Japan Vascular Closure Devices Market Size, Share, and COVID-19 Impact Analysis, By Product (Passive Approximators, Active Approximators, and External Hemostatic Devices), By Procedure (Interventional Cardiology and Interventional Radiology/Vascular Surgery), By End-User (Hospitals, Ambulatory Surgical Centers, and Others), and Japan Vascular Closure Devices Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareJapan Vascular Closure Devices Market Insights Forecasts to 2035

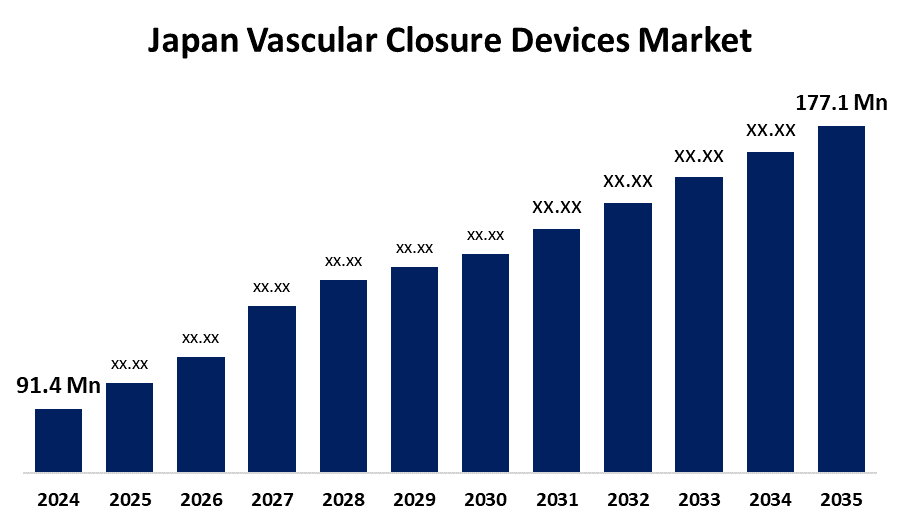

- The Japan Vascular Closure Devices Market Size Was Estimated at USD 91.4 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.2% from 2025 to 2035

- The Japan Vascular Closure Devices Market Size is Expected to Reach USD 177.1 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Japan vascular closure devices market is anticipated to reach USD 177.1 million by 2035, growing at a CAGR of 6.2% from 2025 to 2035. The Japan vascular closure devices market is growing due to rising cardiovascular diseases, an aging population, and a preference for minimally invasive procedures, which are fueling the need for efficient arterial puncture closure techniques post-angiogram and catheterization.

Market Overview

The Japan vascular closure devices market refers to specialized medical devices intended to close blood vessels following catheter-based procedures. The devices are applied to obtain hemostasis, minimize bleeding complications, and ensure quicker recovery of patients in cardiovascular interventions and minimally invasive procedures. Japan's vascular closure devices market benefits from strong technological infrastructure, a robust healthcare system, and increasing adoption of minimally invasive procedures. Opportunities include expanding applications in interventional cardiology, regulatory support for innovation, and growing demand for efficient patient recovery solutions. The market is typified by a range of product types, ranging from passive approximators such as collagen plugs, active approximators in the form of suture-based and clip-based devices, and external hemostatic devices. Government programs, including the Society 5.0 vision, encourage the incorporation of high-tech facilities like VCDs to improve healthcare efficiency and patient outcomes.

Report Coverage

This research report categorizes the market for the Japan vascular closure devices market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan vascular closure devices market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan vascular closure devices market.

Japan Vascular Closure Devices Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 91.4 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 6.2% |

| 2035 Value Projection: | USD 177.1 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 130 |

| Segments covered: | By Product, By Procedure and COVID-19 Impact Analysis. |

| Companies covered:: | Terumo Corporation, Medtronic, Cardinal Health, Vasorum Ltd., Teleflex Incorporated, Asahi Intecc Co., Ltd., Haemonetics Corporation, Merit Medical Systems, Teleflex Incorporated, Vivasure Medical Ltd, Boston Scientific Corporation, Abbott and Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market is further complemented by a robust healthcare infrastructure as well as cultural acceptance of technological developments in Japan. Increasing population and the growth in cardiovascular diseases drive the Japan vascular closure devices market due to the need for minimally invasive procedures. Increased recognition of quicker recovery of patients, fewer complications, and shorter stays at hospitals drives adoption. Device development advances through technology, increasing safety and effectiveness, and improving market growth. Moreover, government efforts to improve healthcare innovation and robust healthcare infrastructure facilitate the adoption of vascular closure devices in hospitals and surgery centers in Japan.

Restraining Factors

The Japan vascular closure devices market is hindered by high costs of devices, rigorous regulatory approvals, and a lack of skilled practitioners, all of which restrict universal use and impede the efficient use of these devices in healthcare.

Market Segmentation

The Japan vascular closure devices market share is classified into product, procedure, and end-user.

- The passive approximators segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan vascular closure devices market is segmented by product into passive approximators, active approximators, and external hemostatic devices. Among these, the passive approximators segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to the increasing need for minimally invasive surgical methods increases the adoption of vascular closure devices that attain hemostasis without active compression, lowering patient pain and healing time. Improvements in design and materials improve safety and effectiveness, while regulatory clearances and clinical validations continue to enhance acceptance in interventional procedures.

- The interventional cardiology segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan vascular closure devices market is segmented by procedure into interventional cardiology and interventional radiology/vascular surgery. Among these, the interventional cardiology segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is owing to the worldwide incidence of cardiovascular diseases, spurred by unhealthy lifestyles and aging populations, which boosts demand for cutting-edge treatments such as PCI and TAVR. The trend spurs interventional cardiology growth, bolstered by technological innovations in stents, imaging, and catheters, improving safety, efficacy, and patient choice for less invasive treatments.

- The hospitals segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan vascular closure devices market is segmented by end-user into hospitals, ambulatory surgical centers, and others. Among these, the hospitals segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is attributed to the increasing need for advanced medical care and treatments is which fuels the demand for highly equipped hospitals with highly trained professionals. Increased chronic and age-related illnesses boost hospital admissions, necessitating a wide variety of devices such as imaging equipment, surgical equipment, and monitoring devices for successful patient care.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan vascular closure devices market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Terumo Corporation

- Medtronic

- Cardinal Health

- Vasorum Ltd.

- Teleflex Incorporated

- Asahi Intecc Co., Ltd.

- Haemonetics Corporation

- Merit Medical Systems

- Teleflex Incorporated

- Vivasure Medical Ltd

- Boston Scientific Corporation

- Abbott

- Others

Recent Developments:

- February 14, 2024, Terumo Medical Corporation launched a new manufacturing facility in Caguas, Puerto Rico, to meet rising worldwide demand for its Angio-Seal® Vascular Closure Device. Angio-Seal enables rapid hemostasis, accelerates patient mobility, and supports same-day discharge after angiographic or interventional procedures.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan vascular closure devices market based on the below-mentioned segments:

Japan Vascular Closure Devices Market, By Product

- Passive Approximators

- Active Approximators

- External Hemostatic Devices

Japan Vascular Closure Devices Market, By Procedure

- Interventional Cardiology

- Interventional Radiology/Vascular Surgery

Japan Vascular Closure Devices Market, By End-User

- Hospitals

- Ambulatory Surgical Centers

- Others

Need help to buy this report?