Global Mobile Card Reader Market Size, Share, and COVID-19 Impact Analysis, By Solution (Hardware and Software), By Deployment (On-premise and Cloud), By Technology (Chip & pin, Magnetic stripe, and Near Field Communication), By Application (Entertainment, Retail, Healthcare, Hospitality, Restaurants, Warehouse, and Others), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 – 2032

Industry: Electronics, ICT & MediaGlobal Mobile Card Reader Market Insights Forecasts to 2032

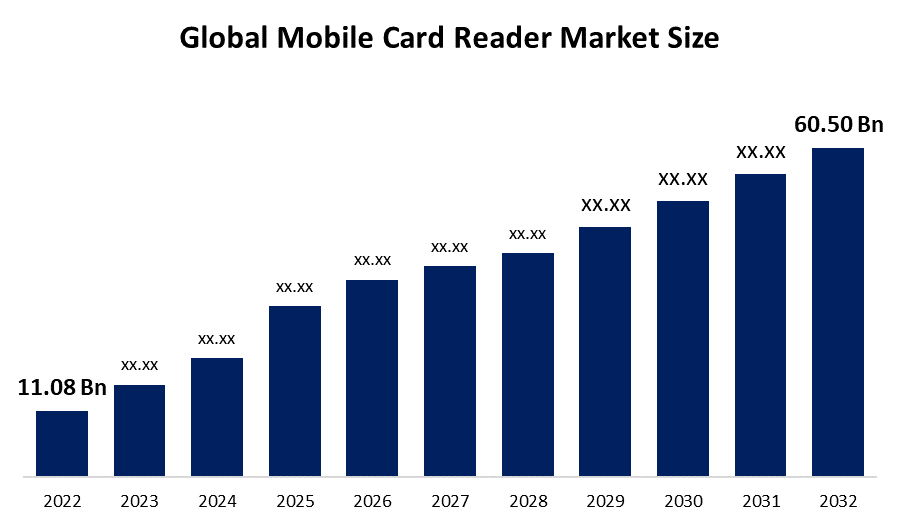

- The Global Mobile Card Reader Market Size was valued at USD 11.08 billion in 2022.

- The market is growing at a CAGR of 18.5% from 2022 to 2032

- The global mobile card reader market is expected to reach USD 60.50 billion by 2032

- Europe is expected to grow the fastest during the forecast period

Get more details on this report -

The Global Mobile Card Reader Market Size is expected to reach USD 60.50 billion by 2032, at a CAGR of 18.5% during the forecast period 2023 to 2032.

Market Overview

A mobile card reader is a compact and portable device that revolutionizes the way businesses accept payments. Designed to work seamlessly with smartphones or tablets, this technology enables merchants to process credit or debit card transactions on the go. With a simple and secure connection, typically through a wired or wireless interface, the mobile card reader empowers businesses of all sizes to expand their payment options beyond cash or checks. Equipped with a card slot or NFC (Near Field Communication) reader, it can securely capture card information, ensuring the privacy and safety of customers' financial data. Mobile card readers offer convenience, flexibility, and mobility, allowing businesses to accept payments anywhere, anytime. They have become essential tools for small businesses, entrepreneurs, and individuals who require the ability to accept card payments in diverse settings, enhancing customer experience and streamlining transaction processes.

Report Coverage

This research report categorizes the market for mobile card reader market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the mobile card reader market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the mobile card reader market.

Global Mobile Card Reader Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 11.08 Billion |

| Forecast Period: | 2022 - 2032 |

| Forecast Period CAGR 2022 - 2032 : | 18.5% |

| 2032 Value Projection: | USD 60.50 Billion |

| Historical Data for: | 2018 - 2021 |

| No. of Pages: | 215 |

| Tables, Charts & Figures: | 125 |

| Segments covered: | By Solution, By Deployment, By Technology, By Application, By Region |

| Companies covered:: | Electronic Merchant Systems Inc., Ezetap Mobile Solutions Private Limited, Ingenico Group, LifePay ZAO, Mswipe Technologies Pvt. Ltd., Miura Systems Limited, PayAnywhere LLC, Payleven Holding GmbH, PayPal Holdings Inc., Square, SumUp, Verifone Inc., eWAY, Stripe Inc., Advanced Card Systems Ltd., Revolut |

Get more details on this report -

Driving Factors

The mobile card reader market has seen significant growth in recent years, driven by several factors. One of the primary drivers is the increasing adoption of mobile payments globally, as more consumers are relying on smartphones and mobile devices for payment transactions. Another driver is the rise of small businesses and entrepreneurship, with mobile card readers providing a convenient and cost-effective way for these entities to accept payments. Additionally, advancements in mobile technology have made it easier to integrate mobile card readers into existing payment systems, further fueling market growth. The increasing popularity of contactless payment methods and the need for businesses to offer a range of payment options has also contributed to the expansion of the mobile card reader market. Furthermore, regulatory initiatives aimed at reducing the use of cash in various regions have led to a surge in demand for mobile card readers, driving the market's growth.

Restraining Factors

The mobile card reader market also faces certain restraints that can hinder its growth. One significant restraint is the security concerns associated with mobile payments, as the potential for data breaches and fraud remains a prominent issue. Trust and confidence in the security of mobile transactions need to be established to overcome this challenge. Another restraint is the compatibility and interoperability issues between different mobile devices and operating systems, which can limit the adoption of mobile card readers. Additionally, the presence of alternative payment methods such as digital wallets and online payment platforms poses competition to mobile card readers. Lastly, the cost of mobile card reader hardware, transaction fees, and the need for stable internet connectivity may act as barriers for some businesses, especially smaller ones, to adopt mobile card reader solutions.

Market Segmentation

- In 2022, the on-premise segment accounted for around 62.3% market share

On the basis of the deployment type, the global mobile card reader market is segmented into on-premise and cloud. The on-premise segment is dominating with the largest market share in 2022, this can be attributed to several factors. Many businesses, especially in sectors like retail, restaurants, and hospitality, prefer on-premise solutions due to their control over the payment process and data security. On-premise mobile card readers offer businesses the ability to directly manage and oversee their payment operations, reducing reliance on third-party services. Additionally, on-premise solutions are often perceived as more secure, as they allow businesses to have physical control over payment devices and data storage. Furthermore, the on-premise segment is favored by enterprises that have specific integration requirements or customized payment workflows. However, as cloud-based solutions and software-as-a-service models continue to advance, the on-premise segment may face competition from off-premise solutions in the future.

- The warehouse segment is expected to grow at a CAGR of around 19.2% during the forecast period

Based on the type of application, the global mobile card reader market is segmented into entertainment, retail, healthcare, hospitality, restaurants, warehouse, and others. the warehouse segment is anticipated to witness substantial growth in the mobile card reader market. This growth can be attributed to the increasing adoption of mobile card readers in warehouse operations to streamline payment processes and enhance efficiency. Mobile card readers enable warehouse personnel to accept payments directly on-site, eliminating the need for traditional stationary payment terminals. By integrating mobile card readers into warehouse management systems, businesses can improve inventory management, track transactions in real time, and simplify payment reconciliation. Moreover, the use of mobile card readers in warehouses offers flexibility and mobility, allowing transactions to take place anywhere within the facility. This is particularly beneficial for businesses involved in wholesale distribution, e-commerce, or fulfillment centers. The growing e-commerce industry, coupled with the need for contactless payments and efficient transaction processing, further drives the adoption of mobile card readers in the warehouse segment.

Regional Segment Analysis of the Mobile Card Reader Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America dominated the market with more than 32.8% revenue share in 2022.

Get more details on this report -

Based on region, North America dominates the mobile card reader market and holds the largest market share due to various factors. The region is home to some of the world's leading mobile payment providers, which has boosted the adoption of mobile card readers. The rise of small businesses and the growing preference for cashless transactions have also contributed to the market's growth in North America. Additionally, the region has advanced infrastructure and widespread internet connectivity, which has facilitated the adoption of mobile card readers. The presence of major market players and the region's large consumer base with high disposable incomes further drive the demand for mobile card readers. Furthermore, the regulatory environment in North America supports the adoption of mobile payment solutions, offering favorable conditions for market growth.

Recent Development

In July 2022, Revolut introduced the Revolut Reader, a compact card reader specifically created to facilitate in-person payment acceptance for merchants. The Revolut Reader ensures swift and secure transactions for credit and debit cards, as well as contactless payment options. Engineered to handle continuous transactions throughout the day, this card reader incorporates intelligent functionalities and expedited payment processing capabilities.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global mobile card reader market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Companies:

- Electronic Merchant Systems Inc.

- Ezetap Mobile Solutions Private Limited

- Ingenico Group

- LifePay ZAO

- Mswipe Technologies Pvt. Ltd.

- Miura Systems Limited

- PayAnywhere LLC

- Payleven Holding GmbH

- PayPal Holdings Inc.

- Square

- SumUp

- Verifone Inc.

- eWAY

- Stripe Inc.

- Advanced Card Systems Ltd.

- Revolut

Key Target Audience

- Market Players

- Investors

- End-Users

- Government Authorities

- Consulting and Research Firm

- Venture Capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2022 to 2032. Spherical Insights has segmented the global mobile card reader market based on the below-mentioned segments:

Mobile Card Reader Market, By Solution

- Hardware

- Software

Mobile Card Reader Market, By Deployment

- On-premise

- Cloud

Mobile Card Reader Market, By Technology

- Chip and pin

- Magnetic stripe

- Near Field Communication

Mobile Card Reader Market, By Application

- Entertainment

- Retail

- Healthcare

- Hospitality

- Restaurants

- Warehouse

- Others

Mobile Card Reader Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?