Global Molecular Quality Controls Market Size, Share, and COVID-19 Impact Analysis, By Product (Independent Controls and Instrument-Specific Controls), By Analyte Type (Single-Analyte Controls and Multi-Analyte Controls), By Application (Infectious Disease Diagnostics, Oncology Testing, Genetic Testing, and Others), By End-User (Diagnostic Laboratories, Hospitals, IVD Manufacturers & Contract Research Organizations, Academic & Research Institutes, and Others), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 – 2032).

Industry: HealthcareGlobal Molecular Quality Controls Market Insights Forecasts to 2032

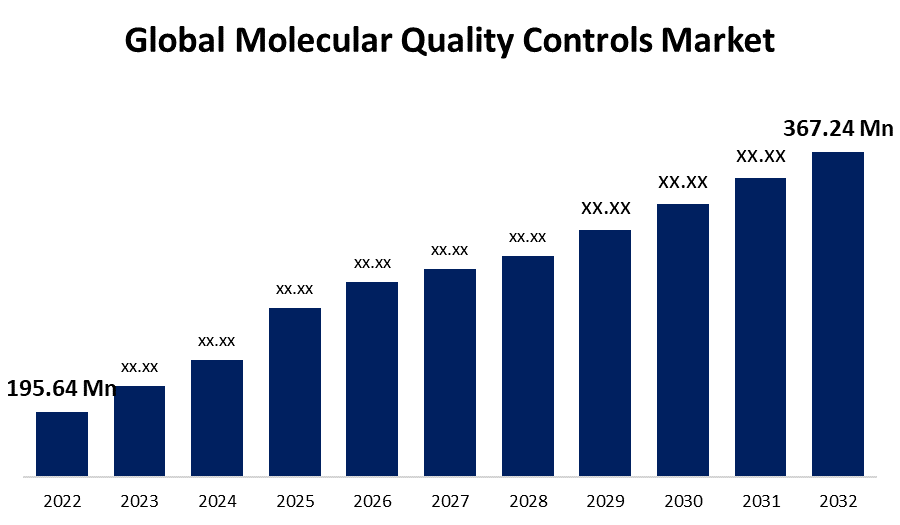

- The Molecular Quality Controls Market was valued at USD 195.64 Million in 2022.

- The Market is growing at a CAGR of 6.5% from 2022 to 2032.

- The Global molecular quality controls market is expected to reach USD 367.24 Million by 2032.

- Asia-Pacific is expected to grow fastest during the forecast period.

Get more details on this report -

The Global Molecular Quality Controls Market is expected to reach USD 367.24 Million by 2032, at a CAGR of 6.5% during the forecast period 2022 to 2032.

Market Overview

Molecular Quality Controls (MQCs) play a pivotal role in ensuring the accuracy, reliability, and consistency of molecular diagnostic assays and laboratory testing processes. These controls consist of well-defined samples with known target sequences, concentrations, or mutations, which are integrated into testing workflows alongside patient samples. By mimicking real patient specimens, MQCs enable continuous monitoring of assay performance, identifying potential variations, instrument issues, or procedural errors. This proactive approach enhances the validity of test results, minimizes false positives/negatives, and aids in troubleshooting.

Report Coverage

This research report categorizes the market for molecular quality controls market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the molecular quality controls market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the molecular quality controls market.

Global Molecular Quality Controls Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 195.64 Mn |

| Forecast Period: | 2022 – 2032 |

| Forecast Period CAGR 2022 – 2032 : | 6.5% |

| 022 – 2032 Value Projection: | USD 367.24 Mn |

| Historical Data for: | 2019-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 160 |

| Segments covered: | By Product, By Analyte Type, By Application, By End-User, By Region. |

| Companies covered:: | F. Hoffmann-La Roche Ltd., Danaher Corporation, Bio-Rad Laboratories, Inc., Anchor Molecular, Thermo Fisher Scientific, Inc., Randox Laboratories Ltd., LGC Limited, Abbott Laboratories, Fortress Diagnostics, SERO AS, Anchor Molecular, Vircell S.L., Ortho Clinical Diagnostics, Inc., Sun Diagnostics, LLC, and Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The molecular quality controls (MQCs) market is driven by a confluence of factors that collectively underscore the importance and growth potential of this essential segment within the healthcare and diagnostics industry, the increasing adoption of molecular diagnostics across a spectrum of applications, including genomics, oncology, infectious diseases, and personalized medicine, has spurred the demand for accurate and reliable testing methods. This has elevated the significance of MQCs, which ensure the precision of these tests and safeguard against errors. Stringent regulatory requirements in the healthcare sector necessitate rigorous quality assurance processes. Regulatory bodies such as the FDA and international organizations like ISO have established guidelines mandating the use of quality controls in diagnostic procedures. Compliance with these regulations drives the integration of MQCs into laboratory workflows, bolstering market growth. Moreover, as technology advances, the complexity of molecular assays grows, demanding higher levels of accuracy and reproducibility. This prompts laboratories to invest in advanced quality control solutions that can emulate the intricacies of real patient samples, thereby facilitating the detection of subtle deviations in assay performance. The evolution of these controls to mimic complex genetic variations, mutations, and concentrations further fuels market expansion. Furthermore, the growing awareness among healthcare professionals and researchers about the impact of pre-analytical and analytical variables on test outcomes has amplified the demand for comprehensive quality control strategies. MQCs, by simulating these variables, enable laboratories to identify and rectify issues early in the testing process, preventing potential diagnostic inaccuracies.

Restraining Factors

The molecular quality controls (MQCs) market faces constraints such as cost implications, as advanced quality control solutions can be expensive to develop and implement. Additionally, the lack of standardized guidelines for certain molecular assays hinders the selection and utilization of appropriate MQCs. Limited availability of clinically relevant and diverse control materials, especially for rare genetic mutations, poses challenges. Furthermore, integrating MQCs into existing laboratory workflows may require adjustments, leading to operational complexities.

Market Segmentation

- In 2022, the independent controls segment accounted for around 38.2% market share

On the basis of the product, the global molecular quality controls market is segmented into independent controls and instrument-specific controls. The independent controls segment has emerged as the dominant force in the molecular quality controls (MQCs) market. This dominance can be attributed to the segment's versatility in catering to various molecular diagnostic assays across different platforms and instruments. Independent controls offer the flexibility to assess assay performance independently from commercial test kits, making them a preferred choice for laboratories aiming to customize their quality control processes. Their wide applicability, cost-effectiveness, and compatibility with diverse testing methods have propelled the independent controls segment to its market leadership position.

- The single-analyte controls segment held the largest market with more than 55.7% revenue share in 2022

Based on the analyte type, the global molecular quality controls market is segmented into single-analyte controls and multi-analyte controls. The single-analyte controls segment has secured the largest share in the molecular quality controls (MQCs) market due to its focused and specialized nature. These controls provide precise assessment of individual target analytes, catering to the specific requirements of molecular assays targeting particular genes or biomarkers. Laboratories often utilize single-analyte controls to address the need for accuracy in specific diagnostic scenarios. This segment's ability to offer in-depth scrutiny of essential molecular targets has contributed to its significant market presence and dominance in the MQCs landscape.

- Infectious disease diagnostics held the largest market with more than 40.5% revenue share in 2022

Based on the application, the global molecular quality controls market is segmented into infectious disease diagnostics, oncology testing, genetic testing, and others. Infectious disease diagnostics have secured the largest share in the Molecular Quality Controls (MQCs) market due to their critical role in public health. The need for accurate detection of pathogens and timely intervention drives the demand for reliable and precise testing methods. MQCs play a pivotal role in ensuring the dependability of infectious disease assays by mimicking patient samples and aiding in detecting errors or deviations. As the global focus on infectious disease control intensifies, the significant demand for accurate diagnostics cements infectious disease diagnostics as the market leader for MQCs.

- The diagnostic laboratories segment held the largest market with more than 34.5% revenue share in 2022

Based on the end-user, the global molecular quality controls market is segmented into diagnostic laboratories, hospitals, IVD manufacturers & contract research organizations, academic & research institutes, and others. The diagnostic laboratories segment has emerged as the largest market player in the molecular quality controls (MQCs) domain. This can be attributed to the indispensable role MQCs play in ensuring the accuracy and reliability of diagnostic test results. Diagnostic laboratories, driven by regulatory compliance and the need for precise patient care, extensively employ MQCs to validate and calibrate their molecular assays. The segment's reliance on consistent, standardized, and validated testing processes has propelled the demand for MQCs, establishing diagnostic laboratories as the primary drivers of the MQCs market.

Regional Segment Analysis of the Molecular Quality Controls Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America dominated the market with more than 46.5% revenue share in 2022.

Get more details on this report -

Based on region, North America exerts a dominant influence on the molecular quality controls (MQCs) market due to advanced healthcare infrastructure, research facilities, and a strong emphasis on quality assurance, driving demand for accurate diagnostics. Stringent regulatory standards and a proactive approach to patient care further elevate the importance of MQCs.

Europe holds the position of the second-largest market for molecular quality controls (MQCs), primarily due to its well-established healthcare systems and robust regulatory framework. The region's focus on precision medicine, advancements in molecular diagnostics, and a growing awareness of the impact of quality assurance on patient outcomes drive the demand for MQCs.

Asia-Pacific region is expected to rapid growth in the molecular quality controls (MQCs) market during the forecast period. Factors driving this expansion include the increasing adoption of molecular diagnostics in densely populated countries, rising healthcare investments, and growing awareness of quality assurance's critical role in diagnostics.

Recent Developments

- In January 2023, The acquisition of The Binding Site Group by Thermo Fisher Scientific (US) enhances the company's current specialised diagnostics offering by adding pioneering innovation in diagnostics and monitoring for multiple myeloma.

- In November 2022, The acquisition of Cryologics (US) by Microbiologics Inc. (US) widened the company's ability to provide quality control microbiologists committed to the security of pharmaceutical and personal care goods.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global molecular quality controls market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Companies:

- F. Hoffmann-La Roche Ltd.

- Danaher Corporation

- Bio-Rad Laboratories, Inc.

- Anchor Molecular

- Thermo Fisher Scientific, Inc.

- Randox Laboratories Ltd.

- LGC Limited

- Abbott Laboratories

- Fortress Diagnostics

- SERO AS

- Anchor Molecular

- Vircell S.L.

- Ortho Clinical Diagnostics, Inc.

- Sun Diagnostics, LLC

Key Target Audience

- Market Players

- Investors

- End-Users

- Government Authorities

- Consulting and Research Firm

- Venture Capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2019 to 2032. Spherical Insights has segmented the global molecular quality controls market based on the below-mentioned segments:

Molecular Quality Controls Market, By Product

- Independent Controls

- Instrument-Specific Controls

Molecular Quality Controls Market, By Analyte Type

- Single-Analyte Controls

- Multi-Analyte Controls

Molecular Quality Controls Market, By Application

- Infectious Disease Diagnostics

- Oncology Testing

- Genetic Testing

- Others

Molecular Quality Controls Market, By End-User

- Diagnostic Laboratories

- Hospitals

- IVD Manufacturers & Contract Research Organizations

- Academic & Research Institutes

- Others

Molecular Quality Controls Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?