Global Luxury Hotel Market By Type (Business Hotels, Airport Hotels, Suite Hotels, Resorts, Others), By Category (Chain, Independent); By Region (U.S., Canada, Mexico, Rest Of North America, The UK, France, Germany, Italy, Spain, Nordic Countries (Denmark, Finland, Iceland, Sweden, Norway), Benelux Union (Belgium, The Netherlands, Luxembourg), Rest Of Europe, China, Japan, India, New Zealand, Australia, South Korea, Southeast Asia (Indonesia, Thailand, Malaysia, Singapore, Rest Of Southeast Asia), Saudi Arabia, UAE, Egypt, Kuwait, South Africa, Rest Of Middle East & Africa, Brazil, Argentina, Rest Of Latin America) – Global Insights, Growth, Size, Comparative Analysis, Trends And Forecast, 2021-2030

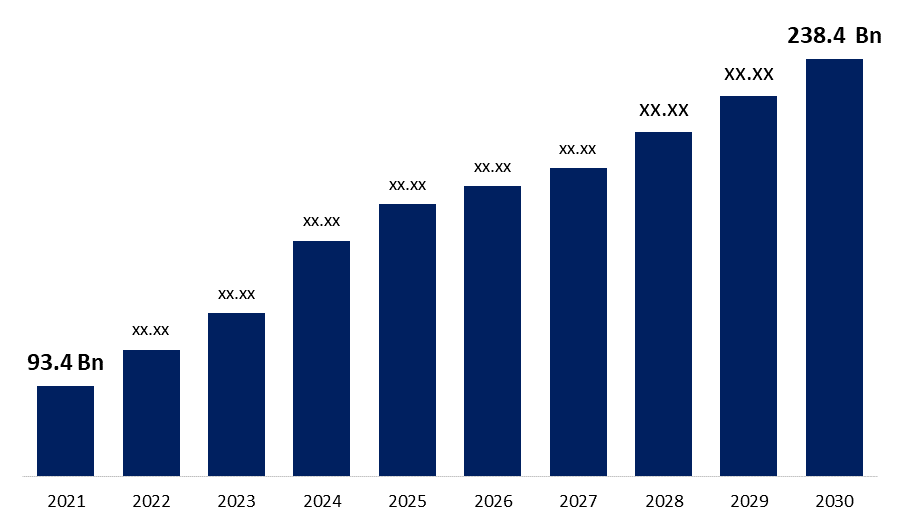

Industry: Consumer GoodsThe Global Luxury Hotel Market size was valued at USD 93.4 Billion in 2021. The market is projected to grow USD 238.4 Billion in 2030, at a CAGR of 10.5%. The travel and tourism industry are a significant industry that generates cash for most governments. Many countries rely on tourism for a significant portion of their GDP. The travel and tourism sector are growing in tandem with the growing number of travellers around the world. The tourism sector is motivated by people's desire to try new kinds of adventure and enjoyment for social, religious, recreational, educational, and business reasons. It accounts for a significant portion of a country's GDP. The luxury hotel industry has been predominantly supported by lavish stays during family vacation time or delivering over-the-top facilities for senior management executives during business visits. To attract guests, hotels are attempting to present the highest level of services and features, ranging from interior design and culinary choices to expanded sorts of services such as spas, gyms, swimming pools, and laundry, among others.

Get more details on this report -

The emergence of the travel and tourism business, as well as shifting patterns in standard of life, has resulted in a steady increase in the luxury hotel market. The demand for luxury hotels varies depending on the property type and is impacted by factors including location, size, and on-site amenities. The market is likely to be driven by rising disposable income, popularizing weekend culture, the introduction of low-cost airline services, and the developing service industry. The rise in spending power and the style of living are two of the most important factors driving people to luxury resorts. The demand for luxury hotels is also fueled by a city's or country's hosting of sporting events. The development of the market has been hastened by the emergence of online lodging booking services. Marriott International, for example, published a new edition of its mobile app, Marriott Bonvoy, on February 10, 2021, with new features like better booking possibilities, greater personalized experiences, and customizations in earning and redeeming points. As a result, the industry is expected to consolidate due to growing demand for premium services with better booking options.

Global Luxury Hotel Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2021 |

| Market Size in 2021: | USD 93.4 Billion |

| Forecast Period: | 2021 - 2030 |

| Forecast Period CAGR 2021 - 2030 : | 10.5% |

| 2030 Value Projection: | USD 238.4 Billion |

| Historical Data for: | 2017 - 2020 |

| No. of Pages: | 198 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Type, By Category, By Region |

| Companies covered:: | ITC HOTELS, Marriott International Inc, Accor S.A, Belmond Ltd, Hyatt Corporation, Belmond Ltd, Four Seasons Hotels Limited, InterContinental Hotels Group PLC, Rosewood Hotels & Resorts, Ritz-Carlton Hotel Company LLC, Shangri-La International Hotel Management Ltd. |

| Growth Drivers: | 1) The business hotel segment accounted largest market share 2) The chain segment accounted largest market share |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

COVID-19 Analysis

The epidemic of COVID-19 has had a significant influence on the tourism and travel industries. The global implementation of social distancing, stay-at-home, and travel restrictions has stifled the expansion of the luxury hotel industry. According to the American Hotel and Lodging Association 2021 study, hotel occupancy in the United States fell from 66 percent to around 40 percent in 2020, compared to the previous year. As a result of the pandemic, the hotel industry is likely to suffer a severe slowdown; nevertheless, the market is expected to return to its prior growth trajectory in the coming years.

Type Outlook

The business hotel segment accounted largest market share for the global luxury hotel market in 2020. Luxury hotels are commercial establishments that provide visitors, tourists, and guests with luxurious and high-end accommodation experiences. Business, airport, and suite hotels and resorts are common examples. Spas, swimming pools, dine-in restaurants, salons, private beaches, and fitness facilities are among the amenities available at these establishments. They also offer check-in and check-out services that are quick, convenient, and discreet, as well as smart planning and booking processes, laundry, business centres, babysitting, dog walking, and concierge services. These hotels usually have high-end designer interiors created with cutting-edge technology. Luxury hotel rooms also have high-quality aesthetic art on the walls, floors, roofs, and windows, as well as flat-screen televisions (TVs), artisan toiletries, and coffee makers to enhance the guest's experience.

Category Outlook

The chain segment accounted largest market share for the global luxury hotel market in 2020 owing to the widespread presence of chain hotels around the world, the chain hotel segment accounts for a significant portion of the market. The chain segment of hotels is concentrating on expanding their reach to new locations throughout the world and enhancing their position in lucrative markets. For example, in April 2018, Accor Hotels signed a deal with Mantis Group, a hospitality and tourism company based in South Africa. Under the terms of the arrangement, Accor purchased a 50% share in Mantis Group, allowing the company to expand its presence in Africa.

The independent segment is anticipated to register a significant growth rate over the forecast period for the global luxury hotel market in 2020 owing to the increased interest in personalized services at a reasonable cost, independent hotels are the fastest expanding segment.

Get more details on this report -

Regional Outlook

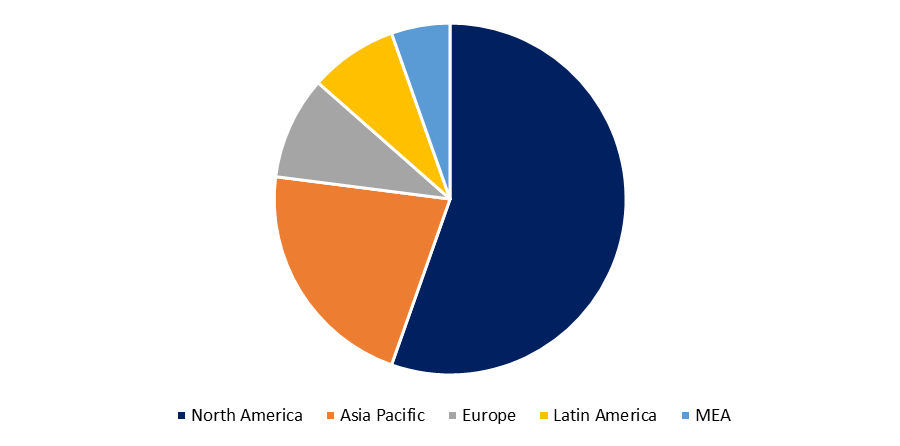

North America dominated largest market share for the global luxury hotel market in 2020 owing to the presence of dominant players in the market are investing profoundly in infrastructure and upgrading their property with the latest accessories to enhance aesthetics and the overall comfort offered to customers. Increased spending on lavish lodging in the United States and Canada generates more revenue, making North America the leading region in the luxury hotel sector. Domestic travelers in the United States spent about USD 972 billion in 2019, according to the U.S. Travel Association's U.S. TRAVEL AND TOURISM OVERVIEW (2019), with spending on lodgings, such as hotels/motels/B&B and vacation homes, among others, totaling USD 242 billion for both domestic and international travelers.

Europe is anticipated to emerge as the fastest-growing region over the forecast period. This is due to the presence of some of the world's most popular tourist spots. According to the UNWTO's Foreign Tourism Highlights 2019 Edition, Europe accounted for half of all international visitor arrivals in 2018. The survey also reveals that five major European countries are among the top ten destinations based on foreign tourist arrivals in 2018. France tops the list with 89 million visitor arrivals, followed by Spain (83 million), Italy (62 million), Germany (39 million), and the United Kingdom (39 million) (36 million). As a result, as more technically sound high-scale hotel chains enter the region to accommodate an expanding number of tourists, the room occupancy rate of European luxury hotels is projected to rise.

Key Companies & Recent Developments

Partnerships, strategic mergers, and acquisitions are expected to be the most successful strategies for industry participants to get speedy access to growing markets while also improving technological capabilities. For example, in November 2020, Accor and Ennismore entered exclusive negotiations to form what they are claiming will be the world’s leading lifestyle operator in the hospitality sector. In February 2020, the combination between Hamilton Hotel Partners with Boston-based Pyramid Hotel Group has been finalized.

In addition, product differentiation and developments, as well as service expansion, are projected to help organizations thrive in the market. For instance, In January 2021, Marriott International, Inc. revealed plans to open almost 100 hotels in Asia Pacific by 2021, including The Ritz-Carlton, St. Regis, W, The Luxury Collection, and JW Marriott, among other luxury brands.

Market Segmentation of Global Luxury Hotel Market

By Type

- Business Hotels

- Airport Hotels

- Suite Hotels

- Resorts

- Others

By Category

- Chain

- Independent

Key Players:

- ITC HOTELS

- Marriott International Inc

- Accor S.A.

- Belmond Ltd.

- Hyatt Corporation

- Belmond Ltd

- Four Seasons Hotels Limited

- InterContinental Hotels Group PLC

- Rosewood Hotels & Resorts

- Ritz-Carlton Hotel Company LLC

- Shangri-La International Hotel Management Ltd

Need help to buy this report?