Global Mutual Fund Assets Market Size, Share, and COVID-19 Impact Analysis, By Type (Open-ended, Close-ended), By Investment Strategy (Equity Strategy, Fixed Income Strategy, Multi-asset, Balanced Strategy, Sustainable Strategy, Money Market Strategy, Others), By Investor Type (Institutional, Individual), By Distribution Channel (Banks, Financial Advisors, Broker-dealer, Direct Sales, Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 - 2032.

Industry: Banking & FinancialGlobal Mutual Fund Assets Market Insights Forecasts to 2032

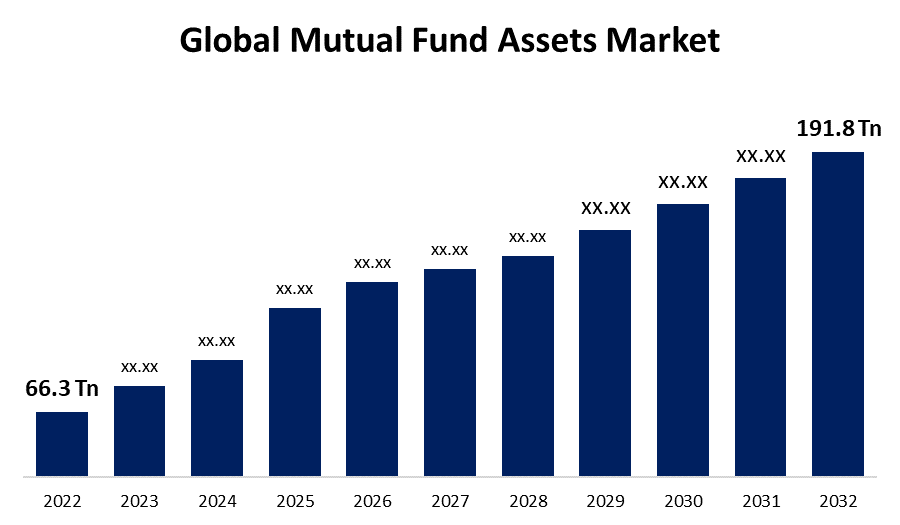

- The Global Mutual Fund Assets Market Size was valued at USD 66.3 Trillion in 2022.

- The Market Size is Growing at a CAGR of 11.2% from 2022 to 2032

- The Worldwide Mutual Fund Assets Market is expected to reach USD 191.8 Trillion by 2032

- Europe is expected To Grow the fastest during the forecast period

Get more details on this report -

The Global Mutual Fund Assets Market Size is expected to reach USD 191.8 Trillion by 2032, at a CAGR of 11.2% during the forecast period 2022 to 2032.

The mutual fund industry is a dynamic ecosystem that is influenced by numerous factors. Among them are shifting market dynamics, changing investor preferences, regulatory reforms, technological advancements, and global economic trends. The rise of index funds and exchange-traded funds (ETFs) has also reshaped the landscape, changing how investors approach diversification and cost management.

Mutual funds have become one of the most popular investment vehicles for both individual and institutional investors. A mutual fund is a type of investment vehicle that pools together money from various investors to invest in a diversified portfolio of assets, such as stocks, bonds, and other securities. The combined holdings the mutual fund owns are known as its portfolio, and each investor in the mutual fund owns shares, which represent a portion of these holdings. The assets of a mutual fund represent the total market value of the investments it holds. One of the primary benefits of mutual funds is the ability to diversify investments. Mutual funds generally offer high liquidity. Investors can easily redeem their shares and convert them into cash, usually within a day of the redemption request. Furthermore, as financial literacy spreads, more individuals recognize the value of investing, leading to potential growth in mutual fund assets. With the rise of robo-advisors and digital investment platforms, there's a significant opportunity to tap into a younger, tech-savvy demographic. However, with numerous funds available in the market, attracting and retaining investors becomes challenging, especially with the growing popularity of alternative investment options like ETFs.

Global Mutual Fund Assets Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 66.3 Trillion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 11.2% |

| 2032 Value Projection: | USD 191.8 Trillion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Investment Strategy, By Investor Type, By Distribution Channel, By Region |

| Companies covered:: | BNP PARIBAS MUTUAL FUND, PIMCO, CITIGROUP INC., BLACKROCK, INC., STATE STREET CORPORATION, CAPITAL GROUP, MORGAN STANLEY, THE VANGUARD GROUP, INC., JPMORGAN CHASE & CO, and GOLDMAN SACHS |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The global mutual fund assets market runs into trillions of dollars. Mutual funds offer a wide range of investment options, from equity funds focused on stocks to bond funds, balanced funds (which combine stocks and bonds), money market funds, and more specialized funds. Developed markets, particularly the U.S. and Europe, account for a significant chunk, but emerging markets are rapidly expanding their share. The size of this market signifies its importance in global finance. An increasing understanding of financial markets and the importance of investments has led to a broader section of the population turning towards mutual funds as a preferred investment avenue. As economies expand, disposable incomes rise, leading to increased investments in mutual funds. Furthermore, the integration of technology, robo-advisors, and digital platforms has made mutual funds more accessible to a broader range of investors, especially younger generations.

Market Segmentation

By Type Insights

The open-ended segment is dominating the market with the largest revenue share over the forecast period.

On the basis of type, the global mutual fund assets market is segmented into the open-ended and close-ended. Among these, the open-ended segment is dominating the market with the largest revenue share of 78.6% over the forecast period. Open-ended mutual funds do not have a fixed number of shares and can redeem existing shares or issue new shares based on investor demand. This allows investors to buy or sell shares anytime, providing easy access to their investments. The open-ended structure also enables the fund manager to actively manage the portfolio by adjusting holdings based on market conditions and investment objectives. This flexibility and convenience have made open-ended mutual funds the preferred choice for many investors, contributing to their dominance in the market.

By Investor Type Insights

The individual segment is witnessing significant CAGR growth over the forecast period.

On the basis of investor type, the global mutual fund assets market is segmented into institutional and individual. Among these, the individual segment is witnessing significant CAGR growth over the forecast period. Individual and retail individuals purchase and sell shares, exchange-traded funds (ETFs), and mutual funds. Individual investors are also known as retail investors. Moreover, mutual funds often have lower investment minimums compared to other investment vehicles, making them more accessible to retail investors with limited capital. This lower barrier to entry allows retail investors to participate in the market and benefit from professional management and potential market returns.

By Investment Strategy Insights

The equity strategy segment is expected to hold the largest share of the Global Mutual Fund Assets Market during the forecast period.

Based on the investment strategy, the global mutual fund assets market is classified into equity strategy, fixed income strategy, multi-asset, balanced strategy, sustainable strategy, money market strategy, and others. Among these, the equity strategy segment is expected to hold the largest share of the m Mutual Fund Assets market during the forecast period. An aggregated investment fund called an equity fund, commonly referred to as a stock fund, invests assets in the stock market to generate returns for the fund's owners. Investing in equity mutual funds offers the advantage of gaining exposure to a diverse portfolio of companies, mitigating the risks associated with holding individual stocks. This diversification strategy allows investors to access various markets and styles, enabling the construction of well-rounded portfolios tailored to their specific financial objectives.

By Distribution Channel Insights

The direct sales segment accounted for the largest revenue share of more than 37.2% over the forecast period.

On the basis of distribution channel, the global mutual fund assets market is segmented into banks, financial advisors, broker-dealer, direct sales, and others. Among these, the direct sales segment is dominating the market with the largest revenue share of 37.2% over the forecast period. Direct sales offer investors the convenience and flexibility to purchase mutual fund units directly without intermediaries, such as brokers or financial advisors. This gives investors greater control over their investment decisions and potentially saves on distribution fees or commissions. Moreover, direct sales provide transparency and direct communication between the mutual fund company and the investor, allowing for a better understanding of the fund's performance, fees, and investment strategy.

Regional Insights

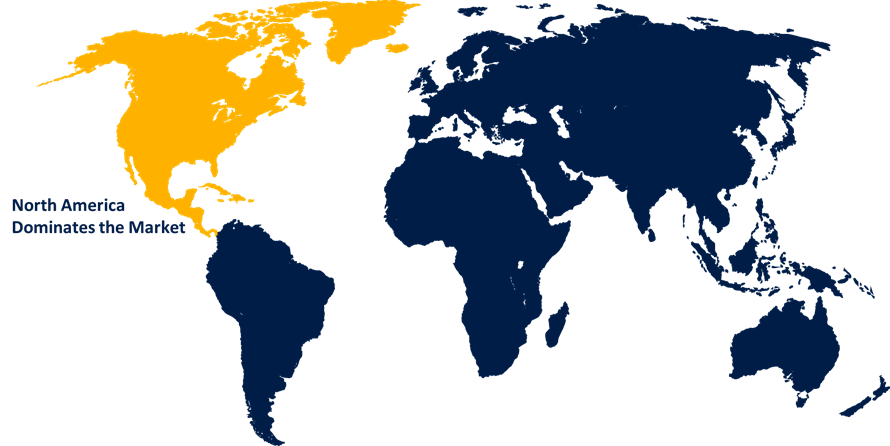

North America dominates the market with the largest market share over the forecast period.

Get more details on this report -

North America is dominating the market with more than 41.8% market share over the forecast period. The region has a well-developed and mature financial market, with a strong presence of asset management companies and financial institutions that offer mutual funds. The depth and breadth of the North American financial industry attract a large number of investors, both institutional and retail, who trust and rely on mutual funds as a preferred investment vehicle. Moreover, North America has a culture of investing and a high level of financial literacy among its population. The region's investors are well-informed and actively seek investment opportunities to grow their wealth, with mutual funds being a popular choice.

The Europe market is expected to register a higher CAGR growth rate during the forecast period. The European mutual fund market has a variety of regulatory environments due to the presence of multiple countries. Luxembourg and Ireland serve as fund domiciles due to favorable regulations. The market is mature, and both retail and institutional investors are active. The European mutual fund market values sustainable and responsible investing, reflecting growing investor interest in environmental, social, and governance (ESG) issues.

List of Key Market Players

- BNP PARIBAS MUTUAL FUND

- PIMCO

- CITIGROUP INC.

- BLACKROCK, INC.

- STATE STREET CORPORATION

- CAPITAL GROUP

- MORGAN STANLEY

- THE VANGUARD GROUP, INC.

- JPMORGAN CHASE & CO

- GOLDMAN SACHS

Key Market Developments

- In July 2022, JPMorgan Chase & Co. announced a USD 30 million investment in Centivo. Centivo is an innovative health plan provider for self-insured businesses that addresses health care affordability for employees and their families.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2032. Spherical Insights has segmented the Global Mutual Fund Assets Market based on the below-mentioned segments:

Mutual Fund Assets Market, Type Analysis

- Open-ended

- Close-ended

Mutual Fund Assets Market, Investment Strategy Analysis

- Equity Strategy

- Fixed Income Strategy

- Multi-asset

- Balanced Strategy

- Sustainable Strategy

- Money Market Strategy

- Others

Mutual Fund Assets Market, Investor Type Analysis

- Institutional

- Individual

Mutual Fund Assets Market, Distribution Channel Analysis

- Banks

- Financial Advisors

- Broker-dealer

- Direct Sales

- Others

Mutual Fund Assets Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?