Global Natural Industrial Absorbent Market Size, Share, and COVID-19 Impact Analysis, By Type (Natural Inorganic (Clay), Natural Organic (Cellulose and Cocob), and Others), By End Use (Manufacturing, Oil & Gas, Chemical Processing, and Automotive), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal Natural Industrial Absorbent Market Insights Forecasts to 2035

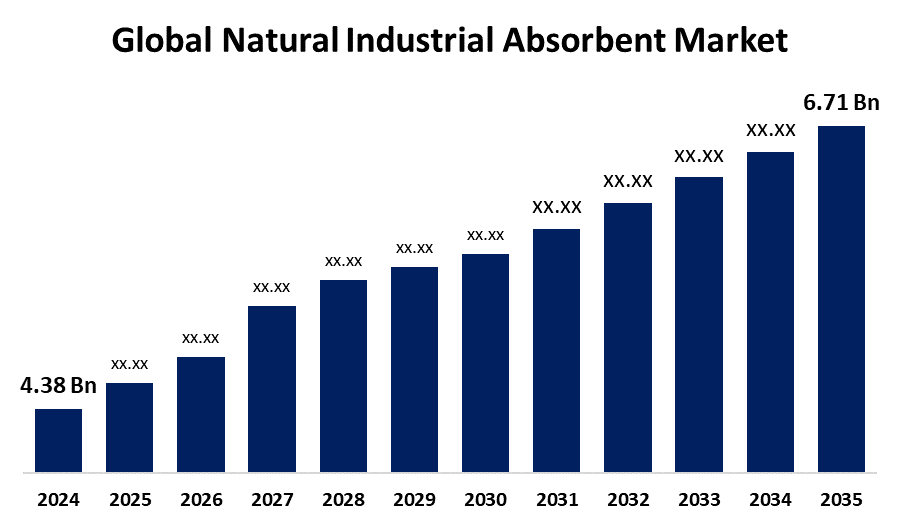

- The Global Natural Industrial Absorbent Market Size Was Estimated at USD 4.38 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 3.95% from 2025 to 2035

- The Worldwide Natural Industrial Absorbent Market Size is Expected to Reach USD 6.71 Billion by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

The global natural industrial absorbent market size was worth around USD 4.38 billion in 2024 and is predicted to grow to around USD 6.71 billion by 2035 with a compound annual growth rate (CAGR) of 3.95% from 2025 to 2035. Technological advancements in eco-friendly materials, along with growing environmental regulations and industrialization, are driving the natural industrial absorbent market globally.

Market Overview

The natural industrial absorbent market is the industry for naturally derived materials used to absorb and contain liquids, primarily in industrial settings, to manage spills and leaks. Natural industrial absorbent is the material derived from natural sources, like plants and minerals, that are designed to quickly soak up spills of oil, chemical solutions, and other hazardous liquids, preventing workplace accidents and contamination. There is a significant increase in the need for eco-friendly absorbent solutions, with companies' growing emphasis on sustainability, environmental consciousness among industries such as automotive, construction, and oil & gas. Further, natural industrial absorbents are increasingly being used in oil spills in the oceans, with rigorous research being carried out globally for the efficient use of natural industrial absorbents. An increasing focus on green technologies is driving the innovations of new natural absorbent materials with advanced performance, providing market growth opportunities for natural industrial absorbent.

Report Coverage

This research report categorizes the natural industrial absorbent market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the natural industrial absorbent market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the natural industrial absorbent market.

Global Natural Industrial Absorbent Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 4.38 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 3.95% |

| 2035 Value Projection: | USD 6.71 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 225 |

| Tables, Charts & Figures: | 119 |

| Segments covered: | By Type, By End Use, By Region The Global Natural Industrial Absorbent Market Size is Expected to Grow from USD 4.38 Billion in 2024 to USD 6.71 Billion by 2035, at a CAGR of 3.95% during the forecast period 2025-2035. |

| Companies covered:: | Wolverine Worldwide, 3M, Intertape Polymer Group, Johnson and Johnson, Strategic Resource Partners, Ecolab, Honeywell, BASF, Mediquik, DuPont, Scapa Group, J and J Snack Foods, Procter and Gamble, Clorox, and Others |

| Pitfalls & Challenges: | COVID-19 has the potential to impact the global market |

Get more details on this report -

Driving Factors

The upsurging production of green technologies through favourable policies and investments is contributing to driving the natural industrial absorbent market growth. Environmental regulations are important for mitigating the negative impact of industrialization on the environment, guiding industrial development towards more sustainable practices, and promoting cleaner technologies. The growing manufacturing sector is driving the need for efficient waste management solutions. Further, effective absorbent materials are required across the automotive, construction, and oil industries for managing spills and leaks. Thus, the growing industrialization is responsible for the market growth of natural industrial absorbent.

Restraining Factors

The decline in cases of major oil spills is reducing the demand for control products, which is negatively impacting the natural industrial absorbent market. The complexity in the standardized certification process for natural absorbents is hindering the market growth.

Market Segmentation

The natural industrial absorbent market share is classified into type and end use.

- The natural inorganic (clay) segment dominated the market with a major share in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on the type, the natural industrial absorbent market is divided into natural inorganic (clay), natural organic (cellulose and cocob), and others. Among these,the natural inorganic (clay) segment dominated the market with a major share in 2024 and is projected to grow at a substantial CAGR during the forecast period. Clay-based absorbents are used for spill management and are reactive to many types of chemicals. They are also used in water treatment plants to ensure the availability of clean and safe drinking water. Some of the examples of clay absorbents are kaolin, montmorillonite, and bentonite. The non-flammability nature of inorganic absorbents, along with the industry's heavy reliance on inorganic absorbents for handling oil, chemical compounds, and heavy metals in green spill management, is driving the market.

- The oil & gas segment dominated the natural industrial absorbent in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the end use, the natural industrial absorbent market is divided into manufacturing, oil & gas, chemical processing, and automotive. Among these, the oil & gas segment dominated the natural industrial absorbent in 2024 and is anticipated to grow at a significant CAGR during the forecast period. This is attributed to the demand for high-performance absorbents for spill cleanup and environmental protection. Natural absorbents are used in the oil and gas industry for removing contaminants from streams, which ultimately protects the high-cost oil and gas equipment from decay and increases the machine’s lifespan.

Regional Segment Analysis of the Natural Industrial Absorbent Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the natural industrial absorbent market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the natural industrial absorbent market over the predicted timeframe. A substantial demand for this absorbent, with an upsurging advancement in the industrial sector, is driving the market growth. The growing investment in green technologies, along with companies' rising emphasis on minimizing their environmental footprint, is driving the market demand in oil & gas, chemicals, and food processing industries.

Asia Pacific is expected to grow at a rapid CAGR in the natural industrial absorbent market during the forecast period. The growing demand for absorbents in oil spill management and chemical processes is driving the market demand. Further, the growing awareness and cost-effectiveness of solutions over other materials, along with the region’s growing need for water and air purification solutions, aid in propelling the market growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the natural industrial absorbent market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Wolverine Worldwide

- 3M

- Intertape Polymer Group

- Johnson and Johnson

- Strategic Resource Partners

- Ecolab

- Honeywell

- BASF

- Mediquik

- DuPont

- Scapa Group

- J and J Snack Foods

- Procter and Gamble

- Clorox

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the natural industrial absorbent market based on the below-mentioned segments:

Global Natural Industrial Absorbent Market, By Type

- Natural Inorganic (Clay)

- Natural Organic (Cellulose and Cocob)

- Others

Global Natural Industrial Absorbent Market, By End Use

- Manufacturing

- Oil & Gas

- Chemical Processing

- Automotive

Global Natural Industrial Absorbent Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?