Japan Water Purifier Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Activated Carbon Filters, UV Water Purifiers, and RO Water Purifiers), By End User (Residential, Commercial), By Distribution Channel (Online, Offline), and Japan Water Purifier Market Insights, Industry Trend, Forecasts to 2035.

Industry: Consumer GoodsJapan Water Purifier Market Insights Forecasts to 2035

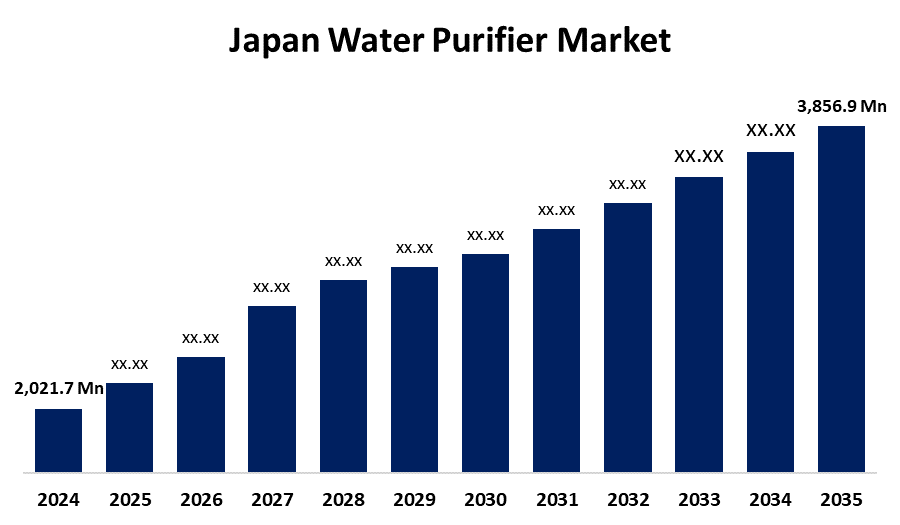

- The Japan Water Purifier Market Size Was Estimated at USD 2,021.7 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.05% from 2025 to 2035

- The Japan Water Purifier Market Size is Expected to Reach USD 3,856.9 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Japan Water Purifier Market Size is Anticipated to reach USD 3,856.9 Million By 2035, Growing at a CAGR of 6.05% from 2025 to 2035. The Japanese water purifier market is expanding as a result of growing consumer knowledge about waterborne disorders and impurities, increasing interest in clean drinking water, improved filtration technology, and many type of governmental efforts promoting safety in water.

Market Overview

The water purifier market originates from all the global and local trades around the equipment and technology for water purification, related to the end-use of drinking water, and for domestic as well as industrial applications. The market’s growth is driven by the potential population growth and demand for supplies of clean drinking water, and by increasing awareness and concerns about water quality. Safe and clean drinking water is prevalent in Japan because of modern culture and modernity. Therefore, there is a potential market opportunity for introducing advanced water purification technologies to the end-user.

In Japan, Water purifiers have gained popularity as a result of health concerns and worries of contaminated water. The demand for higher-quality filtration products is increasing to meet consumer demands as they start realizing the potential health risks of contamination. This is compounded by relevant government programs and regulations aimed at improving drinking water quality that create awareness in the public. In addition, improvements and technological advancements in water filtration systems using reverse osmosis, UV purifiers, or multi-stage filtration systems have raised customers’ awareness, increased the effectiveness of purifications, and can now be marketed much better.

Furthermore, sustainable and eco-friendly consumer preferences have led to improvements, with more energy-efficient and reusable water purifying systems being considered. The market is growing from increased household numbers and increased demand from the commercial sector. Expansion opportunities for leading participants in the Japanese water purifier market are fueled by increasing health consciousness, technological advances, and demand for premium water. The market continues to be projected to grow and create opportunities for players in the market to diversify their product portfolio, enter new segments, and develop new filtration technologies.

Residual chlorine performance standards in municipal drinking water treatment plants are one of the strictest drinking water quality stipulations the Japanese government maintains. Water purifiers must fulfil performance, quality, and safety regulations set by JWPM (Japan Water Purifier Market Standard). This covers filtration specifications, purification capacities, and materials used in production. In addition, the Japanese Government actively promotes environmentally friendly water purifiers and encourages the development of products that reduce plastic waste and promote sustainability.

Report Coverage

This research report categorizes the market for the Japan water purifier market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan water purifier market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan water purifier market.

Japan Water Purifier Market Report Coverage

| Report Coverage | Details |

|---|---|

| No. of Pages: | 177 |

| Tables, Charts & Figures: | 90 |

Get more details on this report -

Driving Factors

The recent large population growth in Japan has also led to changes in the water purifier industry. Higher water usage has been simplified through urbanization, and the ongoing population increase means more housing and a greater necessity for water purifiers in residential units as people want their drinking water to come from clean and pure sources. Along with usage in homes, population increases have resulted in an increased demand for commercial water purification systems for water filtration systems used in restaurants, hotels, workplaces, etc. The demographic transition creates a need to implement and maintain accessible, effective, and efficient water purification systems that satisfy the needs of a rapidly increasing population. In addition, the number of health-based consumers is also fuelling the expansion of the water purifier industry. As individuals become aware of drinking contaminated water, the number of individuals transitioning to purifiers to ensure they have clean drinking water is increasing on a daily basis, it is the growth of the water purifier industry. Moreover, with consumers heading towards a healthier lifestyle, it has always been easier to purchase water purifiers, which can remove impurities but keep the mineral content. Furthermore, new smart technologies, for example, Internet of Things (IoT) ready purifiers, have also increased consumer convenience and system effectiveness, with additional problems solved, like neglected filter replacement notifications and monitoring the real-time performance of purified water. Overall, these technological developments are transitioning water purifiers from standard devices to sophisticated, essential components of Japanese lifestyles.

Restraining Factors

The first major challenge that restrain the market growth is the high initial cost. Some purification systems, such as reverse osmosis (RO) systems or multi-stage filtration systems, are sophisticated purification systems that can seem expensive to price-oriented customers. A second challenge facing the Japanese water purifier industry is the presence of counterfeit products. As confirmed, market demand for water purification devices is growing, and low-quality and unverified purifiers have entered the market and undermined consumer confidence. These products mostly fail to meet performance and safety criteria, exposing consumers to drinking contaminated water. Health threats may arise from incorrect filtering or ineffective purifying practices from counterfeit products, potentially impacting the industry's reputation as a whole. In addition, customers may face even more complex choices if unable to differentiate between genuine, quality purifiers and sub-standard imitations.

Market Segmentation

The Japan water purifier market share is classified into product type, end users, and distribution channels.

- The RO water purifiers segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan water purifier market is segmented by product type into activated carbon filters, UV water purifiers, and RO water purifiers. Among these, the RO water purifiers segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. RO water filters target bottled water quality that fosters segmentation growth, removing 99 percent of impurities. Consumers target these filters to treat hard water because of their outstanding ability to eliminate harmful minerals. The growing awareness of contaminants in drinking water due to increased incidences of waterborne diseases will drive growth throughout the forecast period.

- The residential segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan water purifier market is segmented by end user into residential, commercial. Among these, the residential segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment's expansion is attributed to the increasing concern for human health and growing fears about the safety of tap water. In addition, as more people are moving into urban living and the choices of obtaining clean drinking water in the home are limited, more households are purchasing home purifiers to have access to cleaner water in their daily lives. Technology advancements, awareness of environmentally friendly and energy-efficient products, and supply chain management have all affected the market.

- The offline segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan water purifier market is segmented by distribution channel into online, offline. Among these, the offline segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The notable preference for traditional engagement and the reliability of tangible businesses are the reasons for the sector's growth. In Japan, many consumers like to inspect and try products before purchasing them, particularly for high-value products such as water purifiers. Since store channels offer professional advice and customers can see products in action to assist with decision making, retailers play an important role in hand-holding customers. Additionally, Japanese consumers value after-sales services such as installation and periodic maintenance support, easy to access locally and offline.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan water purifier market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Toray Industries, Inc.

- Genzon Water

- Panasonic Corporation

- Toray Industries, Inc.

- Hitachi, Ltd.

- Toshiba Corporation

- Mitsubishi group (Cleansui)

- Kurita Water Industries Ltd

- Kuraray Aqua Co., LTD

- Others

Recent Developments:

- In November 2023, OSG Japan has designed a water filtration technology In recognition of the essential nature of water for human metabolism and overall health. The Alkaline Hydrogen Water System was developed specifically to improve the quality of the water and to help the body to absorb it as efficiently as possible. The Alkaline Hydrogen Water System improves the quality of water and adds hydrogen and critical antioxidants to the water to neutralize the dangerous free radicals in the body.

- In May 2023, Toray Industries, Inc. announced the TorayvinoTM Cassetty 310MX faucet-mounted water purifier. It contains only one cartridge. Retailers will determine the price. It will be sold in mass retailers, home centers, appliance stores, and other retailers across Japan.This purifier is also the first in the TorayvinoTM line to use a lever made of antibacterial resin that will allow users to tap or filtered water.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan Water Purifier Market based on the below-mentioned segments

Japan Water Purifier Market, By Product Type

- Activated Carbon Filters

- UV Water Purifiers

- RO Water Purifiers

Japan Water Purifier Market, By End User

- Residential

- Commercial

Japan Water Purifier Market, By Distribution Channel

- Online

- Offline

Need help to buy this report?