Global Modular Trailer Market Size, Share, and COVID-19 Impact Analysis, By Trailer Type (Multi-Axle, Telescopic/Extendable, and Lowboy Trailer), By Axles (2 Axles and More than 2 Axles), By End-Users (Construction & Infrastructure, Mining, Wind & Energy, Heavy Engineering, Electrical & Off Shore, Others) and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 - 2032

Industry: Automotive & TransportationGlobal Modular Trailer Market Insights Forecasts to 2032

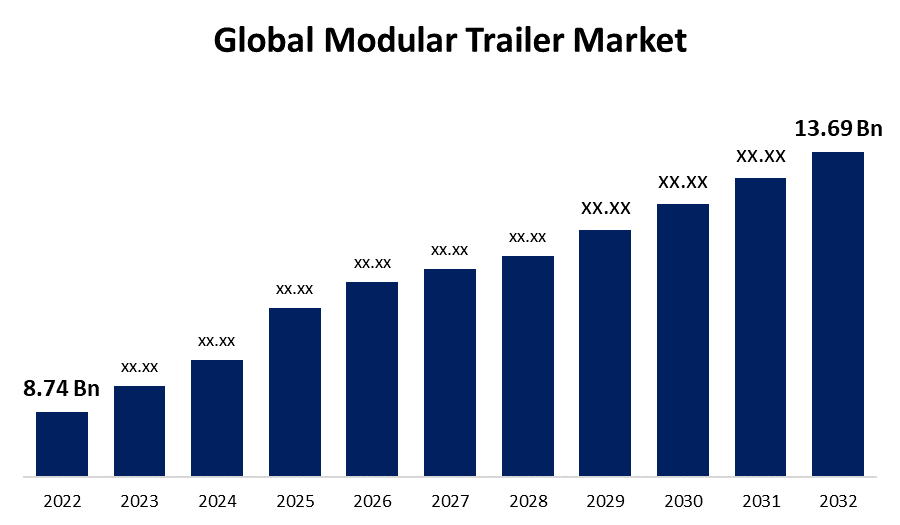

- The Global Modular Trailer Market Size was valued at USD 8.74 Billion in 2022.

- The Market is Growing at a CAGR of 4.59% from 2022 to 2032

- The Worldwide Modular Trailer Market Size is expected to reach USD 13.69 Billion by 2032

- North America is expected To Growth the fastest during the forecast period

Get more details on this report -

The Global Modular Trailer Market Size is expected to reach USD 13.69 Billion by 2032, at a CAGR of 4.59% during the forecast period 2022 to 2032.

A modular trailer, also known as a multi-axle trailer or a hydraulic platform trailer, is a vehicle for long-distance vehicle transportation of enormous or unusual freight. The trailer is a collection of unique vehicles that are employed in a variety of sectors to transport heavy and huge cargo. Trailers are utilized in mining because of their lateral stability. The modular trailers are controlled by computer software to form an axel line. According to industry standards, the trailer is available in two, three, four, five, and above axle configurations.

The manufacturers rely on their equipment to produce high-quality goods. This technology is currently shaping how the manufacturing industry operates. Furthermore, transporting 5,000-ton equipment from one location to another is a significant challenge. It is impossible to transport it using standard trucks and semi-trailers. As a result, the transportation of such huge goods necessitates the employment of a heavy transport modular trailer. Trailers are utilized in industries such as power plants, iron and steel, chemical, mining, and construction in general.

The major key players in the global modular trailer market include Demarko Trailers, Tratec Engineers, TII Group, Nooteboom Trailers, Goldhofer, Shandong Titan Vehicle, Pacton Trailers B.V., and Talbert Manufacturing. To increase their market penetration, these major companies have used techniques such as product portfolio growth, mergers and acquisitions, partnerships, regional expansion, and collaborations.

Global Modular Trailer Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022 : | USD 8.74 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 4.59% |

| 2032 Value Projection: | USD 13.69 Billion |

| Historical Data for: | 2028-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 125 |

| Segments covered: | By Trailer Type, By Axles, By End-Users, By Region |

| Companies covered:: | Demarko Trailers, Tratec Engineers, TII Group, Nooteboom Trailer, Goldhofer, Shandong Titan Vehicle, Pacton Trailers B.V., VMT Industries, Doll Fahrzeugbau AG, Faymonville Group, K-Line Trailers, Anster, Talbert Manufacturing |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges |

Get more details on this report -

Driving Factors

Expanding end-user sectors such as building and infrastructure, mining, wind and energy, and heavy engineering are driving the modular trailer market expansion. In addition, the growing number of infrastructure projects in emerging countries is an important contributor to the demand for modular trailers. Additionally, the increase in mining-related businesses, the shifting adoption of wind energy, and the need to install more power generating equipment are expected to boost the market growth.

Furthermore, heavy engineering is expected to be a rapidly expanding section of the modular trailer market. Modular trailers convey a large amount of heavy engineering equipment which includes steam turbines, heating systems, and other items. A trailer can also transfer already built portions to locations where they will be placed and shift equipment. Moreover, the transporting of big chemical tanks is another application for modular trailers. When loaded with chemicals, these tanks are often large and heavy. It is nearly difficult and dangerous to handle them with semi-trailers. As a result, modular trailers are largely employed in the chemical sector for stability and the heavy nature of the cargo in transportation. The type of modular trailer utilized is determined by the size of the tank to be transported.

Restraining Factors

However, modular trailers are quite expensive, and because multiple trailer assemblies are required for different purposes, the investment cost is rather significant. Furthermore, the trailers' maintenance costs are extremely high. A new trailer has an average working lifespan of roughly 15 years if properly maintained. Also, the air ride suspension employed in modular trailers is more expensive than in traditional trailers. As a result, the high costs function as an obstacle to the modular trailer market growth.

Market Segmentation

By Trailer Type Insights

The multi-axle segment is dominating the market with the largest revenue share over the forecast period.

On the basis of trailer type, the global modular trailer market is segmented into the multi-axle, telescopic/extendable, and lowboy trailers. Among these, the multi-axle segment is dominating the market with the largest revenue share of 38.6% over the forecast period. Demand for reliability from end-user industries is the primary driving driver for multi-axle trailers. It may load over dimension cargo (ODC) by adding axle lines as required. A multi-axle trailer can be utilized for a variety of applications because each of the axle lines is able to be attached and detached. The payload capability of each axle line begins at 15 tons. It also provides optimal agility, durability, and flexibility, as well as safety.

By Axles Insights

The 2 axles segment is witnessing significant CAGR growth over the forecast period.

On the basis of axles, the global modular trailer market is segmented into 2 axles and more than 2 axles. Among these, the 2 axles segment is witnessing significant CAGR growth over the forecast period. The 2-axle line trailers come in a variety of sizes and payload carrying limits. The load capacity for carrying per axle line ranges from 10 to 1000 tons. 2-axle line trailers are widely used for transporting heavy equipment. The Asia-Pacific region and North America account for the largest percentage of the 2-axle line modular trailer market.

By End-Users Insights

The construction & infrastructure segment accounted for the largest revenue share of more than 34.2% over the forecast period.

On the basis of end-users, the global modular trailer market is segmented into construction & infrastructure, mining, wind & energy, heavy engineering, electrical & offshore, and others. Among these, the construction & infrastructure segment is dominating the market with the largest revenue share of 34.2% over the forecast period. Modular trailers serve their purpose to create bridges, big structures, and roadways. Huge bridge segments, massive girders, and concrete beans are carried to building sites on modular trailers. The building firms frequently have projects spread across several locations. Modular trailers aid in the transportation of prefabricated pieces to locations where they will be placed, as well as the movement of products and machinery from one construction site to another. Furthermore, investment in large-scale renovations and infrastructure is predicted to increase dramatically over the forecast period, increasing the demand for construction equipment and materials transportation.

Regional Insights

Asia Pacific dominates the market with the largest market share over the forecast period.

Get more details on this report -

Asia Pacific is dominating the market with more than 38.7% market share over the forecast period. The modular trailer market in the Asia Pacific is being fueled by an increased prognosis for building, mining, wind, and energy. The economic expansion of countries such as India and China has raised the market for the logistics of freight shipping among these nations. Asia Pacific has also seen an increase in development and infrastructure projects. China is predicted to be the world's largest wind power market. During the projection period, all of these variables would contribute to a rise in demand for modular trailers in the region.

North America, on the contrary, is expected to grow the fastest during the forecast period. The North American Free Commerce Agreement (NAFTA), which allows open trade between the United States, Canada, and Mexico, has resulted in higher fleet operations. Freight transportation is predicted to grow as a result of increasing the company's operations and consumer spending. Furthermore, the North American modular trailer market is currently going through an interim cycle due to the need to replace older trailers with more contemporary ones. As a result, the North American modular trailer market is likely to dominate the market with regard to overall value throughout the period of forecasting.

List of Key Market Players

- Demarko Trailers

- Tratec Engineers

- TII Group

- Nooteboom Trailers

- Goldhofer

- Shandong Titan Vehicle

- Pacton Trailers B.V.

- VMT Industries

- Doll Fahrzeugbau AG

- Faymonville Group

- K-Line Trailers

- Anster

- Talbert Manufacturing

Key Market Developments

- On April 2023, Faymonville has delivered two low-loader trailers to ZTZ Logistics in the Netherlands. The order included a VarioMAX 3+5 trailer with an extensible excavator deck. ZTZ Logistics recently utilized it to haul a 77-tonne Fundex F3500 foundation rig. A 1+3 GigaMAX lowbed trailer was also added by the company. The front bogie is combined with the gooseneck, lowering the total length of the convoy while improving payload capacity.

- On May 2022, VESTA Modular, a Kinderhook Industries portfolio company, has announced the acquisition of modular construction assets from Hilltop Trailer Sales in Minnesota. This acquisition demonstrates the company's dedication to providing a Nationwide offering to its clients. These assets add to the company's ever-expanding collection of modular buildings available for purchase or lease.

- On October 2021, Spireon, the Vehicle Intelligence Company, announced the newest version of the FL Flex suite of products, as well as the IntelliScan cargo sensor, as part of its FleetLocate® product line. The new Flex device series offers maximum versatility with alternatives that are faster to install, have additional power options, are wireless sensor-capable, and include an integrated cargo sensor. The improved IntelliScan cargo sensor of the next version provides volumetric capabilities to deliver relevant information on available trailer floor space.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2032. Spherical Insights has segmented the Global Modular Trailer Market based on the below-mentioned segments:

Modular Trailer Market, Trailer Type Analysis

- Multi-Axle

- Telescopic/Extendable

- Lowboy Trailer

Modular Trailer Market, Axles Analysis

- 2 Axles

- More than 2 Axles

Modular Trailer Market, End-Users Analysis

- Construction & Infrastructure

- Mining

- Wind & Energy

- Heavy Engineering

- Electrical & Off Shore

- Others

Modular Trailer Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?