Global N Butyl Stearate (nBS) Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Industrial Grade, Cosmetic Grade, and Pharmaceutical Grade), By Application (Lubricants, Personal Care and Cosmetics, Pharmaceuticals, Plastics, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal N Butyl Stearate (nBS) Market Insights Forecasts to 2035

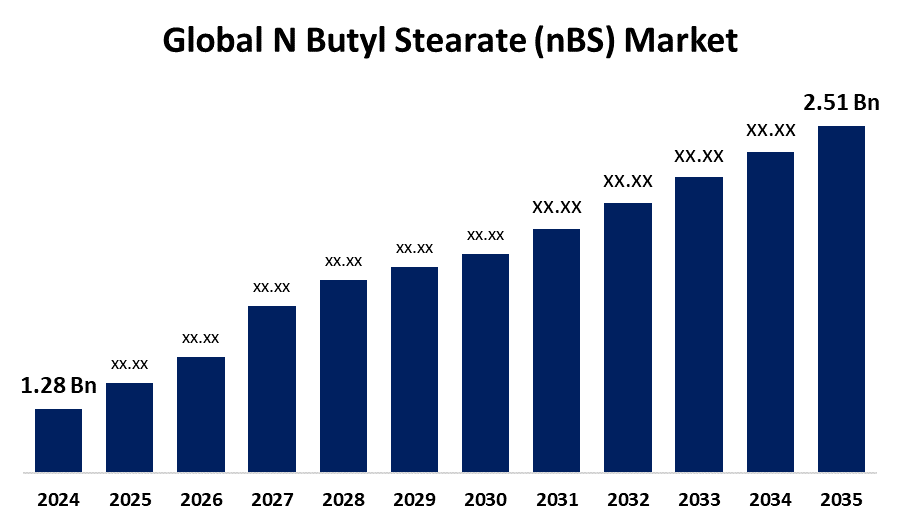

- The Global N Butyl Stearate (nBS) Market Size Was Estimated at USD 1.28 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.31 % from 2025 to 2035

- The Worldwide N Butyl Stearate (nBS) Market Size is Expected to Reach USD 2.51 Billion by 2035

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

The global N butyl stearate (nBS) market size was worth around USD 1.28 billion in 2024 and is predicted to grow to around USD 2.51 billion by 2035 with a compound annual growth rate (CAGR) of 6.31 % from 2025 and 2035. The market for N butyl stearate (nBS) offers opportunities in the areas of sustainable formulations, growing lubricant and cosmetic applications, increasing demand for bio-based esters, and expansion in emerging nations with personal care and industrial sectors.

Market Overview

The global industry that produces, distributes, and uses N butyl stearate (nBS), an ester made from butyl alcohol and stearic acid, is known as the N butyl stearate (nBS) market. In this market, nBS is used as an emulsifier, plasticizer, and skin-conditioning agent in a variety of industries, such as food additives, lubricants, medicines, and cosmetics. The market for N butyl stearate (nBS) is expanding steadily because of its numerous uses in a variety of sectors, such as personal care, lubricants, plasticizers, and cosmetics.

The market expansion is also supported by the rising demand for bio-based solvents and the increased emphasis on preventing exposure to hazardous chemicals. The growing use of nBS in the cosmetics and personal care sector is a major development driver for the market. The growing applications of N butyl stearate in the personal care and cosmetics industries are the main factors propelling the N butyl stearate (nBS) market. The chemical compound nBS's adaptability and versatility make it a valuable asset across its diverse applications, supporting its demand on a global scale.

Report Coverage

This research report categorizes the N butyl stearate (nBS) market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the N butyl stearate (nBS) market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the N butyl stearate (nBS) market.

Global N Butyl Stearate (nBS) Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1.28 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 6.31 % |

| 2035 Value Projection: | USD 2.51 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 225 |

| Tables, Charts & Figures: | 119 |

| Segments covered: | By Product Type, By Application, By Region |

| Companies covered:: | KLK Oleo, BASF SE, Oleon NV, PMC Biogenix, Fine Organics, Faci Group, Stearinerie Dubois, Italmatch Chemicals, IOI Oleochemicals, Croda International Plc, A&A Fratelli Parodi Spa, Acme-Hardesty Company, Wilmar International Ltd., Emery Oleochemicals, Others , and |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The use of nBS is becoming more and more popular among producers as a result of the trend toward natural and organic substances in cosmetics. The lubricant industry's use of nBS is a further factor driving the market's expansion. Growing end-use industries, especially in the automotive, personal care, and packaging sectors, and increased demand for sustainable chemicals are the main drivers of growth. The demand for high-performance additives like nBS in lubricant formulations is being driven by the continuous improvements in vehicle technology as well as the drive for fuel efficiency and lower emissions.

Restraining Factors

The market for N butyl stearate (nBS) is restricted by a number of problems, such as the availability of alternatives, strict chemical regulations, changing raw material prices, and a lack of consumer understanding of sustainable chemical alternatives based on esters.

Market Segmentation

The N butyl stearate (nBS) market share is classified into product type and application.

- The industrial grade segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on the product type, the N butyl stearate (nBS) market is divided into industrial grade, cosmetic grade, and pharmaceutical grade. Among these, the industrial grade segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The manufacturing and processing industries are the main users of industrial grade nBS because of its qualities, which improve product performance in lubricants and polymers, among other uses. This grade of nBS is in high demand since it is essential for companies that need chemical stability and performance under a variety of situations.

- The lubricants segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the N butyl stearate (nBS) market is divided into lubricants, personal care and cosmetics, pharmaceuticals, plastics, and others. Among these, the lubricants segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. In the lubricant industry, nBS is an essential addition that improves performance. It is a great option for creating industrial and automotive lubricants because of its chemical stability and capacity to lessen wear and friction.

Regional Segment Analysis of the N Butyl Stearate (nBS) Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the N butyl stearate (nBS) market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the N butyl stearate (nBS) market over the predicted timeframe. The Asia Pacific region's fast-growing consumer and industrial sectors are to blame. The region's growing automobile sector and growing consumer expenditure on cosmetics and personal care are driving a large demand for nBS. The need for cutting-edge solutions in consumer goods, technology, automobiles, and energy is also growing in the region. Strong industrial growth in nations like China and India is driving up demand for high-performance lubricants and plasticizers, which in turn is fueling the expansion of the nBS market in this area.

North America is expected to grow at a rapid CAGR in the N butyl stearate (nBS) market during the forecast period. The well-established personal care, pharmaceutical, and automotive sectors in North America support the nBS industry. Due to its sophisticated manufacturing skills and emphasis on technological improvements in product creation, the United States, in particular, holds a considerable market share. The demand for nBS in a variety of applications is being driven by the region's focus on innovation and high standards in product formulations.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the N N butyl stearate (nBS) market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- KLK Oleo

- BASF SE

- Oleon NV

- PMC Biogenix

- Fine Organics

- Faci Group

- Stearinerie Dubois

- Italmatch Chemicals

- IOI Oleochemicals

- Croda International Plc

- A&A Fratelli Parodi Spa

- Acme-Hardesty Company

- Wilmar International Ltd.

- Emery Oleochemicals

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the N butyl stearate (nBS) market based on the below-mentioned segments:

Global N Butyl Stearate (nBS) Market, By Product Type

- Industrial Grade

- Cosmetic Grade

- Pharmaceutical Grade

Global N Butyl Stearate (nBS) Market, By Application

- Lubricants

- Personal Care and Cosmetics

- Pharmaceuticals

- Plastics

- Others

Global N Butyl Stearate (nBS) Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?