Japan Washing Machine Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Fully Automatic (Front Load, Top Load), Semi-Automatic, and Washer-Dryer Combos), By End User (Commercial and Residential), By Distribution Channel (Supermarkets & Hypermarkets, Exclusive Stores, Multi-branded Stores, and Online), and Japan Washing Machine Market Insights, Industry Trend, Forecasts to 2035

Industry: Consumer GoodsJapan Washing Machine Market Insights Forecasts to 2035

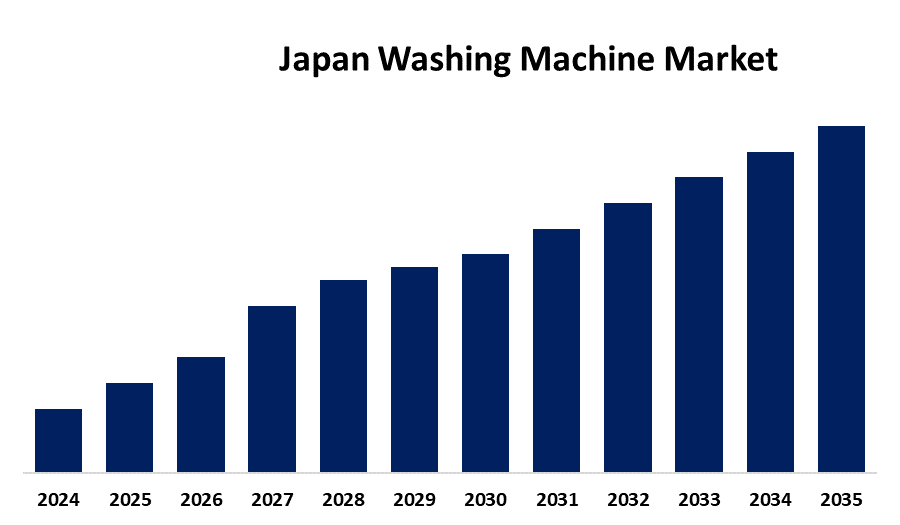

- The Japan Washing Machine Market Size is Expected to Grow at a CAGR of around 4.48% from 2025 to 2035

- The Japan Washing Machine Market Size is expected to hold a significant share by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Japan Washing Machine Market Size is expected to hold a significant share by 2035, Growing at a CAGR of 4.48% from 2025 to 2035. The market is driven by rising demand for energy-efficient appliances, technological innovations in smart washing machines, and changing consumer lifestyles emphasizing convenience.

Market Overview

The Japan washing machine market refers to the industry focused on manufacturing, distributing, and selling washing machines for residential and commercial use. The market for washing machines in Japan is expanding steadily due to factors such as growing urbanization, increased disposable income, and technological developments. The need for appliances that save space has increased as more people live in smaller apartments, leading manufacturers to create stylish and useful washing machines. Additionally, consumers are demonstrating a desire for smart appliances, as evidenced by the growing popularity of energy-efficient models, AI-driven washing cycles, and automatic detergent dispensing. Additionally, the use of water-saving and environmentally friendly gadgets has increased due to growing environmental awareness. Accessibility has been further enhanced by the growth of e-commerce platforms, which have made washing machines more widely available. All of these elements work together to influence how the washing machine market in Japan is developing.

Report Coverage

This research report categorizes the market for the Japan washing machine market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan washing machine market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan washing machine market.

Japan Washing Machine Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 4.48% |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 98 |

| Segments covered: | By Product Type, By Distribution Channel, By End User and COVID-19 Impact Analysis |

| Companies covered:: | Hitachi, Panasonic, Toshiba, Sharp, Whirlpool Corporation, Electrolux Group, Miele, LG Electronics, Haier Japan, Samsung Electronics, Midea Group, Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

The growing need for smart and energy-efficient appliances, along with shifting customer preferences that place a higher value on convenience, are driving the washing machine market in Japan. Approximately 4.9 million washing machines are sold in Japan each year, compared to 110 million units sold globally. This reflects the high washing machine adoption rate in Japan, where buyers are choosing more expensive, high-tech models. The demand for vertical-type washing machines in Japan is gradually expanding, driven by their space-saving design and effective washing capabilities. Because of these characteristics, they are perfect for small urban living areas where making the most of available space is crucial. Approximately 85% of all washing machine sales in Japan are vertical-type machines, which currently dominate the market due to this strong consumer desire. Additionally, the increasing import value of household washing machines, which reached ¥155 billion in Japan in 2024, reflects the rising domestic demand for advanced and high-performance washing appliances. This growing reliance on imports highlights the country's continuous need to meet consumer expectations for innovative and efficient washing solutions

Restraining Factors

The high upfront expenditures of sophisticated models, stringent environmental laws, and competition from international brands are, nevertheless, deterrents. The market's expansion is also hampered by the small living quarters of Japanese homes, the volatility of raw material costs, and shifting consumer tastes toward multipurpose appliances.

Market Segmentation

The Japan washing machine market share is classified into product type, end user, and distribution channel.

- The fully automatic segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan washing machine market is segmented by product type into fully automatic (front load, top load), semi-automatic, and washer-dryer combos. Among these, the fully automatic segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because of their short wash cycles, easy operation, and vertical design that saves space. Top-load fully automatic machines are particularly favored in Japan's small urban houses. Additionally, they are more affordable than front-loading machines, which increases sales volume.

- The residential segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan washing machine market is segmented by end user into commercial and residential. Among these, the residential segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. A washing machine is owned by more than 95% of Japanese households, demonstrating a very high level of product penetration in the residential market. Due to the traditional predilection for personal home laundry care, the commercial sector (such as hotels and laundromats) is still relatively tiny.

- The multi-branded stores segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan washing machine market is segmented by distribution channel into supermarkets & hypermarkets, exclusive stores, multi-branded stores, and online. Among these, the multi-branded stores segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. Japanese shoppers favor stores with multiple brands because they can evaluate models, pricing, and brands in one location before deciding what to buy.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan washing machine market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Hitachi

- Panasonic

- Toshiba

- Sharp

- Whirlpool Corporation

- Electrolux Group

- Miele

- LG Electronics

- Haier Japan

- Samsung Electronics

- Midea Group

- Others

Recent Development

- In June 2023, Wash Plus Co., Ltd. has started a demonstration project for a "drain-less" laundromat that reduces wastewater usage by filtering and reusing wastewater after laundry

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan Washing Machine Market based on the below-mentioned segments:

Japan Washing Machine Market, By Product Type

- Fully Automatic

- Front Load

- Top Load

- Semi-Automatic

- Washer-Dryer Combos

Japan Washing Machine Market, By End User

- Commercial Use

- Residential Use

Japan Washing Machine Market, By Distribution Channel

- Supermarkets & Hypermarkets

- Exclusive Stores

- Multi-branded Stores

- Online

Need help to buy this report?