Japan Vascular Surgery and Endovascular Procedures Market Size, Share, and COVID-19 Impact Analysis, By Procedure (Aneurysm Repair, Bypass Surgery, Carotid Angioplasty and Stenting, Endovascular Repair, and Others), By End-User (Hospitals, Surgical Centers, Academic and Research Institutions, and Others), and Japan Vascular Surgery and Endovascular Procedures Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareJapan Vascular Surgery and Endovascular Procedures Market Insights Forecasts to 2035

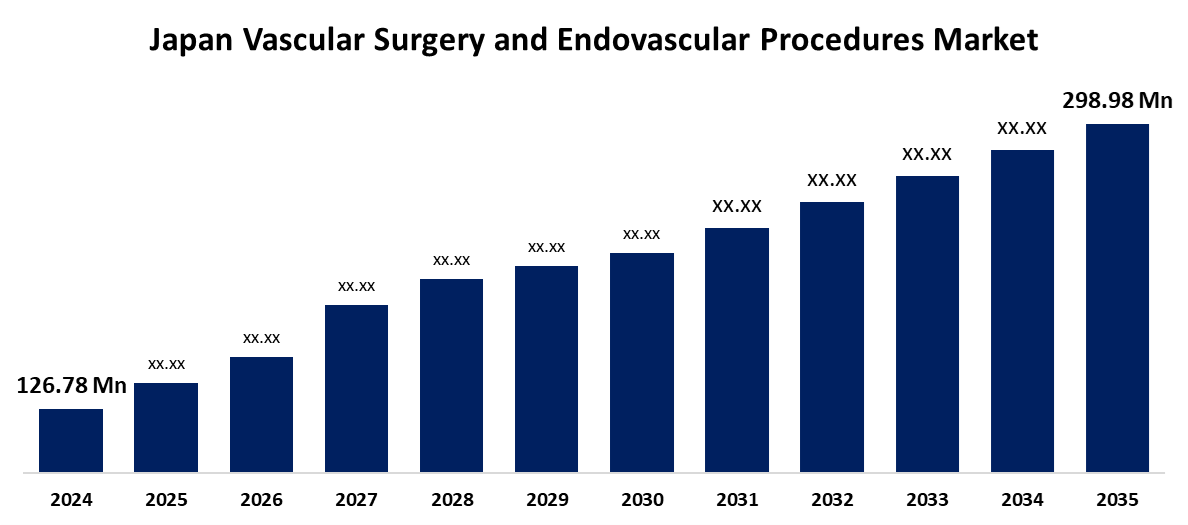

- The Japan Vascular Surgery and Endovascular Procedures Market Size Was Estimated at USD 126.78 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 8.11% from 2025 to 2035

- The Japan Vascular Surgery and endovascular procedures Market Size is Expected to Reach USD 298.98 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The Japan Vascular Surgery and Endovascular Procedures Market Size is anticipated to Reach USD 298.98 Million by 2035, Growing at a CAGR of 8.11% from 2025 to 2035. This market is primarily driven by Japans rapidly aging population, which faces a higher prevalence of conditions like peripheral artery disease and aortic aneurysms.

Market Overview

The Japan Vascular Surgery And Endovascular Procedures Market Size refers to the segment of healthcare focused on diagnosing and treating vascular diseases using both open and minimally invasive techniques. The market for vascular surgery and endovascular operations in Japan has grown rapidly, which is indicative of the nation's changing healthcare requirements and technical developments. The main factor propelling market expansion in Japan is the country's increasingly aging population. More than one in ten people is over 80, and more than one-third of the population is 65 or older. Vascular procedures are necessary for vascular illnesses such as peripheral arterial disease (PAD), aortic aneurysms, varicose veins, and stroke, which are more common as a result of this demographic change. Advanced stents, drug-eluting balloons, and robotic-assisted navigation are examples of innovations in minimally invasive endovascular procedures that have increased therapeutic accessibility, safety, and effectiveness. As a result, more people in Japan are using these techniques.

Report Coverage

This research report categorizes the market for the Japan vascular surgery and endovascular procedures market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan vascular surgery and endovascular procedures market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan vascular surgery and endovascular procedures market.

Japan Vascular Surgery and Endovascular Procedures Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 126.78 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 8.11% |

| 2035 Value Projection: | USD 298.98 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 185 |

| Tables, Charts & Figures: | 92 |

| Segments covered: | By Procedure, By End-User |

| Companies covered:: | Terumo Corporation, Olympus Corporation, FUJIFILM Holdings Corporation, Mizuho Medical Co., Ltd., Nipro Corporation, Shimadzu Corporation, and Other Key Companies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The aging population in Japan is a major factor propelling the growth of the vascular surgery and endovascular procedures market. The World Economic Forum claims that Japan is becoming increasingly elderly. About 10% of the population is 80 years of age or older. An estimated 36.23 million people, or about a third of the population, are over 65. Age-related increases in stroke risk are mostly caused by carotid artery disease, a prevalent vascular disease in the elderly. Given the strong association between advanced age and the prevalence of vascular disorders, Japan's aging population is a major factor driving the market for vascular surgery and endovascular operations.

Restraining Factors

The high upfront costs of these treatments nonetheless put a significant strain on the healthcare system and, indirectly, on patients through higher insurance premiums or government subsidies, even though Japan's national health insurance system caps out-of-pocket spending. The government has even contemplated increasing the maximum amount that patients must pay out of pocket, which, if not handled appropriately, may further deter use.

Market Segmentation

The Japan vascular surgery and endovascular procedures market share is classified into procedure and end-user.

- The endovascular repair segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan vascular surgery and endovascular procedures market is segmented by procedure into aneurysm repair, bypass surgery, carotid angioplasty and stenting, endovascular repair, and others. Among these, the endovascular repair segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. Endovascular techniques, which only involve tiny incisions or punctures and result in less stress, quicker healing, and shorter hospital stays, are becoming more and more popular among patients and doctors as an alternative to open surgery.

- The hospitals segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan vascular surgery and endovascular procedures market is segmented by end-user into hospitals, surgical centers, academic and research institutions, and others. Among these, the hospitals segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. Hospitals' extensive infrastructure, cutting-edge surgical tools, and supply of skilled vascular surgeons are the main causes of this dominance.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan vascular surgery and endovascular procedures market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Terumo Corporation

- Olympus Corporation

- FUJIFILM Holdings Corporation

- Mizuho Medical Co., Ltd.

- Nipro Corporation

- Shimadzu Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan Vascular Surgery and Endovascular Procedures Market based on the following segments:

Japan Vascular Surgery and Endovascular Procedures Market, By Procedure

- Aneurysm Repair

- Bypass Surgery

- Carotid Angioplasty and Stenting

- Endovascular Repair

- Others

Japan Vascular Surgery and Endovascular Procedures Market, By End-User

- Hospitals

- Surgical Centers

- Academic and Research Institutions

- Others

Need help to buy this report?