Japan Testing, Inspection, and Certification (TIC) Market Size, Share, and COVID-19 Impact Analysis, By Service Type (Testing, Inspection, and Certification), By Sourcing Type (Outsourced Source, In-House), and Japan Testing, Inspection, and Certification (TIC) Market Insights, Industry Trend, Forecasts to 2035

Industry: Information & TechnologyJapan Testing, Inspection, and Certification (TIC) Market Size Insights Forecasts to 2035

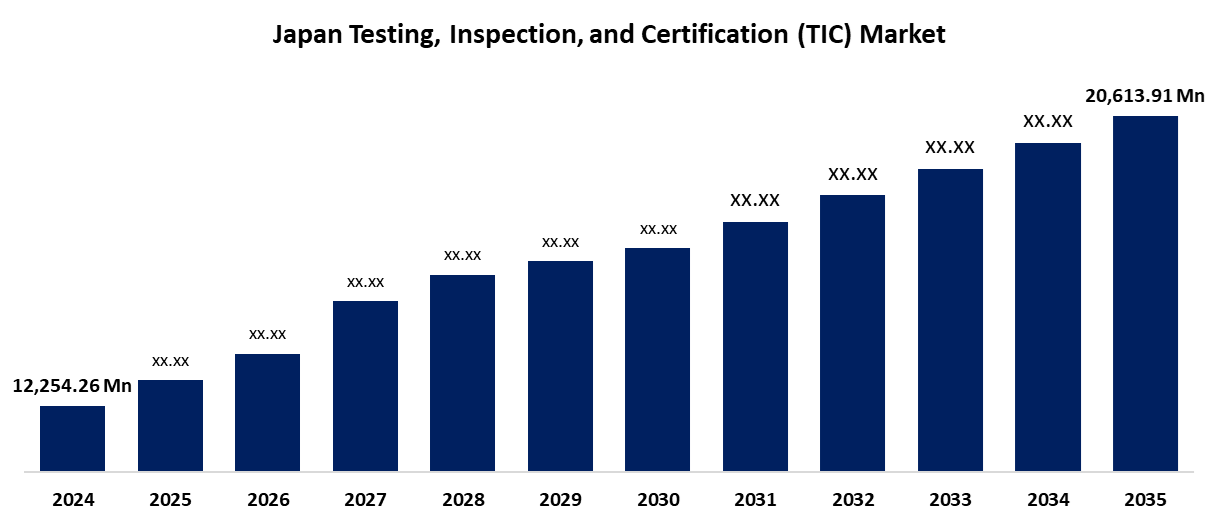

- The Japan Testing, Inspection, and Certification (TIC) Market Size Was Estimated at USD 12,254.26 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.84% from 2025 to 2035

- The Japan Testing, Inspection, and Certification (TIC) Market Size is Expected to Reach USD 20,613.91 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the Japan Testing, Inspection, and Certification (TIC) Market Size is anticipated to reach USD 20,613.91 million by 2035, growing at a CAGR of 4.84% from 2025 to 2035. Japan’s strict regulatory environment and growing emphasis on product safety and global compliance, especially in sectors like automotive, electronics, and healthcare.

Market Overview

The Japan testing, inspection, and certification (TIC) market refers to the industry that ensures products, systems, and services meet regulatory and quality standards through systematic evaluation. Japan has earned a reputation for manufacturing high-quality products, which are backed by strict laws and guidelines to guarantee product safety.For example, with over 10,773 standards as of March 2019, compliance with the voluntary Japan Industrial Standards (JIS) is essential in the automotive industry.Nearly 743 distinct industrial product categories are covered by these standards, which are overseen by the Ministry of Economy, Trade, and Industry (METI). The Electrical Appliances and Materials Safety Act governs 457 goods in the electronics industry and makes sure that electrical appliances adhere to strict safety standards.The Ministry of Agriculture, Forestry and Fisheries (MAFF) created the Japan Agricultural Standards (JAS), which regulate a broad range of goods in the food and beverage industry.

Report Coverage

This research report categorizes the market for the Japan testing, inspection, and certification (TIC) market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan testing, inspection, and certification (TIC) market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan testing, inspection, and certification (TIC) market.

Japan Testing, Inspection, and Certification (TIC) Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 12,254.26 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 4.84% |

| 2035 Value Projection: | USD 20,613.91 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 148 |

| Tables, Charts & Figures: | 125 |

| Segments covered: | By Service Type, By Sourcing Type and COVID-19 Impact Analysis |

| Companies covered:: | SGS SA, American Bureau of Shipping, AmSpec LLC, Apave Group, Applus Services S.A, AsureQuality Ltd, and Other key vendors |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market for testing, inspection, and certification in Japan is fueled by stricter regulations, a growing need for quality control, and increasingly intricate industrial procedures. The efficiency and precision of testing and inspection services are being improved by technological developments, especially in the areas of automation and digitization. The market is also expanding as a result of increased international trade and the requirement to adhere to international standards. The incorporation of artificial intelligence (AI) and the Internet of Things (IoT) into inspection procedures, as well as the trend toward environmental compliance and sustainability, are emerging developments that are becoming important concerns for industry stakeholders.

Restraining Factors

The market faces restraints such as low adoption of advanced technologies, which limits efficiency and scalability. Additionally, high operational costs, fragmented service demand across industries, and a shortage of skilled professionals for specialized testing and certification tasks hinder growth. The complexity of international standards and integration challenges with legacy systems also slow down modernization efforts

Market Segmentation

The Japan Testing, inspection, and certification (TIC) market share is classified into service type and sourcing type.

- The testing segment accounted for the largest revenue in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan testing, inspection, and certification (TIC) market is segmented by service type into testing, inspection, and certification. Among these, the testing segment accounted for the largest revenue in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to Japan’s rigorous quality assurance culture and the increasing complexity of products requiring in-depth evaluation

- The in-house segment accounted for the largest revenue in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan testing, inspection, and certification (TIC) market is segmented by sourcing type into outsourced source, in-house. Among these, the in-house segment accounted for the largest revenue in 2024 and is expected to grow at a significant CAGR during the forecast period. In-House services dominate, as many large Japanese firms prefer internal control over quality processes to maintain proprietary standards and reduce third-party dependency.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan testing, inspection, and certification (TIC) market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- SGS SA

- American Bureau of Shipping

- AmSpec LLC

- Apave Group

- Applus Services S.A

- AsureQuality Ltd

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan Testing, Inspection, and Certification (TIC) Market based on the below-mentioned segments:

Japan Testing, Inspection, and Certification (TIC) Market, By Service Type

- Testing

- Inspection

- Certification

Japan Testing, Inspection, and Certification (TIC) Market, By Sourcing Type

- Outsourced Source

- In-House

Need help to buy this report?