Japan Water Pumps Market Size, Share, and COVID-19 Impact Analysis, By Pump Type (Centrifugal, Positive Displacement, and Others), By Driving Force (Electric Driven and Engine Driven), By End-User (Oil and Gas, Chemical, Power Generation, Water and Wastewater, and General Industry), and Japan Water Pumps Market Insights, Industry Trend, Forecasts to 2035

Industry: Machinery & EquipmentJapan Water Pumps Market Insights Forecasts to 2035

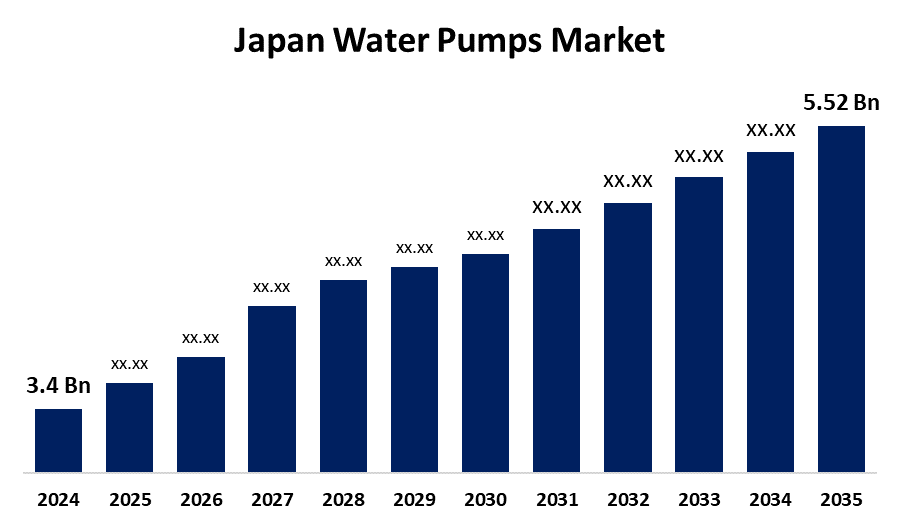

- The Japan Water Pumps Market Size Was Estimated at USD 3.4 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 4.50% from 2025 to 2035

- The Japan Water Pumps Market Size is Expected to Reach USD 5.52 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Japan Water Pumps Market Size is Anticipated to Reach USD 5.52 Billion by 2035, Growing at a CAGR of 4.50% from 2025 to 2035. The Japan water pump market is growing due to urbanization, industrial growth, and the requirement for optimized water management owing to aging infrastructure and natural calamities. Emerging technologies such as energy-saving pumps and intelligent monitoring systems are also driving market expansion.

Market Overview

The Japan water pump market refers to the design, manufacturing, and application of pumps required for water supply, irrigation, wastewater treatment, and industrial usage. These pumps play a significant role in agriculture, infrastructure, power generation, and flood protection industries. Some of the key drivers of market growth include Japan's old equipment, increased urbanization, and natural hazard exposure in the form of typhoons and earthquakes. Additionally, pumps with energy-saving designs and intelligent monitoring systems have improved performance and reliability. The application of smart technologies, such as IoT-enabled pumps, allows for real-time monitoring and predictive maintenance, reducing downtime and the cost of operations. The industry is witnessing innovations like variable frequency drives (VFDs), energy-efficient design, and smart control systems, improving performance and operating efficiency. The need for high-performance, energy-efficient pumps provides opportunities for market expansion, particularly in the upgrading or replacement of older systems to improve performance and reduce maintenance costs. The Japanese market for water pumps is characterized by an overwhelming focus on innovation, sustainability, and durability from both technology push and government policies.

Report Coverage

This research report categorizes the market for the Japan water pumps market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan water pumps market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan water pumps market.

Japan Water Pumps Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 3.4 Billion |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 4.50% |

| 2035 Value Projection: | USD 5.52 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 170 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Pump Type, By Driving Force, By End-User and COVID-19 Impact Analysis. |

| Companies covered:: | Torishima Pump Mfg. Co., Ltd, Ebara Corporation, Flowserve Corporation, KSB SE & Co. KGaA, WILO SE, Tsurumi Manufacturing Co., Ltd, Sulzer Ltd, Xylem, ITT INC, The Weir Group PLC, and Others. |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The demand in Japan's water pumps market is fuelled by urbanization, aging water infrastructure, and disaster resilience requirements arising from recurring natural disasters like floods and earthquakes. The rising scope for energy-efficient, smart water management also boosts the market. Technological innovation, such as IoT integration and variable frequency drives, improves pump efficiency and monitoring. Government policies encouraging sustainable water utilization and energy saving also improve the implementation of advanced water pumps in municipal, industrial, and agricultural applications, fuelling continued growth in Japan water pumps market.

Restraining Factors

The Japan water pumps market faces restraints from high initial investment costs, complex installation processes, and maintenance challenges. Additionally, market saturation in urban areas and limited awareness of advanced technologies hinder wider adoption.

Market Segmentation

The Japan water pumps market share is classified into pump type, driving force, and end user.

- The centrifugal segment held the largest market share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

The Japan water pumps market is segmented by pump type into centrifugal, positive displacement, and others. Among these, the centrifugal segment held the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Centrifugal segment is due to its widespread use in industries requiring high flow rates and moderate pressure, such as water distribution and wastewater treatment. They are recommended for their simple design, ease of maintenance, and cost-effectiveness.

- The electric-driven segment dominated the market in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan water pumps market is segmented by driving force into electric-driven and engine-driven. Among these, the electric-driven segment dominated the market in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Electric-driven is due to their energy efficiency and ease of maintenance, and environmentally friendly features. With the electric motor as their power, these pumps have very wide applications, anything from residential water supply to systems in large industrial operations.

- The oil and gas segment held the largest market share in 2024 and is expected to grow at a substantial CAGR during the forecast period.

The Japan water pumps market is segmented by end-user into oil and gas, chemical, power generation, water and wastewater, and general industry. Among these, the oil and gas segment held the largest market share in 2024 and is expected to grow at a substantial CAGR during the forecast period. This is attributed to an Increase in the utilization of water pumps in the oil and gas sector can rise in demand for energy. New technologies in water pumps enable efficient separation processes for liquids and gases.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan water pumps market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Torishima Pump Mfg. Co., Ltd

- Ebara Corporation

- Flowserve Corporation

- KSB SE & Co. KGaA

- WILO SE

- Tsurumi Manufacturing Co., Ltd

- Sulzer Ltd

- Xylem

- ITT INC

- The Weir Group PLC

- Others

Recent Developments:

- In March 2023, Ebara Corporation, a leading Japanese pump manufacturer, launched an IoT-enabled centrifugal pump in March 2023 specifically optimized for desalination plants, which are critical for addressing water scarcity and supporting sustainable water use.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan water pumps market based on the below-mentioned segments:

Japan Water Pumps Market, By Pump Type

- Centrifugal

- Positive Displacement

- Others

Japan Water Pumps Market, By Driving Force

- Electric Driven

- Engine Driven

Japan Water Pumps Market, By End-User

- Oil and Gas

- Chemical

- Power Generation

- Water and Wastewater

- General Industry

Need help to buy this report?