Global Legal Technology Market Size, Share, and COVID-19 Impact Analysis, By Solution (Software and Services), By Type (E-discovery, Legal Research, Practice Management, Analytics, Compliance, Document Management, Contract Lifecycle Management, Time-Tracking & Billing, and Others), By End-User (Law Firms, Corporate Legal Departments, and Others), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 - 2032

Industry: Information & TechnologyGlobal Legal Technology Market Insights Forecasts to 2032

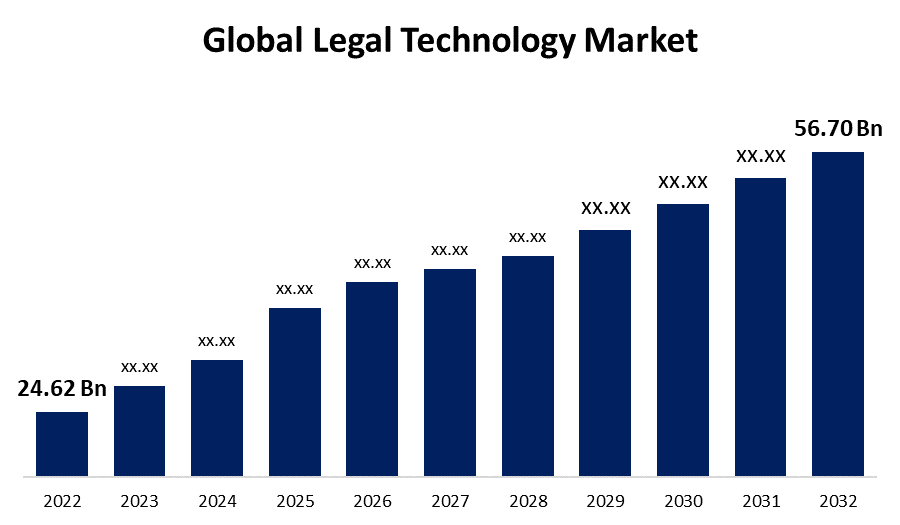

- The Global Legal Technology Market Size was valued at USD 24.62 Billion in 2022.

- The Market Size is Growing at a CAGR of 8.7% from 2022 to 2032

- The Worldwide Legal Technology Market Size is expected to reach USD 56.70 Billion by 2032

- Asia-Pacific is expected to grow significant during the forecast period

Get more details on this report -

The Global Legal Technology Market Size is expected to reach USD 56.70 Billion by 2032, at a CAGR of 8.7% during the forecast period 2022 to 2032.

Market Overview

Legal technology, also known as legal tech, refers to the use of technology to enhance and streamline legal processes and services. It encompasses a wide range of digital tools and software applications designed to support legal professionals in their work. Legal tech solutions leverage automation, artificial intelligence (AI), machine learning, data analytics, and cloud computing to improve efficiency, accuracy, and accessibility in the legal industry. These technologies enable tasks such as document drafting and review, contract management, legal research, e-discovery, case management, and client communication to be performed more efficiently and cost-effectively. Additionally, legal tech facilitates access to justice by providing innovative platforms for online dispute resolution, legal information resources, and self-service tools for individuals seeking legal assistance. With its transformative potential, legal technology is revolutionizing the practice of law, empowering lawyers and legal organizations to deliver better outcomes and effectively navigate the ever-evolving legal landscape.

Report Coverage

This research report categorizes the market for legal technology market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the legal technology market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the legal technology market.

Global Legal Technology Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022 : | USD 24.62 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 8.7% |

| 2032 Value Projection: | USD 56.70 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 130 |

| Segments covered: | By Solution, By Type, By End-User, By Region |

| Companies covered:: | Icertis, Inc., Filevine Inc., DocuSign, Inc., Casetext Inc., ProfitSolv, LLC, Knovos, LLC, Mystacks, Inc., Practice Insight Pty Ltd., TimeSolv Corporation, Themis Solutions Inc., Everlaw, Inc., LexisNexis Legal & Professional Compan |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The legal technology market is driven by several key factors, due to the increasing volume of legal data and documents has created a need for efficient tools to manage and analyze this information. The adoption of artificial intelligence and machine learning technologies has enabled automation of tasks such as document review and contract analysis, leading to improved efficiency and cost savings. Additionally, the demand for enhanced accuracy and risk management in legal processes has fueled the development of advanced analytics and predictive modeling tools. Moreover, the growing emphasis on regulatory compliance and the need for quick and accurate legal research have spurred the adoption of legal tech solutions. Furthermore, the shift towards remote work and virtual collaboration due to the COVID-19 pandemic has accelerated the adoption of cloud-based legal tech platforms. Overall, these drivers are propelling the growth of the Legal Technology market and transforming the way legal services are delivered.

Restraining Factors

The legal technology market faces certain restraints that can impact its growth. One significant restraint is the resistance to change within the legal industry. The conservative nature of the profession and the adherence to traditional methods can hinder the adoption of new technologies. Additionally, concerns regarding data security and privacy pose challenges for legal tech implementation, as sensitive legal information needs to be protected. Moreover, the high initial costs associated with implementing legal tech solutions, along with the need for extensive training and integration, can be deterrents for some law firms. Overall, the complexity and diversity of legal processes present a barrier to developing comprehensive and universally applicable legal tech solutions. Overcoming these restraints requires addressing cultural, security, financial, and technological considerations to foster wider adoption of legal technology.

Market Segmentation

- In 2022, the software segment accounted for around 68.5% market share

On the basis of the solution, the global legal technology market is segmented into software and services. The software segment has emerged as the dominant player in the legal technology market, accounting for the highest market share. This can be attributed to several key factors, software solutions provide the foundation for digital transformation in the legal industry, offering a wide range of applications and tools to streamline various legal processes. Document management software, contract management software, legal research platforms, and e-discovery software are some examples of software solutions widely used in the legal sector. The software solutions enable automation, efficiency, and improved accuracy in legal tasks, leading to cost savings and enhanced productivity. Furthermore, advancements in artificial intelligence and machine learning technologies have revolutionized legal software, enabling functionalities such as natural language processing, predictive analytics, and data mining. The flexibility, scalability, and customization options offered by software solutions make them highly attractive to law firms and legal departments, thus driving their market dominance in the legal technology landscape.

- The analytics segment is expected to grow at a CAGR of around 8.3% during the forecast period

Based on the type of application, the global legal technology market is segmented into e-discovery, legal research, practice management, analytics, compliance, document management, contract lifecycle management, time-tracking & billing, and others. The analytics segment in the legal technology market is expected to experience significant growth in the forecast period. This growth can be attributed to several factors, due to the increasing volume of legal data generated requires sophisticated analytics tools to derive meaningful insights and patterns. Analytics solutions enable legal professionals to analyze large datasets, extract relevant information, and gain valuable intelligence for strategic decision-making. The analytics technologies, such as predictive analytics and data visualization, enhance the accuracy and efficiency of legal research, case assessment, and risk management. They enable practitioners to identify trends, predict outcomes, and assess potential risks and opportunities. Additionally, regulatory compliance requirements and the need for legal departments to demonstrate cost-effectiveness and value generation are driving the demand for analytics solutions. Moreover, advancements in artificial intelligence and machine learning algorithms are enhancing the capabilities of legal analytics, making it a key growth area within the legal technology market.

Regional Segment Analysis of the Legal Technology Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

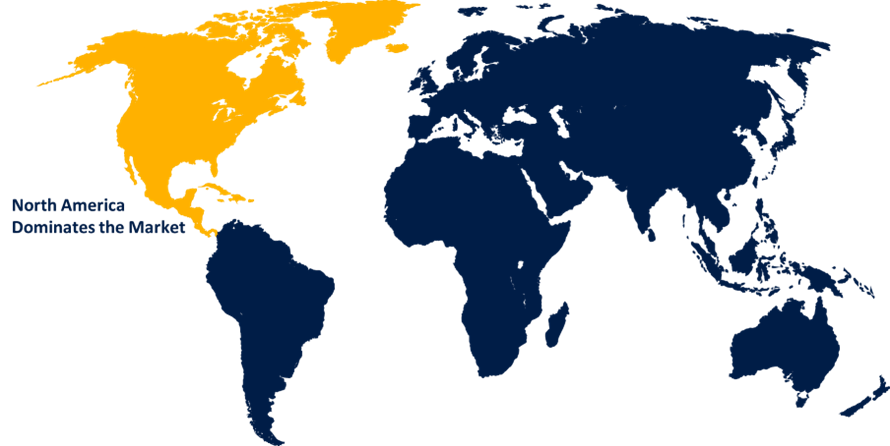

North America dominated the market with more than 45.3% revenue share in 2022.

Get more details on this report -

Based on region, North America has held the largest market share in the legal technology market, and several factors contribute to this dominance, because the region is home to some of the world's largest and most influential legal markets, such as the United States and Canada. These countries have well-established legal systems and a high demand for advanced technology solutions to streamline legal processes. Furthermore, North America boasts a mature and competitive legal technology ecosystem, with a strong presence of leading legal tech companies, start-ups, and venture capital investments. Additionally, the region has a high level of technology adoption across industries, which extends to the legal sector. The robust infrastructure, availability of skilled professionals, and strong regulatory framework also contribute to North America's leadership in the legal technology market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global legal technology market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Companies:

- Icertis, Inc.

- Filevine Inc.

- DocuSign, Inc.

- Casetext Inc.

- ProfitSolv, LLC

- Knovos, LLC

- Mystacks, Inc.

- Practice Insight Pty Ltd.

- TimeSolv Corporation

- Themis Solutions Inc.

- Everlaw, Inc.

- LexisNexis Legal & Professional Company

Key Target Audience

- Market Players

- Investors

- End-Users

- Government Authorities

- Consulting and Research Firm

- Venture Capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In April 2023, Demands.ai was released by Filevine Inc., and it offers an easier and faster approach to construct demand letters by utilising the vine platform and artificial intelligence. By combining the advanced capabilities of the vine platform with AI technology, Demands.ai sets a new standard for expediency and effectiveness in the demanding field of legal communication.

- In January 2023, LexisNexis Legal & Professional Company launched Law360 Canada, a comprehensive legal news portal catering to the Canadian market. This platform offers up-to-date insights, trends, and developments in both legal and business practices, serving as an indispensable resource for professionals seeking the latest news and information in the legal field.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2019 to 2032. Spherical Insights has segmented the global legal technology market based on the below-mentioned segments:

Legal Technology Market, By Solution

- Software

- Services

Legal Technology Market, By Type

- E-discovery

- Legal Research

- Practice Management

- Analytics

- Compliance

- Document Management

- Contract Lifecycle Management

- Time-Tracking & Billing

- Others

Legal Technology Market, By End-User

- Law Firms

- Corporate Legal Departments

- Others

Legal Technology Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?