Japan Thin Wall Packaging Market Size, Share, and COVID-19 Impact Analysis, By Type (Tubs, Jars, Pots, Cups, and Trays), By Materials (Polypropylene (PP), Polyethylene Terephthalate (PET), Polystyrene (PS), Polyethylene (PE), and Polyvinyl Chloride (PVC)), and Japan Thin Wall Packaging Market Insights, Industry Trend, Forecasts to 2035.

Industry: Consumer GoodsJapan Thin Wall Packaging Market Insights Forecasts to 2035

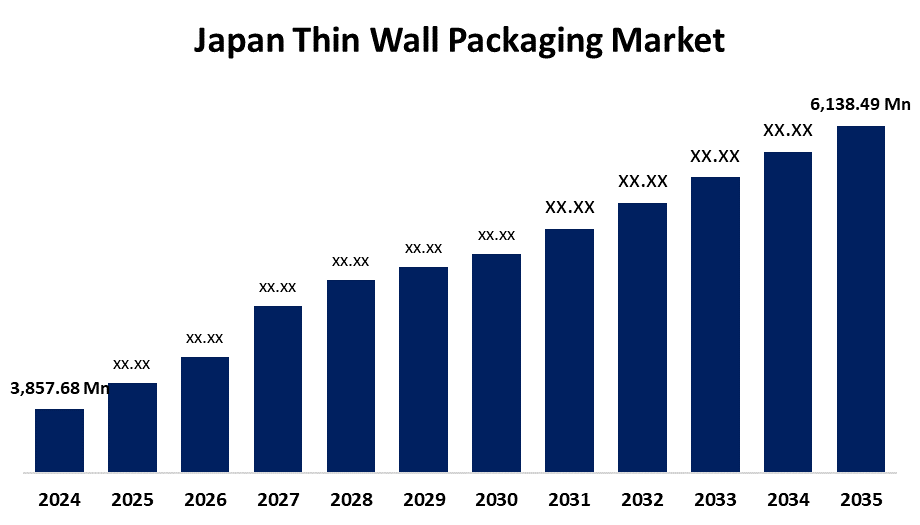

- The Japan Thin wall Packaging Market Size Was Estimated at USD 3,857.68 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.31% from 2025 to 2035

- The Japan Thin Wall Packaging Market Size is Expected to Reach USD 6,138.49 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Japan Thin wall packaging Market Size is anticipated to reach USD 6,138.49 Million by 2035, growing at a CAGR of 4.31% from 2025 to 2035. The market is driven by rising demand for sustainable and eco-friendly packaging, especially in food and beverage sectors.

Market Overview

The Japan thin wall packaging market focuses on lightweight plastic containers, such as tubs, cups, trays, and jars designed with minimal material thickness. The expansion of the thin wall packaging business in Japan has been largely attributed to technological developments in manufacturing techniques and packaging materials. New materials with enhanced strength, durability, and barrier qualities that are lightweight have been created as a result of advancements in polymer technology. With the use of these materials, producers can create thin-wall packaging that is both affordable and effective at safeguarding goods all the way through the supply chain. Furthermore, thin wall packaging can now be produced more precisely and efficiently because of developments in injection molding and other manufacturing processes.

Report Coverage

This research report categorizes the market for the Japan thin wall packaging market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan thin wall packaging market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan thin wall packaging market.

Japan Thin Wall Packaging Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 3,857.68 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 4.31% |

| 2035 Value Projection: | USD 6,138.49 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 233 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Type, By Materials |

| Companies covered:: | Amcor Limited, Berry Global Group, Silgan Holdings Inc., JRD International, Greiner Packaging International GmbH, Plastipak Industries Inc., and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Japanese packaging business has been greatly impacted by the growing environmental concerns and consumer awareness of the effects of plastic waste. Consequently, there is a growing need for environmentally friendly and sustainable packaging options, especially in the thin wall packaging market. Packaging that reduces environmental effect is becoming more and more popular among consumers and businesses, which is propelling the use of recyclable and biodegradable materials. These sustainability objectives are best served by thin wall packaging, which is renowned for using less material and being lightweight. Strict government laws and programs to cut down on plastic trash further encourage this change. In order to encourage recycling and the use of environmentally friendly materials, the Japanese government has put in place a number of rules that push firms to innovate in this area.

Restraining Factors

Manufacturers have difficulties despite expansion due to severe environmental rules and limitations on the use of plastic. Adoption may be hampered by high upfront costs for sophisticated equipment and the limited capacity of some polymers to be recycled. Market expansion is also impacted by consumer preference for biodegradable substitutes and competition from reusable or paper-based packaging. Furthermore, production costs and profitability may be impacted by supply chain interruptions and fluctuations in raw material prices.

Market Segmentation

The Japan thin wall packaging market share is classified into type and materials.

- The tubs segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan thin wall packaging market is segmented by type into tubs, jars, pots, cups, and trays. Among these, the tubs segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. Yogurt, ice cream, and spreads are frequently packaged in tubs because of their ease of use and longevity.

- The polypropylene (PP) segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan thin wall packaging market is segmented by materials into polypropylene (PP), polyethylene terephthalate (PET), polystyrene (PS), polyethylene (PE), and polyvinyl chloride (PVC). Among these, the polypropylene (PP) segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. PP is the market leader because of its affordability and adaptability. Manufacturers prefer PP for food containers, according to a poll conducted by a Japanese packaging association.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan thin wall packaging market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Amcor Limited

- Berry Global Group

- Silgan Holdings Inc.

- JRD International

- Greiner Packaging International GmbH

- Plastipak Industries Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan Thin Wall Packaging Market based on the below-mentioned segments:

Japan Thin Wall Packaging Market, By Type

- Tubs

- Jars

- Pots

- Cups

- Trays

Japan Thin Wall Packaging Market, By Materials

- Polypropylene (PP)

- Polyethylene Terephthalate (PET)

- Polystyrene (PS)

- Polyethylene (PE)

- Polyvinyl Chloride (PVC)

Need help to buy this report?