Global Next-Generation Data Storage Market Size, Share, and COVID-19 Impact Analysis, By Storage System (Direct-Attached Storage, Network-Attached Storage, Storage Area Network, Storage Architecture, File & Object-based Storage, and Block storage), By Storage Medium (Hard Disk Drive, Tape, and Solid-State Drive), By Deployment Type (On-premises and Cloud), By End-Use (BFSI, Healthcare, Retail, Cloud service providers, Government, IT & telecom, and Others), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 - 2032)

Industry: Electronics, ICT & MediaGlobal Next-Generation Data Storage Market Insights Forecasts to 2032

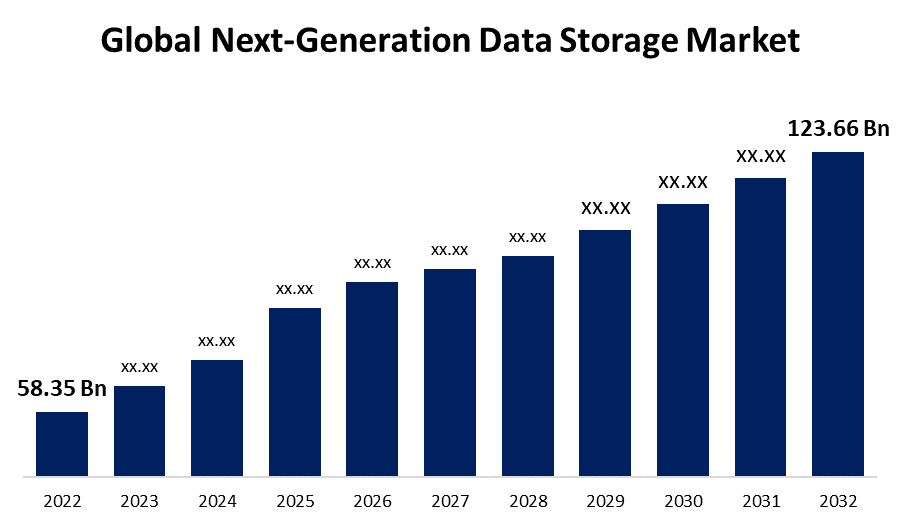

- The Global Next-Generation Data Storage Market was valued at USD 58.35 Billion in 2022.

- The Market is growing at a CAGR of 7.8% from 2023 to 2032.

- The Worldwide Next-Generation Data Storage Market is expected to reach USD 123.66 Billion by 2032.

- Asia-Pacific is expected to grow the highest during the forecast period.

Get more details on this report -

The Global Next-Generation Data Storage Market is expected to reach USD 123.66 billion by 2032, at a CAGR of 7.8% during the forecast period 2023 to 2032.

Market Overview

Next-generation data storage refers to a collection of innovative technologies and approaches that aim to revolutionize the storage and management of data. With the exponential growth of digital information, traditional storage systems have become increasingly inadequate in meeting the demands for capacity, speed, and reliability. Next-generation data storage encompasses various advancements, including solid-state drives (SSDs), cloud storage, object storage, distributed storage systems, and storage virtualization. These technologies offer significant improvements in terms of data transfer rates, scalability, durability, and efficiency. They empower organizations to store and handle vast amounts of data generated by emerging technologies like artificial intelligence, Internet of Things (IoT), and big data analytics. By harnessing these advancements, next-generation data storage enables businesses to optimize their data infrastructure and unlock the full potential of their information resources.

Report Coverage

This research report categorizes the market for next-generation data storage market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the next-generation data storage market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the next-generation data storage market.

Next-Generation Data Storage Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 58.35 Bn |

| Forecast Period: | 2022 – 2032 |

| Forecast Period CAGR 2022 – 2032 : | 7.8% |

| 022 – 2032 Value Projection: | USD 123.66 Bn |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 140 |

| Segments covered: | By Storage System, By Storage Medium, By Deployment Type, By End-Use and By Region . |

| Companies covered:: | IBM Corporation, Dell Technologies, Hewlett Packard Enterprise Development LP, Hitachi Ltd., Huawei Technologies Co., Ltd., NetApp, Cloudian Inc., Fujitsu, Pure Storage, Inc., NetGear, Samsung, Western Digital Corporation and Nutanix. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The next-generation data storage market is driven by several factors that are shaping the future of data storage. The explosive growth of data volumes across industries, fueled by trends like IoT, artificial intelligence, and machine learning, is generating an urgent need for scalable and efficient storage solutions. Additionally, the increasing demand for high-speed data processing and real-time analytics is driving the adoption of faster and more responsive storage technologies such as solid-state drives (SSDs). The rising popularity of cloud computing and the need for flexible and cost-effective storage options are also propelling market growth. Furthermore, regulatory requirements regarding data retention and security are prompting organizations to invest in advanced data storage systems with enhanced reliability and data protection features. Overall, the continuous evolution of storage technologies and the quest for innovation are pushing the boundaries of data storage capabilities, attracting investments, and driving competition in the market.

Restraining Factors

The next-generation data storage market faces certain restraints that can impact its growth. The high initial cost of implementing advanced storage technologies can be a significant barrier for some organizations, especially small and medium-sized businesses. Additionally, concerns regarding data security and privacy pose challenges, as storing data in cloud or distributed storage systems may raise potential risks. The rapid evolution of technology also presents a challenge, as organizations need to continuously upgrade their storage infrastructure to keep up with the pace of innovation. Moreover, compatibility issues and the complexity of integrating new storage solutions with existing systems can hinder the adoption of next-generation data storage. Overall, regulatory compliance requirements and data governance concerns can add further complexity and limitations to the market.

Market Segmentation

- In 2022, the file & object-based storage segment accounted for around 37.8% market share

On the basis of the storage system, the global next-generation data storage market is segmented into direct-attached storage, network-attached storage, storage area network, storage architecture, file & object-based storage, and block storage. The file and object-based storage segment emerged as the leader in terms of market share in the next-generation data storage market. This can be attributed to several factors driving its prominence. The file and object-based storage systems offer flexibility and scalability, allowing organizations to efficiently manage and store large volumes of unstructured data. These systems provide a unified approach to storage, enabling seamless access to files and objects across multiple applications and platforms. Additionally, file and object-based storage solutions offer advanced data management capabilities, including data deduplication, encryption, and metadata tagging, enhancing data organization and retrieval. Furthermore, the growing adoption of cloud-based storage and the need to accommodate diverse data types, such as documents, images, videos, and IoT-generated data, contribute to the dominance of the file and object-based storage segment.

- In 2022, the on-premises segment dominated with more than 74.5% market share

Based on the deployment type, the global next-generation data storage market is segmented into on-premises and cloud. The on-premises segment emerged as the leader in terms of market share in the next-generation data storage market. Several factors contribute to its dominant position. Many organizations prefer on-premises solutions to have direct control and physical ownership of their data storage infrastructure. This is particularly true for industries with stringent security and compliance requirements, where maintaining data within the company premises provides a sense of control and reduces concerns about data privacy. Moreover, on-premises storage offers faster data access and lower latency, making it suitable for applications that require real-time data processing. Additionally, some organizations have significant investments in their existing on-premises infrastructure, making it cost-effective to continue utilizing and upgrading their storage systems rather than migrating to cloud-based solutions. Overall, concerns about data sovereignty and regulatory compliance in certain regions further drive the adoption of on-premises storage solutions.

Regional Segment Analysis of the Next-Generation Data Storage Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

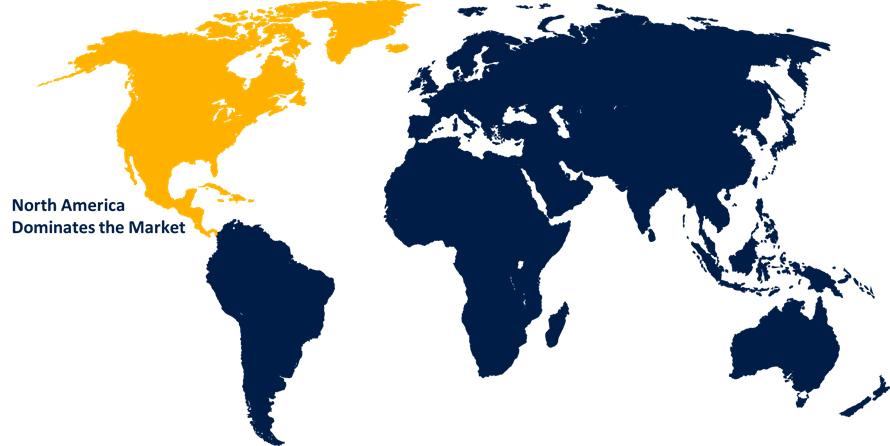

North America dominated the market with more than 34.5% revenue share in 2022.

Get more details on this report -

North America has emerged as the dominant player in the market share of next-generation data storage. Several factors contribute to this regional dominance such as strong technological infrastructure and is home to numerous technology giants and innovative startups, driving the adoption of advanced storage solutions. The region's robust economy fosters investments in research and development, facilitating the development of cutting-edge data storage technologies. Additionally, North America has a high concentration of data-intensive industries such as healthcare, finance, and e-commerce, generating massive amounts of data that require efficient storage solutions. Furthermore, favorable government policies and regulations support the growth of the data storage market. Overall, the presence of a tech-savvy population and early adopters of emerging technologies contributes to the market dominance of North America in next-generation data storage.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global next-generation data storage market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Companies:

- IBM Corporation

- Dell Technologies

- Hewlett Packard Enterprise Development LP

- Hitachi Ltd.

- Huawei Technologies Co., Ltd.

- NetApp

- Cloudian Inc.

- Fujitsu

- Pure Storage, Inc.

- NetGear

- Samsung

- Western Digital Corporation

- Nutanix

Key Target Audience

- Market Players

- Investors

- End-Users

- Government Authorities

- Consulting and Research Firm

- Venture Capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In May 2022, TerraMaster has unveiled a cutting-edge eight-bay Direct-Attached Storage (DAS) device tailored to meet the needs of users seeking centralized data storage. Distinguished from NAS, DAS operates locally by establishing direct connections through cables to PCs or other devices. The recently introduced TerraMaster D8-332 represents a high-performance RAID storage solution, boasting an impressive capacity of up to 160TB.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2019 to 2032. Spherical Insights has segmented the global next-generation data storage market based on the below-mentioned segments:

Next-Generation Data Storage Market, By Storage System

- Direct-Attached Storage

- Network-Attached Storage

- Storage Area Network

- Storage Architecture

- File & Object-based Storage

- Block storage

Next-Generation Data Storage Market, By Storage Medium

- Hard Disk Drive

- Tape

- Solid-State Drive

Next-Generation Data Storage Market, By Deployment Type

- On-premises

- Cloud

Next-Generation Data Storage Market, By End-Use

- BFSI

- Healthcare

- Retail

- Cloud service providers

- Government

- IT & telecom

- Others

Next-Generation Data Storage Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?