Global Mine Closure And Restoration Market Size, Share, and COVID-19 Impact Analysis, By Mine Type (Coal Mines, Metal Mines, Others), By Service (Land Reclamation, Tailings Management, Water Treatment, Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Energy & PowerMine Closure And Restoration Market Summary

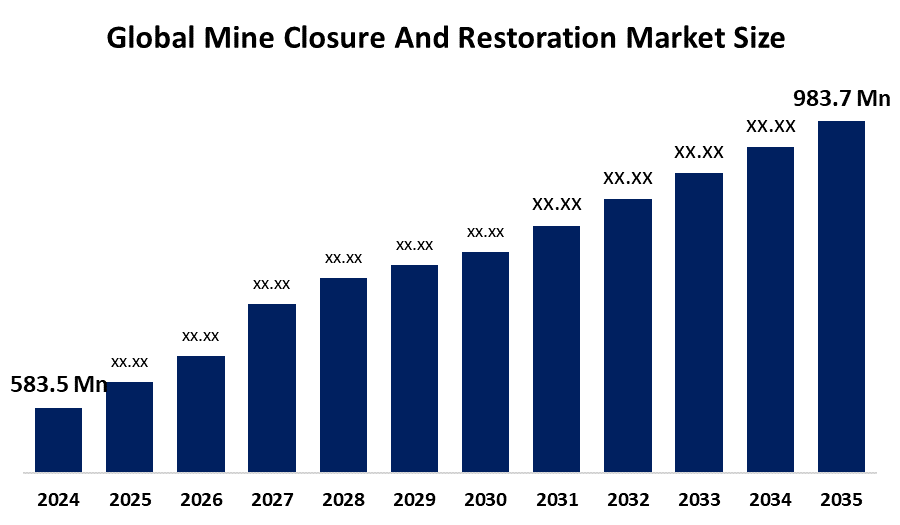

The Global Mine Closure And Restoration Market Size Was Estimated at USD 583.5 Million in 2024 and is Projected to Reach USD 983.7 Million by 2035, at a CAGR of 4.86% from 2025 to 2035. Government requirements for land reclamation, increased environmental legislation, growing awareness of sustainable mining operations, and the desire to reduce environmental impacts and guarantee safe, environmentally friendly mining site rehabilitation are all driving growth in the mine closure and restoration market.

Get more details on this report -

Key Regional and Segment-Wise Insights

- In 2024, the Asia Pacific mine closure and restoration market held the largest revenue share of 59.4% and dominated the global market.

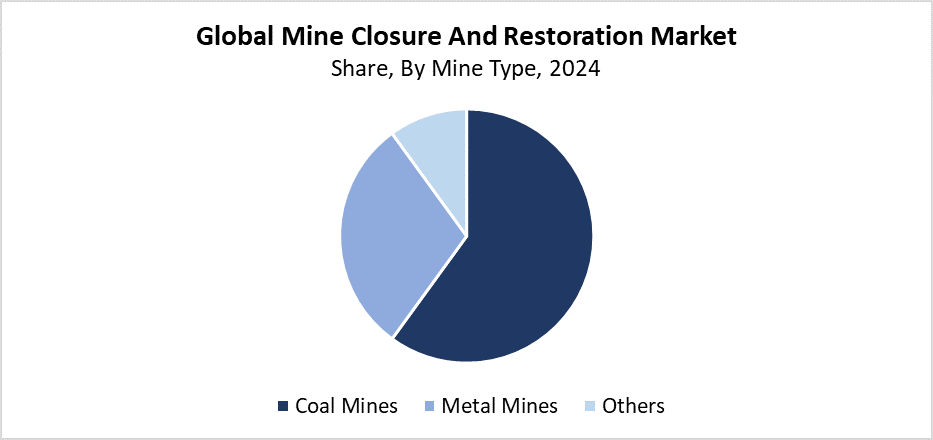

- In 2024, the coal mines segment held the highest revenue share and dominated the global market by mine type.

- With the biggest revenue share of 31.4% in 2024, the land reclamation segment led the worldwide mine closure and restoration market by service.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 583.5 Million

- 2035 Projected Market Size: USD 983.7 Million

- CAGR (2025-2035): 4.86%

- Asia Pacific: Largest market in 2024

The Mine Closure and Restoration Market Size provides services and activities which enable the safe shutdown of mining operations while restoring the environment to reduce damage and restore natural balance. The project includes four main components, which consist of reforestation, water treatment, soil remediation, and infrastructure demolition. The mining industry moves toward sustainable practices because of environmental rules and public understanding about mining's ecological effects. Organisations maintain closure and restoration as their top priority to fulfil regulatory requirements and achieve corporate social responsibility goals because numerous mines worldwide approach their final years of operation. The market experiences growth because companies focus on preventing long-term environmental damage and maintaining land accessibility after mining operations cease.

The development of mine closure and restoration operations depends primarily on advancements in technology. The combination of drone surveillance with GIS and remote sensing technology enables precise environmental assessments, which support efficient site management. Water and soil treatment systems have evolved through technology to speed up natural environmental recovery processes. The world supports closure and rehabilitation best practices through government programs, which establish tough regulations. They allocate money for restoration initiatives. The worldwide market for mine closure and restoration services shows sustainable growth because of these coordinated efforts.

Mine Type Insights

Get more details on this report -

The coal mines segment held the largest revenue share and led the mine closure and restoration market during 2024. The worldwide spread of coal mining operations, along with increasing environmental restoration efforts after coal mine shutdowns, has established this dominant position. Coal mining operations create various major environmental problems, which include habitat destruction, water pollution, and land deterioration that require extensive closure and restoration actions. Regulatory bodies maintain strict standards which coal mine operators must follow to achieve proper rehabilitation of mining sites. The global shift toward clean energy has created a rising demand for closure and restoration services because coal mines shut down at an increasing rate. The segment leads the market because coal mine reclamation projects need complex and extensive work. Businesses fund to meet environmental standards and achieve sustainable land restoration.

The metal mines segment of the mine closure and restoration market is expected to grow at the fastest CAGR during the forecast period. The expansion results mainly from the increasing mining activities of gold, copper, and iron ore extraction. The operations create major environmental problems, which require thorough closure and restoration procedures. Metal mining operations generate complicated contamination issues through acid mine drainage and heavy metal pollution. These need high-tech solutions for proper site rehabilitation. Metal mining companies now face requirements to perform sustainable closures because of stricter environmental rules and rising public opposition. The metal mines industry will experience strong growth during the forecast period because environmental liability management and rising metal demand from various industries drive investments into efficient mine restoration solutions.

Service Insights

The land reclamation segment held the largest revenue share of 31.4% in 2024 and led the mine closure and restoration market. The essential requirement to restore mined land to its natural state or commercial use after mining operations stop drives this leadership approach. The protection of the environment, together with the restoration of ecosystems, requires land reclamation work through contouring and soil stability, re-vegetation, and erosion control measures. The need for reclamation services has grown because of environmental rules. These require proper land rehabilitation. The need for land reclamation funding continues to grow because people recognise that mining areas require restoration to protect biodiversity and support sustainable environmental practices. The segment maintains its leadership position because it plays a vital role in ensuring worldwide mine closures happen safely and lawfully while protecting the environment.

The tailings management segment of the mine closure and restoration market is expected to grow at the fastest CAGR during the forecast period. The mining sector requires proper tailings disposal systems to prevent environmental problems, which include soil erosion and water contamination that result from waste materials left after mineral extraction. The industry has increased its focus on secure and sustainable tailings management systems and regulatory monitoring because of the recent major tailings dam disasters. The implementation of real-time monitoring systems and improved dam construction and dry stacking methods serves to enhance both operational safety and environmental compliance. The tailings management sector experiences rapid growth because environmental regulations have become more stringent, and public understanding about tailings disposal risks has expanded.

Global Mine Closure And Restoration Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 583.5 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 4.9% |

| 2035 Value Projection: | USD 983.7 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Mine Type, By Service |

| Companies covered:: | AECOM, Veolia, Sovereign Consulting, Tetra Tech, Stantec, RESPEC, Geosyntec Consultants, Forgen, WSP, and Other Key Companies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Regional Insights

The Asia Pacific region leads the global mine closure and restoration market with the largest revenue share of 59.4% in 2024. The mining operations in China, Australia, India, and Indonesia, which include numerous mines approaching their end of life, create this dominance in the region. The demand for full closure and restoration services has increased because of both strict environmental regulations and growing mining sustainability awareness. The region supports market growth because it works to protect biodiversity while safeguarding water quality and preserving land resources. Technology advancements and government programs that support ecological restoration allow the Asia Pacific to maintain its position as the leading global market for mine closure and restoration.

North America Mine Closure And Restoration Market Trends

The North American market for mine closure and restoration is experiencing significant growth because environmental laws have become stricter, and mining companies now focus on sustainable mining practices. The area faces rising demands to handle mine closures properly because it contains multiple large-scale mining operations, which cause environmental damage through habitat destruction, water pollution, and soil contamination. Mining corporations need to invest heavily in land rehabilitation and restoration projects because government agencies maintain strict reclamation standards. Remote sensing technology and advanced remediation systems help increase both the operational efficiency and effectiveness of closure procedures. The industry continues to advance because stakeholders require environmental protection. Society needs to be informed about it.

Get more details on this report -

Europe Mine Closure And Restoration Market Trends

The European market for mine closure and restoration continues to expand because environmental regulations have become more stringent, and mining operations must follow sustainable practices throughout the entire continent. European countries actively combat mining operations' environmental destruction through their work on land restoration projects, water purification efforts, and ecosystem rebuilding programs. The requirement for closure and restoration services has grown because mining operations are reaching the end of their operational lifespan. The European market growth receives support from government programs and financial initiatives, which promote environmental sustainability. EU regulatory compliance. The restoration process achieves better results through technological advancements, which include waste management systems, soil treatment methods, and remote sensing technology. The European market growth receives backing from increasing public awareness and stakeholder demands for secure and environmentally friendly mine closure procedures.

Key Mine Closure And Restoration Companies:

The following are the leading companies in the mine closure and restoration market. These companies collectively hold the largest market share and dictate industry trends.

- AECOM

- Veolia

- Sovereign Consulting

- Tetra Tech

- Stantec

- RESPEC

- Geosyntec Consultants

- Forgen

- WSP

- Others

Recent Development

- In July 2025, with ten sites closed under revised frameworks and 147 more scheduled for closure utilising cutting-edge restoration procedures, India's mining industry achieved a major milestone by starting the scientific closure of mines. The industry adopted the new "Reclaim Framework" to guarantee community involvement and the transparent, sustainable recovery of mining areas, while these closures embraced the "6Rs" approach, which focuses on reclamation, rehabilitation, reuse, and restoration.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the mine closure and restoration market based on the below-mentioned segments:

Global Mine Closure And Restoration Market, By Mine Type

- Coal Mines

- Metal Mines

- Others

Global Mine Closure And Restoration Market, By Service

- Land Reclamation

- Tailings Management

- Water Treatment

- Others

Global Mine Closure And Restoration Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?