North America Biological Indicators Market Size, Share, and COVID-19 Impact Analysis, By Product (Steam Biological Indicators, Hydrogen Peroxide Biological Indicators, and Others), By Form (Self-contained Vials, Indicator Strips, and Others), and North America, Biological Indicators Market Insights, Industry Trend, Forecasts to 2035.

Industry: HealthcareNorth America Biological Indicators Market Insights Forecasts To 2035

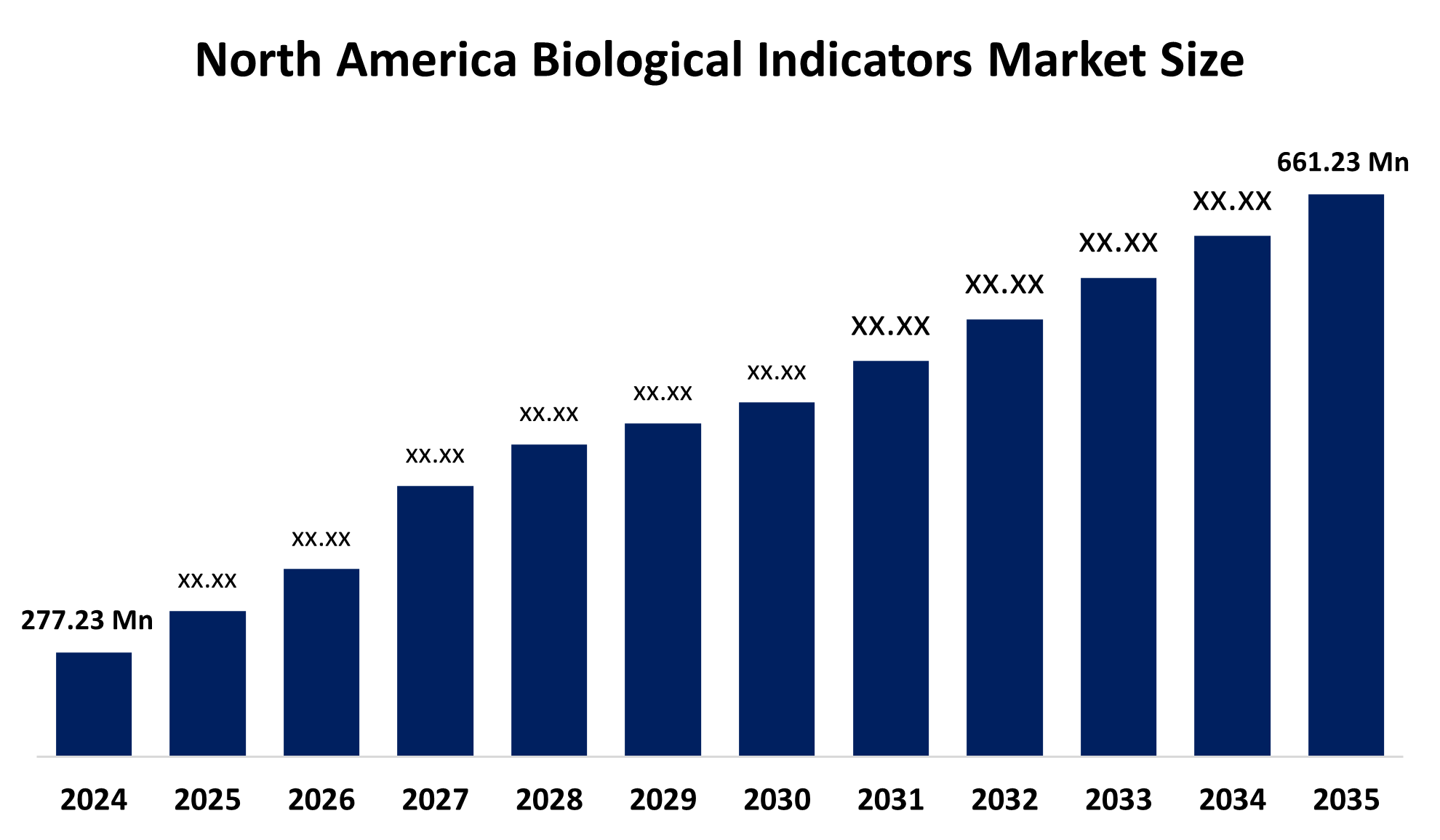

- The North America Biological Indicators Market Size Was Estimated at USD 277.23 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 8.22% from 2025 to 2035

- The North America Biological Indicators Market Size is Expected to Reach USD 661.23 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The North America Biological Indicators Market Size is Anticipated To Reach USD 661.23 Million by 2035, Growing at a CAGR of 8.22% from 2025 to 2035. The North America biological indicators market offers future opportunities in advanced sterilization monitoring, rapid microbial detection, automation integration, and demand from healthcare, pharmaceuticals, and food industries driven by stricter regulations and quality assurance needs.

Market Overview

The North America biological indicators market refers to the segment of healthcare and life sciences focused on products used to monitor and validate sterilization processes. Biological indicators utilize resistant microorganisms to confirm the effectiveness of sterilization in medical devices, pharmaceuticals, biotechnology, and food industries, ensuring patient safety and regulatory compliance. Government initiatives, such as stringent guidelines from the U.S. Food and Drug Administration (FDA) and the Centers for Disease Control and Prevention (CDC), are boosting adoption. Driving factors include the rising demand for infection control, growing pharmaceutical and medical device manufacturing, advancements in sterilization technologies, and increasing regulatory focus on quality assurance.

Report Coverage

This research report categorizes the market for North America biological indicators market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the North America biological indicators market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the North America biological indicators market.

North America Biological Indicators Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024 : | USD 277.23 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 8.22% |

| 2035 Value Projection: | USD 661.23 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product, By Form |

| Companies covered:: | 3M Company, Lohmann & Rauscher (L&R), Steris plc, Getinge Group, Charles River Laboratories, Nelson Laboratories, Biomerieux, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

The North America biological indicators market is driven by rising healthcare-associated infection concerns, stringent regulatory standards for sterilization validation, and growing demand in pharmaceutical and medical device manufacturing. Increasing adoption of advanced sterilization techniques, coupled with technological advancements in rapid microbial detection, is boosting market growth. Additionally, expanding healthcare infrastructure, heightened awareness about patient safety, and the emphasis on quality assurance in food and biotechnology sectors further support the adoption of biological indicators, making them vital for ensuring compliance and safety.

Restraining Factors

High costs associated with biological indicators, longer testing times compared to chemical indicators, and the need for skilled professionals restrain market growth. Limited awareness in smaller facilities and reliance on alternative sterilization monitoring methods also pose challenges.

Market Segmentation

The North America biological indicators market share is classified into product and form.

- The steam biological indicators segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The North America biological indicators market is segmented by product into steam biological indicators, hydrogen peroxide biological indicators, and others. Among these, the steam biological indicators segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The growing emphasis from market participants on introducing biological indicators utilized in the steam sterilization process is a key factor propelling the segment's expansion.

- The self-contained vials segment held a largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The North America biological indicators market is segmented by form into self-contained vials, indicator strips, and others. Among these, the self-contained vials segment held a largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. Self-contained vials dominate due to their ease of use, reliability, and reduced risk of contamination. Their rapid result delivery, compatibility with various sterilization methods, and widespread adoption in hospitals, pharmaceutical, and biotech industries further drive their strong market growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the North America biological indicators market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- 3M Company

- Lohmann & Rauscher (L&R)

- Steris plc

- Getinge Group

- Charles River Laboratories

- Nelson Laboratories

- Biomerieux

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at North America, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the North America biological indicators market based on the below-mentioned segments:

North America Biological Indicators Market, By Product

- Steam Biological Indicators

- Hydrogen Peroxide Biological Indicators

- Others

North America Biological Indicators Market, By Form

- Self-contained Vials

- Indicator Strips

- Others

Need help to buy this report?