Middle East Unmanned Aerial Vehicle Market Size, Share, and COVID-19 Impact Analysis, By Type (Fixed wing (MALE, HALE, TUAV), VTOL), By Range (Visual Range of Sight (VLOS), Beyond Visual Line of Sight (BVLOS)), By Applications (Construction and Mining, Inspection and Monitoring, Delivery, Law Enforcement), By Region (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East), and Middle East Unmanned Aerial Vehicle Market Insights Forecast to 2033

Industry: Aerospace & DefenseMiddle East Unmanned Aerial Vehicle Market Insights Forecasts to 2033

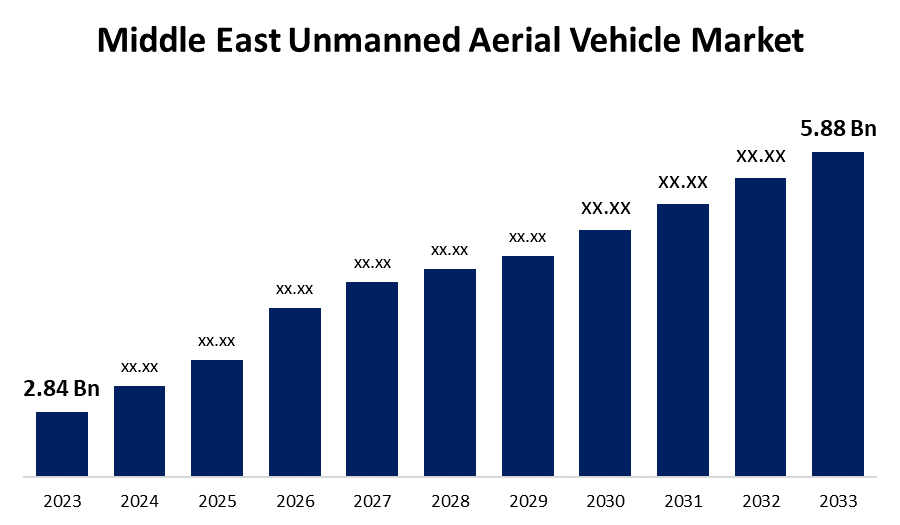

- The Middle East Unmanned Aerial Vehicle Market Size was valued at USD 2.84 Billion in 2023

- The Market Size is Growing at a CAGR of 7.55% from 2023 to 2033.

- The Middle East Unmanned Aerial Vehicle Market Size is Expected to Reach 5.88 Billion by 2033.

Get more details on this report -

The Middle East Unmanned Aerial Vehicle Market size is expected to reach USD 5.88 Billion by 2033, at a CAGR of 7.55% during the forecast period 2023 to 2033.

Market Overview

An unmanned aerial vehicle (UAV), also known as a drone, is an aircraft that operates without a human pilot on board. Unlike traditional manned aircraft, UAVs can be remotely controlled by a human operator or flown autonomously along pre-programmed flight paths in response to various inputs from onboard sensors and computer systems. UAVs come in a variety of sizes and configurations, including small handheld quadcopters and larger fixed-wing aircraft. Depending on their intended purpose, they are typically equipped with a variety of sensors, cameras, and, on occasion, specialized payloads. Technological advancements, regulatory changes, and increased awareness of their potential all contribute to the demand for unmanned aerial vehicles. Miniaturization and portability are two key trends driving the unmanned aerial vehicle (UAV) industry. UAVs are becoming more compact, lightweight, and portable, making them more accessible to a wider range of users. The next-generation UAV serves a variety of functions, including photography, logistics, surveillance, and assessment. Unmanned aerial vehicle (UAV) growth is expected to be assisted by the growing adoption of smart technology for surveillance, analysis, imaging, and other applications across multiple fronts. Its end users include the military and defense industries, agriculture, civil and commercial, logistics and transportation, healthcare, construction and mining, and others.

Report Coverage

This research report categorizes the market for the Middle East unmanned aerial vehicle market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Middle East unmanned aerial vehicle market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Middle East unmanned aerial vehicle market.

Middle East Unmanned Aerial Vehicle Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 2.84 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 7.55% |

| 2033 Value Projection: | USD 5.88 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Type, By Range, By Applications, By Region |

| Companies covered:: | Aeronautics Ltd, AeroVironment Inc, Aurora Flight Sciences, Aviation Industry Corporation of China, BAE Systems Plc, Da-Jiang Innovations (DJI) Science and Technology Co. Ltd, Denel SOC Ltd (Denel Dynamics division), Elbit Systems Ltd, FLIR Systems, General Atomics Aeronautical Systems Inc., and other key companies. |

| Pitfalls & Challenges: | Covid-19 Empact,Challenges,Growth, Analysis. |

Get more details on this report -

Driving Factors

The use of drones to deliver detailed information for disaster relief and the use of unmanned aerial vehicles to investigate natural disasters are expected to drive the market forward. Furthermore, the increasing use of unmanned aerial vehicles for scientific exploration and military research, in addition to government initiatives to support unmanned aerial vehicle research and development, are creating lucrative opportunities for market expansion. Sensor and camera development and design are critical for UAV/drone-based remote sensing technology development. Sensor and technology development leads to lower prices for drone components such as ICs (controllers, GPS). Drones are becoming more affordable as the costs of various ICs (controllers, GPS), IoT sensors, MEMS sensors, and batteries fall while their performance improves, such as GPS accuracy.

Restraining Factors

Ethical considerations about the use of UAVs and strict government regulations regarding the use of the devices may restrain the market growth during forecast period. In addition, unmanned aerial vehicles generate kinetic energy after crashes. This poses a threat to these technologies and might hamper market growth. Technical malfunctions in drones include application errors such as connection failures between users' remote devices and drones, which cause them to collapse or fly away. Another technical issue that causes drones to fly for shorter periods is battery life. The life span of batteries decreases, particularly in cold weather, resulting in a shorter flight time and the possibility of a malfunction.

Market Segment

- In 2023, the fixed wing (MALE, HALE, TUAV) segment accounted for the largest revenue share over the forecast period.

Based on type, the Middle East unmanned aerial vehicle market is segmented into fixed-wing (MALE, HALE, TUAV), and VTOL. Among these, the fixed wing (MALE, HALE, TUAV) segment has the largest revenue share over the forecast period. Fixed-wing drones provide lift with a wing similar to that of a regular aircraft, rather than vertical lift rotors. As such, they require more energy to move forward. Fixed-wing UAVs typically have a longer range and can fly with a heavier payload than VTOL UAVs while consuming less power. In addition to being more efficient, gas engines are a viable option for fixed-wing UAVs due to their higher energy density, which allows them to fly for longer periods. As a result, they are ideal for long-term tasks such as mapping, surveillance, and defense, where endurance is essential. the benefits of their essential market share in manned aviation, helicopters account for a small portion of the unmanned aerial vehicle (UAV) market. A single-rotor helicopter is significantly more efficient than a multi-rotor helicopter and can use a gas motor for even greater endurance. Single-rotor drones can hover while carrying a large payload, as well as perform flowing, long-duration, or forward-moving flights.

- In 2023, the visual range of sight (VLOS) segment is witnessing significant growth over the forecast period.

Based on application, the Middle East unmanned aerial vehicle market is segmented into visual range of sight (VLOS), and beyond visual line of sight (BVLOS). Among these, the visual range of sight (VLOS) segment is witnessing significant growth over the forecast period. Previously, drones could only be used within the pilot's line of sight, which was their maximum permitted operating distance. Visual line of sight (VLOS) refers to an operation that occurs less than 400 feet (120 meters) above ground and no more than 500 meters from the remote pilot. VLOS flights are generally safer than BVLOS flights because operators can avoid potential obstructions without the need for additional collision avoidance technology. The training and certification requirements for VLOS are also straightforward. Several countries still prohibit BVLOS drones and only allow them under certain conditions.

- In 2023, the military segment is witnessing significant growth over the forecast period.

Based on application, the Middle East unmanned aerial vehicle market is segmented into military, construction and mining, inspection and monitoring, delivery, and law enforcement. Among these, the military segment is witnessing significant growth over the forecast period. The military unmanned aerial vehicles are further classified as ISR, combat operations, and delivery. The delivery sub-segment of military unmanned aerial vehicles is expected to grow the most during the forecast period, as drones are used to deliver medical supplies, food, and ammunition to battlefields. Military drones are being sought for direct delivery of emergency supplies to battlefields. Military forces use delivery drones to transport ammunition and food supplies.

- UAE is projected to have the largest share of the Middle East Unmanned Aerial Vehicle market over the forecast period.

Based on region, the UAE is projected to have the largest share of the Middle East unmanned aerial vehicle market over the forecast period. The UAE is home to several of the world's largest UAV manufacturers. Companies manufacture advanced military drones as well as cutting-edge civilian unmanned aerial vehicles. UAE universities and research institutions are at the forefront of UAV technology development, researching topics such as AI-powered drones, drone swarming, and autonomous navigation. The UAE military uses UAVs extensively for reconnaissance, surveillance, and combat missions. Drones are used by government agencies to monitor borders, respond to disasters, and enforce laws. The UAE uses drones for similar purposes, such as search and rescue missions in remote areas.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Middle East unmanned aerial vehicle market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Aeronautics Ltd

- AeroVironment Inc

- Aurora Flight Sciences

- Aviation Industry Corporation of China

- BAE Systems Plc

- Da-Jiang Innovations (DJI) Science and Technology Co. Ltd

- Denel SOC Ltd (Denel Dynamics division)

- Elbit Systems Ltd

- FLIR Systems

- General Atomics Aeronautical Systems Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at regional, and country levels from 2022 to 2033. Spherical Insights has segmented the Middle East unmanned aerial vehicle market based on the below-mentioned segments:

Middle East Unmanned Aerial Vehicle Market, By Type

- Fixed wing (MALE, HALE, TUAV)

- VTOL

Middle East Unmanned Aerial Vehicle Market, By Range

- Visual Range of Sight (VLOS)

- Beyond Visual Line of Sight (BVLOS)

Middle East Unmanned Aerial Vehicle Market, By Application

- Construction and Mining

- Inspection and Monitoring

- Delivery

- Law Enforcement

Middle East Unmanned Aerial Vehicle Market, By Region

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East

Need help to buy this report?