Global Military Working Dog (MWD) Market Size, Share, and COVID-19 Impact Analysis, By Breed (German Shepherd, Belgian Malinois, Dutch Shepherd, Labrador Retriever and Others), By Training Type (Patrol & Detection, Search & Rescue, Combat & Tactical Operations and Specialized Training), By Application (Armed Forces, Homeland Security and Special Operations Units), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Aerospace & DefenseGlobal Military Working Dog (MWD) Market Insights Forecasts to 2033

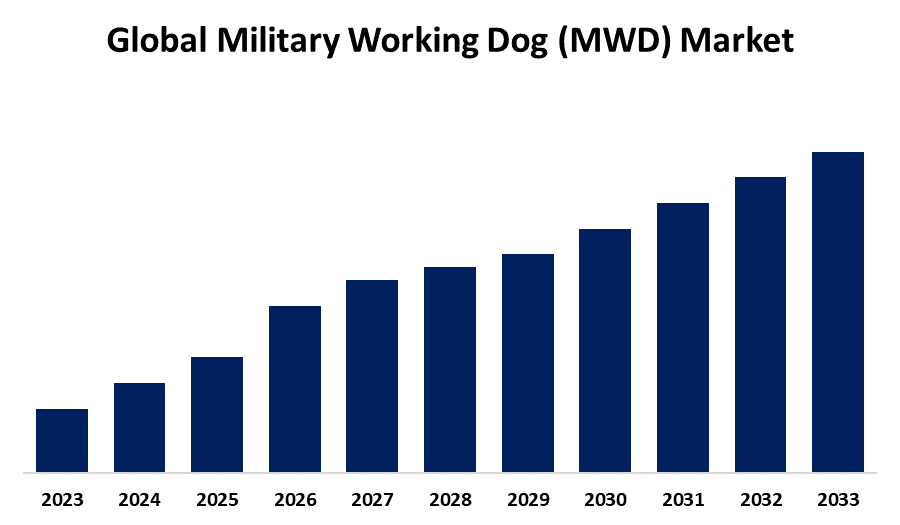

- The Market Size is Expected to Grow at a CAGR of around 5.68% from 2023 to 2033

- The Global Military Working Dog (MWD) Market Size is expected to hold a significant share by 2033

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

The Global Military Working Gog (MWD) market is Anticipated to hold a significant share by 2033, with a compound annual growth rate (CAGR) of 5.68% between 2023 and 2033. The military working dog (MWD) market is propelled by growing defense spending around the globe, escalating security risks, upgraded training initiatives, developments in health care for canine companions, and expanded demand for explosive detection, search and rescue missions, and border security enforcement globally.

Market Overview

The military working dog (MWD) market is the world industry engaged in breeding, training, deploying, and sustaining specially trained canines utilized by defense, military, and law enforcement organizations for tactical, detection, and security missions. Such a market encompasses various services and goods like the acquisition of dogs, advanced training programs, veterinary services, handler training, and equipment utilized to facilitate canine operations in capabilities like explosives detection, search and rescue, patrol and combat operations, and counterterrorism. In addition, MWDs are preferred because they are cost-effective and extremely versatile relative to robotic counterparts in most real-time field operations. Moreover, technologies in the industry involve wearable sensors, GPS location tracking, and real-time communication devices being integrated into the dogs, making them more operationally efficient and coordinating with handlers. Veterinary technology, including supplements and preventive treatment, is also enhancing MWD health and service life. Combined, these elements are driving the continuous expansion of the MWD market as security needs change across the world.

Report Coverage

This research report categorizes the military working dog (MWD) market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the military working dog (MWD) market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the military working dog (MWD) market.

Military Working Dog (MWD) Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 5.68% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 187 |

| Tables, Charts & Figures: | 97 |

| Segments covered: | By Breed, By Training Type, By Application, By Region and COVID-19 Impact Analysis |

| Companies covered:: | Worldwide Canine, K9 Global Training Academy (K9GTA), K2 Solutions, Inc, K9 Storm Inc., Command K9 LLC, Cerberus K9 Solutions, Big Sky K9, Canine Tactical Operations and Consulting (CTOC), and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Global conflicts, terrorism, and insurgencies have increased the demand for greater security in several areas. The military faces ongoing threats like IEDs, border security risks, and counterterrorism missions, hence the need for MWDs as a valuable tool for explosive detection, patrolling sensitive zones and delivering quick security solutions. Moreover, MWDs are employed for patrolling military bases, securing sensitive sites, and supporting counterterrorism missions. Their capacity to operate in both urban and rural settings, across varied landscapes, has led to the increasing need for their services in military campaigns around the world.

Restraining Factors

Training military working dogs is a long and expensive process. Dogs need to be trained in specialized procedures to deal with different tasks like explosives detection, search and rescue, patrolling, and tactical operations. Training, feeding, medical care, and maintenance can be costly, and hence it becomes a burden for defense forces, especially in developing nations. The significant initial investment in the acquisition, training, and upkeep of MWDs may discourage certain military organizations from fully implementing or increasing their MWD programs.

Market Segmentation

The military working dog (MWD) market share is classified into breed, training type, and application.

- The german shepherd segment dominated the market in 2023 and is projected to grow at a substantial CAGR during the forecast period.

Based on the breed, the military working dog (MWD) market is divided into a german shepherd, belgian malinois, dutch shepherd, labrador retriever, and others. Among these, the german shepherd segment dominated the market in 2023 and is projected to grow at a substantial CAGR during the forecast period. The growth is driven by german shepherds are versatile and can do a variety of tasks, making them a first choice among many military and police units. They are expertly trained in patrols, detection, search and rescue, and combat.

- The patrol & detection segment accounted for a significant share in 2023 and is anticipated to grow at a remarkable CAGR during the forecast period.

Based on the training type, the military working dog (MWD) market is divided into patrol & detection, search & rescue, combat & tactical operations, and specialized training. Among these, the patrol & detection segment accounted for a significant share in 2023 and is anticipated to grow at a remarkable CAGR during the forecast period. The growth is attributed to MWDs trained for patrol & detection can be utilized in a range of environments, from urban environments to rural landscapes and combat zones, which makes them highly versatile and very valuable to military forces conducting operations in varied geographical and tactical environments.

- The armed forces segment accounted for the biggest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the military working dog (MWD) market is divided into armed forces, homeland security, and special operations units. Among these, the armed forces segment accounted for the biggest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period. The segmental growth is due to the armed forces' need for security at military bases and in combat operations, and that is one key driver of MWD demand. The dogs aid in securing buildings, detect invaders, and assist in reconnaissance and intelligence collection activities in all operating environments.

Regional Segment Analysis of the Military Working Dog (MWD) Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the military working dog (MWD) market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the military working dog (MWD) market over the predicted timeframe. The U.S. military, which is one of the biggest and most sophisticated in the world, widely employs MWDs in a range of missions, including explosives detection, search-and-rescue operations, and supporting law enforcement efforts. North American troops consistently incorporate new technologies into MWD operations and training, enhancing their efficiency in different conditions, from battlefield to airport environments.

Asia Pacific is expected to grow at a rapid CAGR in the military working dog (MWD) market during the forecast period. Asia Pacific nations like China, India, Japan, and South Korea have been investing significantly to modernize their military units. This involves technology upgrades and the incorporation of specialized troops, including Military Working Dogs (MWDs), for diverse operations like the detection of explosives, search and rescue, and surveillance.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the military working dog (MWD) market along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Worldwide Canine

- K9 Global Training Academy (K9GTA)

- K2 Solutions, Inc

- K9 Storm Inc.

- Command K9 LLC

- Cerberus K9 Solutions

- Big Sky K9

- Canine Tactical Operations and Consulting (CTOC)

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In March 2024, BluePearl joined forces with the U.S. Army to initiate the Veterinary Trauma Readiness and Operational Medicine Agility (Vet-TROMA) program, a first-of-its-kind program to advance the skill of military veterinarians in the treatment of combat-injured Military Working Dogs (MWDs).

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the military working dog (MWD) market based on the below-mentioned segments:

Global Military Working Dog (MWD) Market, By Breed

- German Shepherd

- Belgian Malinois

- Dutch Shepherd

- Labrador Retriever

- Others

Global Military Working Dog (MWD) Market, By Training Type

- Patrol & Detection

- Search & Rescue

- Combat & Tactical Operations

- Specialized Training

Global Military Working Dog (MWD) Market, By Application

- Armed Forces

- Homeland Security

- Special Operations Units

Global Military Working Dog (MWD) Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?