raised floor. Data centers have historically housed cooling infrastructure, such as air conditioners and chilled water pipelines, on high levels.

- The telecom segment held a largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The North America data center cooling market is segmented by application into telecom, IT, retail, healthcare, BFSI, energy, and others. Among these, the telecom segment held a largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The need for more sophisticated and energy-efficient data centers to serve telecom infrastructure is growing as telecom operators continue to extend their networks, particularly with the introduction of 5G technology. Telecom firms are making significant investments in data centers in order to store and handle the enormous volumes of data produced by consumer interactions, IoT devices, and mobile networks.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the North America data center cooling market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Madison Air

- Stulz GmbH

- Asetek A/S

- Thermal Care

- Vertiv Group Corp.

- Schneider Electric SE

- Rittal GmbH & Co. KG

- MODINE MANUFACTURING COMPANY

- Others

Recent Developments

- In March 2025, Davison, North Carolina A new thermal management system designed specifically for data centers, the Trane Fan Coil Wall, has been launched by Trane Technologies a worldwide climate developer with yearly revenues over $19.8 billion and a flawless Piotroski Score of 9 according to InvestingPro. Designed to provide excellent performance and energy efficiency, this platform was announced today as part of the company's expansion into data center cooling systems.

- In February 2025, Carrier Global Corporation, a leader in intelligent climate and energy solutions, announced that ZutaCore®, a game-changing developer of two-phase direct-to-chip liquid cooling technology for data centers, is partnering with its venture arm, Carrier Ventures, in an investment and technological relationship. This investment is in line with Carrier's aim of offering sophisticated, integrated cooling solutions to satisfy data center clients' vital cooling requirements.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at North America, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the North America data center cooling market based on the below-mentioned segments:

North America Data Center Cooling Market, By Type

- Raised Floors

- Non-Raised Floors

North America Data Center Cooling Market, By Application

- Telecom

- IT

- Retail

- Healthcare

- BFSI

- Energy

- Others

Need help to buy this report?