Global Natural Fiber Composites Market Size, Share, and COVID-19 Impact Analysis, By Fiber Type (Wood, Cotton, Flax, Kenaf, Hemp), By Matrix (Inorganic compound, Natural Polymer, Synthetic Polymer), By Technology (Injection Molding, Compression Molding), By Application (Automotive, Electronics, Construction), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 – 2032.

Industry: Advanced MaterialsGlobal Natural Fiber Composites Market Insights Forecasts to 2032

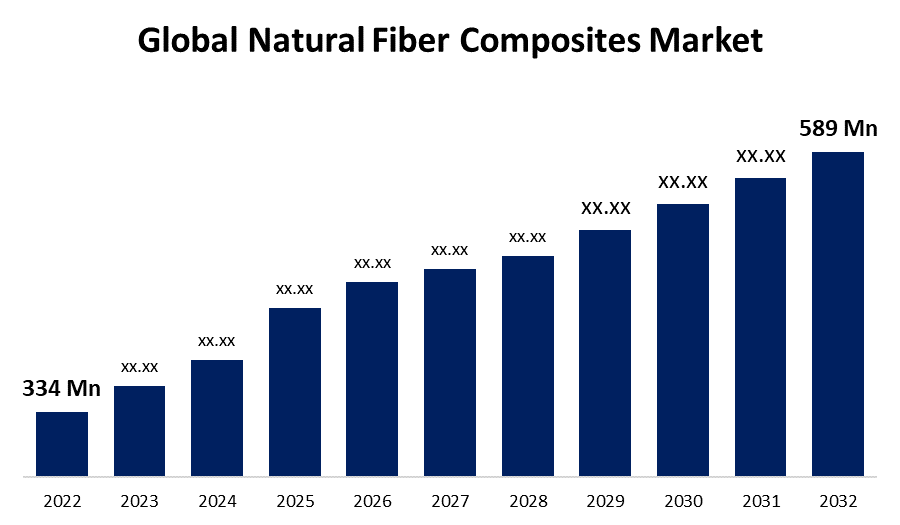

- The Global Natural Fiber Composites Market Size was valued at USD 334 Million in 2022.

- The market is growing at a CAGR of 5.84% from 2022 to 2032.

- The Worldwide Natural Fiber Composites Market is expected to reach USD 589 Million by 2032.

- Europe is expected to grow the fastest during the forecast period.

Get more details on this report -

The Global Natural Fiber Composites Market Size is expected to reach USD 589 Million by 2032, at a CAGR of 5.84% during the forecast period 2022 to 2032.

A form of composite material known as a "natural fiber composite" (NFC) uses carbon-neutral, renewable resources like wood or plants to produce reinforcing fibers. A combination of their desirable appearance and chemical compositions, NFCs are a suitable replacement for glass and carbon fiber. Additionally, they have a lengthy shelf life and are ecologically beneficial. Additionally, NFCs can be used in furniture and automobile parts because of their low weight. The market for natural fiber composites is expanding because of the rise in popularity of electric, lighter, safer, and more fuel-efficient automobiles. This is supported by the greater strength, stiffness, fracture resistance, and thermal & acoustic insulation properties that these fibers display. Additionally, the widespread usage of NFCs reduces the cost of parts for automotive applications. Composite manufacturing is quickly becoming a more cost-effective option than conventional methods for making vehicle components. The use of plant-based fibers including bamboo, kenaf, hemp, jute, flax, coir, sisal, and banana helps this green concept.

In addition, NFCs are recyclable, have a high strength-to-weight ratio, and are not easily broken during production. Additionally, because of their lightweight, they are appropriate for use in automobile applications. Vehicle weight can be decreased by up to 46%. NFCs are therefore ideal for use in the manufacturing of cars due to their numerous advantages. For instance, Bcomp Ltd. and BMW M Motorsport worked together to give the new BMW M4 GT4 an eco-friendly touch.

Global Natural Fiber Composites Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 334 Mn |

| Forecast Period: | 2022 – 2032 |

| Forecast Period CAGR 2022 – 2032 : | 5.84% |

| 022 – 2032 Value Projection: | USD 589 Mn |

| Historical Data for: | 2020-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 140 |

| Segments covered: | By Fiber Type, By Matrix, By Technology, By Application and By Region. |

| Companies covered:: | Toray Industries, Inc., Solvay S.A., BASF SE, Lanxess AG, UFP Technologies, Inc., JNC Corporation, PPG Industries, Inc., Owens Corning, Fibre Extrusion Technology Ltd., Teijin Limited, and Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Natural fiber composites are readily available and renewable. In comparison, synthetic fibers like glass, carbon, and aramid are not renewable they have a degradability problem. Both natural fibers and thermoplastic materials like polypropylene and polyethylene are easily recyclable. As they are less expensive and more ecologically harmless than other fibers, natural fibers, particularly flax, and hemp, are being utilized more frequently in place of glass and carbon fibers. The demand in the automobile sector to handle disposal issues is projected to increase as a result of recent and upcoming laws pertaining to waste management in industrialized nations. Composites are most frequently disposed of in landfills. However, in order to address the issue of waste management, a number of nations and organizations would need to enact strict restrictions.

Restraining Factors

Users are unaware of the benefits of natural fiber composites and their ability to replace regularly used synthetic alternatives. The industry for natural fiber composites has to raise knowledge of the advantages of better characteristics, less weight, easy maintenance, and longer life. Comparing the Asia Pacific region to the US and Europe, China and India have relatively low composite consumption rates. With reduced labor costs and a large variety of raw resources, the Asia Pacific region has a chance of succeeding in this industry. People in Asia and the Pacific are ignorant of the potential uses of natural fiber composites. Environmental protection-related policies are also lacking in the nations in the Asia-Pacific region. To expand their market reach, manufacturers should focus on educating consumers in order to expand the market reach for both current and future uses of natural fiber composites.

Market Segmentation

By Fiber Type Insights

The wood segment dominates the market with the largest revenue share over the forecast period.

On the basis of fiber type, the global natural fiber composites market is segmented into wood, cotton, flax, kenaf, and hemp. Among these, the wood segment is dominating the market with the largest revenue share of 63% over the forecast period. Considering its durability and beautiful natural appearance, wood has been utilized for building purposes for a long time. Wood becomes a suitable filler material or supplement since it is more rigid, less costly, and more powerful than synthetic polymers. These elements play a part in the market domination of the wood segment for natural fiber composites.

By Matrix Insights

The natural polymers segment is witnessing significant CAGR growth over the forecast period.

On the basis of the matrix, the global natural fiber composites market is segmented into inorganic compounds, natural polymers, and synthetic polymers. Among these, the natural polymers segment is witnessing significant CAGR growth over the forecast period. An increasing demand for green products as a result of changing lifestyles and the go green movement is expected to boost the growth of the market. Starch, rubber, and artificial polymers like PLA and PHB (polyhydroxy butyrate) are examples of natural polymers, and the consumer demand for renewable and biodegradable products increases.

By Technology Insights

The injection molding segment is expected to hold the largest share of the Global Natural Fiber Composites Market during the forecast period.

Based on the technology, the global natural fiber composites market is classified into injection molding and compression molding. Among these, the injection molding segment is expected to hold the largest share of the global natural fiber composites market during the forecast period. Popular manufacturing techniques for mass production include injection molding. The popularity of injection molding is largely due to great processability, despite the fact that the enhancing fiber deteriorates during the procedure. The domination of the injection molding market is a result of rising demand for composite materials from the automotive, hardware/apparatus, medical, and bundling industries.

By Application Insights

The automotive segment accounted for the largest revenue share of more than 57.2% over the forecast period.

On the basis of application, the global natural fiber composites market is segmented into automotive, electronics, and construction. Among these, the automotive segment dominates the market with the largest revenue share of 53% over the forecast period. This is a result of the growing need in the automobile sector for lightweight and ecologically friendly materials. Natural fiber composites are a great option for producing a variety of vehicle parts, including dashboards, seat backs, and door panels because of their excellent strength-to-weight ratio. The comfort of the passengers of the car is increased by the superior acoustic and thermal insulation capabilities of natural fiber composites.

Regional Insights

North America dominates the market with the largest market share over the forecast period.

Get more details on this report -

North America is dominating the market with more than 56% market share over the forecast. The market for natural fiber composites in this area is expanding as a result of rising demand for environmentally friendly and sustainable materials from a variety of end-use industries, including the automotive, building, and packaging sectors. Since the rising need for lightweight materials in the automobile industry, the United States is the largest market for natural fiber composites in North America. The government's strict controls on carbon emissions and manufacturers' growing expenses in the development of new fiber composite materials are also expected to contribute to the market's expansion in North America.

Europe, on the contrary, is expected to grow the fastest during the forecast period. The automotive sector in Europe is a key contributor to the growth of the natural fiber composites market in this area. The demand for natural fiber composites in the European market is being driven by the growing need for lightweight and environmentally friendly materials in the manufacture of automotive interior and exterior elements.

Asia-Pacific market is expected to register a substantial CAGR growth rate during the forecast period. The demand for natural fiber composites in the construction industry is being driven by the rapid industrialization and urbanization of emerging nations like China and India.

List of Key Market Players

- Toray Industries, Inc.

- Solvay S.A.

- BASF SE

- Lanxess AG

- UFP Technologies, Inc.

- JNC Corporation

- PPG Industries, Inc.

- Owens Corning

- Fibre Extrusion Technology Ltd.

- Teijin Limited

Key Market Developments

- On June 2022, ARBOTRADE GmbH was created by Tecnaro and JOMA-POLYTEC. For the purpose of replanting forests, the joint venture offers goods composed of bioplastics. This merger establishes a link with a significant amount of additional value. Customers may obtain everything from the raw material to the finished product from a single source thanks to TECNARO's role as a material developer and producer and Joma-Polytec's role as a material processor. The market sales of the ground-breaking internal developments are then handled by the joint firm, ARBOTRADE GmbH.

- On March 2021, Teijin Limited announced the acquisition of Benet Automotive, a leading supplier of automotive interior materials in Europe.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2032. Spherical Insights has segmented the global natural fiber composites market based on the below-mentioned segments:

Natural Fiber Composites Market, Fiber Type Analysis

- Wood

- Cotton

- Flax

- Kenaf

- hemp

Natural Fiber Composites Market, Matrix Analysis

- Inorganic Compounds

- Natural Polymers

- Synthetic Polymers

Natural Fiber Composites Market, Technology Analysis

- Injection Molding

- Compression Molding

Natural Fiber Composites Market, Application Analysis

- Automotive

- Electronics

- construction

Natural Fiber Composites Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?