Japan Used Car Market Size, Share, and COVID-19 Impact Analysis, By Type (Hatchbacks, Sedan, Sports Utility Vehicles, Others), By Fuel Type (Gasoline, Diesel, Others), By Sales Channel (Online, Offline), and Japan Used Car Market Insights Forecasts to 2032

Industry: Automotive & TransportationJapan Used Car Market Insights Forecasts to 2032

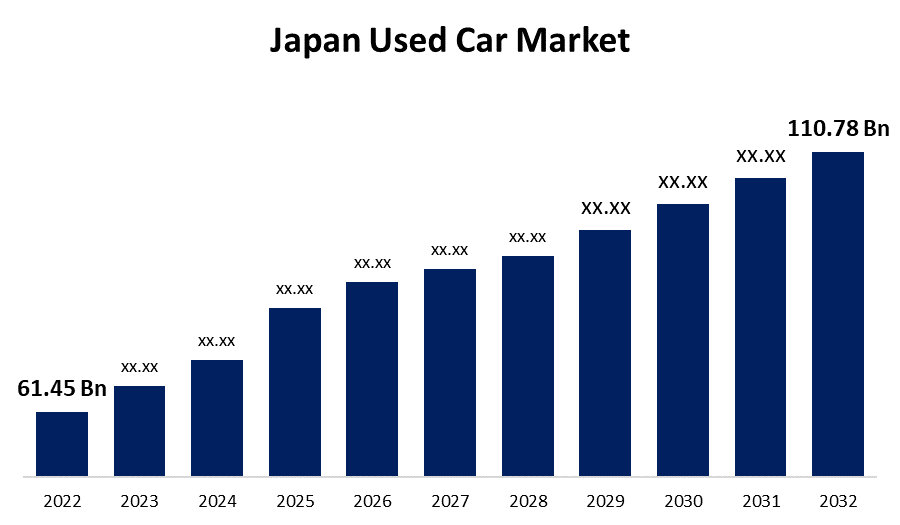

- The Japan Used Car Market Size was valued at USD 61.45 Billion in 2022.

- The Market is Growing at a CAGR of 6.07% from 2022 to 2032.

- The Japan Used Car Market Size is expected to reach USD 110.78 Billion by 2032.

Get more details on this report -

The Japan Used Car Market Size is Expected to reach USD 110.78 Billion by 2032, at a CAGR of 6.07% during the forecast period 2022 to 2032.

Market Overview

A used car is any vehicle that has been previously licensed or registered, including demonstration (demo) vehicles. It does not include vehicles or their parts that have been scrapped or used as spares and cannot be sold as a working vehicle. Customers in the nation seem to favor used cars over new ones, not only because they are less costly but also because many of the latter are still fairly new, having only been on the market for three to seven years, and are in excellent condition, making them very doable options. Furthermore, consumers have been drawn to the used car market by the superior value-added services offered by online used car trading platforms in comparison to traditional used car selling techniques. These value-added services help the Japanese used car market expand while giving customers peace of mind. In addition, as used car retailers are using digitalization to make market offerings appealing, the used car market in Japan is becoming more organized as smartphone and internet penetration rises. Features like the vast array of images and videos on the internet platform and the simple online instant financing services are luring more buyers to used cars.

Report Coverage

This research report categorizes the market for Japan's used car market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japanese used car market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japanese used car market.

Japan Used Car Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 61.45 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 6.07% |

| 2032 Value Projection: | USD 110.78 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 221 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Type, By Fuel Type, By Sales Channel, and COVID-19 Impact Analysis. |

| Companies covered:: | USS Co., Ltd, ORIX Auto Corporation, Yokohama Toyopet, Trust Co Ltd, Autocom Japan Inc, Crown Japan, SBT Japan, Mobilico, Carsensor Net, Proto Corporation and Other Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Japanese used car market is anticipated to grow significantly due to rising digitization and companies' ability to offer immersive purchase experiences remotely. In addition, several finance companies that offer credit for used cars and an increase in value-added service offerings are anticipated to support the expansion of the used car market in Japan. Higher interest rates, however, might deter some prospective buyers, which would impede the market's expansion. The market is expanding due to other factors as well, like rising income levels, a growing desire among owners of two-wheelers to upgrade to smaller, more compact cars, shorter car ownership durations, booming import-export, and an increase in the demand for luxury cars. which is anticipated to fuel market expansion in Japan.

Restraining Factors

Disruptions in the automobile supply chain can limit the availability of pre-owned cars, which in turn limits the used cars in Japan. In addition to affecting the production of new cars, factors like shortages of semiconductors can also restrict the number of trade-ins and lower the total amount of used cars available on the Japanese market. These shortages may result in higher prices and fewer options for buyers of used cars.

Market Segment

- In 2022, the sports utility vehicles segment accounted for the largest revenue share over the forecast period.

Based on the type, the Japanese used car market is segmented into hatchbacks, sedans, sports utility vehicles, and others. Among these, the sports utility vehicles segment has the largest revenue share over the forecast period. Sport utility vehicles are a type of vehicle that combines the features of a truck and a car. They are typically larger and heavier than other cars and have a higher ground clearance, making them ideal for off-road driving. SUVs come in various sizes, from compact to full-size, and are known for their spacious interiors and powerful engines. These factors make them suitable for driving in different terrains and weather conditions.

- In 2022, the gasoline segment accounted for the largest revenue share over the forecast period.

Based on fuel type, the Japanese used car market is segmented into gasoline, diesel, and others. Among these, the gasoline segment has the largest revenue share over the forecast period. For several strong reasons, used cars that run on gasoline are still in high demand. The widespread fueling stations and vast infrastructure that support gasoline-powered vehicles add to their practicality. Gasoline cars are more affordable upfront than alternative fuel vehicles, which appeal to a wide range of consumers. Furthermore, consumers are reassured about accessibility to maintenance and repairs due to the well-established technology and familiarity with gasoline engines.

- In 2022, the online segment is expected to hold the largest share of the Japanese used car market during the forecast period.

Based on the sales channel, the Japanese used car market is classified into online and offline. Among these, the online segment is expected to hold the largest share of the Japanese used car market during the forecast period. Connecting with sellers and buyers has become simpler through online resources. Dealers have significant opportunities for market growth because they can also access information online, such as prices, specifications, and reviews. Digitally savvy customers are empowered by online dealers who offer them comprehensive end-to-end buying capabilities, exclusive delivery options, a wealth of vehicle photos, data, and search tools.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within Japan's used car market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- USS Co., Ltd

- ORIX Auto Corporation

- Yokohama Toyopet

- Trust Co Ltd

- Autocom Japan Inc

- Crown Japan

- SBT Japan

- Mobilico

- Carsensor Net

- Proto Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- On August 2022, the luxury automobile manufacturer from Japan launched a new program for buying and selling used Lexus cars. Through the new Lexus Certified Program, current Lexus owners will be able to sell their cars and prospective buyers will be able to purchase pre-owned cars that have undergone a thorough inspection.

Market Segment

This study forecasts revenue at regional, and country levels from 2021 to 2032. Spherical Insights has segmented the Japan used car market based on the below-mentioned segments:

Japan Used Car Market, By Type

- Hatchbacks

- Sedan

- Sports Utility Vehicles

- Others

Japan Used Car Market, By Fuel Type

- Gasoline

- Diesel

- Others

Japan Used Car Market, By Sales Channel

- Online

- Offline

Need help to buy this report?