Japan Thermal Insulation Material Market Size, Share, and COVID-19 Impact Analysis, By Material Type (Fiberglass, Stone Wool, Foam, and Wood Fiber), By Temperature (0-100°C, 100-500°C, and 500°C), and Japan Thermal Insulation Material Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsJapan Thermal Insulation Material Market Insights Forecasts to 2035

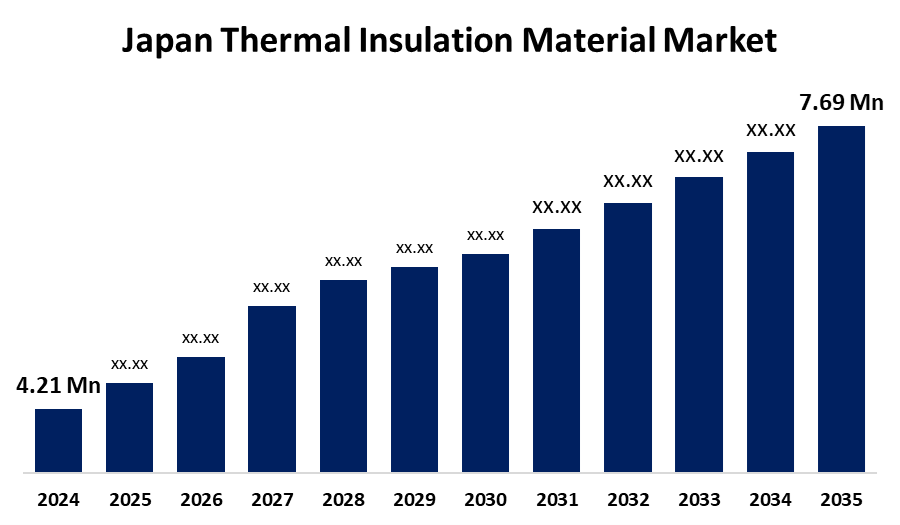

- The Japan Thermal Insulation Material Market Size was Estimated at USD 4.21 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.63% from 2025 to 2035

- The Japan Thermal Insulation Material Market Size is Expected to Reach USD 7.69 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The Japan Thermal Insulation Material Market Size is anticipated to reach USD 7.69 Million by 2035, Growing at a CAGR of 5.63% from 2025 to 2035. The Market Size is driven by stringent energy efficiency regulations, increasing demand for sustainable construction solutions, and rapid urbanization.

Market Overview

The Japan thermal Insulation Material Market Size focuses on materials that reduce heat transfer in buildings, industrial facilities, and vehicles, improving energy efficiency and sustainability. The market for thermal insulation materials in Japan is also significantly influenced by the growing emphasis on environmental preservation and sustainability. To lessen their carbon footprint, businesses and consumers are turning to environmentally friendly insulation options like cellulose, recycled fiberglass, and natural fiber insulation. The use of sustainable insulation technologies is further encouraged by government green building programs and incentives for energy-efficient construction. In response to this trend, manufacturers are spending money on research and development to produce materials that are highly effective in insulating while having a less environmental impact. Demand has been further increased by customers' growing understanding of the advantages of thermal insulation, such as lower energy costs and improved indoor comfort.

Report Coverage

This research report categorizes the market for the Japan thermal insulation material market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan thermal insulation material market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan thermal insulation material market.

Japan Thermal Insulation Material Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 4.21 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.63% |

| 2035 Value Projection: | USD 7.69 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 218 |

| Tables, Charts & Figures: | 108 |

| Segments covered: | By Material Type, By Temperature |

| Companies covered:: | BASF SE, Asahi Kasei Corporation, Saint Gobain SA, Recticel, Kingspan Group, Rockwool International A/S, GAF Material Corporation, and Other Key Companies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Growing energy efficiency standards and the need for sustainable building solutions are driving the thermal insulation material market in Japan. The use of sophisticated insulation materials is encouraged by government programs that encourage energy conservation in both residential and commercial buildings. The market is also driven by the increased emphasis on reducing carbon emissions, as enterprises seek high-performance and environmentally friendly insulation solutions. Rapid infrastructure development and urbanization also increase demand for thermal insulation in a number of industries, such as manufacturing and the automobile sector. Due to their outstanding thermal properties and space-saving advantages, aerogel and vacuum insulation panels are gaining popularity, which is one of the major trends shaping the market. Phase-change materials and other smart insulation technologies are becoming more popular as a way to improve building energy efficiency.

Restraining Factors

The high initial cost of cutting-edge insulation technologies like vacuum insulation panels (VIPs) and aerogels is one of the major obstacles facing the Japanese thermal insulation material market. Compared to traditional insulation materials, the manufacture and installation costs of these materials might be substantially higher, despite their improved thermal efficiency.

Market Segmentation

The Japan thermal insulation material market share is classified into material type and temperature.

- The fiberglass segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan thermal insulation material market is segmented by material type into fiberglass, stone wool, foam, and wood fiber. Among these, the fiberglass segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The most popular material is still fiberglass insulation because of its superior thermal efficiency, affordability, and accessibility.

- The 0-100°C segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan thermal insulation material market is segmented by temperature into 0-100°C, 100-500°C, and 500°C. Among these, the 0-100°C segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The main uses of insulation materials in the 0-100°C range are in residential and commercial settings to preserve energy efficiency and interior comfort.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan thermal insulation material market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- BASF SE

- Asahi Kasei Corporation

- Saint Gobain SA

- Recticel

- Kingspan Group

- Rockwool International A/S

- GAF Material Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan thermal insulation material market based on the below-mentioned segments:

Japan Thermal Insulation Material Market, By Material Type

- Fiberglass

- Stone Wool

- Foam

- Wood Fiber

Japan Thermal Insulation Material Market, By Temperature

- 0-100°C

- 100-500°C

- 500°C

Need help to buy this report?