Global Menstrual Health Apps Market Size, Share, and COVID-19 Impact Analysis, By Platform (Android and iOS), By Application (Period Cycle Tracking, Fertility & Ovulation Management, and Menstrual Health Management), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 - 2032

Industry: HealthcareGlobal Menstrual Health Apps Market Insights Forecasts to 2032

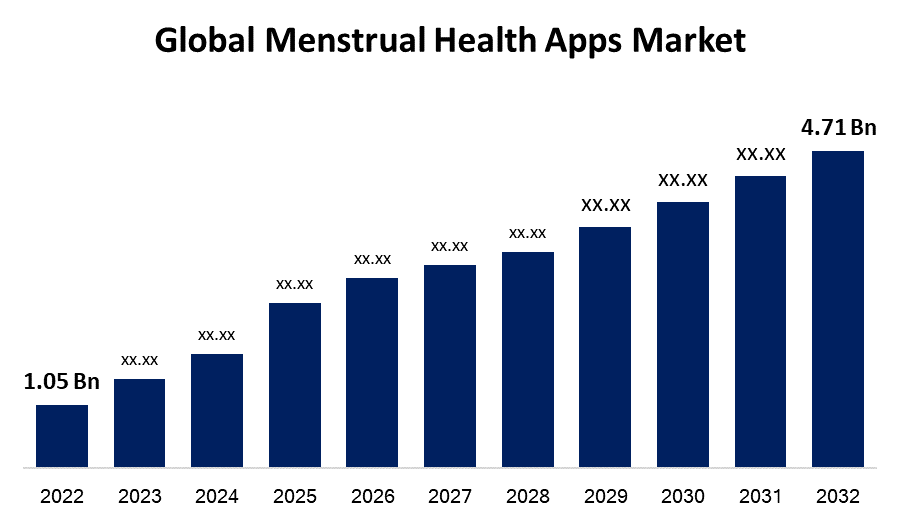

- The Global Menstrual Health Apps Market Size was valued at USD 1.05 Billion in 2022.

- The Market Size is Growing at a CAGR of 16.2% from 2022 to 2032

- The Worldwide Menstrual Health Apps Market Size is expected to reach USD 4.71 Billion by 2032

- Asia-Pacific is expected To Grow higher during the forecast period

Get more details on this report -

The Global Menstrual Health Apps Market Size is expected to reach USD 4.71 Billion by 2032, at a CAGR of 16.2% during the forecast period 2022 to 2032.

Market Overview

Menstrual health apps have gained popularity in recent years as valuable tools for individuals to track and manage their menstrual cycles. These apps typically provide features such as period tracking, ovulation prediction, symptom monitoring, and fertility insights. Users can record details about their menstrual flow, mood, and physical symptoms, allowing them to gain a better understanding of their unique patterns and health needs. Additionally, many apps offer reminders for upcoming periods, ovulation windows, and contraceptive usage, empowering individuals to take control of their reproductive health. Some menstrual health apps also incorporate educational resources, providing information on topics like contraception, sexual health, and general wellness. With their user-friendly interfaces and customizable settings, these apps aim to support users in achieving optimal menstrual health and well-being. However, it is important for individuals to choose reputable apps that prioritize user privacy and data security.

Report Coverage

This research report categorizes the market for menstrual health apps market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the menstrual health apps market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the menstrual health apps market.

Global Menstrual Health Apps Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 1.05 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 16.2% |

| 2032 Value Projection: | USD 4.71 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Platform, By Application, By Region, |

| Companies covered:: | Flo Health Inc., Glow, Inc., Biowink GmbH, Planned Parenthood Federation of America Inc., Ovia Health, MagicGirl, Joii Ltd., Procter & Gamble, Simple Design. Ltd., Cycles. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The menstrual health apps market has experienced significant growth due to increasing awareness and acceptance of menstrual health as an essential aspect of overall well-being have driven the demand for these apps. The growing preference for digital health solutions and the widespread use of smartphones have facilitated the adoption of menstrual health apps. These apps provide personalized and convenient features, such as period tracking, symptom monitoring, and fertility insights, empowering individuals to take control of their reproductive health. Moreover, the integration of advanced technologies like artificial intelligence and machine learning algorithms has enhanced the accuracy and effectiveness of these apps. Additionally, the inclusion of educational resources and community forums within the apps has created a supportive environment for users. Finally, the COVID-19 pandemic has further accelerated the market growth as people increasingly seek remote and self-care options for managing their menstrual health.

Restraining Factors

While the menstrual health apps market has witnessed significant growth, there are several restraints that impact its expansion, there are concerns regarding the accuracy and reliability of these apps in predicting menstrual cycles and fertility windows. Users may encounter discrepancies between app predictions and their actual menstrual patterns, leading to frustration and mistrust. The privacy and data security issues arise as these apps collect sensitive information about users' menstrual cycles and health. Users need assurance that their data is protected and not shared without consent. The accessibility of these apps remains a challenge for individuals who do not have access to smartphones or reliable internet connectivity. Overall, the reliance on technology may exclude segments of the population, such as older adults or those with limited digital literacy, from benefiting fully from these apps.

Market Segmentation

- In 2022, the android segment accounted for around 67.3% market share

On the basis of the platform, the global menstrual health apps market is segmented into android and iOS. The Android segment has emerged as the dominant force in the global menstrual health apps industry for several reasons, because the android devices enjoy a larger market share compared to iOS devices, making them more accessible to a broader user base. This wider user base translates into a larger potential audience for menstrual health apps, contributing to the segment's dominance. Additionally, Android devices are available across a wide range of price points, making them more affordable and attainable for individuals across different socioeconomic backgrounds. Moreover, the Android platform offers a more open and flexible ecosystem, allowing developers to create and distribute a diverse array of menstrual health apps. This flexibility encourages innovation and competition, further boosting the Android segment's dominance. Overall, the Android operating system's compatibility with various devices and its global popularity make it the platform of choice for both app developers and users, solidifying its position as the leading segment in the global menstrual health apps industry.

- In 2022, the period cycle tracking segment dominated with more than 62.4% market share

Based on the application, the global menstrual health apps market is segmented into period cycle tracking, fertility & ovulation management, and menstrual health management. The period cycle tracking segment has emerged as the dominant segment in the menstrual health apps market for various reasons, such as period tracking is a fundamental and widely sought-after feature among individuals looking to understand and monitor their menstrual cycles. These apps offer a user-friendly interface for recording the start and end dates of periods, allowing users to track the duration and frequency of their cycles. The period cycle tracking apps often provide additional functionalities such as symptom monitoring, mood tracking, and personalized insights based on recorded data. This comprehensive approach caters to the diverse needs of users, promoting their overall menstrual health and well-being. Furthermore, period tracking apps have gained popularity among individuals planning for pregnancy or contraception, as they assist in predicting ovulation windows and fertile days. With their simplicity, accessibility, and valuable features, period cycle tracking apps have secured their dominance in the menstrual health apps market.

Regional Segment Analysis of the Menstrual Health Apps Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America dominated the market with more than 38.7% revenue share in 2022.

Get more details on this report -

Based on region, North America has held the largest share in the menstrual health apps market for several reasons, the region has a high level of awareness and acceptance of menstrual health as an integral part of women's overall well-being. This cultural openness has contributed to a greater adoption of menstrual health apps among the population. North America has a strong presence of tech-savvy individuals who readily embrace digital solutions for their healthcare needs. The region also has a high smartphone penetration rate and reliable internet connectivity, facilitating easy access to menstrual health apps. Additionally, North America is home to several prominent app developers and technology companies, leading to the availability of innovative and feature-rich menstrual health apps. Furthermore, the region's advanced healthcare infrastructure and investment in research and development have fostered the growth of the market.

Recent Developments

- In March 2023, Joii, a menstrual health firm, has released an app for recording periods and symptoms to help endometriosis patients. This app is specifically designed to assist users in tracking their menstrual cycles and symptoms associated with endometriosis. By providing a convenient and user-friendly platform, Joii aims to empower endometriosis patients in monitoring and managing their condition more effectively.

- In May 2022, A group of Democrats asked Apple and Google to remove applications that might possibly follow women who show an interest in having an abortion. Following the decision to overturn Roe v. Wade, women in the United States have expressed worry about their privacy and the risk of their personal data kept in period monitoring and fertility tracking apps being used to criminalise those seeking abortions.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global menstrual health apps market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Companies:

- Flo Health Inc.

- Glow, Inc.

- Biowink GmbH

- Planned Parenthood Federation of America Inc.

- Ovia Health

- MagicGirl

- Joii Ltd.

- Procter & Gamble

- Simple Design. Ltd.

- Cycles

Key Target Audience

- Market Players

- Investors

- End-Users

- Government Authorities

- Consulting and Research Firm

- Venture Capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2019 to 2032. Spherical Insights has segmented the Global Menstrual Health Apps Market based on the below-mentioned segments:

Menstrual Health Apps Market, By Platform

- Android

- iOS

Menstrual Health Apps Market, By Application

- Period Cycle Tracking

- Fertility & Ovulation Management

- Menstrual Health Management

Menstrual Health Apps Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?