Japan Tire Market Size, Share, and COVID-19 Impact Analysis, By Vehicle Type (Passenger Cars, Light Commercial Vehicles, Medium and Heavy Commercial Vehicles, Two Wheelers, Three Wheelers, Off-The-Road (OTR)), By End-User (OEM, Replacements), By Distribution Channel (Online Distributors, Offline Distributors), and Japan Tire Market Insights, Industry Trend, Forecasts to 2032.

Industry: Automotive & TransportationJapan Tire Market Insights Forecasts to 2035

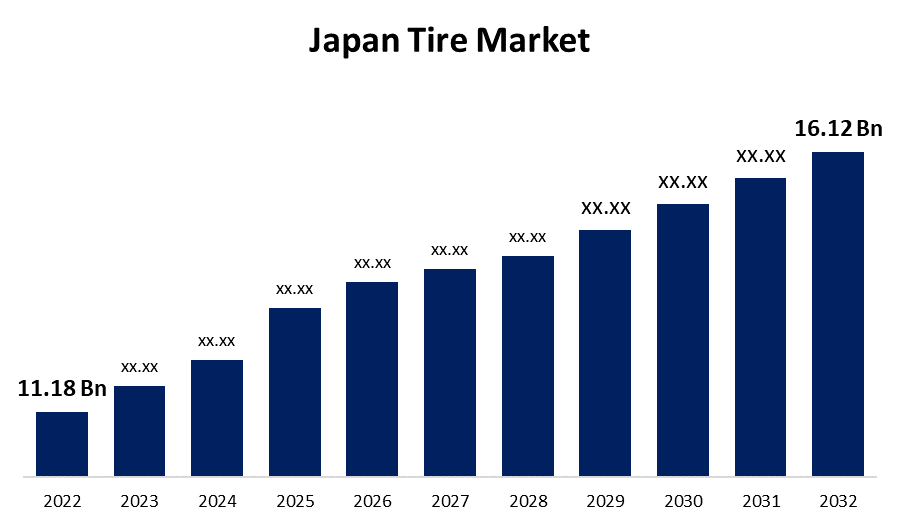

- The Japan Tire Market Size was estimated at USD 7436.8 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 3.57% from 2025 to 2035

- The Japan Tire Market Size is Expected to Reach USD 10932.9 Million by 2035

Get more details on this report -

The Japan Tire Market is anticipated to reach USD 10932.9 million by 2035, growing at a CAGR of 3.57% from 2025 to 2035.

Japan Tire Market

The Japan tire market is a well-established and technologically advanced sector within the countrys automotive industry. It encompasses a wide variety of tires used in passenger cars, commercial vehicles, and specialty applications. Tires in this market are available in different categories such as radial, bias, tubeless, and tube-type, catering to the needs of both original equipment manufacturers (OEMs) and the replacement segment. Japan's strong automotive heritage and precision manufacturing standards have contributed to the production of high-quality, durable, and performance-oriented tires. Major domestic manufacturers like Bridgestone, Yokohama Rubber, and Toyo Tires hold a dominant presence, along with several international players. The market benefits from regular tire replacement practices, seasonal demand (especially for winter tires), and a widespread service network. With an emphasis on quality, innovation, and safety, the Japan tire market continues to maintain its reputation as one of the most reliable and quality-conscious tire industries in the global landscape.

Attractive Opportunities in the Japan Tire Market

- Japan is increasingly embracing environmentally friendly initiatives, driving demand for tire recycling technologies and sustainable disposal methods. This trend aligns with the global push toward circular economies and offers opportunities for companies specializing in eco-friendly tire production, recycling processes, and materials innovation.

- The accelerating adoption of electric and hybrid vehicles in Japan is creating a strong need for specialized tires that offer low rolling resistance, enhanced durability, and noise reduction. Tire manufacturers can capitalize on this by developing EV-optimized tire lines that cater to performance, efficiency, and safety requirements unique to electric mobility.

- As intelligent transport systems and autonomous vehicles evolve, there's increasing demand for smart tires equipped with sensors to monitor pressure, tread wear, temperature, and road conditions in real-time. Collaborations between tire manufacturers and tech firms can lead to innovative products that support connected mobility and fleet management.

Japan Tire Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 7436.8 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 3.57% |

| 2035 Value Projection: | USD 10932.9 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Distribution, By Vehicle Type, and COVID-19 Impact Analysis |

| Companies covered:: | Bridgestone Corporation, Yokohama Rubber Co., Ltd., Toyo Tire Corporation, Sumitomo Rubber Industries, Ltd., Nitto Tire, Kumho Tire Japan, Michelin Japan Co., Ltd., Continental Japan K.K., Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Japan Tire Market Dynamics

DRIVER: Increasing popularity of electric and hybrid vehicles has led to the development

One of the primary drivers is the country’s robust automotive industry, which includes a high concentration of vehicle manufacturers and a steady demand for both OEM and replacement tires. Japan's strict safety and environmental regulations also promote the use of high-quality, fuel-efficient, and low-emission tires, encouraging innovation in tire design and materials. Seasonal demand, particularly for winter and snow tires, further boosts sales due to Japan's varied climate across regions. The increasing popularity of electric and hybrid vehicles has led to the development of specialized tires tailored for low rolling resistance and noise reduction. Additionally, rising consumer awareness regarding road safety and vehicle performance has enhanced demand for premium, durable, and technologically advanced tires. The integration of smart technologies and tire sensors is also gaining momentum, supporting the evolution of intelligent mobility solutions in Japan.

RESTRAINT: Strict government rules on safety and the environment

The Japan tire market faces some key challenges that affect its growth. One major issue is that the market is already mature, with fewer new vehicles being added and a declining population reducing overall car usage. As people drive less, tires take longer to wear out, leading to slower replacement demand. The aging population also means fewer people are buying or driving cars regularly. Rising prices of raw materials like rubber and oil increase production costs, making it harder for companies to keep prices competitive. Strict government rules on safety and the environment, while important, make tire manufacturing more complex and costly. Japanese tire makers also face tough competition from cheaper imported brands, which can affect their sales. Lastly, changes in global trade and weaker demand in export markets can hurt Japanese companies that rely on selling tires abroad. These factors together create pressure on the market’s overall performance.

OPPORTUNITY: Rising demand for tire recycling and sustainable disposal methods

One promising area is the rising demand for tire recycling and sustainable disposal methods, driven by growing environmental awareness and circular economy initiatives. This opens doors for companies offering eco-friendly tire solutions and recycling technologies. Another opportunity lies in the development of tires specifically designed for electric vehicles (EVs), which have different performance needs such as lower rolling resistance and noise reduction. The growth of shared mobility services and autonomous vehicles also creates demand for smart tires equipped with sensors to monitor wear, pressure, and road conditions in real-time. Additionally, the expansion of e-commerce in auto parts and accessories has made online tire sales and digital tire services more accessible to consumers, creating a new distribution channel. Collaborations between tire manufacturers and technology firms can further drive innovation, leading to advanced tire systems integrated with intelligent transport networks.

CHALLENGES: Japan’s risk of natural disasters like earthquakes and typhoons

The Japan tire market also faces some new and unique challenges. As electric and self-driving vehicles become more common, tire makers need to create more advanced and customized tires quickly. This constant need for innovation requires heavy investment and can be difficult for smaller companies to manage. Making tires for different types of modern vehicles also makes production more complex and time-consuming. Another problem is Japan’s risk of natural disasters like earthquakes and typhoons, which can interrupt manufacturing and supply chains without warning. On top of this, the country’s aging population and shortage of skilled workers make it hard to find and keep experienced employees in tire factories. Finally, more people in cities are using shared transport or driving less, which could lower future demand for personal vehicle tires. These changes require tire companies to adapt quickly to stay competitive in the market.

Japan Tire Market Ecosystem Analysis

The Japan tire market ecosystem consists of major manufacturers like Bridgestone, Yokohama, and Toyo, supported by raw material suppliers, OEMs, and aftermarket distributors. It includes a well-established supply chain involving production, logistics, and retail, both offline and increasingly online. Government regulations ensure high safety and environmental standards, while R&D centers and testing facilities drive innovation. Consumers, fleet operators, and emerging sectors like EVs and smart mobility fuel demand. Tire recycling and sustainability initiatives are also becoming vital components, making the ecosystem both technologically advanced and environmentally focused.

Based on the distribution channel, the aftermarket accounted for the largest revenue share and is expected to grow at a remarkable CAGR over the forecast period

Get more details on this report -

The aftermarket segment accounted for the largest revenue share in the Japan tire market and is projected to grow at a remarkable CAGR over the forecast period. This growth is driven by Japans large and aging vehicle fleet, frequent tire replacement due to safety concerns and seasonal weather changes, especially in northern regions requiring winter tires. Additionally, consumer preference for high-quality replacement tires and the widespread availability of service centers and retail outlets contribute to sustained demand. The rise of e-commerce platforms and mobile tire-fitting services further boosts aftermarket expansion by enhancing accessibility and convenience.

Based on the vehicle type, the passenger cars segment led the market with the largest revenue share and is expected to grow at a substantial CAGR over the forecast period

The passenger cars segment dominance is attributed to the high number of passenger vehicles on Japanese roads, consistent replacement demand, and a strong culture of vehicle maintenance among consumers. Urbanization, improved road infrastructure, and the popularity of compact and hybrid vehicles further support tire consumption in this segment. Additionally, advancements in tire technology and growing interest in fuel-efficient and low-noise tires are expected to sustain growth in the passenger car category.

Key Market Players

KEY PLAYERS IN THE JAPAN TIRE MARKET INCLUDE

- Bridgestone Corporation

- Yokohama Rubber Co., Ltd.

- Toyo Tire Corporation

- Sumitomo Rubber Industries, Ltd.

- Nitto Tire

- Kumho Tire Japan

- Michelin Japan Co., Ltd.

- Continental Japan K.K.

- Others

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan tire market based on the below-mentioned segments:

Japan Tire Market, By Distribution Channel

- OEM

- Aftermarket

Japan Tire Market, By Vehicle Type

- Two-wheelers

- Passenger Cars

Need help to buy this report?