Global Meat Substitutes Market Size , Share, and COVID-19 Impact Analysis, By Source (Plant-based Protein, Mycoprotein, Soy-based, and Others), By Distribution Channel (Foodservice and Retail), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 – 2032.

Industry: Consumer GoodsGlobal Meat Substitutes Market Size Insights Forecasts to 2032

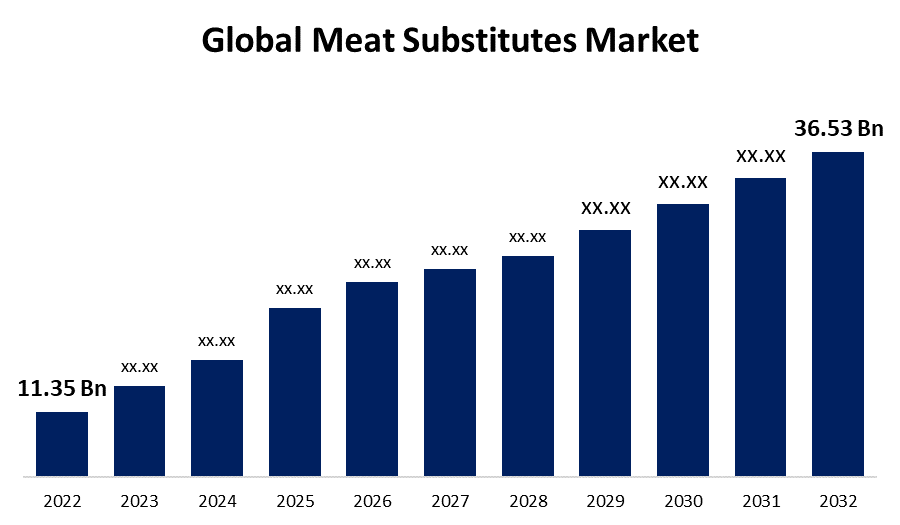

- The meat substitutes market was valued at USD 11.35 Billion in 2022.

- The market is Growing at a CAGR of 12.4% from 2023 to 2032

- The Global Meat Substitutes Market Size is expected to reach USD 36.53 Billion by 2032

- Asia-Pacific is expected to Grow fastest during the forecast period

Get more details on this report -

The Global Meat Substitutes Market Size is expected to reach USD 36.53 Billion by 2032, at a CAGR of 12.4% during the forecast period 2022 to 2032.

Market Overview

Meat substitutes, also known as plant-based or alternative proteins, have gained significant popularity in recent years as a response to various concerns, including health, environmental, and ethical issues associated with traditional meat production. These substitutes are innovative food products designed to mimic the taste, texture, and nutritional profile of meat without using animal-derived ingredients. Common sources of meat substitutes include soy, wheat gluten, mushrooms, legumes, and algae. They offer a versatile solution for consumers seeking to reduce their meat consumption or transition to a plant-based diet. Beyond burgers, sausages, and nuggets, meat substitutes now encompass a wide range of products, from tofu and tempeh to jackfruit and seitan. As the industry continues to evolve and innovate, meat substitutes play a pivotal role in reshaping our approach to food sustainability and dietary choices.

Report Coverage

This research report categorizes the market for meat substitutes market based on various segments and regions and forecasts revenue Growth and analyzes trends in each submarket. The report analyses the key Growth drivers, opportunities, and challenges influencing the meat substitutes market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the meat substitutes market.

Global Meat Substitutes Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 11.35 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 12.4% |

| 2032 Value Projection: | USD 36.53 Billion |

| Historical Data for: | 2019-2020 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Source, By Distribution Channel, By Region and COVID-19 Impact. |

| Companies covered:: | Amy’s Kitchen, Inc., Beyond Meat, Impossible Foods Inc., Quorn Foods, Kellogg Co., Unilever, Meatless B.V., VBites Foods Ltd., SunFed, Tyson Foods, Inc., and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth & Analysis. |

Get more details on this report -

Driving Factors

The meat substitutes market is experiencing significant Growth, driven by a confluence of factors that span health, environmental, ethical, and culinary considerations. The increasing awareness of health and wellness among consumers has prompted a surge in demand for meat alternatives. Meat substitutes are often perceived as healthier options due to their lower saturated fat and cholesterol content, making them appealing to those looking to reduce the risks of chronic diseases. The environmental impact of conventional meat production has become a pressing concern. Meat substitutes offer a more sustainable alternative, as they generally require fewer natural resources such as land, water, and energy, and produce fewer greenhouse gas emissions compared to livestock farming. Concerns about deforestation, water scarcity, and climate change are pushing environmentally conscious consumers to opt for these products. Ethical considerations are another driver of the meat substitutes market. Concerns about animal welfare and the treatment of livestock in industrial farming have led many individuals to seek out plant-based alternatives. This segment of consumers is driven by a desire to reduce their contribution to animal suffering and often chooses meat substitutes as a more ethical choice. Culinary innovation also plays a pivotal role. Advances in food technology have allowed manufacturers to create meat substitutes that closely mimic the taste, texture, and appearance of real meat. As a result, consumers are more willing to embrace these products, as they no longer have to compromise on sensory experiences. Additionally, a Growing trend towards flexitarian and vegetarian diets is boosting the meat substitutes market. Many consumers are looking to reduce their meat consumption while still enjoying familiar flavors and dishes, and meat substitutes provide a bridge between their dietary aspirations and traditional meals. An expanding market for plant-based diets and alternative protein sources is attracting investment and research into meat substitutes, leading to a wider variety of options and improved product quality. As a result, the meat substitutes market is expected to continue its Growth trajectory, appealing to a diverse range of consumers with varying motivations, and potentially revolutionizing the global food industry in the process.

Restraining Factors

The meat substitutes market faces several restraints, including taste and texture challenges, limited consumer acceptance, and higher price points compared to conventional meat products. Achieving the exact taste and texture of meat remains a complex task, often resulting in products that do not fully satisfy the sensory expectations of meat consumers. Additionally, while demand is Growing, some consumers remain hesitant to fully embrace meat substitutes due to unfamiliarity or loyalty to traditional meat. The production costs for meat substitutes can be higher, which can deter price-sensitive consumers from making the switch to these alternatives, especially in regions where affordability is a significant concern.

Market Segmentation

- In 2022, the plant-based protein segment accounted for around 56.5% market share

On the basis of the source, the Global Meat Substitutes Market Size is segmented into plant-based protein, mycoprotein, soy-based, and others. The plant-based protein segment's dominance in the meat substitutes market, holding the largest revenue share, can be attributed to its alignment with consumer preferences for healthier, more sustainable, and ethical dietary choices. Plant-based proteins, derived from sources like soy, peas, wheat, and legumes, offer a wide array of options for creating meat alternatives. They are recognized for their nutritional benefits, often providing essential nutrients while reducing saturated fat and cholesterol content. Additionally, plant-based proteins appeal to a broad range of dietary preferences, including vegan, vegetarian, and flexitarian diets. As a result, they have become the foundation for a diverse range of popular meat substitute products, driving their substantial revenue share in the market.

- The retail segment held the largest market with more than 63.2% revenue share in 2022

Based on the distribution channel, the Global Meat Substitutes Market Size is segmented into foodservice and retail. The retail segment's leadership in the meat substitutes market, securing the largest revenue share, can be attributed to its widespread accessibility and convenience. Retail outlets, including supermarkets, grocery stores, and online platforms, have played a pivotal role in bringing meat substitute products directly to consumers. These channels offer a wide range of options, from frozen and refrigerated plant-based meats to pantry staples like tofu and legumes. Additionally, marketing efforts and promotional campaigns in retail settings have effectively educated consumers and encouraged adoption. The ease of incorporating meat substitutes into home-cooked meals has further boosted the retail segment's dominance in the market, making it the preferred choice for a majority of consumers.

Regional Segment Analysis of the Meat Substitutes Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

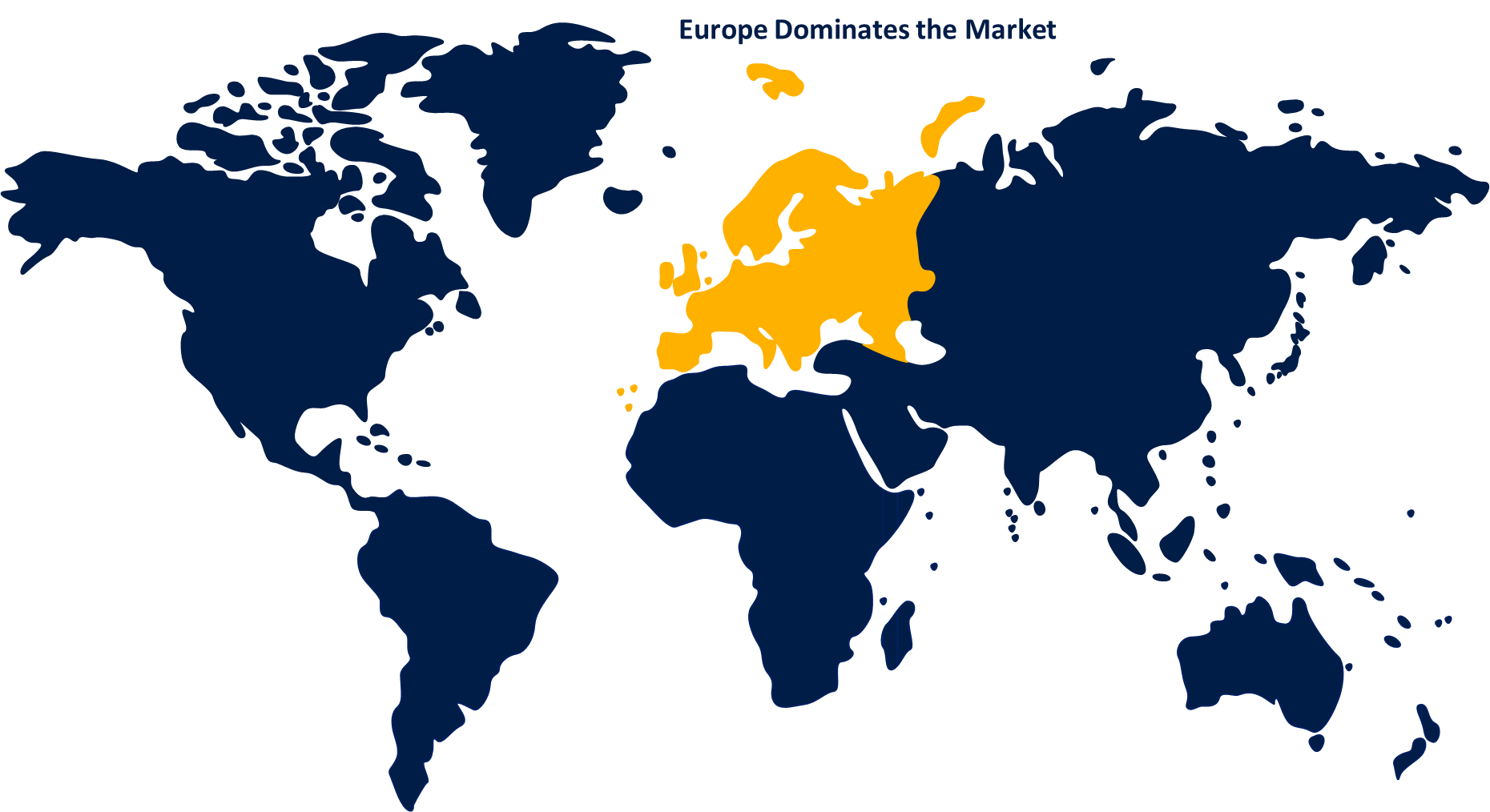

Europe dominated the market with more than 37.2% revenue share in 2022.

Get more details on this report -

Based on region, Europe's prominent role in the global meat substitute market is attributed to the heightened awareness of environmental sustainability and ethical concerns related to animal agriculture has driven European consumers toward plant-based alternatives. Government initiatives and regulations supporting sustainability and healthy eating have further fueled this trend. Moreover, the region has witnessed a surge in product innovation and a Growing number of vegetarian and vegan consumers. As a result, Europe has consistently led in terms of revenue share, reflecting a strong and expanding market for meat substitutes that align with the evolving preferences and values of its population.

Asia Pacific region is experiencing the fastest Growth in the meat substitutes market due to rising incomes, urbanization, and a Growing middle-class population have led to increased consumer spending on healthier and sustainable food options. Additionally, a surge in awareness regarding health and environmental concerns is driving the demand for meat alternatives in countries like China and India. The availability of diverse plant-based protein sources from tofu to tempeh aligns with the region's rich culinary traditions, making it easier for consumers to adopt meat substitutes. These factors collectively position Asia Pacific as the fastest-Growing market in the meat substitute industry during the forecast period.

North America's status as the second-largest revenue contributor in the Global Meat Substitutes Market Size can be attributed to region has seen a significant shift in consumer preferences toward healthier and more sustainable dietary choices, with a rising number of people adopting flexitarian, vegetarian, or vegan diets. Additionally, the presence of well-established and innovative food companies in North America has led to a robust market with a wide variety of meat substitute products. Furthermore, proactive marketing campaigns and increased availability of these products in mainstream retail outlets have driven consumer adoption, resulting in North America's substantial revenue share in the market.

Recent Developments

- In June 2022, Cookout Classic is now available in over 10,000 stores throughout the country, including Giant Food, Hannaford, Publix, ShopRite, Sprouts, Stop & Shop, Wegmans, Whole Foods Market, and select Albertsons, Kroger, Target, and Walmart locations.

- In June 2022, The Kellogg Company revealed intentions to split into three independent firms, one of which would specialise on plant-based meat product products and will control the MorningStar Farms brand.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Global Meat Substitutes Market Size along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Companies:

- Amy’s Kitchen, Inc.

- Beyond Meat

- Impossible Foods Inc.

- Quorn Foods

- Kellogg Co.

- Unilever

- Meatless B.V.

- VBites Foods Ltd.

- SunFed

- Tyson Foods, Inc.

Key Target Audience

- Market Players

- Investors

- End-Users

- Government Authorities

- Consulting and Research Firm

- Venture Capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2019 to 2032. Spherical Insights has segmented the Global Meat Substitutes Market Size based on the below-mentioned segments:

Meat Substitutes Market, By Source

- Plant-based Protein

- Mycoprotein

- Soy-based

- Others

Meat Substitutes Market, By Distribution Channel

- Foodservice

- Retail

Meat Substitutes Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?