Japan UAV Market Size, Share, and COVID-19 Impact Analysis, By UAV Class (Micro UAVs, Mini UAVs, Small UAVs, and Tactical UAVs), By End User (Government & Defense, Energy, Power, Oil & Gas, Construction & Mining, and Agriculture), and Japan UAV Market Insights, Industry Trend, Forecasts to 2035

Industry: Aerospace & Defense

Japan UAV Market Insights Forecasts to 2035

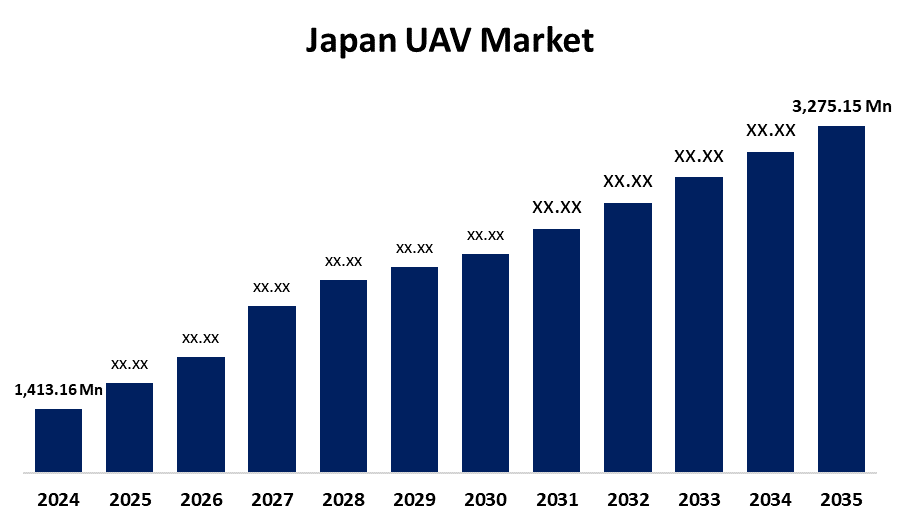

- The Japan UAV Market Size Was Estimated at USD 1,413.16 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 7.94% from 2025 to 2035

- The Japan UAV Market Size is Expected to Reach USD 3,275.15 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The Japan UAV Market Size is anticipated to reach USD 3,275.15 Million by 2035, growing at a CAGR of 7.94% from 2025 to 2035. The market is driven by rising demand for surveillance and monitoring, especially in the defense and infrastructure sectors.

Market Overview

The Japan UAV (unmanned aerial vehicle) market encompasses the development, production, and deployment of drones for applications across defense, agriculture, logistics, infrastructure monitoring, and disaster management. Japan's UAV market is mostly driven by the defense industry, which is placing an increasing focus on improving observation and reconnaissance capabilities. The Japan Air Self-Defense Force, for example, has observed a rise in the employment of UAVs for intelligence collection and border monitoring operations. With multiple successful testing carried out in the East China Sea, UAVs have become an essential part of Japan's maritime surveillance activities, according to a report by the defense industry. Research and development of UAVs, with an emphasis on AI-enhanced autonomous systems, has received significant support from the Ministry of Defense. In order to create next-generation UAVs with sophisticated data processing capabilities, a top defense contractor established a partnership with a domestic tech startup. The strategic significance of UAVs has been further illustrated by their incorporation into cooperative military drills with allies.

Report Coverage

This research report categorizes the market for the Japan UAV market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan UAV market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan UAV market.

Japan UAV Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1,413.16 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 7.94% |

| 2035 Value Projection: | USD 3,275.15 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 266 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By UAV Class and By End User |

| Companies covered:: | AeroVironment, Inc., Northrop Grumman Corp., BAE Systems Plc, Lockheed Martin Corp., ACSL Ltd., Boeing Co., and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Japan's agricultural industry is adopting unmanned aerial vehicles (UAVs) more and more in an effort to increase efficiency and output. According to a Ministry of Agriculture, Forestry, and Fisheries assessment, for example, the number of farms that use drones to spray crops has more than doubled in recent years. Precision farming is using UAVs to help farmers better monitor crop health, evaluate soil conditions, and control irrigation systems. One of the top manufacturers of agricultural drones claimed that their UAVs have greatly decreased farmers' use of pesticides while increasing crop yields. Pilot trials showing significant labor savings and increased productivity have further pushed the deployment of UAVs under the Japanese government's "Smart Agriculture" plan.

Restraining Factors

The extensive deployment of UAVs is restricted by severe regulatory frameworks and airspace restrictions, notwithstanding their robust growth. Limited cargo capacity and high initial investment costs make commercial scalability difficult. Adoption is further hampered by public mistrust and privacy concerns about drone monitoring. Technical obstacles also include low battery life and interaction with current systems.

Market Segmentation

The Japan UAV market share is classified into UAV class and end user.

- The micro UAVs segment accounted for the largest revenue in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan UAV market is segmented by UAV class into micro UAVs, mini UAVs, small UAVs, and tactical UAVs. Among these, the micro UAVs segment accounted for the largest revenue in 2024 and is expected to grow at a significant CAGR during the forecast period. Micro UAVs have become more and more common in urban settings, such as the heavily populated parts of Tokyo, where they are utilized for short-range surveillance and internal inspections of high-rise buildings.

- The construction & mining segment accounted for the largest revenue in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan UAV market is segmented by end user into government & defense, energy, power, oil & gas, construction & mining, and agriculture. Among these, the construction & mining segment accounted for the largest revenue in 2024 and is expected to grow at a significant CAGR during the forecast period. Using UAVs to survey large-scale projects and track progress has resulted in significant time and cost savings for big construction corporations in the field of infrastructure assessment.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan UAV market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- AeroVironment, Inc.

- Northrop Grumman Corp.

- BAE Systems Plc

- Lockheed Martin Corp.

- ACSL Ltd.

- Boeing Co.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan UAV Market based on the below-mentioned segments:

Japan UAV Market, By UAV Class

- Micro UAVs

- Mini UAVs

- Small UAVs

- Tactical UAVs

Japan UAV Market, By End User

- Government & Defense

- Energy

- Power

- Oil & Gas

- Construction & Mining

- Agriculture

Need help to buy this report?