North America Beverage Can Market Size, Share, and COVID-19 Impact Analysis, By Type (Aluminum and Steel), By Application (Carbonated Soft Drinks, Alcoholic Beverages, Fruits & Vegetable Juices, and Others), and North America Beverage Can Market Insights, Industry Trend, Forecasts to 2035.

Industry: Food & BeveragesNorth America Beverage Can Market Insights Forecasts To 2035

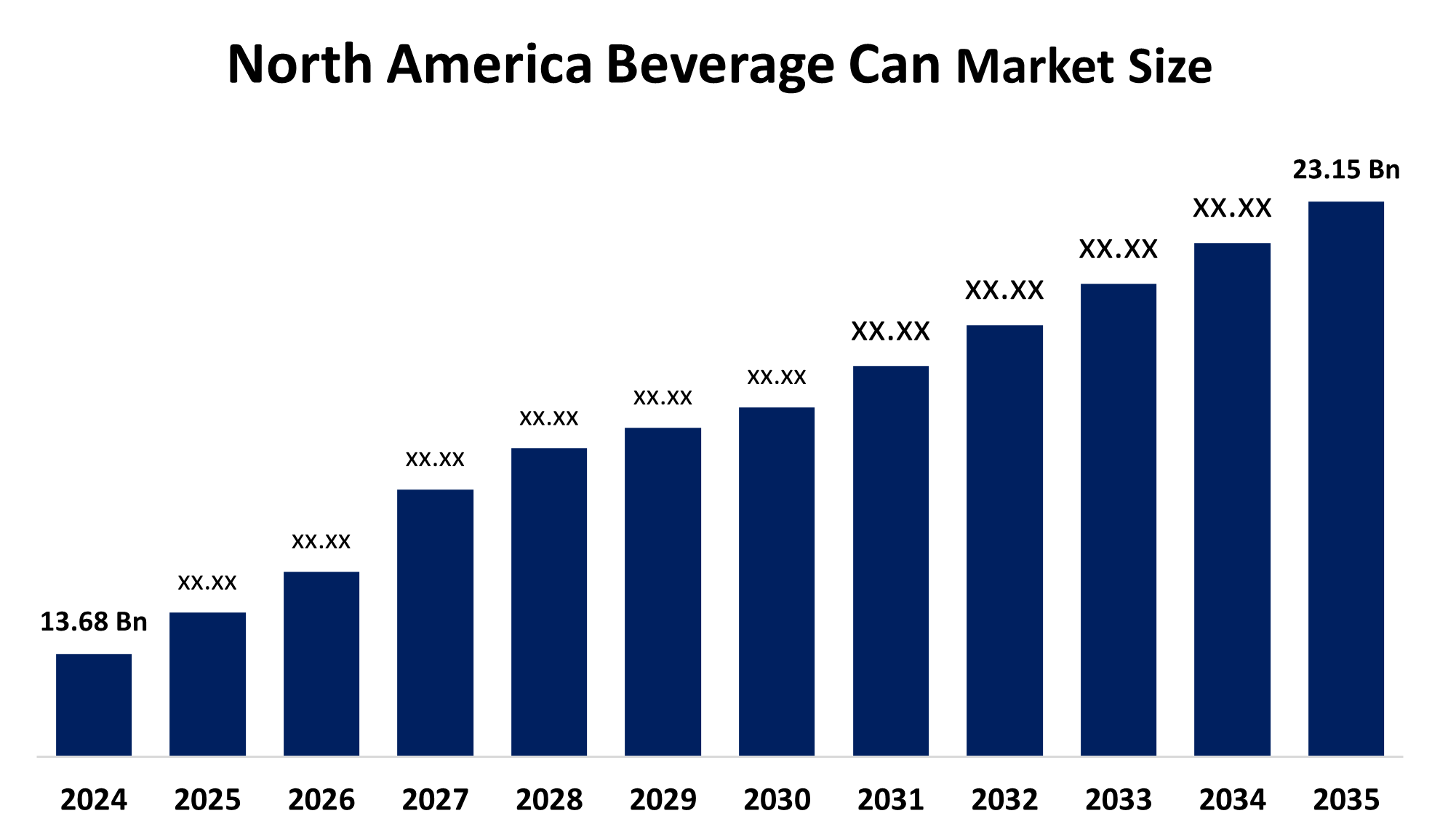

- The North America Beverage Can Market Size Was Estimated at USD 13.68 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 4.9 % from 2025 to 2035

- The North America Beverage Can Market Size is Expected to Reach USD 23.15 Billion by 2035.

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, North America Beverage Can Market is anticipated to Reach USD 23.15 Billion by 2035, growing at a CAGR of 4.9% from 2025 to 2035. The North America beverage can market provides opportunities for sustainable packaging due to factors like growing demand for ready-to-drink beverages, technical developments, improving recycling rates, and customer preferences for eco-friendly, lightweight containers.

Market Overview

The commercial industry that produces, distributes, and uses metal cans, mostly made of aluminum, to package different kinds of beverages such as juices, alcoholic beverages, energy drinks, carbonated soft drinks, and ready-to-drink items in the US, Canada, and Mexico is known as the North America beverage can market. The North America beverage can market is essential to the beverage supply chain due to providing packaging options that satisfy consumer and environmental requirements while being lightweight, strong, and highly recyclable.

The market for North America beverage cans is anticipated to rise as a result of rising alcoholic beverage consumption, stricter laws against plastic packaging, and more government programs to recycle aluminum. The demand for beverage cans is being driven by the global increase in the consumption of beverages like beer, cider, and carbonated soft drinks. Furthermore, the market for North America beverage cans is anticipated to rise due to the high recycling rate of aluminum cans and the superior physical qualities of metals compared to their substitutes.

Report Coverage

This research report categorizes the market for North America beverage can market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the North America beverage can market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the North America beverage can market.

North America Beverage Can Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 13.68 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 4.9% |

| 2035 Value Projection: | USD 23.15 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 230 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Application |

| Companies covered:: | Ball Corporation, Envases Group, Ardagh Group S.A., Crown Holdings, Inc, Gamer Packaging, Inc., Silgan Containers LLC, Land & Sea Packaging, Allstate Can Corporation, Metal Container Corporation, Others, |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Agreements and partnerships between producers of beverage cans and suppliers of raw materials are anticipated to promote innovation and propel the creation of new products in the beverage cans industry. Due to growing environmental consciousness among businesses and customers, beverage cans to be recycled has emerged as a key motivator. One of the main factors driving the beverage can industry is the stringent laws and regulations aimed at reducing environmental pollution and creating a healthy environment. It is anticipated that the expanding beverage sector will drive North America beverage can market.

Restraining Factors

Irregular raw material prices, environmental concerns about mining techniques, competition from alternative packaging options, and regulatory obstacles about sustainability requirements are some of the contributing factors that are restricting the North America beverage can market.

Market Segmentation

The North America beverage can market share is classified into type and application.

- The aluminum segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The North America beverage can market is segmented by type into aluminum and steel. Among these, the aluminum segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. Aluminum's ability to be readily heated and cooled for sterilization, as well as its ability to preserve the integrity and structure of packaged products, has led to an increase in its use as a raw material for beverage packaging

.

- The alcoholic beverages segment held a largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The North America beverage can market is segmented by application into carbonated soft drinks, alcoholic beverages, fruits & vegetable juices, and others. Among these, the alcoholic beverages segment held a largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The large percentage can be attributed to rising millennial demand for alcoholic beverages, rising disposable income, and growing customer desire for high-end, premium alcoholic beverage products.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the North America beverage can market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Ball Corporation

- Envases Group

- Ardagh Group S.A.

- Crown Holdings, Inc

- Gamer Packaging, Inc.

- Silgan Containers LLC

- Land & Sea Packaging

- Allstate Can Corporation

- Metal Container Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In May 2025, A new era in the production of aluminum beverage cans is being ushered in by VulCan Packaging's launched of leading ATULCTM technology. With great pleasure, VulCan Packaging announces its formal debut, bringing the newest aluminum beverage cans to North America. Scott Fore, Dana Abernathy, and Alvin Widitora are leading this daring new endeavor.

Market Segment

This study forecasts revenue at North America, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the North America beverage can market based on the below-mentioned segments:

North America Beverage Can Market, By Type

- Aluminum

- Steel

North America Beverage Can Market, By Application

- Carbonated Soft Drinks

- Alcoholic Beverages

- Fruits & Vegetable Juices

- Others

Need help to buy this report?