Global Logistics Automation Market Size, Share, and COVID-19 Impact Analysis, By Component (Hardware, Software, Services), By Function (Transportation Management, Warehouse Management, Inventory & Storage, Others), By Logistics Type (Sales Logistics, Production Logistics, Recovery Logistics, Others), By Enterprise Size (Large Enterprises, SMEs), By Software Application (Inventory Management, Order Management, Yard Management, Shipping Management, Labor Management, Vendor Management, Customer Support, Others), By End-User (Retail & E-commerce, Healthcare, Automotive, Aerospace & Defense, Electronics & Semiconductors, Others) and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 - 2032

Industry: Information & TechnologyGlobal Logistics Automation Market Insights Forecasts to 2032

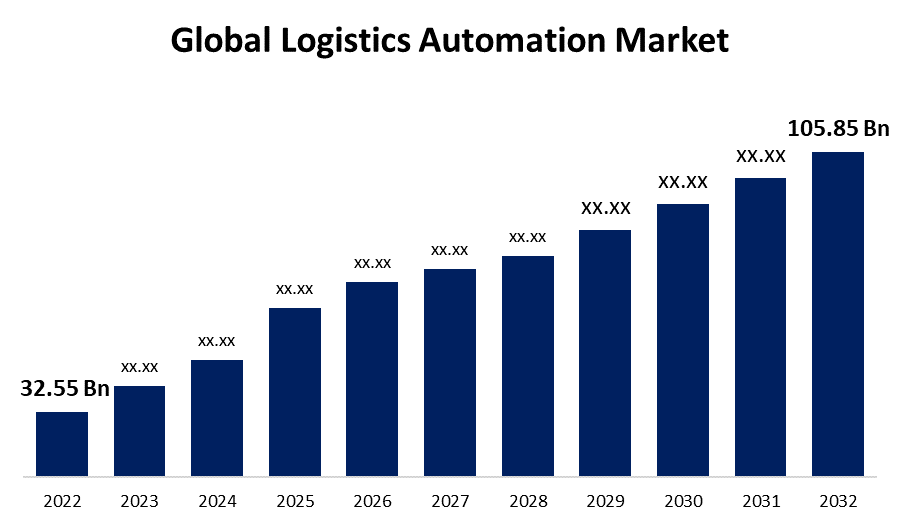

- The Global Logistics Automation Market Size was valued at USD 32.55 Billion in 2022.

- The Market is Growing at a CAGR of 12.5% from 2022 to 2032

- The Worldwide Logistics Automation Market Size is expected to reach USD 105.85 Billion by 2032

- Asia Pacific is expected to Grow the fastest during the forecast period

Get more details on this report -

The Global Logistics Automation Market Size is expected to reach USD 105.85 Billion by 2032, at a CAGR of 12.5% during the forecast period 2022 to 2032.

Automation in logistics is the use of machinery, control systems, and software to improve operational efficiency. It usually refers to procedures carried out in a warehouse or distribution center that require little human participation. Some of the advantages of logistics automation include increased customer service, scalability, speed, organizational control, and decreases in errors. The market is being driven by the rise of the e-commerce industry and the global demand for effective warehousing and inventory management. Logistics automation systems can be a powerful addition to the services provided by these more advanced computer systems. When a single node inside an overall logistics network is the focus, solutions might be modified to match its specific requirements.

Global Logistics Automation Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 32.55 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 12.5% |

| 2032 Value Projection: | USD 105.85 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Component, By Function, By Logistics Type, By Enterprise Size, By Software Application, By End-User and By Region |

| Companies covered:: | Dematic Corp. (Kion Group AG), Daifuku Co. Limited, Swisslog Holding AG (KUKA AG), Honeywell International Inc., Jungheinrich AG, Murata Machinery Ltd, Knapp AG, TGW Logistics Group GmbH, Kardex Group, Mecalux SA, Beumer Group GmbH & Co. KG, SSI Schaefer AG, Vanderlande Industries BV, WITRON Logistik, Oracle Corporation, One Network Enterprises Inc., SAP SE, and Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Robots are becoming more frequently utilized to improve logistics operations. Logistics robots have been an increasingly popular idea in recent years. Companies have invested in automated storage and retrieval systems (AS/RS) to automate movements and different regions in the facility due to the increasing complexity of warehousing and the need for flexible and efficient operations. The rise in logistics robots is a response to the need to cut costs and streamline processes in order to boost competitiveness. Unlike traditional equipment, logistics robots provide the greatest efficiency 24 hours a day, seven days a week, in addition to the safety of the goods, the operators, and all other elements in the warehouse. Robots can be used to efficiently and quickly transfer objects from one location to another. They eliminate the need for human participation in laborious, dull, risky operations associated with various sectors such as warehousing and material handling. Additionally, the deployment of autonomous cars and drones, as well as increased demand for warehouse automation from emerging nations, are likely to provide prospects for market expansion.

Restraining Factors

There is a lack of uniform governance standards. Logistics companies are focusing on increasing supply chain efficiency in order to increase profitability and viability. Common governance rules for the logistics business are required. Universal standardization in logistics management makes it easier and more efficient for each provider to provide the bulk of solutions in a single package. The lack of standardized governance standards makes it difficult for end users to fully automate supply chain and logistics activities, restricting the logistics automation market's growth.

Market Segmentation

By Component Insights

The software segment dominates the market with the largest revenue share over the forecast period.

On the basis of components, the global logistics automation market is segmented into hardware, software, and services. Among these, the software segment is dominating the market with the largest revenue share over the forecast period. The software market is further subdivided into warehouse management systems and transportation management systems. The warehouse management software automates and optimizes multiple warehouse activities, including tracking, inventory storage, receiving, and workload planning, and is predicted to hold the largest market share during the forecast period.

By Function Insights

The inventory & storage segment is witnessing significant CAGR growth over the forecast period.

On the basis of function, the global logistics automation market is segmented into transportation management, warehouse management, inventory & storage, and others. Among these, the inventory & storage segment is witnessing significant CAGR growth over the forecast period. Inventory and storage management involves automated storage and retrieval systems. Autonomous storage systems allow for the automated storage of crates or pallets in racks or shelves, while retrieval systems allow for the automated retrieval of products from the warehouse for dispatch. The automation of the inventory and storage process simplifies and expedites the tracking and tracing of a product in a huge warehouse.

By Logistics Type Insights

The production logistics segment is expected to hold the rapid revenue growth of the global Logistics Automation market during the forecast period.

Based on the logistics type, the global logistics automation market is classified into sales logistics, production logistics, recovery logistics, and others. Among these, the production logistics segment is expected to grow at a rapid pace during the forecast period. Businesses place a high value on optimizing manufacturing processes, including time and cost efficiency, in order to increase profitability. Logistics is one of a business's primary costs, and automation can be very helpful in lowering or at least optimizing expenditures. Production logistics includes raw material inventory management, transportation within the manufacturing unit, and distribution.

By Enterprise Size Insights

The small & medium enterprises (SMEs) segment is projected to grow at the highest CAGR in the market during the forecast period.

On the basis of enterprise size, the global logistics automation market is segmented into large enterprises and SMEs. Among these, the small & medium enterprises (SMEs) segment grow at highest CAGR growth over the forecast period. Small and medium-sized businesses focus on cost efficiency and use automation technologies to reduce labor costs. A number of businesses have grown in the e-commerce fulfillment service industry, and fulfillment centers are progressively employing automated sorting systems for fulfillment procedures including kitting and bundling. Small and medium-sized businesses can compete with big companies because of automation.

By Software Application Insights

The inventory management segment is projected to grow at the highest CAGR in the market during the forecast period.

On the basis of software application, the global logistics automation market is segmented into inventory management, order management, yard management, shipping management, labor management, vendor management, customer support, and others. Among these, the inventory management segment grows at highest CAGR growth over the forecast period. Inventory management involves keeping track of inventory levels, managing each product's inventory, estimating demand, and accounting for the overall inventory. Inventory management is essential to a successful organization because both excess and low inventory may be costly to a company's probability. Forecasting product demand based on historical sales is extremely useful in maintaining optimal inventory levels.

By End-Users Insights

The healthcare segment is projected to grow at the highest CAGR in the market during the forecast period.

On the basis of end-users, the global logistics automation market is segmented into retail & e-commerce, healthcare, automotive, aerospace & defense, electronics & semiconductors, and others. Among these, the healthcare segment grows at highest CAGR growth over the forecast period. Healthcare logistics automation systems provide the safe and secure handling, storage, and retrieval of healthcare supplies such as vaccines and medicines. The healthcare industry requires a high level of accuracy and accountability to maintain product safety, and automation helps tremendously in this regard. To avoid shortages and track expiration dates, pharmaceutical products require careful inventory management.

Regional Insights

North America dominates the market with the largest market share over the forecast period.

Get more details on this report -

North America is dominating the largest market share over the forecast period. The presence of various logistics automation solution providers and logistics giants such as UPS, DHL, and FedEx Corporation, among others, in North America has contributed to the region's growth. Furthermore, the quick implementation of current technology and the presence of modern infrastructure in the region contribute to the target market's growth. Because of the country's significant growth in the e-commerce sector, the United States is likely to maintain its dominance over the forecast period.

Asia-Pacific market is expected to grow the fastest during the forecast period. The Asia Pacific region is predicted to have incredible economic expansion, particularly in e-commerce. Furthermore, Asia Pacific comprises various countries that serve as logistics hubs, such as Singapore, Indonesia, China, and India. Furthermore, rising technology breakthroughs and increased adoption of Industry 4.0 in countries like as China, India, Japan, and Southeast Asia are expected to significantly boost demand for logistics automation over the forecast period.

List of Key Market Players

- Dematic Corp. (Kion Group AG)

- Daifuku Co. Limited

- Swisslog Holding AG (KUKA AG)

- Honeywell International Inc.

- Jungheinrich AG

- Murata Machinery Ltd

- Knapp AG

- TGW Logistics Group GmbH

- Kardex Group

- Mecalux SA

- Beumer Group GmbH & Co. KG

- SSI Schaefer AG

- Vanderlande Industries BV

- WITRON Logistik

- Oracle Corporation

- One Network Enterprises Inc.

- SAP SE

Key Market Developments

- In October 2022, Supply Sensing, a new generation solution introduced by 09 Solutions, would assist businesses in better anticipating supply-chain disruptions by localizing the impact of macro-level impacts on their specific supply chains and developing mitigating strategies to minimize any negative effects on their operations.

- In May 2022, Oracle Fusion Cloud Supply Chain & Manufacturing (SCM) now includes new logistics management capabilities. Oracle Fusion Cloud Transportation Management and Oracle Fusion Cloud Global Trade Management upgrades can assist firms in lowering costs and risks, improving customer experience, and becoming more adaptive to business changes.

- In September 2021, SAP Yard Logistics offers a variety of alternatives for providing customers with a long-term solution for managing all processes in the yard. SAP Yard Logistics, which plans and ensures the smooth and effective operation of the yard, supports long-term, future-proof yard management in both essential and complicated scenarios.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2022 to 2032. Spherical Insights has segmented the global logistics automation market based on the below-mentioned segments:

Logistics Automation Market, Component Analysis

- Hardware

- Software

- Services

Logistics Automation Market, Function Analysis

- Transportation Management

- Warehouse Management

- Inventory & Storage

- Others

Logistics Automation Market, Logistics Type Analysis

- Sales Logistics

- Production Logistics

- Recovery Logistics

- Others

Logistics Automation Market, Enterprise Size Analysis

- Large Enterprises

- SMEs

Logistics Automation Market, Software Applications Analysis

- Inventory Management

- Order Management

- Yard Management

- Shipping Management

- Labor Management

- Vendor Management

- Customer Support

- Others

Logistics Automation Market, End-Users Analysis

- Retail & E-commerce

- Healthcare

- Automotive

- Aerospace & Defense

- Electronics & Semiconductors

- Others

Logistics Automation Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?