Latin America Casualty Reinsurance Market Size, Share, and COVID-19 Impact Analysis, By Type (Treaty Reinsurance, Facultative Reinsurance, Excess of Loss, Quota Share, Stop Loss, and Others), By Application (Commercial & Industrial, Personal, Infrastructure & Construction, Healthcare & Life Sciences, Transportation & Logistics, and Others), and Latin America, Casualty Reinsurance Market Insights, Industry Trend, Forecasts to 2035

Industry: Banking & FinancialLatin America Casualty Reinsurance Market Insights Forecasts to 2035

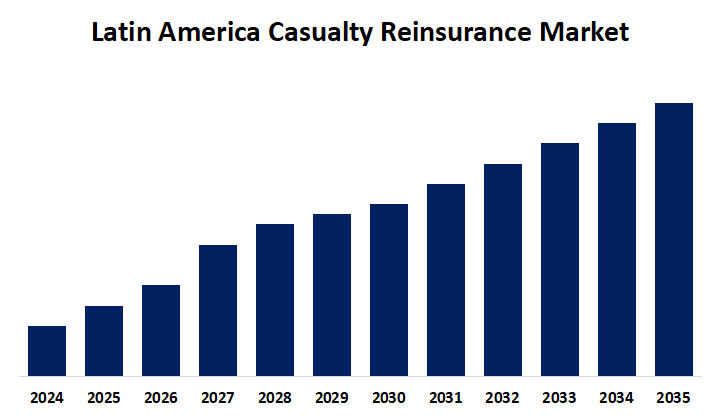

- The Latin America Casualty Reinsurance Market Size is Expected to Grow at a CAGR of 6.2% from 2025 to 2035

- The Latin America Casualty Reinsurance Market Size is Expected to Hold a Significant Share by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Latin America casualty reinsurance market is expected to hold a significant share by 2035, at a CAGR of 6.2% during the forecast period 2025-2035. Rising insurance penetration, advantageous pricing circumstances, the need for diverse risk solutions, regulatory improvements, and growing interest from around the world in underwriting capacity and market expansion are some of the opportunities in the Latin America casualty reinsurance market.

Market Overview

The industry in the region that underwrites and transfers risk related to casualty insurance, such as general liability, workers' compensation, and personal injury coverage, is known as the Latin America casualty reinsurance market. In this sector, reinsurers improve solvency and underwriting capacity by offering primary insurers financial protection against significant or unforeseen losses. Exposure to natural disasters, sovereign risk, and worldwide pricing trends all influence the Latin America casualty reinsurance market. The need for varied risk management solutions, legislative changes, and rising insurance penetration all have a positive effect on growth. A number of structural, economic, and regulatory elements work together to support the growth and stability of the Latin American casualty reinsurance market. Increased insurance coverage, economic expansion in important countries, legislative changes, the need for diverse risk solutions, the involvement of international reinsurers, and technology developments in data analytics and catastrophe modeling for accurate underwriting are some of the driving forces in the Latin America casualty reinsurance market.

Report Coverage

This research report categorizes the market for Latin America casualty reinsurance market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Latin America casualty reinsurance market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Latin America casualty reinsurance market.

Latin America Casualty Reinsurance Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 6.2% |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 225 |

| Tables, Charts & Figures: | 119 |

| Segments covered: | By Type, By Application |

| Companies covered:: | Munich Re, Swiss Re, SCOR SE, Hannover Re, Lloyd’s of London, Everest Re, AXA XL Reinsurance, PartnerRe, TransRe, Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Rising awareness of risk management and financial protection, together with growing insurance coverage across personal and business lines, are important drivers in Latin America casualty reinsurance market. Profitability and market stability are influenced by rigorous underwriting procedures and favorable worldwide reinsurance pricing circumstances. The Latin America casualty reinsurance market is driven by a number of important factors that contribute to its resilience and expansion. Growing awareness of risk management and financial security is reflected in the growing prevalence of insurance across personal and commercial lines.

Restraining Factors

The Latin America casualty reinsurance market is restricted by a number of factors, including sovereign risk, inflation-driven claims expenses, regulatory ambiguity, a lack of data infrastructure, vulnerability to natural disasters, and economic volatility.

Market Segmentation

The Latin America casualty reinsurance market share is classified into type and application.

- The treaty reinsurance segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Latin America casualty reinsurance market is segmented by type into treaty reinsurance, facultative reinsurance, excess of loss, quota share, stop loss, and others. Among these, the treaty reinsurance segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. A more comprehensive, pre-existing contract between the insurer and the reinsurer to cover particular risk categories is known as treaty reinsurance. Treaty reinsurance trends point to a move toward more open and cooperative alliances.

- The healthcare & life sciences segment held a largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Latin America casualty reinsurance market is segmented by application into commercial & industrial, personal, infrastructure & construction, healthcare & life sciences, transportation & logistics, and others. Among these, the healthcare & life sciences segment held a largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. Increasing healthcare demands and growing life sciences activities are the main drivers of the healthcare & life sciences industry. Growing investment in regional health infrastructure and demographic trends are expected to support it.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Latin America casualty reinsurance market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Munich Re

- Swiss Re

- SCOR SE

- Hannover Re

- Lloyd’s of London

- Everest Re

- AXA XL Reinsurance

- PartnerRe

- TransRe

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Latin America, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Latin America casualty reinsurance market based on the below-mentioned segments

Latin America Casualty Reinsurance Market, By Type

- Treaty Reinsurance

- Facultative Reinsurance

- Excess of Loss

- Quota Share

- Stop Loss

- Others

Latin America Casualty Reinsurance Market, By Application

- Commercial & Industrial

- Personal

- Infrastructure & Construction

- Healthcare & Life Sciences

- Transportation & Logistics

- Others

Need help to buy this report?