Global Medical Injection Molding Market Size, Share, and COVID-19 Impact Analysis, By Product (Medical Equipment Components, Consumables, Patient Aids, Orthopedics Instruments, Dental Products, and Others), By System (Hot Runner and Cold Runner), By Material (Plastics, Metals, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Advanced MaterialsGlobal Medical Injection Molding Market Insights Forecasts to 2033

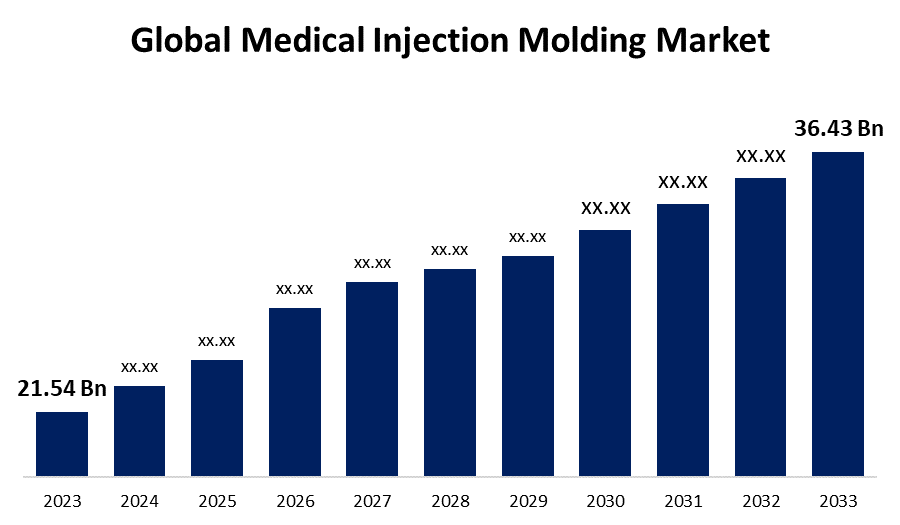

- The Global Medical Injection Molding Market Size was Valued at USD 21.54 Billion in 2023

- The Market Size is Growing at a CAGR of 5.40% from 2023 to 2033

- The Worldwide Medical Injection Molding Market Size is Expected to Reach USD 36.43 Billion by 2033

- North America is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Medical Injection Molding Market Size is Anticipated to Exceed USD 36.43 Billion by 2033, Growing at a CAGR of 5.40% from 2023 to 2033.

Market Overview

An injection molding machine which is also referred to as an injection press is a device that uses the injection molding technique to create plastic products. It consists of two primary components: an injection unit and a clamping unit. The melted material is injected into a mold during the injection molding manufacturing process to create a product. A wide range of materials can be injected, although those that are most prevalent include metals (die casting is the procedure used for this), glass, confections, elastomers, and thermoplastic and thermoset polymers. The part's material is supplied into a heated barrel, mixed, and then injected into a mold cavity. There, it cools and solidifies into the shape of a cavity using a curved screw. The market is primarily driven by the healthcare industry's growing need for precision-molded, high-quality components. The need for modern medical equipment and gadgets has increased due to the rising incidence of chronic diseases and an aging population, which has increased the demand for injection-molded products. Furthermore, the need for medical-grade injection-molded plastics is driven by increased R&D spending and technological improvements in the healthcare industry.

Report Coverage

This research report categorizes the market for the medical injection molding market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the medical injection molding market recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the medical injection molding market

Global Medical Injection Molding Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 21.54 Billion |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 5.40% |

| 023 – 2033 Value Projection: | USD 36.43 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 230 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product, By System, By Material, By Region |

| Companies covered:: | The Rodon Group, Currier Plastics, Inc., D&M Plastics, LLC, Molded Rubber & Plastic Corporation, Metro Mold & Design, ARBURG GmbH, BOLE Machinery, Biomerics, Rutland Plastic, Sumitomo Chemical Co., Ltd., Evco Plastics, C&J Industries, Hillenbrand Inc., Tessy Plastics, Others, |

| Pitfalls & Challenges: | Covid-19 Impact, Challenge, Future,Growth and Analysis |

Get more details on this report -

Driving Factors

One of the main elements propelling the medical injection molding machine market's expansion is material selection. Because of its high molecular weight, attractiveness, resilience, and relative smoothness, polyethylene is a suitable material for wearable technology and prosthetic surfaces. Ceramic materials are used to make components such as glow plugs, electronic fuel pumps, sealing and insulating rings, spark plugs, valves, etc. because of their resistance to corrosion and high temperatures. As a consequence, the market for automotive ceramics is growing in demand.

Restraining Factors

Medical injection molding machines have significant initial tooling and machinery costs that will probably prevent the organization from expanding. Large investments are needed for setting up an injection molding facility, which can prevent small and medium-sized businesses from entering the market.

Market Segmentation

The medical injection molding market share is classified into product, system, and material.

- The medical equipment components segment is expected to grow at the highest CAGR during the forecast period.

Based on the product, the medical injection molding market is categorized into medical equipment components, consumables, patient aids, orthopedics instruments, dental products, and others. Among these, the medical equipment components segment is expected to grow at the highest CAGR during the forecast period. A variety of significant variables are driving the growing need for medical injection molding in the medical equipment manufacturing industry. As the healthcare sector evolves, there is an increasing need for cutting-edge and advanced medical devices, and injection molding provides an extremely efficient and accurate production process to fulfill these requirements.

- The hot runner segment dominated the market with the largest market share through the forecast period.

Based on the system, the medical injection molding market is categorized into hot runner and cold runner. Among these, the hot runner segment dominated the market with the largest market share through the forecast period. There is a growing need for hot runner systems due to several benefits, including a shorter cycle time and less pressure. Hot runner systems are effective in producing complex, high-quality parts, which are essential in the medical industry.

- The plastics segment is anticipated to hold the largest market share through the forecast period.

Based on the material, the medical injection molding market is categorized into plastics, metals, and others. Among these, the plastics segment is anticipated to hold the largest market share through the forecast period. Complex designs in medical devices are currently created with plastic injection molding. Plastic medical injection molding's unmatched accuracy, adaptability, and affordability in the production of a wide range of medical equipment and components have made it an essential component of the healthcare sector.

Regional Segment Analysis of the Medical Injection Molding Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the medical injection molding market over the forecast period.

Get more details on this report -

Asia Pacific is projected to hold the largest share of the medical injection molding market over the forecast period. The need for advanced medical equipment and components is being driven by the region's growing population and growing healthcare needs, which is encouraging the use of injection molding technology. The need for precise and economical manufacturing processes in the healthcare industry, in addition to the rising incidence of chronic illnesses, is driving the market's expansion. Additionally, the region's position as a center for medical device manufacture is been fueled with the availability of trained labor and improvements in injection molding technologies in nations like China and India.

North America is expected to grow at the fastest CAGR growth in the medical injection molding market during the forecast period. There is an immense demand for medical equipment and devices due to established healthcare infrastructure. In addition, the aging population and rising incidence of chronic illnesses are fueling the expansion of the medical injection molding market in this region. The increasing per capita healthcare spending in the US on health insurance is one of the major trends influencing the industry in North America. It is projected that this is going to contribute to a rise in the demand for medical supplies and generic drugs.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the medical injection molding market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- The Rodon Group

- Currier Plastics, Inc.

- D&M Plastics, LLC

- Molded Rubber & Plastic Corporation

- Metro Mold & Design

- ARBURG GmbH

- BOLE Machinery

- Biomerics

- Rutland Plastic

- Sumitomo Chemical Co., Ltd.

- Evco Plastics

- C&J Industries

- Hillenbrand Inc.

- Tessy Plastics

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In October 2023, Milacron, a major player in the global plastics technology & processing sector, presented a device for injection molding to 20/20 Custom Molded Plastics, LLC.

- In September 2023, C&J Industries, a manufacturer specializing in custom injection molding and medical devices, disclosed the purchase of a Meadville, PA, building measuring 53,000 square feet and the related property.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the medical injection molding market based on the below-mentioned segments:

Global Medical Injection Molding Market, By Product

- Medical Equipment Components

- Consumables

- Patient Aids

- Orthopedics Instruments

- Dental Products

- Others

Global Medical Injection Molding Market, By System

- Hot Runner

- Cold Runner

Global Medical Injection Molding Market, By Material

- Plastics

- Metals

- Others

Global Medical Injection Molding Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?