Global Linerless Labels Market Size By Printing Technology (Digital, Flexographic), By End Use (Food, Beverage), By Region, And Segment Forecasts, By Geographic Scope And Forecast to 2032

Industry: Consumer GoodsGlobal Linerless Labels Market Size Insights Forecasts to 2032

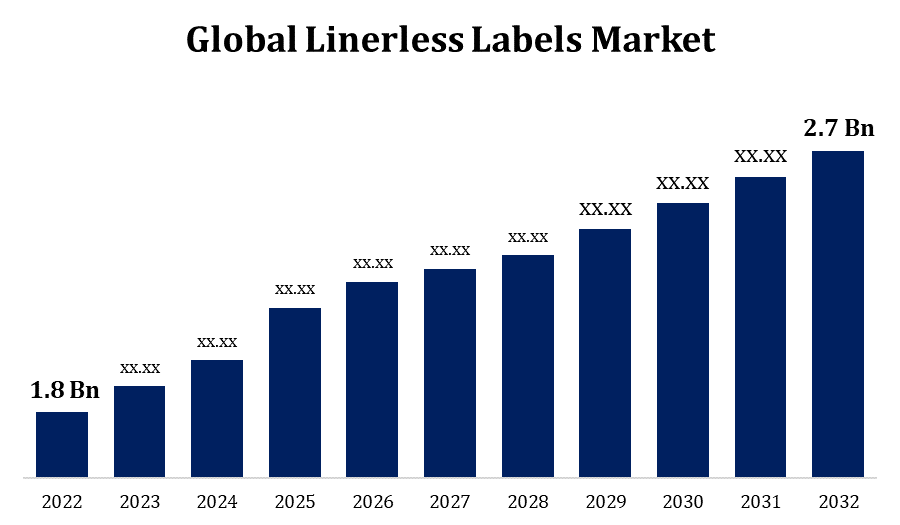

- The Global Labels Market Size was valued at USD 1.8 Billion in 2022.

- The Market Size is Growing at a CAGR of 5.2% From 2022 to 2032

- The Worldwide Linerless Labels Market Size is Expected to reach USD 2.7 Billion by 2032

- Asia Pacific is Expected to Grow the Fastest during the Forecast period

Get more details on this report -

The Global Linerless Labels Market Size is Expected to reach USD 2.7 Billion by 2032, at a CAGR of 5.2% during the Forecast period 2022 to 2032.

The linerless labels market is booming. Businesses are resorting to linerless labels to save waste as sustainability becomes more than a catchy catchphrase. The eco-friendly appeal is undoubtedly a motivating element behind their increased popularity. Another important component in this growth tale is efficiency. Linerless labels are all about reducing waste, getting more labels on a roll, and making application easier. It's the labelling equivalent of a triple threat.

Linerless Labels Market Value Chain Analysis

It all starts with the raw materials, which include paper, glue, and any specialised coatings required for endurance. Here, quality sets the tone for the entire process. The raw components are transported to the manufacturing stage, where labels are created and adhesive is applied. This is where the magic happens, transforming ordinary materials into useful linerless labels. These linerless labels are used for products and packaging in industries such as food and beverage, retail, and logistics. Linerless labelling benefits end users by being environmentally friendly, efficient, and space-saving. The labels are applied to the items or packaging by the end customers. The linerless design makes this process easier, and the labels can be found on anything from food to deliveries. Consumers are the final link in the chain. They come across linerless labels on things they buy, and the cycle repeats. The appeal is not only in the product, but also in the environmentally friendly and effective packaging.

Linerless Labels Market Opportunity Analysis

Businesses are constantly looking for methods to streamline their processes. Linerless labels improve labelling processes by eliminating downtime for roll changes and lowering waste. This efficiency perspective opens up opportunities in industries where time and resource management are crucial. Technological advancements can improve the usefulness of linerless labels. Integration with smart labelling technologies such as RFID or NFC may enable real-time tracking, authentication, and improved supply chain management. Customizable packaging is becoming increasingly popular as consumer preferences shift. With their adaptability and ease of printing, linerless labels may capitalise on this trend by allowing firms to produce unique and eye-catching labels for their products. There is possibility for geographical expansion in the linerless labels market. As more regions become aware of the benefits of linerless labels, there is a chance for market penetration in locations where these labels may not yet be widely used.

Global Linerless Labels Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 1.8 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 5.2% |

| 2032 Value Projection: | USD 2.7 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Printing Technology, By End Use, By Region and by Segment |

| Companies covered:: | Multi-Color Corporation, CCL Industries Inc, R.R. Donnelley & Sons Company, 3M Company, Coveris Holdings S.A, Skanem SA, Sato Holdings Corporation, Avery Dennison Corporation, Cenveo Corporation, Gipako, and Others. |

| Growth Drivers: | Demand for the pharmaceutical industry and consumer goods industry |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Linerless Labels Market Dynamics

Demand for the pharmaceutical industry and consumer goods industry

Brand visibility is essential in the consumer goods business. Linerless labels provide a wider printable area, giving brands more room to create imaginative and dramatic graphics, which helps products stand out on crowded shelves. Consumer goods frequently have a wide variety of products and frequent packaging modifications. Linerless labels, with their quick changeovers and effective application technique, meet the dynamic needs of this business. The space-saving aspect of linerless labels aids the retail industry within consumer products. More labels on a roll mean fewer roll changes, which reduces downtime and improves overall supply chain efficiency. In the pharmaceutical industry, security and authenticity are critical. RFID and QR codes, for example, can be integrated into linerless labels to enable real-time tracking and authentication.

Restraints & Challenges

Transitioning to linerless labels may incur some initial expenditures. To accommodate linerless labels, businesses may need to invest in new labelling equipment or technology, which could be a barrier to entry for some. Maintaining print quality and durability can be a challenge, especially in demanding areas such as the pharmaceutical or chemical industries. Labels must withstand a variety of circumstances while maintaining legibility and integrity. Not every industry understands the advantages of linerless labelling. Increasing awareness and teaching businesses about the benefits, particularly in terms of sustainability and efficiency, is a continuous struggle. The linerless labels market is still emerging, and there may be fragmentation in terms of standards and technologies. It can be difficult to achieve industry-wide standardisation.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Linerless Labels Market from 2023 to 2032. Transitioning to linerless labels may incur some initial expenditures. To accommodate linerless labels, businesses may need to invest in new labelling equipment or technology, which could be a barrier to entry for some. Maintaining print quality and durability can be a challenge, especially in demanding areas such as the pharmaceutical or chemical industries. Labels must withstand a variety of circumstances while maintaining legibility and integrity. Not every industry understands the advantages of linerless labelling. Increasing awareness and teaching businesses about the benefits, particularly in terms of sustainability and efficiency, is a continuous struggle. The linerless labels market is still emerging, and there may be fragmentation in terms of standards and technologies. It can be difficult to achieve industry-wide standardisation.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2032. This is due to the region's thriving economies, increased industrialization, and increased awareness of sustainable packaging alternatives. With a thriving e-commerce sector in countries such as China and India, efficient labelling and packaging solutions are critical. Linerless labels, with their space-saving and speedy application benefits, are finding a niche in today's hectic e-commerce market. Many Asian Pacific countries serve as industrial hubs for a variety of industries. The efficiency improvements provided by linerless labels, such as reduced downtime and faster changeovers, are well suited to the region's fast-paced industrial environments. Asia Pacific is well-known for its quick adoption of new technology. Linerless labels, especially when combined with sophisticated labelling technologies, are perfectly suited to this technologically advanced environment.

Segmentation Analysis

Insights by Printing Technology

Digital segment accounted for the largest market share over the forecast period 2023 to 2032. Because digital printing does not require traditional printing plates, it is more cost-effective for short print runs. This is useful in situations where businesses want fewer labels for unique promotions, seasonal variations, or niche products. Digital printing shines in areas such as pharmaceuticals, where tight rules require accurate and varied data on labels. It ensures accuracy while printing complicated data such as barcodes, QR codes, and serial numbers. Labels are printed on demand with digital printing, which reduces extra inventory and waste. This matches nicely with business sustainability goals and contributes to the overall eco-friendly profile of linerless labels.

Insights by End Use

Food segment accounted for the largest market share over the forecast period 2023 to 2032. Linerless labels have gained popularity due to their environmental and cost-saving benefits. They're very popular in the food industry for packaging because they reduce waste and environmental effect. Many food manufacturers are implementing linerless labelling to accord with eco-friendly practises as consumer awareness of sustainability rises. These labels do not require release liners, minimising both material consumption and waste. Furthermore, they frequently include efficient application techniques, significantly optimising the packing process. The linerless labels market in the food segment is expected to expand further as more companies prioritise sustainable packaging options.

Recent Market Developments

- In January 2020, Skanem Stavanger, Norway's largest producer of self-adhesive labels, has purchased a new Nilpeter FA-22 with 9 colours.

Competitive Landscape

Major players in the market

- Multi-Color Corporation

- CCL Industries Inc

- R.R. Donnelley & Sons Company

- 3M Company

- Coveris Holdings S.A

- Skanem SA

- Sato Holdings Corporation

- Avery Dennison Corporation

- Cenveo Corporation

- Gipako

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2032.

Linerless Labels Market, Printing Technology Analysis

- Digital

- Flexographic

Linerless Labels Market, End Use Analysis

- Food

- Beverage

Linerless Labels Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

Need help to buy this report?