Global Limited Slip Differential Market Size By Type (Mechanical LSD, Electronic LSD, etc.), by Application (SUV & Pickup Truck, Sedan & Hatchback, etc.) By Region (North America, Europe, Asia Pacific, the Middle East and Africa, South America) Analysis and Forecast 2021 - 2030

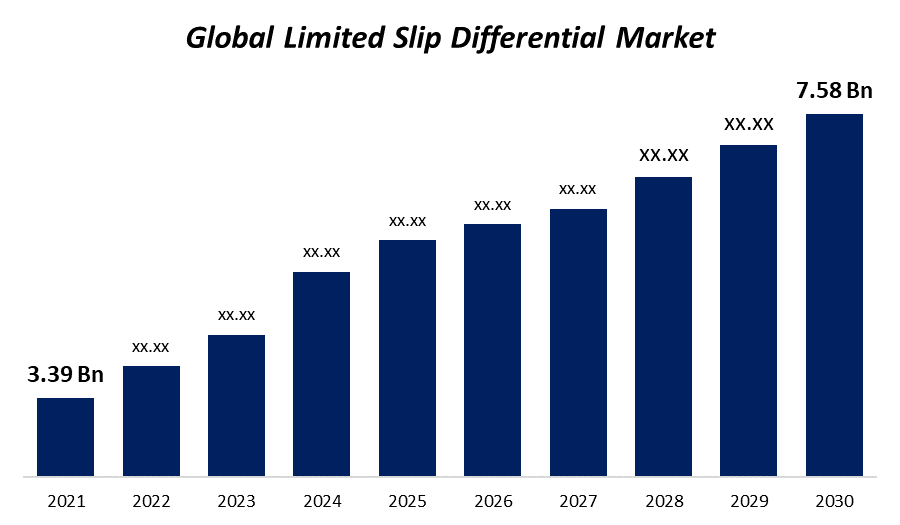

Industry: Automotive & TransportationIn 2021, the size of the Global Limited Slip Differential Market was estimated at USD 3.39 billion. Market analysts anticipate that it will expand at a CAGR of 11.3% from 2021 to 2030, from USD 3.58 billion to USD 7.58 billion. The limited slip difference is a component of the drive system in cars. Open differential is comparable to it. Instead of a motorised pinion gear, it makes use of an integrated clutch system. Limited Slip Differences are made to help the engine use its power more effectively on the road, improving the vehicle's performance and handling.

Get more details on this report -

By comparing the situation of a regular (or "open") differential in off-roading or snow conditions where one tyre starts to slip, the fundamental benefit of a limited-slip differential is illustrated. With a conventional differential, in such a situation, the sliding or non-contacting wheel will get the majority of the power (in the form of low-torque, high-rpm spinning), whereas the contacting wheel will stay fixed in relation to the ground. The market for Limited Slip Difference is projected to increase in the near future due to rising consumer demand for effective automotive performance and improved vehicle handling. Additionally, raising the driver's level of vehicle control will result in increased road safety.

Global Limited Slip Differential Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2021 |

| Market Size in 2021: | USD 3.39 billion. |

| Forecast Period: | 2021-2030 |

| Forecast Period CAGR 2021-2030 : | 11.3% |

| 2030 Value Projection: | USD 7.58 billion |

| Historical Data for: | 2017-2020 |

| No. of Pages: | 211 |

| Tables, Charts & Figures: | 112 |

| Segments covered: | By Type, By Application Type, By Region |

| Companies covered:: | JTEKT Corporation (Japan), Drexler Automotive GmbH (Germany), BorgWarner Inc. (U.S.), Eaton (Ireland), ZF Friedrichshafen AG (Germany), Linamar Corporation (Canada), Dana Limited (U.S.), GKN Automotive (U.K.), American Axle & Manufacturing Inc. (U.S.), CUSCO Japan, Co, Ltd. (Japan), RT Quaife Engineering Ltd (U.K.) |

| Pitfalls & Challenges: | COVID-19 has the potential to impact the global market |

Get more details on this report -

Driving Factors

In both developed and developing nations, including India, there is a growing preference for and acceptance of SUVs, which is expected to boost market expansion in the coming years. During the projected period, a strong demand for high-performance cars is anticipated to support limited slip differential market share. The popularity of luxury SUVs will also drive LSD makers to expand their product lines. It is important to note that electronic limited slip differentials are more popular now since they improve control and torque capacity. Leading manufacturers will probably invest money in R&D projects to improve cyber security.

Limited slip differentials enhance a driver's ability to control a vehicle. As a result, during the course of the projected period, the market is likely to rise due to their rising need for high-performance automobiles for improved safety. Leading businesses are set to invest money in LSD to improve vehicle handling and road safety. The projection era will be marred by increased maintenance requirements, such as the price of replacing the oil.

Restraining Factor

The clutch plates of a limited slip differential may worm out. The price of replacing the oil also adds to the overall expense of LSD maintenance. As a result, maintenance costs are higher than open differentials, which could limit market expansion.

COVID 19 Impact

Globally, the automotive industry has suffered greatly as a result of the COVID-19 pandemic epidemic. It has forced a number of automakers to halt their manufacturing operations. In the midst of this pandemic, a fall in vehicle sales and manufacturing is anticipated to hurt demand for limited slip differentials. You could determine the best course of action to escape this dire circumstance with the aid of our in-depth research reports. As factories were compelled to shut down or operate at reduced capacity after production resumed at the end of Q2 2020 due to the lockdown brought on by the Covid-19 pandemic, this resulted in a significant decline in vehicle manufacturing.

Segmentation

The Global Limited Slip Differential market is segmented into Type, Application and Region.

Global Limited Slip Differential Market, By Type

Based on the Type market is segmented into Mechanical and Electronic LSD. Mechanical, which contributed for 58.8% of the limited slip differential market in 2021, is anticipated to maintain its leadership during the forecast period. Due to its wide range of uses, particularly in luxury and high-performance automobiles, mechanical LSDs are the most popular type of LSD.

Over the anticipated period, the electronic segment is anticipated to see the fastest CAGR. Comparatively speaking, they perform better than mechanical LSDs. As a result, increasing consumer and automaker preference for E-LSD is projected to fuel market expansion in electronic LSD R&D to enhance their main offerings and satisfy rising client demand.

Global Limited Slip Differential Market, By Application Type

Based on the Application Type market is segmented into SUV & Pickup Trucks and Sedan & Hatchback. With the biggest market share in 2021, the SUV & pickup truck segment is anticipated to develop at the quickest rate over the forecast period. The category growth is predicted to be fuelled by the rising trend of SUV and pickup truck usage in emerging and developing nations. Not all vehicles have limited slip differentials.

Off-road vehicles with improved versions of LSD include the Jeep Wrangler, Jeep Grand Wagoneer, Toyota Land Cruiser, and many more upscale SUVs. They can recognise changing road conditions and improve vehicle control with the aid of these sophisticated differentials. In the upcoming years, it is projected that rising demand for luxury SUVs would fuel segment expansion. A significant growth rate is also anticipated for the sedan and hatchback due to rising disposable income and rising desire for driving comfort in developing economies.

Global Limited Slip Differential Market, By Region

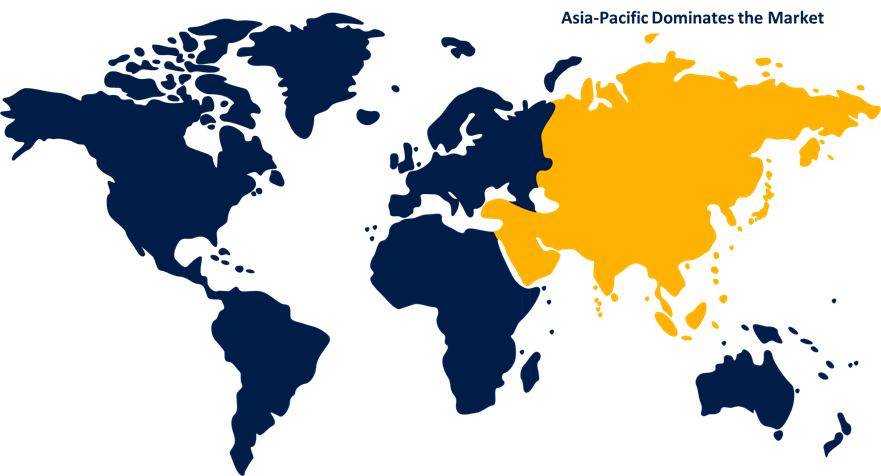

With a market size of USD 1.71 billion in 2021, APAC leads the world market for limited slip differentials, and it is anticipated that it will hold that position for the foreseeable future. The second-highest market share in 2021 will come from North America. The U.S. market's expanding sales of luxury and high-performance automobiles are projected to support regional market expansion. The ubiquity of automotive safety standards and the EURO-NCAP grade for cars will help the European market share grow. Industry participants may invest in cutting-edge LSDs in France, Italy, Germany, and the U.K. With the demand for comfortable driving, automakers may look to add LSDs to their line-up of upscale and premium automobiles.

Get more details on this report -

As a result of growing awareness and brisk demand for road safety across emerging economies, the Asia Pacific market projection will be strong. The size of the Asia Pacific market, which was $1.71 billion in 2021, is expected to rise as high-performance cars and SUVs become more prevalent. Due to the presence of top businesses in these countries, prominent automakers are anticipated to increase their market share.

Recent Developments In The Global Limited Slip Differential Market

In November 2021= The 2022 GMC HUMMER EV's TracRite differentials from American Axle & Manufacturing were the essential parts fitted in the vehicle to provide significant power and performance.

In October 2021= Launched with an LSD made by JTEKT Corporation, the new "Land Cruiser" from Toyota Motor Corporation.

In July 2020= For medium-duty vehicle applications, Dana Limited unveiled its brand-new genuine Spicer Trac-Lok limited slip differential. The new type automatically improves vehicle handling while maintaining a small, light weight for better performance, durability, and traction.

List of Key Market Players

- JTEKT Corporation (Japan)

- Drexler Automotive GmbH (Germany)

- BorgWarner Inc. (U.S.)

- Eaton (Ireland)

- ZF Friedrichshafen AG (Germany)

- Linamar Corporation (Canada)

- Dana Limited (U.S.)

- GKN Automotive (U.K.)

- American Axle & Manufacturing Inc. (U.S.)

- CUSCO Japan, Co, Ltd. (Japan)

- RT Quaife Engineering Ltd (U.K.)

Segmentation

By Type

- Mechanical

- Electronic LSD

By Application Type

- SUV

- Pickup Truckes

- Sedan

- Hatchback

By Region:

North America

- North America, by Country

- U.S.

- Canada

- Mexico

- North America, by Type

- North America, by Application Type

Europe

- Europe, by Country

- Germany

- Russia

- U.K.

- France

- Italy

- Spain

- The Netherlands

- Rest of Europe

- Europe, by Technology Type

- Europe, by Application Type

Asia Pacific

- Asia Pacific, by Country

- China

- India

- Japan

- South Korea

- Australia

- Indonesia

- Rest of Asia Pacific

- Asia Pacific, by Type

- Asia Pacific, by Application Type

Middle East & Africa

- Middle East & Africa, by Country

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

- Middle East & Africa, by Type

- Middle East & Africa, by Application Type

South America

- South America, by Country

- Brazil

- Argentina

- Colombia

- Rest of South America

- South America, by Type

- South America, by Application Type

Need help to buy this report?