Global Medical Weight Loss Clinics Market Size, Share, and COVID-19 Impact Analysis, By Ownership Type (Hospital-based and Standalone), By Age Group (Pediatric, Adult, and Geriatric), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 – 2032

Industry: HealthcareGlobal Medical Weight Loss Clinics Market Insights Forecasts to 2032

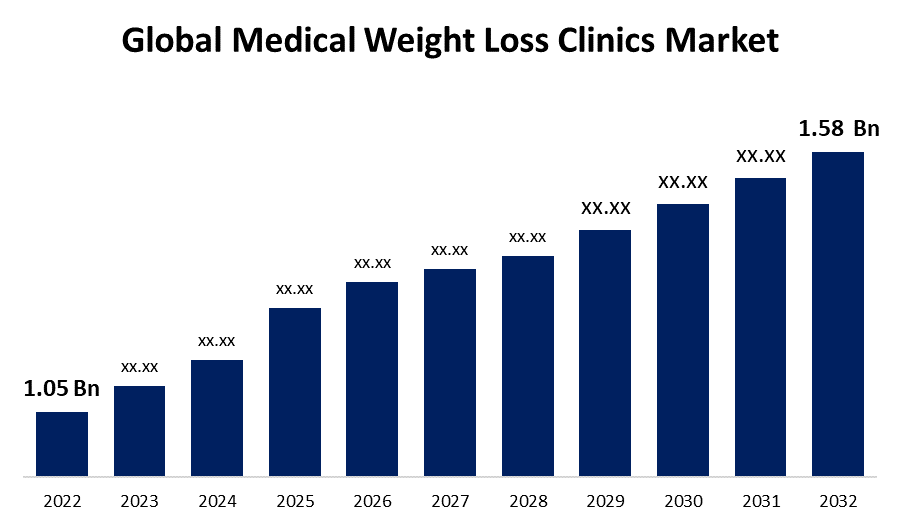

- The Medical Weight Loss Clinics Market Size was valued at USD 1.05 Billion in 2022.

- The Market Size is growing at a CAGR of 4.2% from 2022 to 2032.

- The word wiled medical weight loss clinics Market Size is expected to reach USD 1.58 Billion by 2032

- Asia-Pacific is expected to grow higher during the forecast period.

Get more details on this report -

The Global Medical Weight Loss Clinics Market Size is expected to reach USD 1.58 Billion by 2032, at a CAGR of 4.2% during the forecast period 2023 to 2032.

Market Overview

Medical weight loss clinics are specialized facilities that provide comprehensive programs and support for individuals looking to achieve their weight loss goals under the guidance of medical professionals. These clinics offer a structured approach to weight management, combining personalized diet plans, exercise regimens, and behavioral counseling. The programs are tailored to meet each patient's unique needs, taking into consideration their medical history, lifestyle, and preferences. Medical weight loss clinics often employ a team of experts, including physicians, nutritionists, and fitness trainers, who collaborate to create individualized treatment plans and monitor patients' progress. These clinics may also incorporate medical interventions, such as prescription medications or meal replacements, to assist with weight loss. By offering a holistic and medically supervised approach, medical weight loss clinics aim to help individuals achieve sustainable weight loss, improve their overall health, and develop lifelong habits for maintaining a healthy weight.

Report Coverage

This research report categorizes the market for medical weight loss clinics market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the medical weight loss clinics market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the medical weight loss clinics market.

Global Medical Weight Loss Clinics Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 1.05 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 4.2% |

| 2032 Value Projection: | USD 1.58 Billion |

| Historical Data for: | 2019-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | COVID-19 Impact Analysis, By Ownership Type, By Age Group, By Region |

| Companies covered:: | Cleveland Clinic, Medical Weight Loss Clinic, Rivas Weight Loss, Medi IP, LLC, NYU Langone Hospitals, Stanford Health Care, UCLA Health, Long Island Weight Loss Institute, Cedars-Sinai, Allegheny Health Network, Options Medical Weight Loss, Med-Fit Medical Weight Loss, and Key venders |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The medical weight loss clinics market is driven by several factors because the increasing prevalence of obesity and overweight individuals globally is a major driver. As the demand for effective weight management solutions rises, the need for specialized clinics offering comprehensive programs and medical supervision becomes crucial. Additionally, the growing awareness about the health risks associated with obesity, such as diabetes, cardiovascular diseases, and certain cancers, has propelled individuals to seek professional help for weight loss. Furthermore, the advancements in medical technology and research have led to the development of innovative treatment options and interventions, such as prescription medications and minimally invasive procedures, which attract patients to medical weight loss clinics. Moreover, the rising focus on preventive healthcare and wellness initiatives by governments and healthcare organizations has created a favorable environment for the growth of the market. Lastly, the increasing disposable income and changing lifestyles have contributed to the demand for tailored weight loss programs, further driving the growth of medical weight loss clinics.

Restraining Factors

The medical weight loss clinics market also faces certain restraints, main challenge is the high cost associated with these specialized programs, which may limit access for individuals with lower income levels. Additionally, the lack of insurance coverage for weight loss treatments and interventions can be a barrier for some patients. Moreover, the market may face regulatory hurdles and compliance requirements due to the involvement of medical professionals and the use of prescription medications. Furthermore, the success of weight loss programs heavily relies on patient adherence and lifestyle changes, which can be challenging for some individuals. Overall, the market may also face competition from alternative weight loss solutions, such as commercial diet plans and online programs, which offer convenience and cost-effectiveness to consumers.

Market Segmentation

- In 2022, the standalone segment accounted for around 57.3% market share

On the basis of the ownership type, the global medical weight loss clinics market is segmented into hospital-based and standalone. The standalone segment accounted for the largest market share in the medical weight loss clinics market. This can be attributed to standalone clinics having the advantage of being focused solely on weight loss services. These clinics specialize in providing comprehensive and tailored programs specifically designed for weight management. As a result, they are able to offer a higher level of expertise and specialization compared to clinics that offer weight loss services as part of a broader healthcare institution. Standalone clinics often have a greater degree of flexibility and autonomy in their operations. They can adapt quickly to changing market trends and patient needs, allowing them to introduce innovative treatments and services more efficiently. This flexibility also enables them to provide personalized and customized programs that cater to the unique requirements of their patients. standalone clinics tend to have a distinct brand identity and reputation in the market. They are often known for their expertise and success in helping individuals achieve their weight loss goals. This reputation helps them attract and retain a larger patient base. Additionally, standalone clinics often have a more patient-centric approach. They prioritize individualized care, providing personalized attention and support to their patients. This focus on patient satisfaction and outcomes enhances their reputation and leads to positive word-of-mouth referrals, further driving their market share. Overall, the standalone segment is characterized by a diverse range of clinic sizes, from small local clinics to larger regional or national chains. This diversity allows for greater accessibility and reach, attracting a broader patient population.

- In 2022, the adult segment held a significant market share

Based on the age group, the global medical weight loss clinics market is segmented into pediatric, adult, and geriatric. The adult segment holds a significant market share in the medical weight loss clinics market for several reasons, because obesity and overweight issues are prevalent among adults, making this demographic a primary target for weight loss clinics. Adults often face various challenges in managing their weight due to factors such as sedentary lifestyles, busy schedules, and age-related metabolic changes. As a result, they are more likely to seek professional assistance from medical weight loss clinics to address their weight concerns. The adults typically have a higher awareness of the health risks associated with obesity, such as diabetes, cardiovascular diseases, and joint problems. This increased awareness motivates them to take proactive steps toward weight management and seek specialized care offered by medical weight loss clinics. Additionally, adults tend to have more financial resources compared to other age groups, allowing them to invest in comprehensive weight loss programs offered by clinics. They are often more willing to pay for personalized services, including tailored diet plans, exercise regimens, and behavioral counseling, which are commonly provided by medical weight loss clinics. Moreover, adults have a higher level of commitment and motivation toward their weight loss goals compared to younger age groups. They are often driven by a desire to improve their overall health, enhance their appearance, and increase their quality of life. This dedication makes the adult segment a key driver in the medical weight loss clinics market. Overall, the adult segment's significant market share in medical weight loss clinics can be attributed to the high prevalence of obesity among adults, their awareness of associated health risks, higher financial resources, and increased commitment towards achieving weight loss goals.

Regional Segment Analysis of the Medical Weight Loss Clinics Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America dominated the market with more than 45.6% revenue share in 2022.

Get more details on this report -

Based on region, North America dominates the medical weight loss clinics market for several reasons, because the region has a high prevalence of obesity and overweight individuals, which creates a significant demand for weight management solutions. North America has a well-established healthcare infrastructure and advanced medical technology, enabling the provision of comprehensive and specialized weight loss services. Additionally, the region's strong focus on preventive healthcare and wellness initiatives, coupled with a high disposable income, encourages individuals to seek professional help for weight loss. Furthermore, North America is home to several key market players and research institutions dedicated to developing innovative weight loss treatments and interventions. Overall, favorable reimbursement policies and insurance coverage for weight loss services contribute to the market dominance of North America in the medical weight loss clinics industry.

Recent Developments

- In April 2023, Ideal Weight Center recently expanded its presence by opening a new medical weight loss clinic in Rock Hill, South Carolina. The clinic stands out as the first of its kind in the area, offering specialized GLP-1 therapy, a cutting-edge treatment option for weight loss. With this new facility, Ideal Weight Center aims to provide residents of Rock Hill and the surrounding areas access to innovative weight loss solutions and personalized care through the utilization of GLP-1 therapy.

- In May 2023, Eli Lilly Company has announced its plans to seek U.S. FDA approval for Trizepatide as a weight loss treatment in the United States. Although currently approved for type-2 diabetes, Trizepatide has shown positive effects on weight loss during clinical trials. This development highlights the potential for repurposing existing medications to address the growing need for effective weight management solutions.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global medical weight loss clinics market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Companies:

- Cleveland Clinic

- Medical Weight Loss Clinic

- Rivas Weight Loss

- Medi IP, LLC

- NYU Langone Hospitals

- Stanford Health Care

- UCLA Health

- Long Island Weight Loss Institute

- Cedars-Sinai

- Allegheny Health Network

- Options Medical Weight Loss

- Med-Fit Medical Weight Loss

Key Target Audience

- Market Players

- Investors

- End-Users

- Government Authorities

- Consulting and Research Firm

- Venture Capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2019 to 2032. Spherical Insights has segmented the global medical weight loss clinics market based on the below-mentioned segments:

Medical Weight Loss Clinics Market, By Ownership Type

- Hospital-based

- Standalone

Medical Weight Loss Clinics Market, By Age Group

- Pediatric

- Adult

- Geriatric

Medical Weight Loss Clinics Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?