North America Cafes & Bars Market Size, Share, and COVID-19 Impact Analysis, By Cuisine (Bars & Pubs, Cafes, Juice/Smoothie/Desserts Bars, Specialist Coffee & Tea Shops), By Outlet (Chained Outlets, Independent Outlets), and North America Cafes & Bars Market Insights, Industry Trend, Forecasts to 2033.

Industry: Food & BeveragesNorth America Cafes & Bars Market Insights Forecasts to 2033

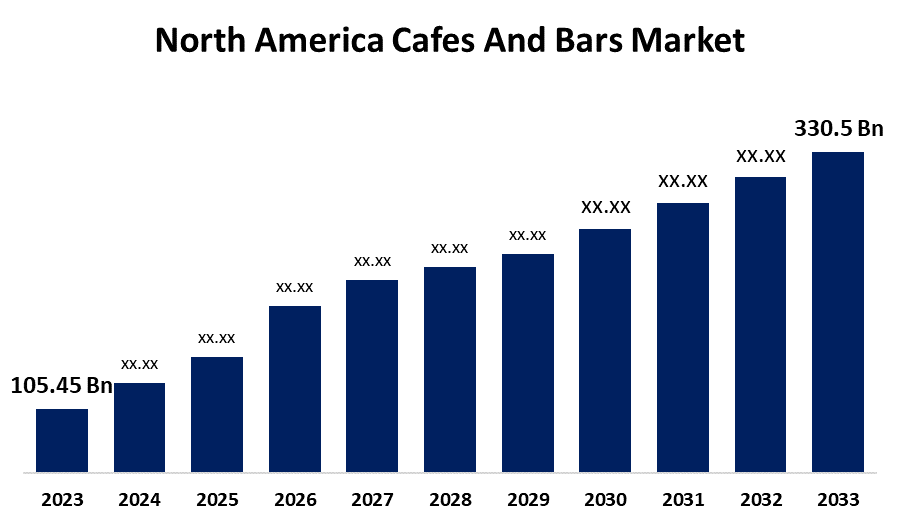

- The North America Cafes & Bars Market Size was valued at USD 105.45 Billion in 2023.

- The North America Cafes & Bars Market Size is Growing at a CAGR of 12.10% from 2023 to 2033

- The North America Cafes & Bars Market Size is Expected to Reach USD 330.5 Billion by 2033

Get more details on this report -

The North America Cafes & Bars Market Size is anticipated to reach USD 330.5 Billion by 2033, growing at a CAGR of 12.10% from 2023 to 2033. The North America cafes & bars market is fuelled by expanding coffee culture, growing urbanization, the need for social eating, specialty beverages growth, and tech-enabled offerings such as mobile order and delivery that boost customer convenience and business scalability.

Market Overview

North America cafes & bars market is defined as the market that includes businesses mainly engaged in offering coffee, tea, alcoholic drinks, and light food in a social and informal environment. The businesses involved vary from standalone cafes to extensive bar chains and serve an array of consumer tastes in nations such as the United States, Canada, and Mexico. In addition, the increasing popularity of nightlife, coupled with a rise in the number of high school and college students socializing in cafes, are two key drivers of the expansion of the North American café and bar market. The North America cafes & bars market is driven by innovation in specialty drinks, including gourmet coffee, craft cocktails, and health-focused options like plant-based beverages. Emerging trends involve green packaging, sustainable procurement, and special menu offerings to appeal to a variety of consumers. Expansion through digital ordering and delivery services has also furthered the market, offering convenience to consumers and taking establishments beyond their geographical locations.

Report Coverage

This research report categorizes the market for the North America cafes & bars market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the North America cafes & bars market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the North American cafes & bars market.

North America Cafes And Bars Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 105.45 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 12.10% |

| 2033 Value Projection: | USD 330.5 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Cuisine, By Outlet |

| Companies covered:: | Dutch Bros Inc., Focus Brands LLC, Inspire Brands Inc., International Dairy Queen Inc., McDonald’s Corporation, Smoothie King Franchises Inc., Starbucks Corporation, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Consumers increasingly value high-quality specialty drinks like artisanal coffee and craft cocktails. Demand for these items supports premium pricing and innovation, allowing cafés and bars to draw a loyal customer base interested in distinctive flavors and upscale drinking experiences. In addition, mobile apps, online ordering, and third-party delivery further enhance customer convenience and accessibility. These devices enable cafes and bars to connect with more people, enhance the speed of service, and induce repeat business through digital loyalty and targeted marketing approaches further fueling the demand.

Restraining Factors

Operating a bar or café in North America entails high expenses, ranging from rent, labor, and ingredients to utilities. Increasing wages, particularly within cities, and inflation have narrowed profit margins, especially for standalone establishments. Furthermore, the hospitality sector is dealing with a persistent shortage of skilled labor, impacting service quality and availability. Challenges in staffing and retention place added pressure on operations, slowing down expansion and consistency of service.

Market Segmentation

The North America cafes & bars market share is classified by cuisine and outlets.

- The cafes segment accounted for the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the cuisine, the North America cafes & bars market is segmented into bars & pubs, cafes, juice/smoothie/desserts bars, and specialist coffee & tea shops. Among these, the cafes segment accounted for the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period. The growth is attributed to the expansion of specialty coffee and third-wave coffee culture has increased demand for high-end brews, artisanal roasts, and distinctive café experiences, which further spur growth in the café segment. Cafes are front-runners in adopting digital ordering, delivery apps, and loyalty programs, enhancing convenience and customer retention. Such technology-based features enhance user experience and draw a broad consumer base.

- The independent outlets segment accounted for the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the outlets, the North America cafes & bars market is divided into chained outlets and independent outlets. Among these, the independent outlets segment accounted for the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is due to customers increasingly looking for authentic, local, and personalized experiences. Independent outlets tend to provide distinctive menus, intimate atmospheres, and community-oriented service that resonate more with contemporary consumers than the standardized method of large chains. Independent outlets are more at liberty to test new concepts, flavors, or service models without the need for corporate sanction. This enables them to react quickly to trends like plant-based, craft beverages, and seasonal menus.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the North America cafes & bars market. It also includes a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Dutch Bros Inc.

- Focus Brands LLC

- Inspire Brands Inc.

- International Dairy Queen Inc.

- McDonald's Corporation

- Smoothie King Franchises Inc.

- Starbucks Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In April 2025, Dutch Bros re-released its fan-favorite White Chocolate Lavender drinks at more than 650 company-owned locations nationwide. Coming in three flavors Cold Brew, Breve, and Dutch Freeze, the beverages feature white chocolate and lavender together with Dutch Bros' classic Soft Top. For those who don't drink coffee, the flavor is also available in Strawberry Lavender Lemonade, tea, or Frost (a milkshake-like drink).

Market Segment

This study forecasts revenue at North America, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the North America cafes & bars market based on the below-mentioned segments:

North America Cafes & Bars Market, By Cuisine

- Bars & Pubs

- Cafes

- Juice/Smoothie/Desserts Bars

- Specialist Coffee & Tea Shops

North America Cafes & Bars Market, By Outlets

- Chained Outlets

- Independent Outlets

Need help to buy this report?