North America Construction Equipment Market Size, Share, and COVID-19 Impact Analysis, By Equipment Type (Earthmoving Equipment, Material Handling Equipment & Cranes, Concrete Equipment, Road Building Equipment, Civil Engineering Equipment, Crushing and Screening Equipment, and Others), By Application (Residential, Commercial, and Industrial), and North America Construction Equipment Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsNorth America Construction Equipment Market Insights Forecasts to 2035

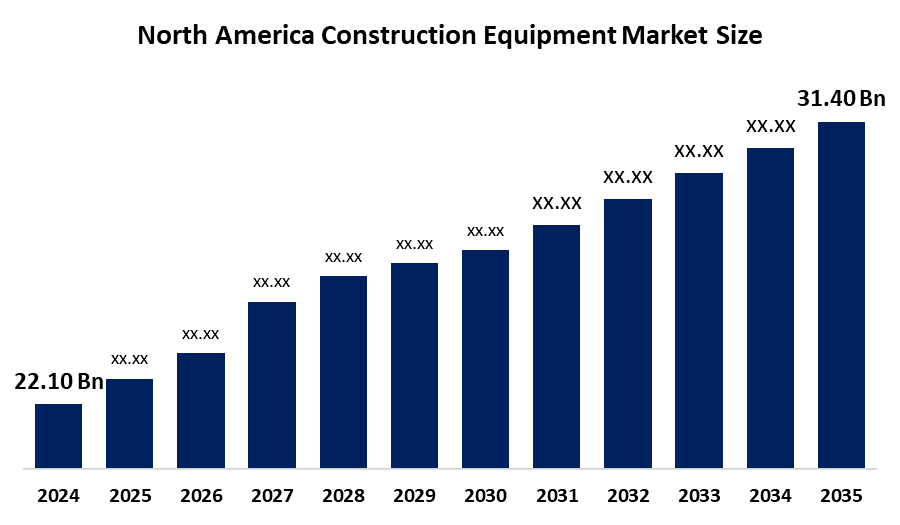

- The North America Construction Equipment Market Size Was Estimated at USD 22.10 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 3.24 % from 2025 to 2035

- The North America Construction Equipment Market Size is Expected to Reach USD 31.40 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the North America construction equipment market is anticipated to reach USD 31.40 billion by 2035, growing at a CAGR of 3.24 % from 2025 to 2035. The demand for sophisticated, effective machinery and automation solutions is being driven by factors such as urbanization, smart technology integration, infrastructure modernization, and growing investments in sustainable construction methods. These factors are creating opportunities for the North America construction equipment market.

Market Overview

The North America construction equipment market is made up of the manufacture, distribution, sale, and product support of equipment used to carry out construction activities in the United States, Canada, and Mexico. The construction equipment includes many lines, which include heavy trucks, road-building equipment, material handling equipment, and earthmoving equipment. The North America construction equipment market is vital for infrastructure, commercial, and residential development in this region. The market for construction equipment can be shaped by growing electrification trends and innovations in new product introductions. The need for earthmoving and material handling equipment is expected to rise as a result of increased infrastructure building activities worldwide, propelling the North America construction equipment market. Technology is advancing significantly in the construction equipment market to provide more dependable and efficient products.

Report Coverage

This research report categorizes the market for North America construction equipment market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the North America construction equipment market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the North America construction equipment market.

North America Construction Equipment Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 22.10 Billion |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 3.24 % |

| 2035 Value Projection: | USD 31.40 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 120 |

| Tables, Charts & Figures: | 140 |

| Segments covered: | By Equipment Type, By Application. |

| Companies covered:: | Caterpillar Inc, Terex Corp, Volvo AB ADR, Hitachi Ltd, Komatsu Ltd, Deere & Co, Kubota Corp, Liebherr Group, Manitou BF SA, Hyundai Motor Co, Wacker Neuson SE, CNH Industrial NV and Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Rapid urbanization, significant technical improvements, and a growing focus on innovation and sustainability by major players to meet the rising demand for products are driving the North America construction equipment market expansion. Infrastructure development and the rise of electric and self-driving construction equipment are the main factors propelling the North America construction equipment market expansion. The market is growing as a result of numerous government efforts, growing infrastructure, fast urbanization, frequent equipment replacement needs, strict environmental laws, and constant technical improvements.

Restraining Factors

High upfront investment costs, strict environmental restrictions, supply chain interruptions, a lack of experienced labor, and volatile raw material prices that impact output and profitability are some of the factors restricting the North America construction equipment market.

Market Segmentation

The North America construction equipment market share is classified into equipment type and application

- The earthmoving equipment segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The North America construction equipment market is segmented by equipment type into earthmoving equipment, material handling equipment & cranes, concrete equipment, road building equipment, civil engineering equipment, crushing and screening equipment, and others. Among these, the earthmoving equipment segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The vital function that earthmoving equipment plays in excavation, grading, and site preparation drives this market sector. Technological developments like electric and GPS-enabled excavators, as well as strong demand from mining, urban construction, and infrastructure projects, reinforce its supremacy.

- The residential segment held a largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The North America construction equipment market is segmented by application into residential, commercial, and industrial. Among these, the residential segment held a largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The ongoing need for housing and urban growth are the main drivers of the residential sector. Governments and developers give priority to residential developments as cities and populations increase, which increases demand for concrete, material handling, and earthmoving equipment.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the North America construction equipment market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Caterpillar Inc

- Terex Corp

- Volvo AB ADR

- Hitachi Ltd

- Komatsu Ltd

- Deere & Co

- Kubota Corp

- Liebherr Group

- Manitou BF SA

- Hyundai Motor Co

- Wacker Neuson SE

- CNH Industrial NV

- Others

Recent Developments

- In May 2023, the small excavators ZAXIS-7, launched by Hitachi Construction Machinery Co., Ltd., are intended to improve task efficiency on urban construction sites. Additionally, the business introduced the ZX75US-7 model, which had an ultra-short tail swing radius that made it possible to enter tight locations. Furthermore, the ZX85USB-7 model allowed for productive excavation close to guardrails and walls with its swing boom and ultra-short-tail swing radius.

- In May 2023, the new Cat D10 Dozer, created for demanding construction sites and conditions, was announced by Caterpillar Inc. To efficiently transfer power to the ground, the dozer uses a stator clutch torque converter and load-sensing hydraulics.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at North America, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the North America construction equipment market based on the below-mentioned segments:

North America Construction Equipment Market, By Equipment Type

- Earthmoving Equipment

- Material Handling Equipment & Cranes

- Concrete Equipment

- Road Building Equipment

- Civil Engineering Equipment

- Crushing and Screening Equipment

- Others

North America Construction Equipment Market, By Application

- Residential

- Commercial

- Industrial

Need help to buy this report?