North America Benzene Market Size, Share, and COVID-19 Impact Analysis, By Derivative (Alkyl Benzene, Cumene, Cyclohexane, Ethyl Benzene, Nitro Benzene, Aniline, Toluene, Phenol, and Others), By Application (Solvent, Chemical Intermediates, Surfactants, Plastics, Rubber Manufacturing, Detergent, Explosives, Lubricants, Pesticides, Anti-Knock Additives, and Others), and North America, Benzene Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsNorth America Benzene Market Size Insights Forecasts to 2035

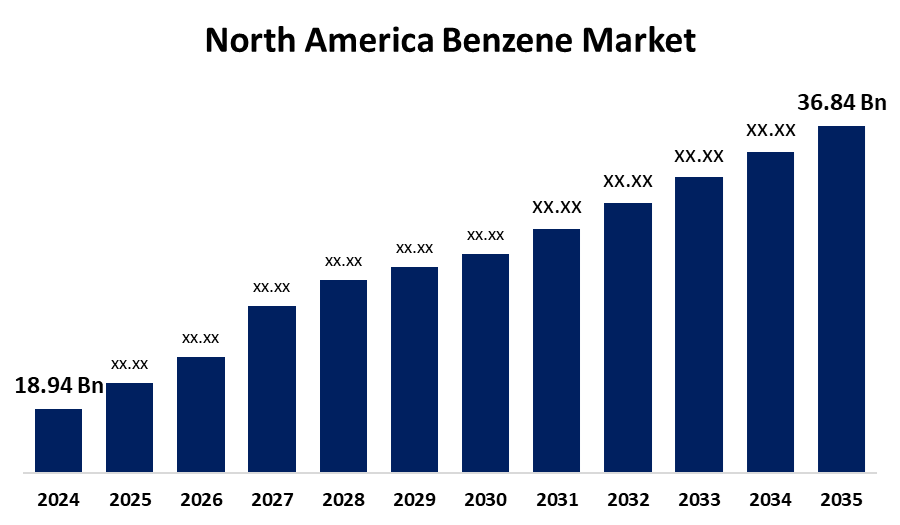

- The North America Benzene Market Size Was Estimated at USD 18.94 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.23% from 2025 to 2035

- The North America Benzene Market Size is Expected to Reach USD 36.84 Billion by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the North America Benzene Market Size is anticipated to reach USD 36.84 Billion by 2035, growing at a CAGR of 6.23% from 2025 to 2035. Industrial growth, changing regulations, and changing consumer tastes are driving the North American Benzene Market, which offers opportunities for petrochemical expansion, growing demand for derivatives, technical advancements, and sustainable production methods.

Market Overview

The industry that produces, distributes, and uses benzene, a crucial petrochemical utilized in the production of plastics, synthetic fibers, rubber, resins, and dyes, is referred to as the North America benzene market. Demand from industries like automotive, construction, and packaging, all of which depend heavily on benzene derivatives, drives the North America benzene market. Due to its abundant supply of crude oil and robust petrochemical infrastructure, the United States dominates the market. Technological developments, governmental regulations, and environmental concerns over benzene emissions all have a positive effect on growth in the market. One of the main factors driving the steadily rising demand for benzene is the growing need for styrene in a variety of end-use industries, including packaging, automotive, electronics, and others. The petrochemical industry's growing demand, improvements in shale oil production, and growing use in the construction, automotive, and packaging sectors are the main drivers of the North America benzene market.

Report Coverage

This research report categorizes the market for North America benzene market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the North America benzene market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the North America benzene market.

North America Benzene Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 18.94 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 6.23% |

| 2035 Value Projection: | USD 36.84 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 136 |

| Tables, Charts & Figures: | 107 |

| Segments covered: | By Derivative, By Application and COVID-19 Impact Analysis |

| Companies covered:: | Dow Inc, Shell PLC, INEOS, Chevron Corp,, Basf SE, LG Chem, INEOS, LyondellBasell Industries NV Class A, Marathon Petroleum Corp, Others, and key vendors |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Legislative frameworks encouraging sustainable production and effective resource use, growing industrial uses, technical advancements, and advantageous economic conditions all contribute to North America benzene market expansion. The automotive sector is expanding steadily, and the launch of a new line of electric vehicles has increased demand for benzene styrene is required to make tires and various body elements for both gasoline-powered and diesel-powered cars, as well as electric cars. The majority of the styrene used in rubber tires, plastic packaging, various automotive components, and electronic devices is made from ethylbenzene drives the North America benzene market.

Restraining Factors

The stability and profitability of the North American benzene market are hampered by supply chain interruptions, strict environmental laws, growing production costs, fluctuating crude oil prices, and import tariffs.

Market Segmentation

The North America benzene market share is classified into derivative and application.

- The ethyl benzene dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The North America benzene market is segmented by derivative into alkyl benzene, cumene, cyclohexane, ethyl benzene, nitro benzene, aniline, toluene, phenol, and others. Among these, the ethyl benzene segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The growing need for ethyl benzene in the production of styrene is the main driver of the ethyl benzene market. Petroleum and coal tar are natural sources of ethylbenzene, which is created industrially by alkylating benzene with ethylene.

- The rubber manufacturing segment held a largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The North America benzene market is segmented by application into solvent, chemical intermediates, surfactants, plastics, rubber manufacturing, detergent, explosives, lubricants, pesticides, anti-knock additives, and others. Among these, the rubber manufacturing segment held a largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The benzene market was driven by the rubber manufacturing segment growing use of styrene. A wide range of products, including polystyrene, styrene-butadiene elastomers, latexes, unsaturated polyester resins, acrylonitrile-butadiene-styrene (ABS), and styrene-acrylonitrile (SAN), are made from styrene.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the North America benzene market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Dow Inc

- Shell PLC

- INEOS

- Chevron Corp,

- Basf SE

- LG Chem

- INEOS

- LyondellBasell Industries NV Class A

- Marathon Petroleum Corp

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at North America, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the North America benzene market based on the below-mentioned segments:

North America Benzene Market, By Derivative

- Alkyl Benzene

- Cumene

- Cyclohexane

- Ethyl Benzene

- Nitro Benzene

- Aniline

- Toluene

- Phenol

- Others

North America Benzene Market, By Application

- Solvent

- Chemical Intermediates

- Surfactants

- Plastics

- Rubber Manufacturing

- Detergent

- Explosives

- Lubricants

- Pesticides

- Anti-Knock Additives

- Others

Need help to buy this report?