Global Medical Gas Market Size, Share, and COVID-19 Impact Analysis, By Product, (Pure Gases, Gases Mixtures, Others), By Application (Pharmaceutical Manufacturing & Research, Diagnostic Applications, Therapeutic Applications, Others), By End Users (Hospitals, Ambulatory Surgical Centers, Home Healthcare, Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2021 – 2030

Industry: HealthcareGlobal Medical Gas Market Insights Forecasts to 2030

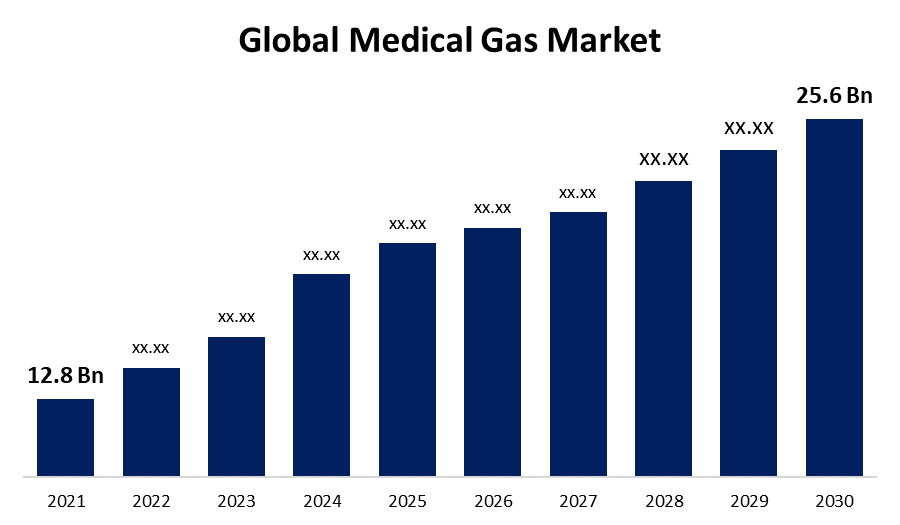

- The Global Medical Gas Market Size was valued at USD 12.8 billion in 2021.

- The market is growing at a CAGR of 8.1% from 2021 to 2030.

- The Worldwide Medical Gas Market size is expected to reach USD 25.6 billion by 2030.

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

The Global Medical Gas Market Size is expected to reach USD 25.6 billion by 2030, at a CAGR of 8.1% during the forecast period 2021 to 2030. The increasing prevalence of chronic diseases, and advantageous initiatives commenced by government organizations, are key factors driving the global medical gas market.

Market Overview

Pharmaceutical gaseous molecules that address medical requirements are known as a medical gas. Medical gas is sterile and free of contaminants. A patient's life is directly affected by the medical gases used in hospitals because they are a vital component of life support. As part of a practice known as "gas therapy," medical gases are also inhaled by patients. Medical gases are used to synthesize, sterilize, or insulate procedures or products that can improve human health. There are numerous ways to deliver medical gases, including with the use of portable compressed air systems or with standalone oxygen cylinders. In May 2022, according to the World Health Organization (WHO), data updated explains that more than three billion people die because of CRDs, including asthma, occupational lung diseases, and pulmonary hypertension. The use of oxygen and other mixtures like lung gas mixtures is used to treat multiple respiratory disorders.

Report Coverage

This research report categorizes the global medical gas market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global medical gas market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the global medical gas market. Technological innovation and advancement will further optimize the performance of the product, enabling it to acquire a wider range of applications in the downstream market.

Global Medical Gas Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2021 |

| Market Size in 2021: | 12.8Bn |

| Forecast Period: | 2021-2030 |

| Forecast Period CAGR 2021-2030 : | 8.1% |

| 2030 Value Projection: | 25.6 Bn |

| Historical Data for: | 2017-2020 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Product, By Application, By End Users and By Region, Analysis and Forecast 2021 – 2030 |

| Companies covered:: | Linde plc., Air Liquide, Atlas Copco, Messer, Air Products Inc., Taiyo Nippon Sanso Corporation, Matheson Tri-Gas Inc. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The major driving factors for the global medical gas market growth include the demand for medical gases has been driven by the rise in the incidence of Chronic Respiratory Disorders (CRDs), including pulmonary hypertension, chronic obstructive pulmonary disease, and occupational lung diseases. Also, one of the main contributing factors to the increasing number of chronic disorders, such as diabetes and heart conditions is called obesity. Furthermore, the increase in home healthcare applications and the growing awareness of chronic diseases among patients and physicians both temper the market's growth during the forecast period. The increasing burden of respiratory diseases and favorable initiatives undertaken by government organizations also drive the market growth of medical gases.

Restraining Factors

The market's overall growth is restricted by changes in medical gas calibration standards and declining federal reimbursement for respiratory therapies. Moreover, the overall operating expense of medical gas equipment will also increase due to the expenses involved in educating specialists to use it effectively, which would restrain market expansion. Also, the oxygen industry with high maintenance costs is preventing the medical gas sector from expanding the market growth over the forecast period.

Market Segmentation

In 2021, the pure gases segment is holding the largest market share over the forecast period.

Based on the product, the medical gas market is bifurcated into pure gases, gas mixtures, and others. Among these, the pure gases segment is holding the market share during the forecast period owing to the increasing usage of oxygen gas, which serves as the foundation for all modern anesthetic procedures and as a form of life support for patients who are artificially ventilated. The segment's growth is primarily driven by an increase in hospitalization rates, the incidence of chronic diseases, and worldwide road deaths. For example, in 2021, according to the United Nations data, vehicle accidents have caused more than 50 million injuries and 1.3 million deaths annually worldwide. The need for oxygen therapy in various life care settings is developing significantly due to the increase in road accidents.

The gas mixtures segment is expected to witness the fastest growth over the forecast period due to its increasing use in therapeutic and diagnostic applications.

In 2021, the therapeutic application segment is dominating the market growth over the forecast period.

Based on application, the medical gas market is classified into pharmaceutical manufacturing and research, diagnostic applications, therapeutic applications, and others. Among these, the therapeutic segment accounts for a major share of the medical gas market due to a broad range of medical gases used to regulate and treat several illness disorders. Also, the huge demand for medicinal products and the equipment required in hospitals may drive the market during the forecast period. Furthermore, the high prevalence of cardiovascular and respiratory diseases, which has increased the use of medical gases and equipment, is projected to be the faster-growing market segment over the forecast period.

In 2021, the hospital segment is leading the market over the forecast period.

Based on the end users, the global medical gas market is segmented into Hospitals, Ambulatory Surgical Centers, and Home Healthcare. Among these segments, the hospital segment held the largest market share due to all types of commercially available medical gases such as oxygen (O2), nitrogen (N2), medicinal air, carbon dioxide (CO2), and nitrogen protoxide (N2O), being widely used. Moreover, the high prevalence of medical procedures conducted globally and the application of medical gases in surgical procedures, intensive care, and emergency response also contribute to the segment's dominance.

Regional Segment Analysis of the medical gas market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

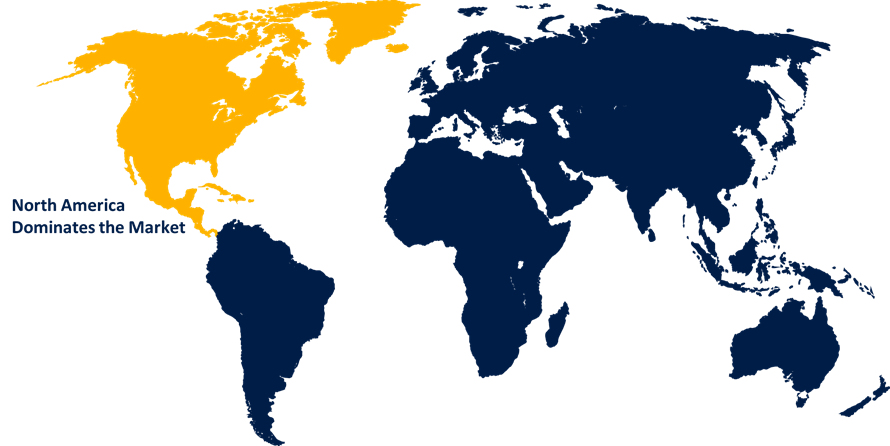

North America is dominating the largest market share of 36.2 % during the forecast period

Get more details on this report -

North America accounts for the largest market share of 36.2% during the forecast period, owing to the demand for medical gases in the U.S. will increase due to the increased prevalence of COPD, asthma, and other medical illnesses like cardiovascular and lifestyle-related diseases. Furthermore, The U.S. has dominated the market due to the availability of government healthcare facilities, notably intensive care units, a well-established market, and an increasing geriatric population. Moreover, Due to the present rise in the use of home oxygen therapy, the medical gas industry in the United States is also going through a change in norms, analysis, and distribution methods. Such a shift is affecting the availability of medical gas and the modernization of standards for the industry.

The Asia Pacific market is expected to witness the highest growth during the forecast period. The rapid growth in the developing healthcare industry across China and India is expected to offer significant growth opportunities for players operating in this market during the forecast period.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the medical gas market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Linde plc.

- Air Liquide

- Atlas Copco

- Messer

- Air Products Inc.

- Taiyo Nippon Sanso Corporation

- Matheson Tri-Gas Inc.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In August 2021, The AMS2106 intelligent digital gas mass flow meter from Aosong was introduced. It is based on cutting-edge semiconductor technology. For providing cumulative flow measurements, including mixed gas flow detection, this flow meter is increasingly crucial. It is intended for flexible use and gas flow monitoring in the health industry.

- In July 2020, the largest oxygen-producing facility in South Africa will be purchased by Air Liquide S.A. Air Liquide will purchase and run the plant as part of an agreement between Sasol and Air Liquide. The action was taken to strengthen the company's business production capacity and, as a result, its position in the market.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2019 to 2030. Spherical Insights has segmented the Global Medical Gas Market based on the below-mentioned segments:

Global Medical Gas Market, By Product

- Pure Gases

- Gases Mixtures

- Others

Global Medical Gas Market, By Application

- Pharmaceutical Manufacturing and Research

- Diagnostic Applications

- Therapeutic Applications

- Others

Global Medical Gas Market, By End Users

- Hospitals

- Ambulatory Surgical Centers

- Home Healthcare

- Others

Global Medical Gas Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?