North America Confectionery Market Size, Share, and COVID-19 Impact Analysis, By Confections (Chocolate, Gums, Snack Bar, Sugar Confectionery), By Distribution Channel (Convenience Store, Online Retail Store, Supermarket/Hypermarket, Others), and North America Confectionery Market Insights, Industry Trend, Forecasts to 2033.

Industry: Food & BeveragesNorth America Confectionery Market Insights Forecasts to 2033

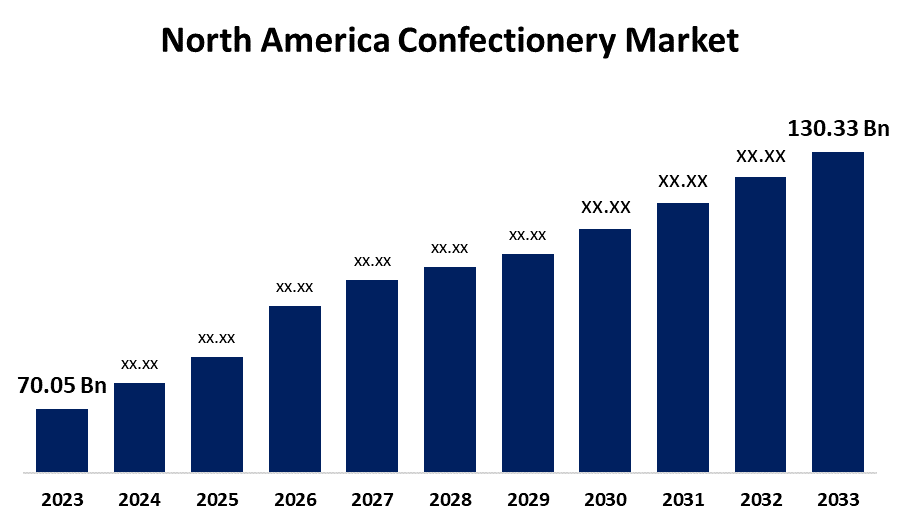

- The North America Confectionery Market Size was valued at USD 70.05 Billion in 2023.

- The North America Confectionery Market Size is Growing at a CAGR of 6.41% from 2023 to 2033

- The North America Confectionery Market Size is Expected to Reach USD 130.33 Billion by 2033

Get more details on this report -

The North America Confectionery Market Size is anticipated to reach USD 130.33 Billion by 2033, growing at a CAGR of 6.41% from 2023 to 2033. The North America confectionery market is propelled by increasing consumer demand for indulgent and convenient snacks, continuous product innovation, robust seasonal sales, premium and artisanal growth, and improved accessibility through growing e-commerce and digital marketing platforms.

Market Overview

North America confectionery industry is the market that constitutes manufacturing, promotion, and retail of sweet foods like chocolates, gums, sweets, and snack bars in the North America region. Customer's preferences and their fondness towards sweets and chocolates is a never-ending explanation for the expanding size of the confectionery industry globally. Retailers are increasingly embracing technologies such as digital signage, integrated payment, and customized marketing to improve the in-store environment and make shopping easier for customers. Rapid commerce and same-day delivery have also transformed the way consumers buy confectionery, with convenience emerging as a primary driver of sales. Meanwhile, sustainability is emerging as a primary concern for manufacturers. Numerous firms are now pledging responsible ingredient sourcing and green packaging to respond to increasing demand from consumers who care about the environment. In addition, manufacturers are spending money on sustainable packaging and clean-label products to stay in sync with environmental and health trends. These advancements, combined with effective marketing and robust brand affinity, set the North American confectionary market up for sustained growth, diversification, and resistance to a competitive environment.

Report Coverage

This research report categorizes the market for the North America confectionery market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the North America confectionery market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the North American confectionery market.

North America Confectionery Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 70.05 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 6.41% |

| 2033 Value Projection: | USD 130.33 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Confections (Chocolate, Gums, Snack Bar, Sugar Confectionery), By Distribution Channel (Convenience Store, Online Retail Store, Supermarket/Hypermarket, Others) |

| Companies covered:: | Kraft Foods, The Hersheys Company, Mars International, Mondelez International, Ferrero Group, Nestle, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

North American consumers have a strong desire for indulgent treats, and confectionery items such as chocolates, candies, and gums are affordable luxuries. They are usually eaten for comfort, celebration, or convenience, sustaining steady market demand. Additionally, Manufacturers are constantly introducing new flavors, textures, and limited-edition items to keep consumers interested. From spicy and exotic candies to low-sugar and organic chocolates, innovation sustains repeat buying and draws new consumers from diverse demographics.

Restraining Factors

Stricter controls on sugar levels, added ingredients, and labeling particularly on children-oriented products are influencing the way confectionery firms develop and sell their products. Adherence to regulations could involve expensive recipe or packaging reformulations and limit advertising campaigns, particularly for high-sugar products.

Market Segmentation

The North America confectionery market share is classified by confections and distribution channel.

- The chocolate segment accounted for the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the confections, the North America confectionery market is segmented into chocolate, gums, snack bar, sugar confectionery. Among these, the chocolate segment accounted for the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is due to chocolate is always among the most beloved and widely enjoyed confections in North America. It crosses a broad age demographic from kids to adults and is linked with indulgence, gifting, and holiday celebrations. The rise in demand for premium, artisanal, and ethically sourced chocolate, which has especially resonated with adult consumers looking for high quality or health-oriented choices.

- The supermarket/hypermarket segment accounted for the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the distribution channel, the North America confectionery market is divided into convenience store, online retail store, supermarket/hypermarket, others. Among these, the supermarket/hypermarket segment accounted for the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period. The growth is attributed due to these convenience stores carry a wide assortment of confectionery products, from mass brands to premium and seasonal offerings. With their capacity to highlight new product launches and limited editions, there is enhanced visibility and consumer trials, and they become the first choice for regular and occasional purchasers alike. It provides promotions, bulk offers, and loyalty schemes on confectionery products, which drives greater basket sizes. Such pricing strategies not only engage cost-conscious consumers but also promote brand loyalty and repeat sales.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the North America confectionery market. It also includes a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Kraft Foods

- The Hersheys Company

- Mars International

- Mondelez International

- Ferrero Group

- Nestle

- Others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In April 2025, Moon Pie introduced a limited-batch Key Lime Mini Moon Pie with a lime-coated shell and the traditional marshmallow filling. This summer-specific flavor is found only in Publix stores and appeals to shoppers looking for a cool summer dessert.

- In May 2024, Ferrero's Tic Tac brand entered the candy category with Tic Tac Chewy! a product with a crunchy shell and chewy center. Offered in two flavors Fruit Adventure and Sour Adventure, this introduction represents Tic Tac's initial candy product.

Market Segment

This study forecasts revenue at North America, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the North America confectionery market based on the below-mentioned segments:

North America Confectionery Market, By Confections

- Chocolate

- Gums

- Snack Bar

- Sugar Confectionery

North America Confectionery Market, By Distribution Channels

- Convenience Store

- Online Retail Store

- Supermarket/Hypermarket

- Others

Need help to buy this report?