Japan Tuna Market Size, Share, and COVID-19 Impact Analysis, By Type (Canned, Fresh, and Frozen), By Species (Skipjack, Yellowfin, Albacore, Bigeye, and Bluefin), By End User (Residential/Retail and Commercial/HoReCa), and Japan Tuna Market Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesJapan Tuna Market Insights Forecasts to 2035

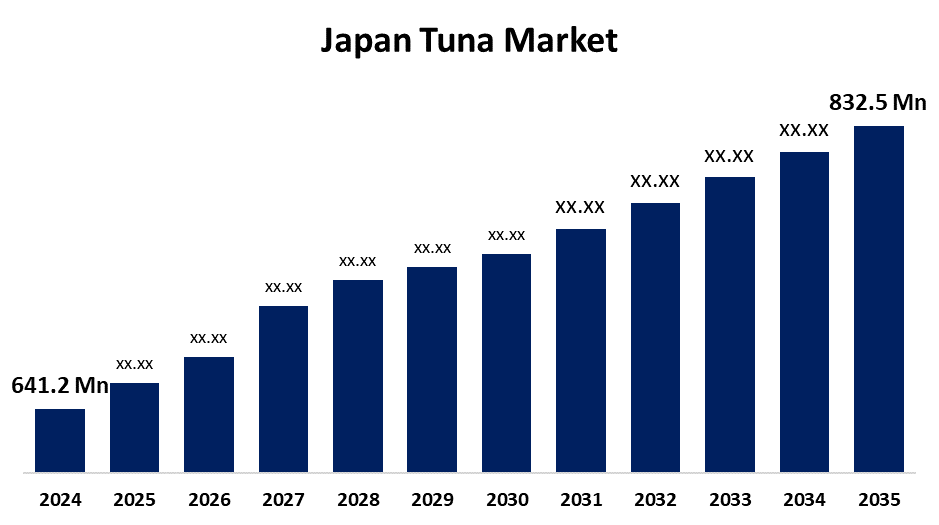

- The Japan Tuna Market Size was Estimated at USD 641.2 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 2.4% from 2025 to 2035

- The Japan Tuna Market Size is Expected to Reach USD 832.5 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The Japan tuna market Size is anticipated to reach USD 832.5 Million by 2035, growing at a CAGR of 2.4% from 2025 to 2035. The Japan tuna market is undergoing strong growth due to robust domestic demand for sushi and sashimi, international popularity of Japanese food, and developments in sustainable aquaculture and processing technologies.

Market Overview

Japan's tuna market refers to an important sector of the country's seafood industry, involving a number of major species like bluefin, yellowfin, bigeye, and skipjack. Tuna is highly ingrained in Japanese cuisine, greatly used in sushi, sashimi, canned foods, and convenience foods. Japan's high-tech fishing fleet, cold chain transport, and processing facilities provide immense added value to the sector. The opportunities exist in increasing exports, value-added, and organic product investment, and embracing sustainable aquaculture techniques such as tuna ranching in order to ease pressure on wild stocks. Technological advancements in traceability and certification are also growth opportunities. The market is backed by strong domestic demand and international renown for top-grade tuna. Principal market drivers are high-protein, low-fat consumer choice in seafood, growing demand for processed and convenience tuna products, and expanding concern about sustainable sourcing. Government efforts, under the leadership of Japan's Fisheries Agency, encompass enforcement of Total Allowable Catch (TAC) regimes, encouraging responsible fishing, and investment in fishery sustainability and resources management.

Report Coverage

This research report categorizes the market for the Japan tuna market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan tuna market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan tuna market.

Japan Tuna Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 641.2 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 2.4% |

| 2035 Value Projection: | USD 832.5 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 270 |

| Tables, Charts & Figures: | 99 |

| Segments covered: | By Type, By Species and By End User |

| Companies covered:: | Nissui Corporation, Maruha Nichiro Corporation, Fujimitsu Corporation, Itoham Foods Inc., Mitsubishi Corporation, Sapporo Holdings Limited, Sojitz Corporation, Ajinomoto Co., Inc., Kyokuyo Co., Ltd., Daiwa Foods Co., Ltd., and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Japan's tuna market is fueled by strong domestic demand for tuna for use in sushi, sashimi, and convenience foods, as well as growing health consciousness in favor of high-protein seafood. Product quality and supply efficiency improve due to technology advancements in fishing and cold storage. The growing popularity of sustainable and traceable sourcing methods, supported by a certification like MSC, increases consumer trust. In addition, increasing demand for high-quality Japanese tuna and increases in processed and ready-to-eat tuna products also drive the market's consistent expansion.

Restraining Factors

Japan's tuna market is restricted by overfishing issues, severe overseas fishing restrictions, and unstable stocks of tuna. Heightened environmental regulations, intensified operational expenditures, and greater competition from other protein alternatives also hinder persistent market growth.

Market Segmentation

The Japan Tuna Market share is classified into type, species, and end user.

- The canned segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan tuna market is segmented by type into canned, fresh and frozen. Among these, the canned segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The canned segment is owing to its affordability, shelf life, and versatility in the preparation of numerous recipes in salads, sandwiches, or casseroles, making it a repeat bestseller within homes on a global scale. It is also a provider of cost-effective nutrition, which responds to the growing demand for healthy yet affordable food products.

- The skipjack segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan tuna market is segmented by species into skipjack, yellowfin, albacore, bigeye, and bluefin. Among these, the skipjack segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to its large population and huge output in large volumes at affordable prices. Skipjack is also versatile when it comes to application in food preparation and is widely used in canned, frozen, and ready-to-consumer products, which is appealing to a broad base of consumers.

- The residential/retail segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan tuna market is segmented by end user into residential/retail and commercial/horeca. Among these, the residential/retail segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The number of retail outlets carrying a wide variety of tuna products increases with economic growth and urbanization, further driving market growth. In addition, the increasing popularity of Online shopping channels has enabled tuna products to reach customers more conveniently, allowing them to easily shop and purchase a range of products from the comfort of their own homes.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan tuna market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Nissui Corporation

- Maruha Nichiro Corporation

- Fujimitsu Corporation

- Itoham Foods Inc.

- Mitsubishi Corporation

- Sapporo Holdings Limited

- Sojitz Corporation

- Ajinomoto Co., Inc.

- Kyokuyo Co., Ltd.

- Daiwa Foods Co., Ltd.

- Others

Recent Developments:

- In May 2024, Maruha Nichiro Corporation collaborated with East Japan Railway and the University of Tokyo to make the "Planetary Health Diet" popular, which, among other green food methods, has as its goal tuna being sustainably source tuna for the next 100 years.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan tuna market based on the below-mentioned segments:

Japan Tuna Market, By Type

- Canned

- Fresh

- Frozen

Japan Tuna Market, By Species

- Skipjack

- Yellowfin

- Albacore

- Bigeye

- Bluefin

Japan Tuna Market, By End User

- Residential/Retail

- Commercial/HoReCa

Need help to buy this report?