Global Monoethylene Glycol Market Size, Share, and COVID-19 Impact Analysis, By Application (PET, Polyester Fibers, Antifreeze, and Others), By End User (Packaging, Textile, Automotive, Plastics, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035.

Industry: Chemicals & MaterialsGlobal Monoethylene Glycol Market Insights Forecasts to 2035

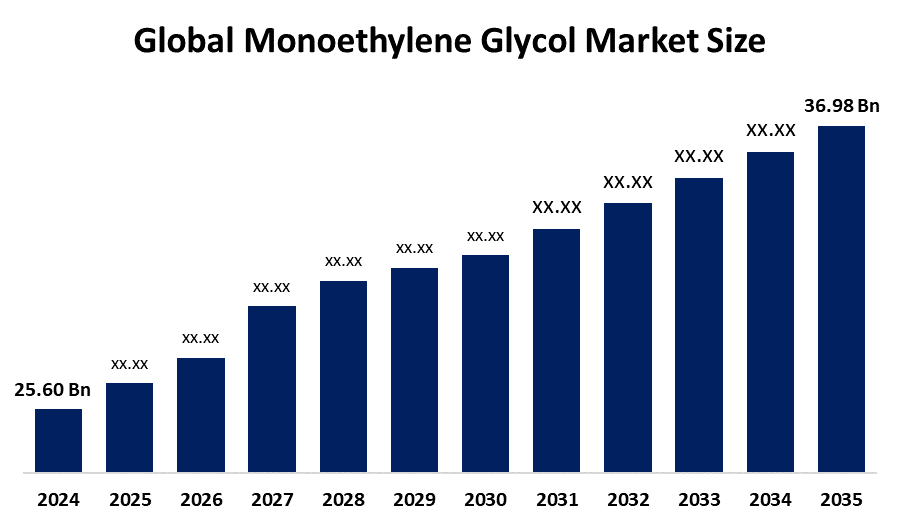

- The Global Monoethylene Glycol Market Size Was Estimated at USD 25.60 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 3.4 % from 2025 to 2035

- The Worldwide Monoethylene Glycol Market Size is Expected to Reach USD 36.98 Billion by 2035

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The Global Monoethylene Glycol market size was valued at around USD 25.60 Billion in 2024 and is predicted to Grow to around USD 36.98 Billion by 2035 with a compound annual Growth rate (CAGR) of 3.4 % from 2025 to 2035. Increasing demand for polyester, packaging development, electric car coolants, infrastructure expansion, recycling technologies, and breakthroughs in bio-based production throughout emerging and developed economies worldwide present opportunities for the monoethylene glycol market.

Market Overview

The need for polyester, antifreeze, packaging, textiles, and industrial chemical uses globally drives the manufacture, distribution, and consumption of monoethylene glycol, which is referred to as the monoethylene glycol market. The main source of ethylene oxide is ethylene glycol, which is mainly used in the manufacturing of polyester, PET resins, and other products. The U.S. and European governments are driving the sustainable MEG utilization through the use of bio-based and recycled PET raw materials in meeting their green aims. UPM Biochemicals started bio-MEG production at its Leuna biorefinery in December as a result of the U.S. DOE tax credits and India's eased import restrictions that helped the sustainable ethylene glycol supply chains worldwide, along with the industry innovation. For Instance, in October 2025, Sustainea launched plans for a USD 400 million bio-monoethylene glycol plant in Lafayette, designed to process 42,000 bushels of corn daily, strengthening sustainable MEG production capacity. The discovery of novel End User s for MEG, such as in the manufacturing of batteries and green solvents, as well as its increasing use in the manufacturing of polyester fibers, antifreeze, braking fluids, and numerous other products, are important factors driving the monoethylene glycol market's expansion.

Report Coverage

This research report categorizes the monoethylene glycol market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the monoethylene glycol market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the monoethylene glycol market.

Global Monoethylene Glycol Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 25.60 Billion |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 3.4% |

| 2035 Value Projection: | USD 36.98 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Type, By Application |

| Companies covered:: | Acuro Organics Ltd., Arham Petrochem Pvt. Ltd., Euro Industrial Chemicals, Indian Oil Corporation Ltd., India Glycols Ltd., Ishtar Company, LLC, Kimia Pars Co., LyondellBasell N.V., MEGlobal, Pon Pure Chemicals Group, Raha Group, SABIC, Shell, UPM Biochemicals, Others, and key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market is anticipated to rise as new applications for MEG are developed, such as in the manufacturing of batteries and environmentally friendly solvents. The market for monoethylene glycol (MEG) is driven by a number of important elements that promote its steady expansion throughout international industries. The demand for packaged products and synthetic textiles has increased due to rapid urbanization, population growth, and rising consumer spending, which has led to an increase in MEG consumption. The need for MEG-based industrial fluids, coolants, and antifreeze is further supported by growth in the automotive and construction industries. Market growth is also being stimulated by government programs that support recycling, sustainable materials, and circular economy principles.

Restraining Factors

Volatile crude oil prices, environmental laws, high production costs, reliance on petrochemical feedstocks, supply-demand imbalances, and growing competition from recycled PET and bio-based alternative materials all restricted the monoethylene glycol market.

Market Segmentation

The monoethylene glycol market share is classified into application and end user.

- The PET segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the monoethylene glycol market is divided into PET, polyester fibers, antifreeze, and others. Among these, the PET segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. PET bottles consistently replace glass and aluminum in beverages, and antifreeze and industrial uses bring stable, margin-accretive volume. This is explained by MEG's superior qualities over other materials used in PET manufacturing. These consist of its barrier qualities, clarity and transparency, compatibility, reactivity, and thermal stability.

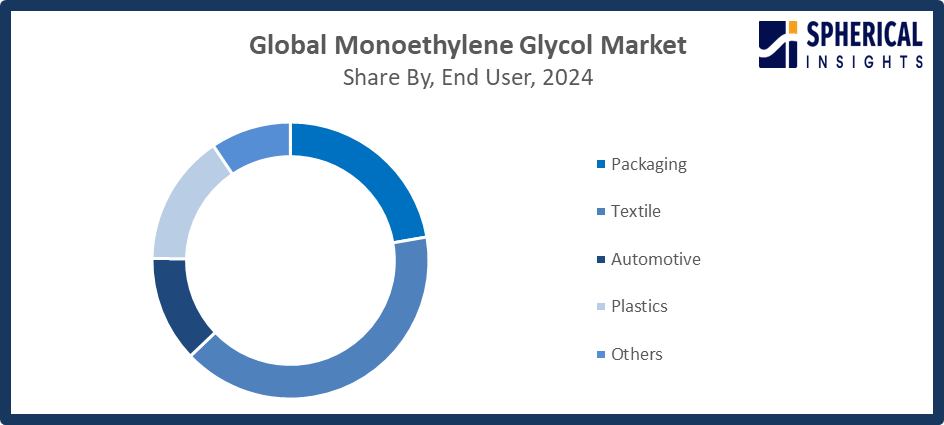

- The textile segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the end user, the monoethylene glycol market is divided into packaging, textile, automotive, plastics, and others. Among these, the textile segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The demand of synthetic textiles has increased due to rapid urbanization, rising disposable incomes, and shifting consumer lifestyles, which has increased the need for MEG. Monoethylene glycol's wide range of applications in the textile sector, including dyeing, polyester fiber manufacture, textile printing, finishing, and textile processing, is responsible for the market.

Get more details on this report -

Regional Segment Analysis of the Monoethylene Glycol Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the monoethylene glycol market over the predicted timeframe.

Asia Pacific is anticipated to hold the largest share of the monoethylene glycol market over the predicted timeframe. Particularly in nations like China, India, Japan, and South Korea, the area enjoys a strong production base for polyester fibers, polyethylene terephthalate (PET) resins, and packaging materials. Regional potential for growth is further boosted by government programs that support sustainability, domestic manufacturing, and infrastructure development. In order to improve textile and automotive supply chains with integrated ethylene feedstock, Sinopec announced and opened a 1-million-ton MEG plant in Shandong, China. In July, Reliance Industries of India announced a bio-based MEG project in Gujarat that uses sustainable antifreeze made from renewable sugarcane and is funded by the government's USD 1 billion petrochemical incentive program under the Production Linked Incentive (PLI) program.

North America is expected to grow at a rapid CAGR in the monoethylene glycol market during the forecast period. Growing PET packaging, automobile antifreeze, and industrial coolant consumption in the US and Canada are major factors contributing to the region's expansion. One of the main factors propelling the regional market is the increasing investments made by top manufacturing firms in North America. AI-driven catalysts were incorporated into Dow Chemical's July $400 million capacity upgrade at its Louisiana factory, which reduced energy consumption by 20% and improved antifreeze compositions. The petrochemical value chain for PET recycling was strengthened by ExxonMobil's June joint venture extension with SABIC in the Gulf Coast, which added 300,000 tons.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the monoethylene glycol market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Acuro Organics Ltd.

- Arham Petrochem Pvt. Ltd.

- Euro Industrial Chemicals

- Indian Oil Corporation Ltd.

- India Glycols Ltd.

- Ishtar Company, LLC

- Kimia Pars Co.

- LyondellBasell N.V.

- MEGlobal

- Pon Pure Chemicals Group

- Raha Group

- SABIC

- Shell

- UPM Biochemicals

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In February 2025, Shell Chemicals launched an expansion of monoethylene glycol production capacity in Asia, aiming to meet growing PET demand, support industrial growth, and ensure a reliable MEG supply across the region.

- In June 2024, Technip Energies and Shell Catalysts and Technologies announced a technology transfer agreement to commercialize Bio-2-Glycols, enabling bio-based monoethylene glycol production from glucose, significantly reducing lifecycle emissions.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the monoethylene glycol market based on the below-mentioned segments:

Global Monoethylene Glycol Market, By Application

- PET

- Polyester Fibers

- Antifreeze

- Others

Global Monoethylene Glycol Market, By End User

- Packaging

- Textile

- Automotive

- Plastics

- Others

Global Monoethylene Glycol Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?