Global Medical Display Market Size, Share, and COVID-19 Impact Analysis, By Technology (LED-Backlit LCD Displays, CCFL-Backlit LCD Displays, OLED Displays), By Panel Size (Under 22.9-inch panels, 23.9-26.9 inch panels, 27-41.9 inch panels), By Resolution (Up to 2Mp, 2.1 to 4Mp, 4.1 to 8Mp, & Above 8Mp), By Application (Diagnostic Applications, Surgical/Interventional Applications, Dentistry, and Others), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 - 2032

Industry: Electronics, ICT & MediaGlobal Medical Display Market Insights Forecasts to 2032

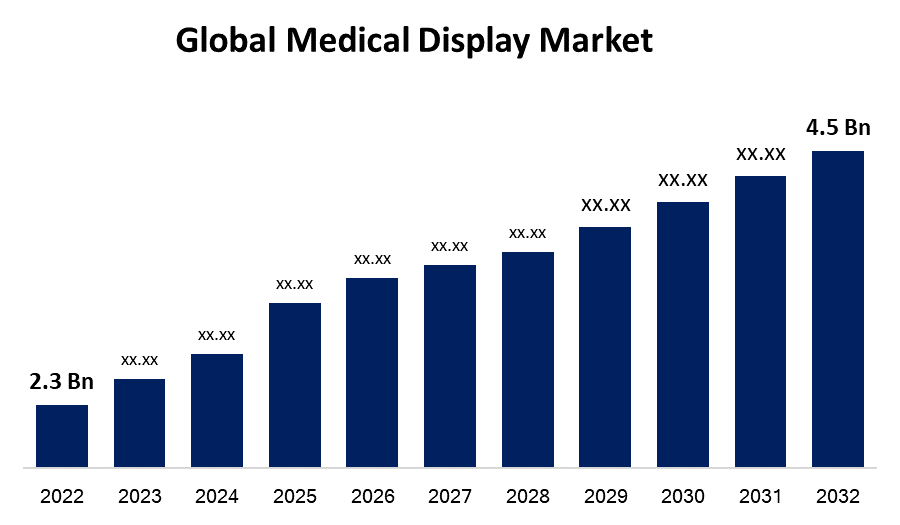

- The Global Medical Display Market Size was valued at USD 2.3 Billion in 2022.

- The Market Size is Growing at a CAGR of 6.9% from 2022 to 2032.

- The Worldwide Medical Display Market size is expected to reach USD 4.5 Billion by 2032.

- Asia Pacific is expected To Grow the fastest during the forecast period.

Get more details on this report -

The Global Medical Display Market Size is expected to reach USD 4.5 Billion by 2032, at a CAGR of 6.9% during the forecast period 2022 to 2032.

Market Overview

A medical display is a monitor that fulfills the stringent requirements of medical imaging. It is often equipped with image-enhancing technologies that assure consistent brightness over the life of the display, noise-free pictures, ergonomic reading, and automated compliance with digital imaging and communications in medicine (DICOM) and other medical standards. Medical imaging technologies have enhanced healthcare by offering strong diagnostic tools, allowing non-invasive inspection of wounds and interior abnormalities, and allowing for the early discovery of illnesses. When used for medical imaging, medical screens are preferable to consumer displays. The easy solution is to ensure that medical displays adhere to visual quality, medical rules, and quality assurance requirements.

Report Coverage

This research report categorizes the global medical display market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global medical display market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global medical display market. Technological innovation and advancement will further optimize the performance of the product, enabling it to acquire a wider range of applications in the downstream market.

Global Medical Display Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 2.3 Billion |

| Forecast Period: | 2018-2021 |

| Forecast Period CAGR 2018-2021 : | 6.9% |

| 2021 Value Projection: | USD 4.5 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Technology, By Panel Size, By Resolution, By Application, By Region. |

| Companies covered:: | LG Display, FSN Medical, EIZO, Sony, Double Black Imaging, Barco, STERIS, Jusha Medical, Advantech, Quest International. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Hospitals throughout the world are increasingly transitioning to hybrid operating rooms to undertake complex and less invasive surgery. This has led to replacing older display systems with newer, higher-resolution medical displays. Mixed operating rooms are frequently utilized for image-guided interventions such as minimally invasive surgeries, endovascular operations, and catheter-based therapies. Medical displays play an important role in showing imaging data, allowing surgeons to observe the patient's anatomy and real-time imaging simultaneously. The combination of imaging and surgical equipment increases precision, safety, and operative results. Furthermore, hybrid operating rooms frequently include numerous imaging modalities, such as angiography systems, MRI scanners, and ultrasound devices. Medical displays provide a standard interface for these many imaging sources, allowing surgeons and radiologists to compare pictures from multiple modalities side by side. This integration improves productivity, increases communication between surgical and imaging teams, and allows for more complete patient care. Hybrid operating rooms provide various advantages over traditional operating rooms, including better visualization, fewer difficulties, and shorter hospital stays, which has increased demand for hybrid operating rooms.

Restraining Factors

The growing demand for reconditioned products presents a significant challenge for industry participants, particularly small producers. To increase their market position and build a strong user base for their imaging systems, industry participants must either drop their pricing or develop better or more sophisticated technologies that fulfill unmet market demands. Refurbished medical displays are becoming more popular in healthcare institutions for a variety of reasons, including cost savings, quality, and dependability, longer lifespan, legacy system availability, rapid technological obsolescence, and established refurbishing channels.

Market Segmentation

- In 2022, the OLED displays segment is dominating the market with the largest market share over the forecast period.

Based on the technology, the global medical display market is segmented into LED-backlit LCD displays, CCFL-backlit LCD displays, and OLED displays. Among these segments, the OLED displays segment is dominating the market with the largest revenue share during the forecast period owing to OLED displays assist healthcare practitioners in seeing extremely minute features such as faint color changes between various tissues and hemodynamics, which many LED displays lack. Furthermore, OLED medical displays are rapidly being employed in radiology and diagnostic imaging medical applications, which are predicted to drive market growth throughout the forecast period.

- In 2022, the 27-41.9 inch panels segment is influencing the largest market share over the forecast period.

Based on panel size, the global medical display market is classified into under 22.9-inch panels, 23.9-26.9 inch panels, and 27-41.9 inch panels. Among these segments, the 27-41.9 inch panels segment is dominating the market because they're frequently utilized in radiology, computed tomography (CT), magnetic resonance imaging (MRI), and ultrasound.

- In 2022, the 2.1 to 4MP segment is influencing the largest market share over the forecast period.

On the basis of resolution, the global medical display market is classified into up to 2Mp, 2.1 to 4Mp, 4.1 to 8Mp, & above 8Mp. Among these segments, the 2.1 to 4MP segment is dominating the market, because of its suitable arrangement for surgical and diagnostic applications, the 2.1-4MP resolution monitor is often employed. Furthermore, the 2.1-4 MP medical displays offer improved picture detail, more screen real estate, multi-modality support, accurate image rendering, DICOM compliance, broad viewing angles, and dependability. These benefits will maintain their market share over the projection period.

- In 2022, the diagnostic applications segment is influencing the largest market share over the forecast period.

On the basis of application, the global medical display market is classified into diagnostic applications, surgical/interventional applications, dentistry, and others. Among these segments, the diagnostic applications segment is dominating the market. The market for medical display systems in diagnostic applications is expanding as display systems become more widely used in various imaging modalities.

Regional Segment Analysis of the medical display market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America dominated the market with the largest market revenue during the forecast period

Get more details on this report -

North America is dominating the significant market growth during the forecast period due to is expected rising need for diagnostic imaging, technical developments, and increased usage of picture archiving and communication systems (PACS) would be important drivers influencing the market growth in North America. North America's large market share is due to the availability of superior healthcare infrastructure as well as increased R&D expenditure in medical displays.

Asia Pacific is expected to experience high revenue market growth during the forecast period due to the government's attempts to promote the healthcare industry and the region's growing senior population. The rise in the number of public and private healthcare institutions is boosting market demand.

Competitive Analysis

The report offers the appropriate analysis of the key organizations/companies involved within the global medical display market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- LG Display

- FSN Medical

- EIZO

- Sony

- Double Black Imaging

- Barco

- STERIS

- Jusha Medical

- Advantech

- Quest International

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In June 2022, The RadiForce MX243W is a 24.1-inch 2.3-megapixel (1920 x 1200 pixel) monitor by EIZO Corporation. The 24.1-inch, 2.3-megapixel (1920 x 1200 pixel) monitor is intended for meticulous monitoring and diagnosis of the entire physiology of the patient system in clinics and hospitals. The introduction added new medical equipment to the portfolio and provided remarkable market purity.

- In May 2021, The Nio Fusion 12MP medical display has been introduced by Barco. The product introduction resulted in a more robust product portfolio, increased revenues, and the growth of the medical display product line throughout North America and Europe.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2022 to 2032. Spherical Insights has segmented the Global Medical Display Market based on the below-mentioned segments:

Global Medical Display Market, By Technology

- LED-Backlit LCD Displays

- CCFL-Backlit LCD Displays

- OLED Displays

Global Medical Display Market, By Panel Size

- Under 22.9-inch panels

- 23.9-26.9-inch panels

- 27-41.9-inch panels

Global Medical Display Market, By Resolution

- Up to 2Mp

- 2.1 to 4Mp

- 4.1 to 8Mp

- Above 8Mp

Global Medical Display Market, By Application

- Diagnostic Applications

- Surgical/Interventional Applications

- Dentistry

- Others

Medical Display Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?