North America Artificial Organs and Bionics Market Size, Share, and COVID-19 Impact Analysis, by Product (Artificial Organs and Artificial Bionics), by Technology (Mechanical and Electronic), with Market Insights, Industry Trends, and Forecast to 2035

Industry: HealthcareNorth America Artificial Organs and Bionics Market Insights Forecasts to 2035

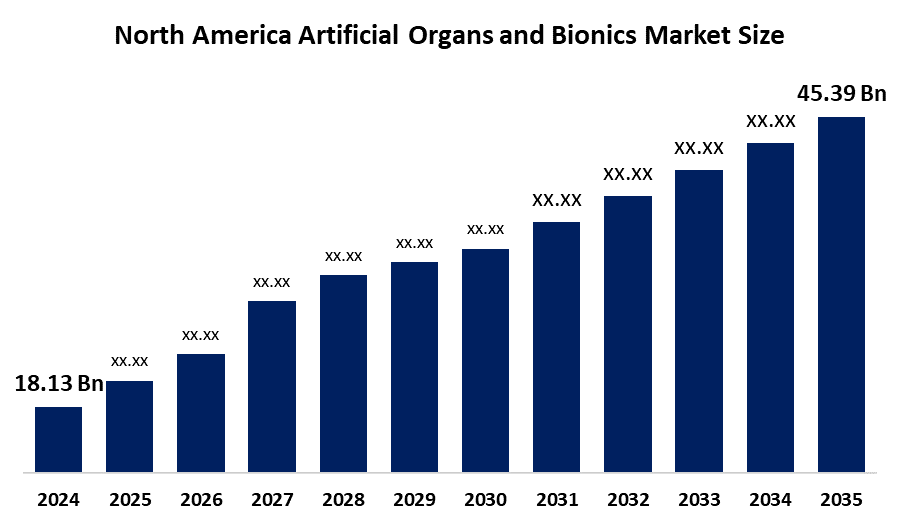

- The North America Artificial Organs and Bionics Market Size Was Estimated at USD 18.13 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 8.7% from 2025 to 2035

- The North America Artificial Organs and Bionics Market Size is Expected to Reach USD 45.39 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The North America Artificial Organs and Bionics Market Size is Anticipated to reach USD 45.39 Billion by 2035, Growing at a CAGR of 8.7% from 2025 to 2035. The market is driven by the increasing population and awareness among the patients and the players regarding healthcare facilities and telemedicine. The growing community and knowledge of the new techniques.

Market Overview

Bionic implants and artificial organs are artificial medical devices that can be either worn externally or implanted internally. The purpose of these devices is to mimic or to improve the functioning of corresponding natural organs through their artificial manufacturing. An artificial organ refers to a product, either a device or tissue, that is created by man and is either implanted or integrated into a patient to communicate with the living tissue. The rhythmic progression of innovation in bionic implant technology has achieved remarkable leaps in terms of prosthetic limbs, neuroprosthetics, and cochlear implants, and all these have remarkably enhanced their functionality, comfort, and human body amalgamation.

The government of Canada is providing, mainly through significant research funding and healthcare initiatives, great support for artificial organs and bionic implants. In 2023, the Canadian Institutes of Health Research (CIHR) gave CAD 275 million to regenerative medicine and biomedical engineering research specifically. The North American market is the largest one because of the large number of kidney diseases, high-tech health care, and a lot of organ transplants.

According to a report from the Centers for Disease Control and Prevention (CDC), more than 65% of hospitals have specific artificial organ implantation programs, with specialized medical teams and post-operative care units to provide a full range of patient care during the entire treatment process.

Report Coverage

This research report categorizes the market for the North America artificial organs and bionics market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the North America artificial organs and bionics market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the North America artificial organs and bionics market.

North America Artificial Organs and Bionics Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 18.13 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 8.7% |

| 2035 Value Projection: | USD 45.39 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product, By Technology |

| Companies covered:: | SynCardia Systems, Symbotic Inc., Edwards Lifesciences Corp., Ekso Bionics Holdings Inc., Boston Scientific Corp., Johnson & Johnson, Bionic, Abiomed, Paragon Medical, Biomerics and Others, Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The artificial organs and bionics market in North America is driven by the increase in the organ market, are the rising organ incidence owing to age-related diseases, technological advancements, a large number of injuries leading to organ deletion year after year, and the favorable attitude towards organ transplants. The artificial dynamic organs and the medical bionics market are showing balanced growth owing to the large gap between them. The growth is attributed to the rising awareness and the increase in disposable incomes. The main factors driving the growth are the increase in transplant surgeries and the demand for artificial organs as a result of the high rate of organ failures. In addition, the availability of advanced medical facilities and the local presence of many large biotech and medical device companies like Zimmer Biomet, Arthrex, Inc., Medtronic, Novartis AG and Stryker are giving support to its lead.

Restraining Factors

The artificial organs and bionics market in North America is restrained by the high cost of equipment, surgery, a lack of skilled professionals, and undefined compensation policies. Shortages of organ donors, biocompatibility concerns with long-term implantation, and technical complexity requiring specialized surgical expertise and postoperative management are other factors that slow down the market. Generally, ethical considerations and complex regulatory frameworks significantly challenge market growth.

Market Segmentation

The North America artificial organs and bionics market share is categorised into product and technology.

- The artificial organs segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The North America artificial organs and bionics market is segmented by product into artificial organs and artificial bionics. Among these, the artificial organs segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by several elements, like the patient's size, blood group, the distance to the donor, and the severity of the disease, which are taken into consideration during the organ transplantation waiting period. The market size is increasing due to the high demand for kidney, heart, lung, and liver transplants, among other things. The rising demand for cochlear implants and brain bionics is also a factor in this segment's growth.

- The mechanical segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on technology, the North America artificial organs and bionics market is segmented into mechanical and electronic. Among these, the mechanical segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The growth of the segment is driven by the growing occurrence of organ failure and the expensive-to-use mechanical bionic devices. Mechanical heart valves, which can last much longer than any other alternatives, are very popular. Furthermore, fast FDA approvals and good payment policies are also helping to grow the market. The long life of mechanical heart valves, along with quick regulations and supportive refund policies, are the main factors in the market growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the North America artificial organs and bionics market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- SynCardia Systems

- Symbotic Inc.

- Edwards Lifesciences Corp.

- Ekso Bionics Holdings Inc.

- Boston Scientific Corp.

- Johnson & Johnson

- Bionic

- Abiomed

- Paragon Medical

- Biomerics

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

In July 2025, Zimmer Biomet Holdings, Inc., a global medical technology leader, and Monogram Technologies Inc., an orthopedic robotics company, announced they had entered into a definitive agreement for Zimmer Biomet to acquire all outstanding shares of stock of Monogram for an upfront payment of $4.04 per share in cash.

Market Segment

This study forecasts revenue at the North America, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the North America artificial organs and bionics market based on the below-mentioned segments:

North America Artificial Organs and Bionics Market, By Product

- Artificial Organs

- Artificial Bionics

North America Artificial Organs and Bionics Market, By Technology

- Mechanical

- Electronic

Need help to buy this report?