North America Cell Separation Market Size, Share, and COVID-19 Impact Analysis, By Cell Type (Human Cells and Animal Cells), By Technique (Centrifugation, Surface Marker, and Filtration), By Application (Biomolecule Isolation, Cancer Research, Stem Cell Research, Tissue Regeneration, In Vitro Diagnostics, and Therapeutics), and North America Cell Separation Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareNorth America Cell Separation Market Insights Forecasts to 2035

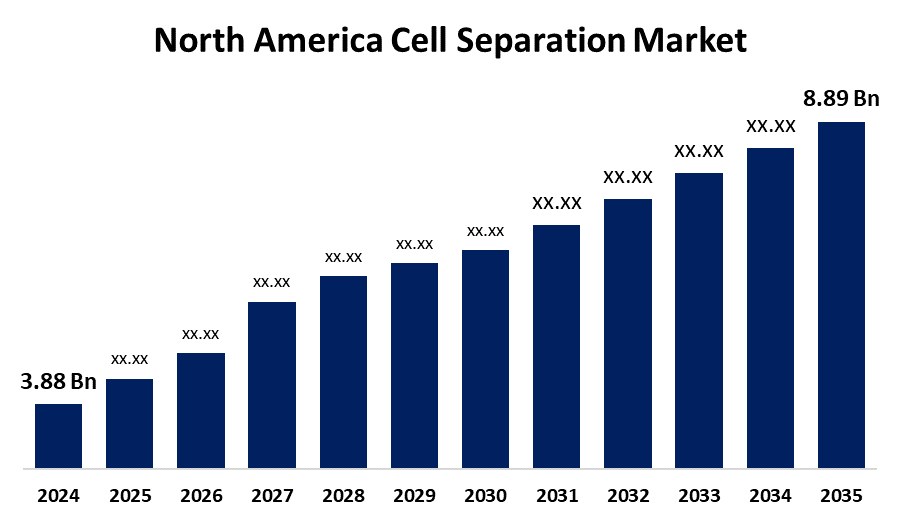

- The North America Cell Separation Market Size Was Estimated at USD 3.88 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 7.83% from 2025 to 2035

- The North America Cell Separation Market Size is Expected to Reach USD 8.89 Billion by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the North America cell separation Market Size is Anticipated to Reach USD 8.89 Billion by 2035, Growing at a CAGR of 7.83% from 2025 to 2035. The growing need for biomolecule isolation, stem cell research, regenerative medicine, and increased investments in biotechnology and sophisticated diagnostic technologies across healthcare sectors are driving the North America cell separation market, which has important opportunities.

Market Overview

The biotechnology industry's regional section devoted to separating particular cell populations from heterogeneous mixtures for use in medicinal, diagnostic, and research applications is known as the North America cell separation market. The North America cell separation market includes products like consumables and instruments, and covers a variety of technologies like surface marker-based separation, filtration, and centrifugation. The market for cell separation is expanding rapidly due to its use in many different industries, such as biologics, oncology research, diagnostics, and therapeutic protein manufacturing. Growing rates of infectious and chronic illnesses, including COVID-19 and cancer, as well as ongoing government efforts to boost the biotechnology sector, are the main drivers of the North America cell separation market expansion. Proteins, nucleic acids, chromatin, and protein complexes can all be better separated for further investigation with the help of advanced cell isolation products these elements are anticipated to propel North America cell separation market expansion.

Report Coverage

This research report categorizes the market for North America cell separation market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the North America cell separation market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the North America cell separation market.

North America Cell Separation Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 3.88 Billion |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 7.83% |

| 2035 Value Projection: | USD 8.89 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 170 |

| Tables, Charts & Figures: | 140 |

| Segments covered: | By Cell Type, By Application and COVID-19 Impact Analysis. |

| Companies covered:: | Corning Inc., Terumo Corp, Merck KGaA, BD, Danaher Corp, Akadeum Life Sciences, STEMCELL Technologies, Agilent Technologies Inc., Bio-Rad Laboratories Inc, Thermo Fisher Scientific Inc and Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

One of the main factors driving the growth of the North America cell separation market is the growing interest of biopharmaceutical businesses and researchers worldwide in cancer and stem cell research. Additionally, the market for cell separation is growing as a result of rising investments in stem cell research. Cell separation is one of the primary factors driving the demand for specialized drugs and the creation of effective generic methods for treating large populations. The increase in the prevalence of chronic diseases worldwide is expected to spur the development of tissue engineering or regenerative treatments and push researchers to use cell separation methods more quickly.

Restraining Factors

The North America cell separation market growth can be hampered by the high cost of cell separation technology implant therapy, but it is anticipated that the lack of technically skilled personnel and growing worries about the strict regulations and compliances for cell separation are going to restrict market expansion.

Market Segmentation

The North America cell separation market share is classified into cell type, technique, and application.

- The animal cells segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The North America cell separation market is segmented by cell type into human cells and animal cells. Among these, the animal cells segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The expansion of the animal cells market is mostly being driven by the increased attention that the public, private, and healthcare organizations are paying to the development and discovery of new drugs. Animal cells are used in drug research and development to investigate efficacy, novel drug molecule pharmacokinetics, and initial toxicity.

- The centrifugation segment held a largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The North America cell separation market is segmented by technique into centrifugation, surface marker, and filtration. Among these, the centrifugation segment held a largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The centrifugation segment results from the widespread use of this technique by research labs, academic institutions, and biotechnology and pharmaceuticals enterprises. One of the most crucial phases in the procedure is centrifugation.

- The biomolecule isolation segment held a largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The North America cell separation market is segmented by application into biomolecule isolation, cancer research, stem cell research, tissue regeneration, in vitro diagnostics, and therapeutics. Among these, the biomolecule isolation segment held a largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The primary factor influencing the largest percentage of biomolecule isolation is a growing focus on the manufacturing of biopharmaceuticals, such as recombinant proteins, monoclonal antibodies, and biosimilars. Additionally, the market is growing as a result of increased government financing for the discovery of new drugs.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the North America cell separation market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Corning Inc.

- Terumo Corp

- Merck KGaA

- BD, Danaher Corp

- Akadeum Life Sciences

- STEMCELL Technologies

- Agilent Technologies Inc.

- Bio-Rad Laboratories Inc

- Thermo Fisher Scientific Inc

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In October 2023, the Alerion cell separation system preview was launched by Akadeum Life Sciences, a world leader in buoyancy-based cell separation technology. Using Akadeum's ground-breaking Buoyancy Activated Cell Sorting (BACS) microbubble technology, the device will offer a closed system for removing T cells from a leukopak. The device promises to reduce cell depletion, increase cell recovery, automate a number of manual tasks, improve sample processing resilience, speed up the cell separation process, and lower the frequency of user errors.

Market Segment

This study forecasts revenue at North America, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the North America cell separation market based on the below-mentioned segments:

North America Cell Separation Market, By Cell Type

- Human Cells

- Animal Cells

North America Cell Separation Market, By Technique

- Centrifugation

- Surface Marker

- Filtration

North America Cell Separation Market, By Application

- Biomolecule Isolation

- Cancer Research

- Stem Cell Research

- Tissue Regeneration

- In Vitro Diagnostics

- Therapeutics

Need help to buy this report?