Global Military Drone Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Fixed Wing, Hybrid, and Rotary Wing), By Range (Visual Line of Sight (VLOS), Extended Visual Line of Sight (EVLOS), and Beyond Line of Sight (BLOS)), By Technology (Remotely Operated Drones, Semi-Autonomous Drones, and Autonomous Drones), By System (Airframe, Avionics, Propulsion, Payload, Software, and Others), By Application (Intelligence, Surveillance Reconnaissance and Targeting (ISRT), Combat Operations, Battle Damage Management, Logistics & Transportation), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 - 2032.

Industry: Aerospace & DefenseGlobal Military Drone Market Insights Forecasts to 2032.

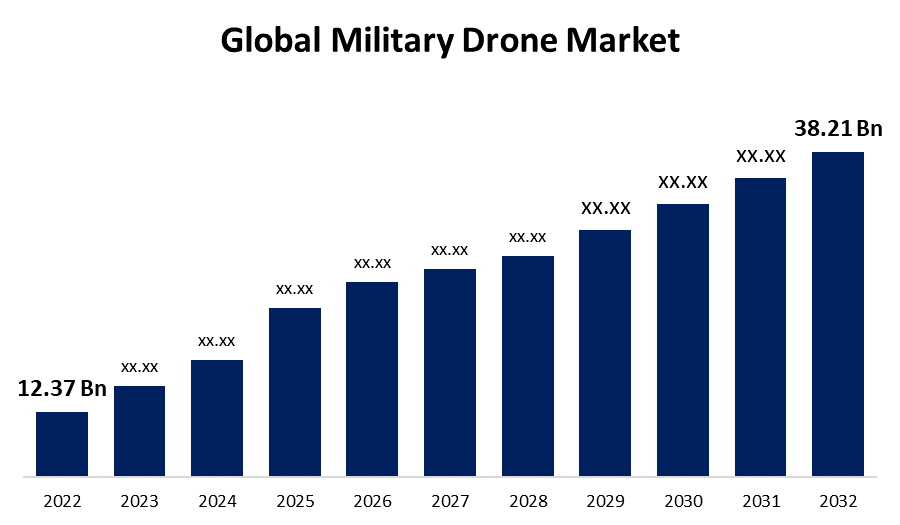

- The Global Military Drone Market Size was valued at USD 12.37 Billion in 2022.

- The Market is Growing at a CAGR of 11.9% from 2022 to 2032.

- The Worldwide Military Drone Market Size is expected to reach USD 38.21 Billion by 2032.

- Asia Pacific is expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Military Drone Market size is anticipated to exceed USD 38.21 Billion by 2032, growing at a CAGR of 11.9% from 2022 to 2032. Drone technology has grown rapidly in recent years as a result of ongoing research and development. Unmanned Aerial Vehicles (UAVs) are increasingly being used in the defense and security industries for a variety of purposes such as surveying, mapping, transportation, combat operations, and tracking, which will drive demand for military UAVs during the forecast period.

Market Overview

Military drones detect vulnerable areas as well as safety and terrorism-related challenges that pose a threat to national security. Military drones are a modern force multiplier that can help security forces find new homeland and defense security challenges. Military drones detect high-risk areas in remote areas, conduct reconnaissance missions, and act as border guards. Military drones provide continuous situational awareness to military commanders, allowing them to take informed decisions quickly and effectively. Drones equipped with sophisticated sensors, cameras, and other technologies can provide a detailed view of the battlefield. Using military drones to conduct operations remotely can help minimize the risk to military personnel. This is especially important in dangerous environments, such as those with high levels of enemy activity or that are exposed to chemical or biological hazards. AI is being used to commercially develop autonomous flight systems for high-altitude military drones. The rise of artificial intelligence and self-driving cars will almost certainly boost the market. This development is projected to drive future growth in the global military unmanned aircraft market. The weapon payload consists of missiles and guided bombs.

Report Coverage

This research report categorizes the market for the global military drone market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the military drone market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the military drone market.

Global Military Drone Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 12.37 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 11.9% |

| 2032 Value Projection: | USD 38.21 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Product Type, By Range, By Technology, By System, By Application, By Region and COVID-19 Impact Analysis. |

| Companies covered:: | General Atomics Aeronautical Systems, Inc., Northrop Grumman Corporation, Teledyne FLIR LLC, Raytheon Technologies Corporation, Elbit Systems Ltd., Israel Aerospace Industries Ltd., AeroVironment, Inc., Lockheed Martin Corporation, Thales Group, Boeing, BAE Systems, Shield AI Inc., SAAB Group, Textron Systems and other key venders. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Growing conflicts between nations over land ownership and control of an area shared by two or more states are projected to drive up product demand. India, Pakistan, Syria, China, Israel, Iran, and others have all had territorial disputes in recent years. These nations have increased their defense expenditures to acquire real-time surveillance drones in order to improve situation awareness and border patrolling. Several countries' defense industries are heavily focused on video investigation and tracking, border patrol, thermographic inspection, infrastructure security, law enforcement and firefighting, and remote surveillance, all of which necessitate technically advanced equipment and tools. As a result, demand for military drones has been rapidly increasing in the market, which could lead to significant market growth throughout the forecast period.

Restraining Factors

Military drones, unlike conventional aircraft, must ensure the overall reliability of the unmanned aerial system, which includes UAVs, ground control stations, and communication equipment. Drones can fly at various altitudes and must be controlled and operated by skilled pilots. There are not many pilots available for high precision operations. Increased drone adoption in military drone verticals contributes to the growing demand for skilled drone pilots. Currently, efforts are being made to improve the autonomy of these systems in order to reduce the number of accidents caused by poor control skills of drone operators.

Market Segmentation

The Global Military Drone Market share is classified into product type, range, and technology.

- The fixed wing segment is expected to hold the largest share of the global military drone market during the forecast period.

The global military drone market is categorized by product type into fixed wing, hybrid, and rotary wing. Among these, the fixed wing segment is expected to hold the largest share of the global military drone market during the forecast period. Fixed-wing drones, like airplanes, use wings to lift themselves off the ground during takeoff. They need engines to provide forward thrust, while wings provide the necessary vertical lift to fly. Fixed-wing UAVs can fly for longer distances than rotary-wing drones. They differ most in terms of payloads, endurance ranges, and uses.

- The extended visual line of sight segment is expected to hold the largest share of the global military drone market during the forecast period.

Based on the range, the global military drone market is divided into visual line of sight (VLOS), extended visual line of sight (EVLOS), and beyond line of sight (BLOS). Among these, the extended visual line of sight segment is expected to hold the largest share of the global military drone market during the forecast period. The rapid growth can be attributed to the widespread use of EVLOS UAVs in long-range missions for data collection, battle management, and electronic warfare.

- The remotely operated drones segment is expected to hold the largest share of the global military drone market during the forecast period.

Based on the technology, the global military drone market is divided into remotely operated drones, semi-autonomous drones, and autonomous drones. Among these, the remotely operated drones segment is expected to hold the largest share of the global military drone market during the forecast period. These unmanned aerial vehicles are typically used for monitoring, reconnaissance, and strike missions, and their flight and payload are controlled by a human operator. Many contracted Unmanned Aircraft Vehicles are flying remotely around the world due to strict government demands for long-range autonomous flight. This kind of technology has been used on unmanned aerial vehicles (UAVs) in Command and Control (C&C), telemetry systems, and radio transmissions.

Regional Segment Analysis of the Global Military Drone Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America holds the largest share of the global military drone market in 2022.

Get more details on this report -

North America holds the largest share of the global military drone market in 2022. Several factors are driving the growth, including increased demand for sophisticated ISR capabilities, increased investments in military modernization programs, and increased deployment of drones for homeland security and law enforcement applications. Drone technology advancements resulted in significant developments within the United States military, and higher expenditures by key regional players boosted market growth. The United States is a major exporter of unmanned aerial vehicles, which is projected to fuel regional growth. Lockheed Martin Corporation and General Atomic Aeronautics have previously received contracts from NATO and major defense partners such as India for military HALE and MALE drones.

Asia Pacific is expected to grow at the fastest pace in the global military drone market during the forecast period. The increase in military spending by countries to improve their defense capabilities can be attributed to market growth in this region. Political tensions in Asia Pacific countries have resulted in the deployment of drones to protect their borders. This is one of the most important factors driving the market's expansion in this region. China is developing novel technologies to produce low-cost drones.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global military drone market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- General Atomics Aeronautical Systems, Inc.

- Northrop Grumman Corporation

- Teledyne FLIR LLC

- Raytheon Technologies Corporation

- Elbit Systems Ltd.

- Israel Aerospace Industries Ltd.

- AeroVironment, Inc.

- Lockheed Martin Corporation

- Thales Group

- Boeing

- BAE Systems

- Shield AI Inc.

- SAAB Group

- Textron Systems

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In February 2023, The Indian Army announced that it is looking for 850 nano drones for special military operations, including surveillance and counter-terrorism operations.

- In February 2023, The United States Air Force has completed the development of face recognition technology for unmanned aerial vehicles (UAVs). Autonomous drones could identify the target and kill it on their own. Furthermore, special operations forces will use the drones to gather intelligence and mission information.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2032. Spherical Insights has segmented the Global Military Drone Market based on the below-mentioned segments:

Global Military Drone Market, By Product Type

- Fixed Wing

- Hybrid

- Rotary Wing

Global Military Drone Market, By Range

- Visual Line of Sight (VLOS)

- Extended Visual Line of Sight (EVLOS)

- Beyond Line of Sight (BLOS)

Global Military Drone Market, By Technology

- Remotely Operated Drones

- Semi-Autonomous Drones

- Autonomous Drones

Global Military Drone Market, By System

- Airframe

- Avionics

- Propulsion

- Payload

- Software

- Others

Global Military Drone Market, By Application

- Intelligence, Surveillance Reconnaissance and Targeting (ISRT)

- Combat Operations

- Battle Damage Management

- Logistics & Transportation

Global Military Drone Market, By Region

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?