North America Beer Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Standard Lager, Premium Lager, Specialty Beer, and Others), By Distribution Channel (Supermarkets and Hypermarkets, On-Trades, Specialty Stores, Convenience Stores, and Others), and North America, Beer Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareNorth America Beer Market Insights Forecasts to 2035

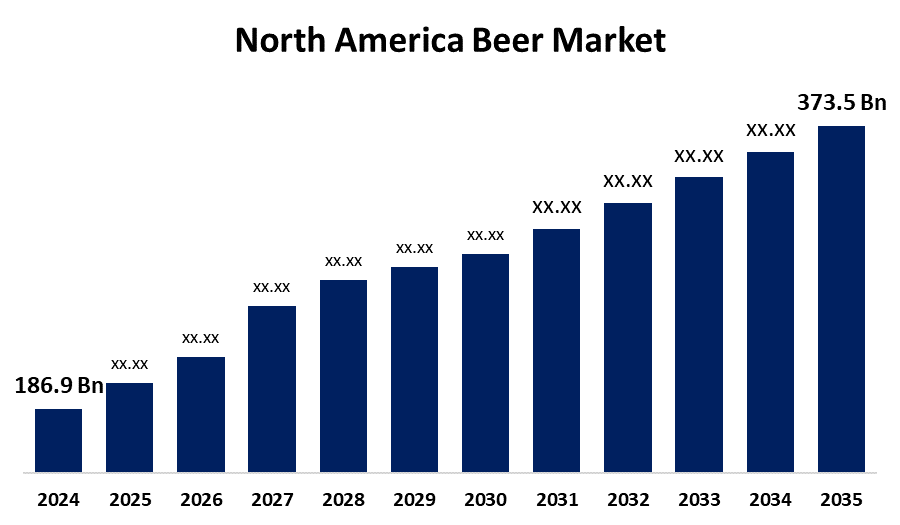

- The North America Beer Market Size Was Estimated at USD 186.9 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 6.50% from 2025 to 2035

- The North America Beer Market Size is Expected to Reach USD 373.5 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The North America Beer market Size is anticipated to reach USD 373.5 Billion by 2035, growing at a CAGR of 6.50% from 2025 to 2035. Craft beer growth, premium product innovation, sustainable brewing, digital marketing, e-commerce growth, low-alcohol alternatives, and rising consumer desire for organic and flavored beer types are all opportunities in the North America beer market.

Market Overview

The industry that includes beer production, distribution, and consumption in the US, Canada, and Mexico is known as the North America beer market. Lager, ale, and specialty beers are among the different kinds of beer that are included, and they are categorized according to factors including packaging, production volume, alcohol content, and distribution methods. Rising disposable incomes and the appeal of flavored and low-alcohol beer variations are expected to fuel North America beer market growth. Growing craft breweries and rising customer tastes for premium beers are driving expansion in the North America beer market. The industry is expanding due to a number of causes, including the increased demand for craft and specialty beers, a growing desire for non-alcoholic or low-alcohol choices, and an increasing focus on sustainability and environmental responsibility in brewing techniques. The industry is expanding mostly due to changes in customer preferences toward premium products, flavored beer, and craft beer. Furthermore, the increase in social events and people's growing purchasing power are also contributing to the market's expansion.

Report Coverage

This research report categorizes the market for North America beer market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the North America beer market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the North America beer market.

North America Beer Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 186.9 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 6.50% |

| 2035 Value Projection: | USD 373.5 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 254 |

| Tables, Charts & Figures: | 99 |

| Segments covered: | By Product Type and By Distribution Channel |

| Companies covered:: | Asahi Group Holdings Ltd, Heineken NV, Carlsberg A/S Class B, Diageo PLC, Sierra Nevada Brewing, Anheuser-Busch InBev SA/NV, China Resources Beer (Holdings) Co Ltd, Molson Coors Beverage Co Class A, United Breweries Co Inc ADR, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The North America beer market is undergoing significant upheaval due to shifting consumer preferences and rising health consciousness. The North America beer market is expanding as a result of customers' desire for novel alcoholic beverages with a variety of tastes. The changing tastes of consumers and their increasing desire for ready-to-drink forms, which call for creative and efficient packaging solutions, are driving the North America beer market. One of the main aspects driving the market's expansion is the increasing diversity of customer cultural groupings and social class.

Restraining Factors

Strict laws, high taxes, changing customer tastes, competition from other drinks, supply chain interruptions, increased manufacturing costs, and health-conscious tendencies that impact traditional beer consumption are all factors limiting the North American beer market.

Market Segmentation

The North America Beer Market share is classified into product type and Distribution Channel.

Get more details on this report -

- The standard lager segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The North America beer market is segmented by product type into standard lager, premium lager, specialty beer, and others. Among these, the standard lager segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. Standard lager beer is a classic mass-produced beer with a crisp, light flavor profile that is usually made with only basic components, including barley, hops, water, and yeast. It frequently appeals to a wide range of customers looking for a well-known and reasonably priced beer alternative.

- The supermarkets and hypermarkets segment held a largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The North America beer market is segmented by distribution channel into supermarkets and hypermarkets, on-trade, specialty stores, convenience stores, and others. Among these, the supermarkets and hypermarkets segment held a largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The wide distribution of supermarkets and hypermarkets in both urban and rural regions guarantees that a large number of customers can quickly access the products. Customers' changing preferences for convenience in their purchasing experiences are provided by this availability.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the North America beer market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Asahi Group Holdings Ltd

- Heineken NV

- Carlsberg A/S Class B

- Diageo PLC

- Sierra Nevada Brewing

- Anheuser-Busch InBev SA/NV

- China Resources Beer (Holdings) Co Ltd

- Molson Coors Beverage Co Class A

- United Breweries Co Inc ADR

- Others

Recent Developments

- In March 2024, in Canada, Molson Coors launched Madri Excepcional, a new beer in the European style. It has a light golden hue, a smooth, well-rounded flavor profile, and a brief, bitter aftertaste at 4.6% ABV.

- In October 2023, Elon Musk launched a limited-edition beer bottle set called Cyberbeer. The CyberTruck's "angular exoskeleton" served as the model for the CyberBeer bottles' shape. However, German beer served as the inspiration for its flavor.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at North America, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the North America beer market based on the below-mentioned segments:

North America Beer Market, By Product Type

- Standard Lager

- Premium Lager

- Specialty Beer

- Others

North America Beer Market, By Distribution Channel

- Supermarkets and Hypermarkets

- On-Trades

- Specialty Stores

- Convenience Stores

- Others

Need help to buy this report?