North America Carotenoids Market Size, Share, and COVID-19 Impact Analysis, By Product (Beta Carotene, Lutein, Lycopene, Astaxanthin, Zeaxanthin, Canthaxanthin, and Others), By Application (Food, Supplements, Feed, Pharmaceuticals, and Cosmetics), and North America Carotenoids Market Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesNorth America Carotenoids Market Insights Forecasts to 2035

- The North America Carotenoids Market Size Was Estimated at USD 2.35 Million in 2024

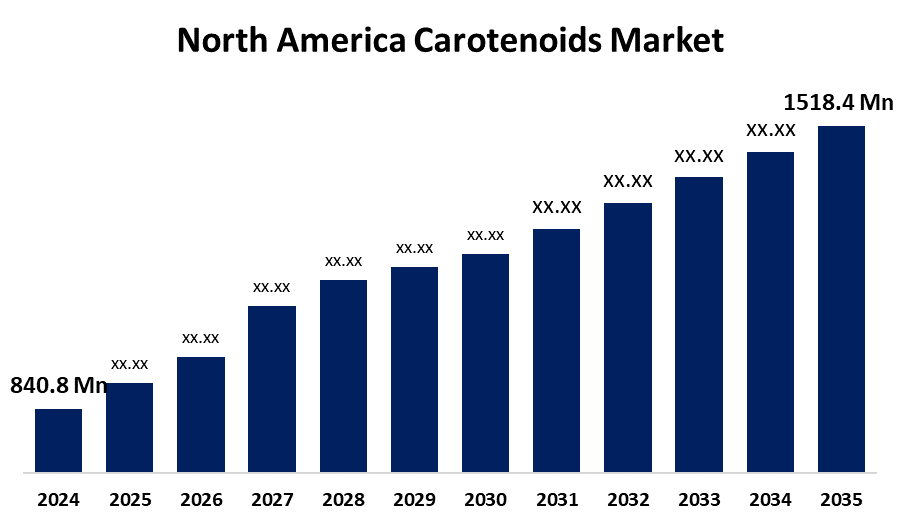

- The Market Size is Expected to Grow at a CAGR of Around 5.52 % from 2025 to 2035

- The North America Carotenoids Market Size is Expected to Reach USD 1518.4 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The North America carotenoids Market Size is anticipated to reach USD 1518.4 Million by 2035, growing at a CAGR of 5.52 % from 2025 to 2035. Growing health consciousness, the need for natural food additives, the development of nutraceuticals, and the expansion of uses in the pharmaceutical, cosmetic, and animal feed sectors all offer opportunities for the North America carotenoids market.

Market Overview

The regional industry that produces, distributes, and uses carotenoids in nations like the US, Canada, and Mexico is known as the North America carotenoids market. Natural pigments called carotenoids are present in plants, algae, and photosynthetic bacteria. They are used extensively for their health advantages and antioxidant qualities. A growing number of products, such as food and drink, dietary supplements, cosmetics, medications, and animal feed, include these substances. The North America carotenoids market is driven by the need for natural and clean-label products, rising consumer awareness of preventive healthcare, and technological developments in formulation and extraction. Government initiatives, increased use of carotenoids as food coloring, and the expansion of end-user industries are all factors contributing to the North America carotenoids market. The advantages of carotenoid extraction for preventative healthcare, increased use as food coloring, expansion of end-user businesses, and, more recently, cutting-edge technology are additional important motivators.

Report Coverage

This research report categorizes the market for North America carotenoids market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the North America carotenoids market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the North America carotenoids market.

North America Carotenoids Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 840.8 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.52% |

| 2035 Value Projection: | USD 1518.4 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 123 |

| Segments covered: | By Product, By Application |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

The North America carotenoids market is expanding due to the growing demand for natural colorants in the food and beverage sector, as customers favor natural and clean-label products. Changing dietary habits and increased awareness of health and well-being are further factors propelling this market expansion. Natural carotenoids are increasingly being used as food coloring due to the food industry's increased preference for natural and clean-label products. A major factor contributing to the rise in carotenoids is consumers' growing health consciousness, since these compounds are well-known for their antioxidant qualities and other health advantages, such as lowering the risk of chronic illnesses like cancer and eye conditions.

Restraining Factors

High production and extraction costs, regulatory obstacles, the restricted stability of carotenoids after processing, and competition from synthetic substitutes and other functional ingredients are some of the problems that are restricting the North America carotenoids market.

Market Segmentation

The North America carotenoids market share is classified into product and application.

- The astaxanthin segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The North America carotenoids market is segmented by product into beta carotene, lutein, lycopene, astaxanthin, zeaxanthin, canthaxanthin, and others. Among these, the astaxanthin segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The astaxanthin carotenoids due to the enhanced health-promoting qualities. Health-conscious consumers favor it as a supplement because of its widespread use in the nutraceutical sector to promote cardiovascular health, strengthen the immune system, and lower inflammation. Astaxanthin is essential for improving the pigmentation of farmed seafood, such as salmon, trout, and shrimp, in the aquaculture and animal feed industries.

- The feed segment held a largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The North America carotenoids market is segmented by application into food, supplements, feed, pharmaceuticals, and cosmetics. Among these, the feed segment held a largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The feed application market is a result of their critical function in promoting animal health, raising the caliber and appeal of animal products, and satisfying consumer desire for natural ingredients. Carotenoids such as astaxanthin, beta-carotene, lutein, and canthaxanthin are widely utilized in livestock, poultry, and aquaculture. They are added to feed to improve animal performance, pigmentation, and nutritional value.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the North America carotenoids market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- BASF SE

- Döhler Group

- Royal DSM N.V.

- Chr. Hansen A/S

- FMC Corporation

- Excelvite SDN. BHD

- Kemin IndustrieInc.NC

- Cyanotech Corporation

- Allied Biotech Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In January 2024, A new branded lycopene formulation that targets cardiovascular health was launched by Lycored Ltd. Alongside the launch, a consumer and healthcare professional education campaign was introduced to promote the ingredient's clinical benefits and boost uptake.

- In May 2024, Kemin Industries expanded its manufacturing facility in Iowa to boost production capacity for natural carotenoids, particularly those used in animal feed and pet nutrition. The expansion was part of Kemin’s broader strategy to meet growing demand for natural pigmentation and immune-supportive additives.

Market Segment

This study forecasts revenue at North America, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the North America carotenoids market based on the below-mentioned segments:

North America Carotenoids Market, By Product

- Beta Carotene

- Lutein

- Lycopene

- Astaxanthin

- Zeaxanthin

- Canthaxanthin

- Others

North America Carotenoids Market, By Application

- Food

- Supplements

- Feed

- Pharmaceuticals

- Cosmetics

Need help to buy this report?