North America Cable Market Size, Share, and COVID-19 Impact Analysis, By Product Type (LV/MV/HV Power Cables, Fiber Optic Cables, Specialty Cables, Coaxial & Data Cables, and Control & Instrumentation Cables), By Application (Energy Transmission & Distribution, Control & Automation, Communication & Data Transfer, and Mobility), By End User Industry (Renewables, Industrial Applications, Industrial Automation and Control, Data Cables, Data Centers and Cloud Infrastructure, Home and Commercial Appliances, Aerospace and Aviation, Defense and Military, and Infrastructure and Civil Works), and North America, Cable Market Insights, Industry Trend, Forecasts to 2035

Industry: Semiconductors & ElectronicsNorth America Cable Market Insights Forecasts to 2035

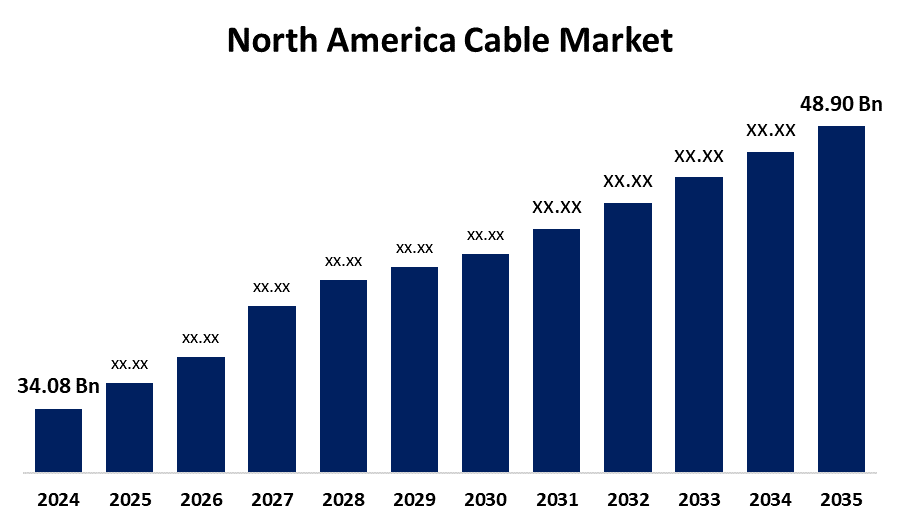

- The North America Cable Market Size was Estimated at USD 34.08 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 3.34% from 2025 to 2035

- The North America Cable Market Size is Expected to Reach USD 48.90 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The North America Cable Market Size is anticipated to reach USD 48.90 Billion by 2035, growing at a CAGR of 3.34% from 2025 to 2035. The market presents opportunities in the areas of smart grid modernization, the growth of energy from renewable sources, the deployment of 5G networks, the expansion of electric vehicles, and the sophisticated production of high-performance, energy-efficient cables for a range of industries and commercial uses.

Market Overview

The manufacturing, distribution, and use of wire and cable products in a variety of industries, such as energy, telecommunications, construction, automotive, and industrial infrastructure, are all included in the North America cable market. It serves both residential and commercial purposes and comprises a variety of cable types, including fiber optic, control, and low-voltage power cables. The goals of the North America cable market are to sustain telecommunications infrastructure, improve energy efficiency, advance cable technology, and satisfy the rising demand for high-performance solutions in the commercial, residential, and industrial sectors.

Urbanization, infrastructural growth, and the rising demand for dependable power transmission and communication networks are some of the factors driving the North America cable market. The expansion of the North America cable market is fueled by the growing deployment of new power grid infrastructure. The need for specialized cables is being driven by the growing need for renewable energy sources like wind and solar electricity.

Report Coverage

This research report categorizes the market for North America cable market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the North America cable market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the North America cable market.

North America Cable Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 34.08 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 3.34% |

| 2035 Value Projection: | USD 48.90 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 121 |

| Segments covered: | By Product Type, By Application and By End User Industry |

| Companies covered:: | Prysmian, Nexans, Southwire, General Cable, Corning, CommScope, OFS Fitel, TE Connectivity, Amphenol, Belden, Legrand, Hubbell, Superior Essex, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of data centers, electric cars, and 5G networks all contribute to the acceleration of demand. It is anticipated that the rise in government spending on power distribution and transmission would fuel the expansion of the North America cable market. Increased demand for sophisticated cabling solutions is fueled by the proliferation of data centers and electric cars. Strong infrastructure development, growing energy consumption, and fast urbanization are the main factors propelling the North America cable market.

Restraining Factors

The North America cable market is hampered by unstable raw material prices, strict environmental laws, expensive installation costs, and a lack of competent workers. Widespread adoption and infrastructure scalability are further hampered by supply chain interruptions and difficulties integrating technology.

Market Segmentation

The North America cable market share is classified into product type, application, and end user industry.

Get more details on this report -

- The LV/MV/HV power cables segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The North America cable market is segmented by product type into LV/MV/HV power cables, fiber optic cables, specialty cables, coaxial & data cables, and control & instrumentation cables. Among these, the LV/MV/HV power cables segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. Increased investments in energy infrastructure, grid modernization, and the incorporation of renewable energy sources propelled the LV/MV/HV power cables market. The segment is strengthened by the rising need for dependable and effective electricity transmission and distribution networks.

- The energy transmission & distribution segment held a largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The North America cable market is segmented by application into energy transmission & distribution, control & automation, communication & data transfer, and mobility. Among these, the energy transmission & distribution segment held a largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The integration of renewable energy sources like solar and wind, grid modernization, and large investments in power infrastructure propelled the energy transmission and distribution market. Government programs to achieve carbon-free electricity and improve energy reliability also contribute to the segment's growth.

- The renewables segment held a largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The North America cable market is segmented by end user industry into renewables, industrial applications, industrial automation and control, data cables, data centers and cloud infrastructure, home and commercial appliances, aerospace and aviation, defense and military, and infrastructure and civil works. Among these, the renewables segment held a largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. Large investments in wind and solar energy projects, as well as government programs to achieve carbon-free electricity, are driving the renewables market. The segment's expansion was mostly driven by the growing need for specialized cables in renewable energy systems, such as grid integration and power transmission.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the North America cable market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Prysmian

- Nexans

- Southwire

- General Cable

- Corning

- CommScope

- OFS Fitel

- TE Connectivity

- Amphenol

- Belden

- Legrand

- Hubbell

- Superior Essex

- Others

Recent Developments

- In May 2023, the EZConnect platform, a new, adaptable antenna design with 1-foot cables with standard connectors that connect seamlessly to a customizable cable harness, was launched by Airgain, Inc., a leading global supplier of wireless connectivity solutions that designs and manufactures embedded components, external antennas, and integrated systems.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at North America, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the North America cable market based on the below-mentioned segments:

North America Cable Market, By Product Type

- LV/MV/HV Power Cables

- Fiber Optic Cables

- Specialty Cables

- Coaxial & Data Cables

- Control & Instrumentation Cables

North America Cable Market, By Application

- Energy Transmission & Distribution

- Control & Automation

- Communication & Data Transfer

- Mobility

North America Cable Market, By End User Industry

- Renewables

- Industrial Applications

- Industrial Automation and Control

- Data Cables

- Data Centers and Cloud Infrastructure

- Home and Commercial Appliances

- Aerospace and Aviation

- Defense and Military

- Infrastructure and Civil Works

Need help to buy this report?