Global Newborn Screening Market Size, Share, and COVID-19 Impact Analysis, By Product (Instruments and Reagents), By Technology (Tandem Mass Spectrometry, Pulse Oximetry, Enzyme Based Assay, DNA Assay, Electrophoresis, and Others), By Test Type (Dry Blood Spot Test, CCHD, and Hearing Screen), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2032.

Industry: HealthcareGlobal Newborn Screening Market Insights Forecasts to 2032

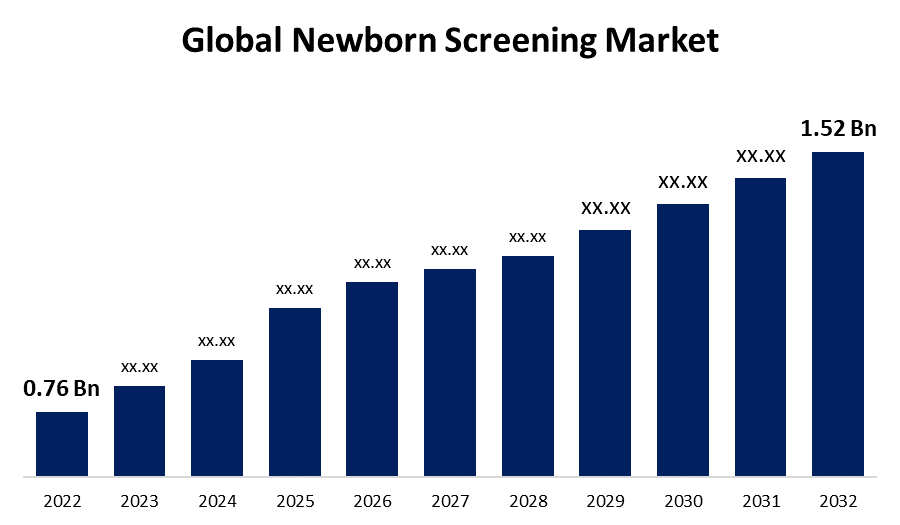

- The newborn screening market was valued at USD 0.76 Billion in 2022.

- The Market Size is Growing at a CAGR of 7.2% from 2023 to 2032

- The Worldwide Newborn Screening Market is expected to reach USD 1.52 Billion by 2032

- North America is expected to Grow significant during the forecast period

Get more details on this report -

The global newborn screening market is expected to reach USD 1.52 billion by 2032, at a CAGR of 7.2% during the forecast period 2023 to 2032.

Market Overview

Newborn screening is a vital public health initiative aimed at identifying genetic, metabolic, and congenital disorders in infants shortly after birth, allowing for early intervention and treatment. Typically conducted within the first few days of life, this screening involves a simple blood test, often referred to as the "heel prick," to collect a small sample of a newborn's blood. The sample is then analyzed in a laboratory to detect a range of conditions, such as phenylketonuria (PKU), cystic fibrosis, congenital hypothyroidism, and sickle cell disease, among others. Early detection of these disorders is crucial because it enables medical professionals to initiate timely interventions that can prevent or minimize the long-term health complications associated with these conditions. Newborn screening programs vary by region, but they play a pivotal role in safeguarding the health and well-being of newborns worldwide.

Report Coverage

This research report categorizes the market for newborn screening market based on various segments and regions and forecasts revenue Growth and analyzes trends in each submarket. The report analyses the key Growth drivers, opportunities, and challenges influencing the newborn screening market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the newborn screening market.

Global Newborn Screening Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 0.76 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 7.2% |

| 2032 Value Projection: | USD 1.52 Billion |

| Historical Data for: | 2019-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product, By Technology, By Test Type, By Region, and COVID-19 Impact. |

| Companies covered:: | Bio-Rad Laboratories, Agilent Technologies, Covidien plc, Masimo, Waters Corporation, Natus Medical, Trivitron Healthcare, GE Lifesciences, PerkinElmer Inc., AB SCIEX, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth & Analysis. |

Get more details on this report -

Driving Factors

The newborn screening market is driven by a combination of factors, reflecting both the Growing demand for early disease detection and advancements in healthcare technology, the increasing awareness among healthcare professionals and parents about the benefits of early disease detection is a significant driver. Parents are becoming more proactive in their child's healthcare, and healthcare providers are emphasizing the importance of early intervention to prevent severe health issues later in life. The expansion of newborn screening programs worldwide is fueling market Growth. Governments and healthcare organizations are recognizing the cost-effectiveness of these programs in preventing long-term healthcare costs associated with untreated conditions. Consequently, many regions are expanding their screening panels, adding more disorders to the list of conditions screened, thereby driving the demand for screening technologies and services. Technological advancements are playing a pivotal role in propelling the newborn screening market forward. Innovations in screening methods, such as tandem mass spectrometry, DNA sequencing, and multiplex assays, are enabling the detection of a broader range of disorders with higher accuracy and efficiency. This not only enhances diagnostic capabilities but also reduces the false-positive rate, which is crucial in minimizing unnecessary anxiety for parents and follow-up costs for healthcare systems. Furthermore, the Growing prevalence of genetic and metabolic disorders is contributing to market Growth. Factors like an increase in consanguineous marriages and changes in lifestyle are leading to a higher incidence of these disorders, necessitating more comprehensive screening programs. Another driving force is the push for standardized newborn screening guidelines and policies by regulatory authorities and medical organizations. These guidelines ensure uniformity in testing protocols and encourage the adoption of screening programs, further boosting the market. The increasing collaborations between diagnostic laboratories, healthcare institutions, and technology providers are fostering market Growth. These partnerships aim to streamline screening processes, improve data management, and reduce turnaround times, thereby enhancing the overall efficiency and accessibility of newborn screening services.

Restraining Factors

The newborn screening market faces several restraints, including cost concerns related to the implementation and maintenance of comprehensive screening programs. These programs require significant financial resources for equipment, personnel, and follow-up testing, which can strain healthcare budgets. Additionally, ethical and privacy issues arise due to the storage and use of newborn screening data, necessitating stringent regulations and oversight. The potential for false-positive results can cause anxiety and unnecessary medical interventions for families. Furthermore, limited access to advanced screening technologies in certain regions and the need for skilled healthcare professionals for interpretation and follow-up are additional barriers to widespread adoption, hindering equitable access to newborn screening services.

Market Segmentation

- In 2022, the instruments segment accounted for around 71.5% market share

On the basis of the product, the global newborn screening market is segmented into instruments and reagents. The dominance of the instruments segment in the newborn screening market can be attributed to its critical role in enabling and enhancing the screening process. These instruments encompass a wide range of technology, including mass spectrometers, DNA analyzers, and other specialized equipment used for sample processing and analysis. Their advanced capabilities and automation have significantly improved the accuracy and efficiency of newborn screening, allowing for the simultaneous testing of multiple disorders and rapid result generation. As healthcare systems worldwide prioritize comprehensive screening programs, the demand for these advanced instruments has surged, solidifying their dominant share in the market.

- The tandem mass spectrometry segment held the largest market with more than 23.6% revenue share in 2022

Based on the technology, the global newborn screening market is segmented into tandem mass spectrometry, pulse oximetry, enzyme-based assay, DNA assay, electrophoresis, and others. The dominance of the tandem mass spectrometry (MS/MS) segment in the newborn screening market is attributed to its unparalleled capabilities in simultaneously detecting multiple metabolic and genetic disorders with high precision and sensitivity. MS/MS technology allows for expanded screening panels, making it a preferred choice for comprehensive newborn screening programs. Its ability to identify a wide range of disorders in a single test has led to its widespread adoption, ensuring early diagnosis and intervention. This versatility and efficiency have positioned MS/MS as the leading technology in newborn screening.

- The dry blood spot tests segment is expected to Grow at a CAGR of around 7.3% during the forecast period

Based on the test type, the global newborn screening market is segmented into dry blood spot test, CCHD, and hearing screen. The dry blood spot tests segment is poised for Growth during the forecast period due to several factors. Dry blood spot tests offer a convenient and minimally invasive method for collecting blood samples from newborns, making them a preferred choice for screening programs. Their ease of collection and transport reduces logistical challenges. Moreover, advancements in analytical techniques have improved the accuracy and expanded the range of disorders that can be detected using dry blood spot samples. As healthcare systems continue to emphasize early disease detection and expand newborn screening programs, the demand for dry blood spot tests is expected to increase significantly.

Regional Segment Analysis of the Newborn Screening Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

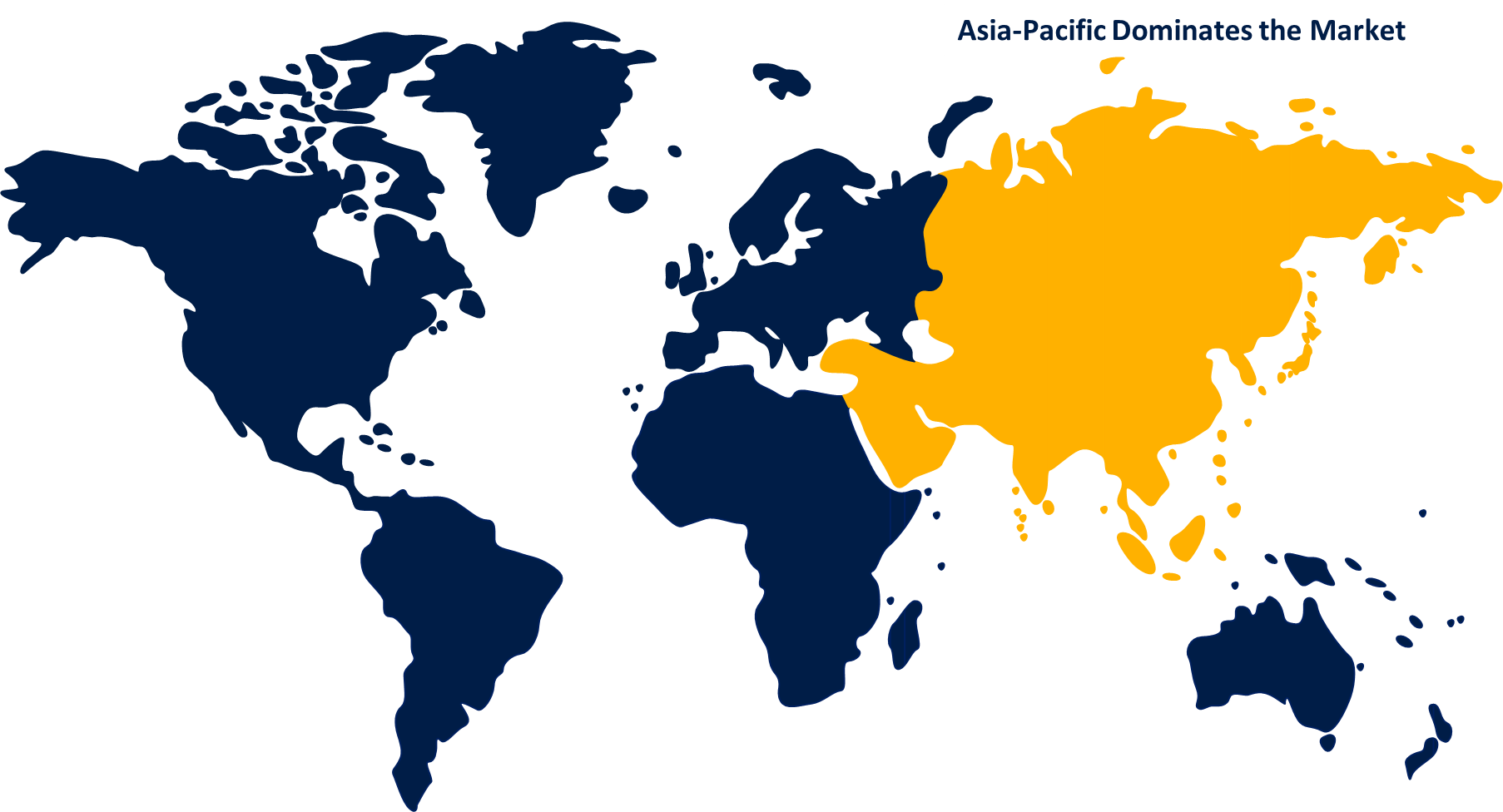

Asia-Pacific dominated the market with more than 30.8% revenue share in 2022.

Get more details on this report -

Based on region, Asia Pacific's dominance in the newborn screening market can be attributed to several key factors. The region's large and Growing population, particularly in countries like China and India, has increased the number of births and the demand for newborn screening services. Furthermore, rising healthcare awareness, government initiatives, and the expansion of healthcare infrastructure have led to the establishment and expansion of comprehensive newborn screening programs. The region's increasing incidence of genetic and metabolic disorders also contributes to the market's Growth. Additionally, ongoing technological advancements and collaborations with global healthcare companies have further boosted Asia Pacific's market share in newborn screening.

North America is projected for significant Growth in the newborn screening market during the forecast period for several reasons. The region boasts advanced healthcare infrastructure and high healthcare expenditure, facilitating the adoption of cutting-edge screening technologies and comprehensive screening programs. Moreover, a well-established regulatory framework and stringent quality standards ensure the accuracy and reliability of screening tests. Rising awareness among healthcare providers and parents about the benefits of early disease detection and treatment further fuels market Growth. Additionally, ongoing research and development activities and strategic collaborations in the region are driving innovations, enhancing the region's position in the global newborn screening market.

Recent Developments

- In January 2023, Masimo has announced the release of their latest cutting-edge infant monitoring device. This newly released method enables carers to monitor baby data in real time.

- In August 2022, Trivitron Healthcare established a Centre of Excellence (CoE) in Vishakhapatnam, India, with cutting-edge research and development and production capabilities for metabolomics, genomics, newborn screening, and molecular diagnostics.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global newborn screening market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Companies:

- Bio-Rad Laboratories

- Agilent Technologies

- Covidien plc

- Fields

- Waters Corporation

- Born Medical

- Trivitron Healthcare

- GE Lifesciences

- PerkinElmer Inc.

- FROM SCIENCE

Key Target Audience

- Market Players

- Investors

- End-Users

- Government Authorities

- Consulting and Research Firm

- Venture Capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2019 to 2032. Spherical Insights has segmented the global newborn screening market based on the below-mentioned segments:

Newborn Screening Market, By Product

- Instruments

- Reagents

Newborn Screening Market, By Technology

- Tandem Mass Spectrometry

- Pulse Oximetry

- Enzyme Based Assay

- DNA Assay

- Electrophoresis

- Others

Newborn Screening Market, By Test Type

- Dry Blood Spot Test

- CCHD

- Hearing Screen

Newborn Screening Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Need help to buy this report?